Which States Pay Extra Ssi Payments And How Much

While many states pay all SSI recipients some additional money, some states pay the supplement only to SSI recipients who live in nursing homes. For example, Texas pays a $60 supplement to those living in a nursing home and pays nothing to others. Similarly, Georgia pays an extra $20 to those living in nursing homes, and nothing to others. Maine pays only $10 extra, both to those living independently and those living in nursing homes.

A few states don’t pay a supplement at all, including Arizona, North Dakota, and West Virginia. Oregon no longer pays an SSI supplementary payment, but some residents with special needs can receive a cash benefit through the Oregon Supplemental Income Program.

California pays the average highest supplement, making the average payment there $729 per month. Here are the average SSI payments, including the state supplemental amounts, for the next ten states with the most SSI recipients.

SSI Payment Amounts by State

| California | |

| Texas | $598 |

Visit our state SSI disability articles to learn the details of the SSI payment for your state.

How Much Can I Earn While On Social Security Disability In 2022

The prices consumers pay for groceries and other essential goods have dramatically risen due to inflation. For someone who is disabled and receiving monthly Social Security disability benefits, earnings from a part-time job may be necessary to make ends meet.

The Social Security Administration increased SSD benefits as of the beginning of 2022 through a cost-of-living adjustment of 5.9%. The COLA increase to Supplemental Security Income and Social Security Disability Insurance benefits also increased income eligibility standards making it possible to earn more while receiving disability benefits through SSDI and SSI.

As you read through this explanation of changes to SSD benefits for 2022, pay close attention to new limits on the amount of income you may earn before jeopardizing your eligibility for a continuation of benefits. Remember that a Social Security disability lawyer at Liner Legal Disability Lawyers is available to respond to your questions and concerns about disability benefits and provide skilled representation in all SSDI and SSI matters, including applications and appeals.

Get Benefit Verification Letter

Get a benefit letter to show that you receive benefits, have submitted an application, or don’t receive benefits.

This documentation is often needed for loan applications, housing assistance, and other processes that require verification of your income. It may be referred to as a “proof of income letter” or “benefit letter” and is personalized based on the status of your Social Security benefits, Supplemental Security Income, and Medicare coverage.

You May Like: Iphone Disabled For 15 Minutes

Other Ways You Can Apply

Apply With Your Local Office

You can do most of your business with Social Security online. If you cannot use these online services, your local Social Security office can help you apply. You can find the phone number for your local office by using our Office Locator and looking under Social Security Office Information. The toll-free Office number is your local office.

Apply By Phone

If You Do Not Live in the U.S. Or One of Its Territories

Contact the if you live outside the U.S. or a U.S. territory and wish to apply for retirement benefits.

Mailing Your Documents

If you mail any documents to us, you must include the Social Security number so that we can match them with the correct application. Do not write anything on the original documents. Please write the Social Security number on a separate sheet of paper and include it in the mailing envelope along with the documents.

Information You Need To Apply

Before applying, be ready to provide information about yourself, your medical condition, and your work. We recommend you print and review the . It will help you gather the information you need to complete the application.

Information About You

- Your date and place of birth and Social Security number.

- The name, Social Security number, and date of birth or age of your current spouse and any former spouse. You should also know the dates and places of marriage and dates of divorce or death .

- Names and dates of birth of children not yet 18 years of age.

- Your bank or other and the account number.

Information About Your Medical Condition

- Name, address, and phone number of someone we can contact who knows about your medical conditions and can help with your application.

- Detailed information about your medical illnesses, injuries, or conditions:

- Names, addresses, phone numbers, patient ID numbers, and dates of treatment for all doctors, hospitals, and clinics.

- Names of medicines, the amount you are taking, and who prescribed them.

- Names and dates of medical tests you have had and who ordered them.

Information About Your Work:

- Award letters, pay stubs, settlement agreements, or other .

We accept photocopies of W-2 forms, self-employment tax returns, and medical documents, but we must see the originals of most other documents, such as your birth certificate.

Do not delay applying for benefits because you do not have all the documents. We will help you get them.

Don’t Miss: What Is 100 Va Disability

Benefits For Your Children

When you qualify for Social Security disability benefits, your children may also qualify to receive benefits on your record. Your eligible child can be your biological child, adopted child, or stepchild. A dependent grandchild may also qualify.

To receive benefits, the child must:

- Be under age 18 or

- Be 18-19 years old and a full-time student or

Substantial Gainful Activity & Disability Benefits

While receiving SSDI benefits, you may engage in substantial gainful activity but only up to a limit. For 2022, that SGA limit is $1350 for most people. Those who are statutorily blind may make $2260. For blind individuals, this SGA does not apply to supplemental security insurance SSI benefits, a different type of social security. However, for non-blind people, the SGA limit applies to both SSI and Social Security retirement . In neither case your spouses income will not impact your qualification for SSDI benefits.

