How Much Will You Get Paid On Short

When you take advantage of your short-term disability benefit, your time off is paidbut that doesnt necessarily mean youll be getting your full paycheck. Some plans offer full salary replacement, but most dont. Instead, they offer a percentage of compensation with a dollar amount cap.

There are also programs that award you different amounts based on your longevity with the company, McDonald says. For example, If you are there for 10 years and have a 26-week disability period, you might get three months at 100% and then three months at 50%.

If you live in one of the five states where short-term disability benefits are mandated, then the amount youll be compensated is regulated as well.

Can I Receive Social Security Disability And Long Or Short

Certainly, both long and short-term disability benefits can be quite helpful in easing the financial stress associated with difficult medical conditions. Often, however, we are asked if it is possible to not only receive short or long-term disability benefits but Social Security disability benefits as well.

Social Security disability benefits come in two primary forms Social Security Disability Insurance benefits, and Supplemental Security Income benefits. Typically, SSDI benefits are available to those who have a qualifying condition and have worked a job through which they made payments into the Social Security system for a certain amount of time. SSI benefits, by contrast, are typically for those who have a disability that renders them unable to work, but did not pay into the system for the required length of time, and meet other certain income and qualifying conditions.

The short answer to this question regarding receiving dual benefits is that yes, you can generally collect both Social Security benefits and long-term disability benefits at the same time. In fact, many long-term disability insurance providers will actually require applicants to apply for Social Security disability as well. While this is generally true, those receiving such benefits should realize that the amount of long-term disability benefits you receive may be reduced by the value of your monthly Social Security disability benefit.

Employment Rights On Short

In this chapter, I discuss the employment issues you will need address while on short-term disability.

We will discuss your rights and how to protect your benefits and employment.

Lets dive in.

Employers have the right to fire a person who is on sick leave. Most employers wont do this, however. There are practical and legal reasons. Firstly, you must get reasonable notice of termination to be fired legally. Otherwise, without notice, they have to pay you severance. This is the same for those on sick leave and those actively working.

As an employee on sick leave, you may be protected by human rights laws. Namely, laws that prevent discrimination against disability. However, protection under these laws isnt guaranteed. Not all sick leaves qualify as a disability, especially if youre expected to recover shortly.

Being protected under these laws can mean a few things. Your employment is protected but maybe not your specific role. And your employer has a duty to accommodate your disability. They might modify your job, allow you to work reduced hours, or move you to a different role.

If youre on sick leave that goes well beyond the short-term disability period, then your employer eventually has the right to stop your employment. Yes even without notice of termination or severance pay.

To learn more, check out our page on employment rights and disability benefits.

Chapter 7

Read Also: How To Apply For Disability In Washington State

What If I Was Terminated While On Short

While an employee can be terminated while on disability leave or sick leave, provided you are given termination or severance pay, it is discriminatory under human rights legislation to terminate an employee due to their disability. Under the Human Rights Code of Ontario, an employer is required to accommodate an employee to the point of undue hardship.

If you are terminated from your job while on disability leave, you should contact a Short Term Disability Lawyer at Monkhouse Law as soon as possible for advice about your claims and whether the termination may have been discriminatory.

What If Your Short

An employee may be denied short-term disability benefits for many reasons, one of which may be that the insurer does not believe they are totally disabled and eligible under the short-term disability policy. Even if the employee has ample documentation to support their claim for benefits including medical records and doctor notes, it may be deemed insufficient.

A worker who has been denied short-term disability benefits has two options:

If your short-term disability application is denied, dont waste time arguing in appeals with the insurer. Instead, you could hire an employment lawyer at Monkhouse Law to assist you with going through the Court, which is a higher authority. Be sure to act fast in consulting with us about your options given the insurers internal appeal deadlines and the legal limitation deadline of 2 years which will need to be considered.

Also Check: How Does Disability Lawyer Get Paid

Is Depression A Disability At Work

Currently, the law considers the effects of an impairment on the individual. For example, someone with a mild form of depression with minor effects may not be covered. However, someone with severe depression with significant effects on their daily life is likely to be considered as having a disability.

What Qualifies For Short Term Disability

Asked by: Edwin Daniel

To qualify for short-term disability benefits, an employee must be unable to do their job, as deemed by a medical professional. Medical conditions that prevent an employee from working for several weeks to months, such as pregnancy, surgery rehabilitation, or severe illness, can qualify to receive benefits.

Read Also: This Device Is Disabled Code 22

What Are The Top 10 Disabilities

What Are the Top 10 Disabilities?

Your Social Security Disability Lawyers

Its very difficult to be disabled, to say the least. Having a chronic illness, or complications from a severe injury can be overwhelming. Sometimes, it can feel as if life as you know is entirely altered, while around you, the world keeps moving on as normal. Bills continue to arrive. The rent needs to be paid. You still have to provide for yourself and your family, all while seeking the medical care and treatment that you need. Its a lot to process and handle and you shouldnt have to face it alone.

At The Clauson Law Firm, our dedicated, experienced, and talented team of disability lawyers is here to walk with you on that journey, to guide you through the process of applying for the benefits you need and deserve, and to fight for your rights under the law. You deserve to move forward toward a better and brighter chapter ahead, and you deserve to live the fullest life possible, even with your medical conditions.

Wherever you are in the legal process, from applications to appeals or anywhere in between, we can help. We would welcome the opportunity to learn your story and let you know what legal options you may have available. If youre ready to get started, give us a call. We look forward to speaking with you soon.

About Author

Clauson

Clauson Law has focused on representing the injured and disabled for over 10 years. We have handled thousands of cases. Each client is important to us and has a unique situation.

Read Also: Independent Living Programs For Adults With Learning Disabilities

What If My Insurance Company Arranged A Gradual Return To Work For Me

Sometimes an insurance company may arrange what is called a gradual return to work program as they feel you are able to return to work on a graduated basis. This might occur at any point in your claim. It could occur towards the end of your STD claim and extend into your LTD claim. Your benefits may only be approved until the end of the gradual return to work program. However, you may not be able to participate in the program as your treating physician do not feel you are ready to engage in work at that time or you may have tried it, and it exacerbated your symptoms.If you are unable to complete a gradual return to work, it is important to provide your insurer with medical evidence demonstrating your functional limitations and how working exacerbates your symptoms/condition.

Does Social Security Cover The Same Conditions

This is another question were often asked, particularly as clients who may have long-term or short-term disability policies also consider the possibility of pursuing Social Security disability benefits. Generally, Social Security disability benefits are available for many of the same conditions that may be covered by short or long-term disability.

The good news is that if you have a condition that qualifies you to receive either short or long-term disability benefits, you can generally collect Social Security disability benefits at the same time. Indeed, many long-term disability policies actually mandate that policyholders apply for Social Security disability as well. In many cases, while both types of benefits can be received, the amount of long-term disability benefits may be offset by the value of the Social Security benefits received.

In the case of short-term disability benefits, recipients can usually collect both Social Security disability and short-term benefits simultaneously. Its important to remember, however, that there is generally a waiting period before Social Security disability benefits are paid, so often, short-term disability benefits may have ceased before the payment of Social Security disability benefits begins.

The Law Office of Daniel Berger Here for You

You May Like: How Do I Get On Disability

How To Find The Right Short

We recommend assessing the following questions when seeking the right short-term disability plan for you:

- How many months can you stay afloat financially if you experience a short-term disability? Its important to find a short-term disability plan that complements your financial abilities.

- What kind of monthly premium can you afford for a short-term disability insurance plan? Short-term disability prices typically depend on age, medical history, location, income and employment history.

- How much income do you need monthly to support yourself and your loved ones? It is crucial to figure out each companys maximum monthly cash payout and compare it to your financial needs.

How Hard Is It To Get Disability For Depression

Like other conditions with symptoms that are based on emotional distress, a disability based on depression can be difficult to prove to the Social Security Administration because the symptoms are often difficult to measure. Additionally, just being diagnosed with depression is not enough to qualify for benefits.