This seems rather straightforward, but heres where this can get a little more complex.

Also Check: Assisted Living For Mentally Disabled Adults

Benefits For Widows Or Widowers With Disabilities

If something happens to a worker, benefits may be payable to their widow, widower, or surviving divorced spouse with a disability if the following conditions are met:

- The widow, widower, or surviving divorced spouse is between ages 50 and 60.

- The widow, widower, or surviving divorced spouse has a medical condition that meets our definition of disability for adults and the disability started before or within seven years of the worker’s death.

Widows, widowers, and surviving divorced spouses cannot apply online for survivors benefits. If they want to apply for these benefits, they should contact Social Security immediately at 1-800-772-1213 to request an appointment

To speed up the application process, complete an Adult Disability Report and have it available at the time of your appointment.

We use the same definition of disability for widows and widowers as we do for workers.

Will I Get More Money If I Am More Disabled

The amount of disability money you receive either through SSDI or SSI doesn’t depend on how disabled you are. The SSA will find you 100% disabled or not at all.

Other programs for injured or disabled persons, such as workers’ compensation and veterans disability, are different in this regard. The workers’ comp and service-connected disability compensation programs generally rate your disability on a percentage scale and your percentage of disability sets the amount of money you’ll get.

Read Also: Short Term Disability Insurance Individual

Social Security Disability Evaluation Process

Though there are some conditions that the SSA considers so severe that they automatically render an applicant disabled, many conditions require careful screening, including answering these five questions:

In addition, qualifying conditions must be expected to last at least one year or result in death.

Cost Of Living Increase

The federal SSI amount regularly increases with cost-of-living adjustments each year. The COLA is usually between 1.3% and 2%, but some years it can be as high as 8% or as low as 0%.

For 2023, the COLA is a whopping 8.7%, which increases the maximum federal SSI payment from $841 in 2022 to $914 in 2023. But in 2021, the COLA was only 1.3%, which only added $11 to the monthly federal SSI payment. Read our article on Social Security’s annual COLA for more information.

Don’t Miss: How To Get Disability In Ga

Is Your Condition Found In The List Of Disabling Conditions

For each of the major body systems, we maintain a list of medical conditions we consider severe enough to prevent a person from doing SGA. If your condition is not on the list, we must decide if it is as severe as a medical condition that is on the list. If it is, we will find that you have a qualifying disability. If it is not, we then go to Step 4.

We have two initiatives designed to expedite our processing of new disability claims:

- Compassionate Allowances: Certain cases that usually qualify for disability can be allowed as soon as the diagnosis is confirmed. Examples include acute leukemia, Lou Gehrigs disease , and pancreatic cancer.

- Quick Disability Determinations: We use sophisticated computer screening to identify cases with a high probability of allowance.

For more information about our disability claims process, visit our Benefits for People with Disabilities website.

How Much Work Do You Need

In addition to meeting our definition of disability, you must have worked long enough and recently enough under Social Security to qualify for disability benefits.

Social Security work credits are based on your total yearly wages or self-employment income. You can earn up to four credits each year.

The amount needed for a work credit changes from year to year. In 2022, for example, you earn one credit for each $1,510 in wages or self-employment income. When you’ve earned $6,040 you’ve earned your four credits for the year.

The number of work credits you need to qualify for disability benefits depends on your age when your disability begins. Generally, you need 40 credits, 20 of which were earned in the last 10 years ending with the year your disability begins. However, younger workers may qualify with fewer credits.

For more information on whether you qualify, refer to How You Earn Credits.

Read Also: How To Win Disability Hearing For Depression

Benefits Increased In 2022

SSDI and SSI benefits increased as of January 1, 2022. Recipients of SSI benefits saw the maximum federal benefit increase to $841 for individuals and $1,261 for couples where both spouses qualify for SSI. What you actually receive each month may be less than the maximum benefit if you have income from sources other than SSI. It could be more if you live in one of the states that supplements the federal SSI benefit for its eligible residents.

Monthly SSDI payments also increased by 5.9% for 2022. The payment that you receive each month depends, of course, on your average lifetime earnings that Social Security uses to calculate your actual monthly benefit.

Special Rules For People Who Are Blind Or Have Low Vision

We consider you to be legally blind under Social Security rules if your vision cannot be corrected to better than 20/200 in your better eye. We will also consider you legally blind if your visual field is 20 degrees or less, even with a corrective lens. Many people who meet the legal definition of blindness still have some sight and may be able to read large print and get around without a cane or a guide dog.

If you do not meet the legal definition of blindness, you may still qualify for disability benefits. This may be the case if your vision problems alone or combined with other health problems prevent you from working.

There are several special rules for people who are blind that recognize the severe impact of blindness on a person’s ability to work. For example, the monthly earnings limit for people who are blind is generally higher than the limit that applies to non-blind workers with disabilities.