You May Like: Attorneys For Social Security Disability

Knowing The Differences Can Make A Smoother Application Process

The differences between short-term disability and FMLA aren’t always very obvious. It’s possible that if a person is ineligible for one, they may qualify for the other. Knowing the key differences between the two can help speed up the process and avoid setbacks for both parties, employer and employee alike.

The content appearing on this website is not intended as, and shall not be relied upon as, legal advice. It is general in nature and may not reflect all recent legal developments. Thomson Reuters is not a law firm and an attorney-client relationship is not formed through your use of this website. You should consult with qualified legal counsel before acting on any content found on this website.

Adults With A Disability That Began Before Age 22

An adult who has a disability that began before age 22 may be eligible for benefits if their parent is deceased or starts receiving retirement or disability benefits. We consider this a “child’s” benefit because it is paid on a parent’s Social Security earnings record.

The Disabled Adult Child who may be an adopted child, or, in some cases, a stepchild, grandchild, or step grandchild must be unmarried, age 18 or older, have a qualified disability that started before age 22, and meet the definition of disability for adults.

Example

It is not necessary that the DAC ever worked. Benefits are paid based on the parent’s earnings record.

- A DAC must not have substantial earnings. The amount of earnings we consider substantial increases each year. In 2022, this means working and earning more than $1,350 a month.

Working While Disabled: How We Can Help

Also Check: Student Loan Forgiveness For 100 Disabled Veterans

What Is Short Term Disability Insurance Heres What Qualifies & How It Works

When people think of Disability Insurance, their first thought is often the more permanent disabilities covered by Long Term Disability Insurance.

But what if youre only temporarily disabled, say for a period of only a few weeks? Youll still be off work and unable to make an income, but unable to qualify for LTD.

Thats where Short Term Disability Insurance comes in.

Can You Get Disability Benefits After Weight Loss Surgery

Leave for bariatric surgery is routinely covered by SDI plans, but check with your human resources department and consult your disability insurance policy to be sure. Pregnancy and childbirth. One often overlooked situation where SDI benefits may be available is during pregnancy and following childbirth.