In 2022, the monthly earnings limit is $2,260.

You May Like: How To Un Disable Iphone

Earnings Exclusion Increases For Students Receiving Ssi

If you receive SSI and work, the income normally reduces the amount of your monthly benefits. As a blind or disabled student who qualifies for SSI benefits, you may exclude all or some of the income that you earn each month to avoid having it reduce your benefits.

Students on SSI may exclude up to $2,040 a month in earnings for 2022, which is an increase from the 2021 exclusion of $1,930. The annual cap on excluded earnings increased for 2022 to $8,230, which is considerably more than the $7,770 maximum annual exclusion in 2021.

To be eligible for the student earnings exclusion, you must meet each of the following requirements:

Ask an SSI lawyer to review your benefits to determine if you qualify for a student earnings exclusion.

Learn more about changes to SSDI and SSI for 2022

An SSD lawyer at Liner Legal Disability Lawyers makes it easy for you to know about changes to SSI and SSDI earnings limits and other regulations affecting Social Security disability programs. Contact us today for a free consultation.

Social Security Disability Benefits Pay Chart 2022

Social Security disability payments increased by 5.9% in 2022. See how much you can earn in this Social Security Disability Benefits Pay Chart guide.

The Social Security disability benefits pay chart applies only to payments through the SSI program. It does not apply if the benefits you receive are through the Social Security Disability Insurance program.

You May Like: Edd Disability Phone Number Shortcut

Please Answer A Few Questions To Help Us Determine Your Eligibility

How much your SSDI benefit will be is based on your “covered earnings”the wages that you paid Social Security taxes onprior to becoming disabled.

What is SSDI? Social Security Disability Insurance is the federal insurance program that provides benefits to qualified workers who can no longer work. To be eligible, you must be insured under the program and you must meet the Social Security Administration’s definition of disabled. SSI payments, on the other hand, aren’t based on past earnings.

Your SSDI benefits may be reduced if you get disability payments from other sources, such as workers’ comp, but regular income won’t affect your SSDI payment amount.

Disability And Money In The Bank

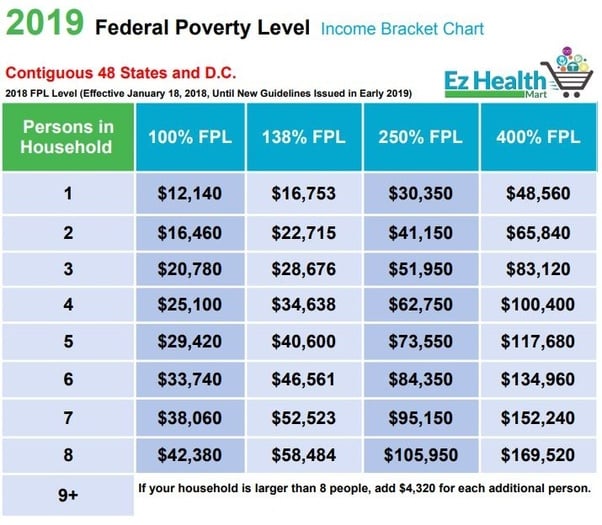

Supplemental Security Income disability is a disability program that is based upon need therefore, there are income and resource limits which affect SSI eligibility. Unlike Supplemental Security Income disability, Social Security Disability does not have any kind of income or resource limits because it is based upon insured status rather than need. Consequently, income and resources do not affect eligibility for Social Security Disability benefits.

You May Like: Residential Living For Adults With Disabilities Texas

Are Social Security Payments Taxed

Yes and No. First, we are attorneys and not CPAs. Any tax question should be directed at your CPA or your tax preparer.

Generally, the IRS will tax your SSDI benefits when half of your benefits, plus other income, exceeds an income threshold on your tax filing status.

If youre filing single, head of household, married filing separately, or qualifying widower, the threshold is $25,000.

If youre filing married and jointing, that threshold is $32,000. And if youre filing separately but lived with your spouse during the tax year, the threshold is $0

Supplemental Security Income Benefits are not taxable.

Note: Visit irs.gov to learn additional information on paying taxes social security benefits.

What Do I Need To Know About Advance Designation

You should be aware of another type of representation called .

Advance Designation allows capable adult and emancipated minors who are applying for or receiving Social Security benefits, Supplemental Security Income, or Special Veterans Benefits the option to choose up to three people in advance who could serve as their representative payee, if the need arises.

In the event that you can no longer manage your benefits, you and your family will have peace of mind knowing that someone you trust may be appointed to manage your benefits for you. If you need a representative payee to assist with the management of your benefits, we will first consider your advance designees. We must still fully evaluate them and determine their suitability at that time.

You can submit and update your advance designation request when you apply for benefits or after you are already receiving benefits. You may do so through your personal account, contacting us by telephone at 1-800-772-1213 , or at .

Recommended Reading: 90 Percent Va Disability How To Get 100