Read Also: How Do You Sign Up For Disability

What Conditions Are Covered By Short Term Disability

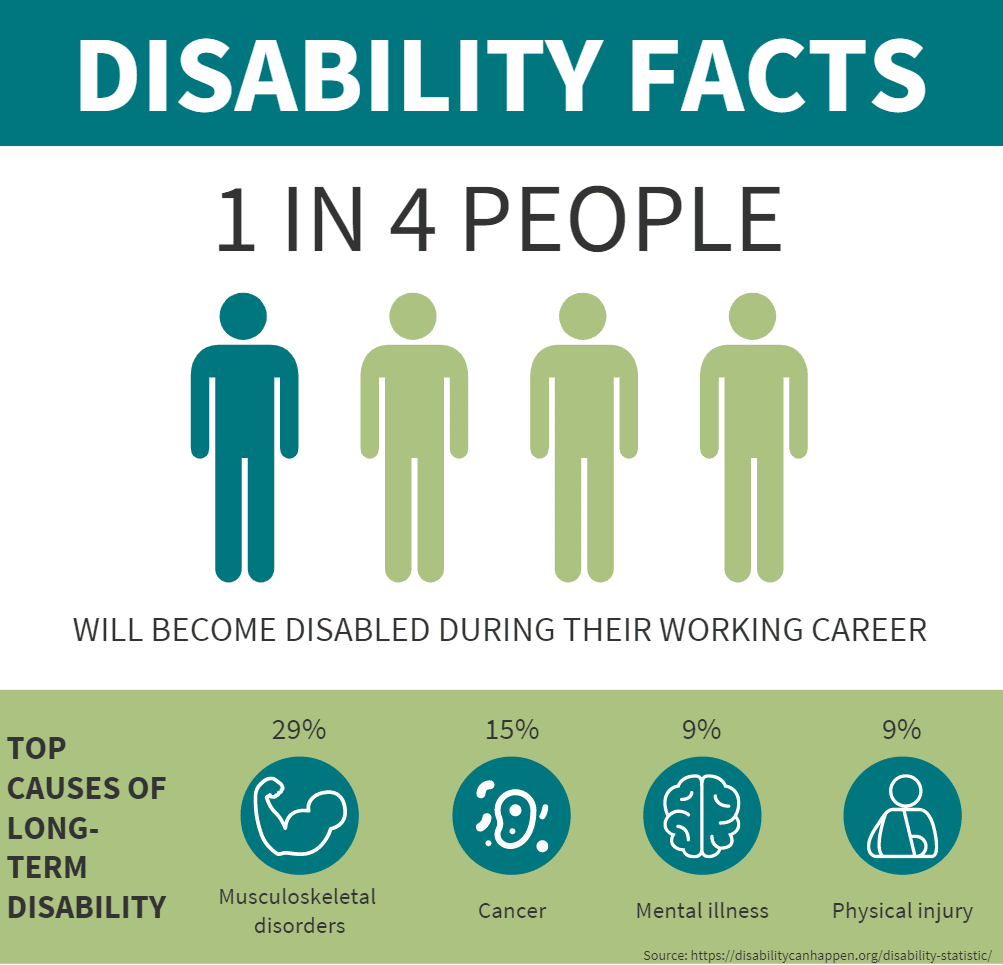

What conditions qualify for short term disability? Cancer, pregnancy, mental health issues, injuries and musculoskeletal diseases are among the top reasons for disability claims. Coverage varies by policy, but your plan should outline if there are any conditions that would be exempt from coverage under your policy.

What Conditions Arent Covered By Disability Insurance

Every disability policy has a list of exclusions injuries and illnesses that dont qualify for coverage.

They vary between insurers, but these are the most common limitations:

- Specific preexisting conditions

- Conditions caused by substance abuse including prescription drugs

- Normal pregnancies with no complications

- Workplace injuries

- Injuries caused by acts of war

Recommended Reading: Can You Get Disability For Ibs

How Do I Ask My Doctor For Short

Employees who plan to apply for short-term disability should notify their attending physicians so they can gather the necessary forms and supporting records.

This article is intended to be used as a starting point in analyzing short-term disability and is not a comprehensive resource of requirements. It offers practical information concerning the subject matter and is provided with the understanding that ADP is not rendering legal or tax advice or other professional services.

Do I Need To Make A Separate Application For Long

Due to recent case law, it is important that you ensure a complete LTD application is being submitted to your insurance company so that you do not forfeit your right to benefits. If the end of the waiting period is nearing and you have not been provided with LTD forms from the insurance company, you should request an LTD application package or an LTD transition package . You must submit your Members Statement and Attending Physicians Statement within a timely manner, in accordance with your policy. It is of utmost importance that you review your policy to find out how long you have to make an application.

Don’t Miss: Social Security Disability Benefits Pay Chart 2020

Understand Your Recovery And Treatment Timelines

Work with your doctor to understand how much time you will be unable to work. Short term disability benefit terms depend on your insurance coverage, but commonly can provide you with income assistance for up to 6 months. If your doctor recommends that you remain off work for longer than 6 months, you may be required to apply for Long Term Disability benefits, if you have this coverage.

Understanding your timeline can also involve making a transition plan for returning to work. You should consult with your doctor or treatment team and your employer to ensure that you have a safe and viable return-to-work plan. This can include returning to light duties or starting back to work on a part-time basis.

Drug & Alcohol Provision

You will not qualify for payments from the LTD Plan for any disabilities related to drug or alcohol use unless you are engaged in, and subsequently complete, a recognized rehabilitation program intended specifically for the treatment of substance abuse. This treatment must begin during the 6-month period of STD benefits.

You May Like: Student Loan Forgiveness With Disability

Std Benefits: When And How Much

STD plans usually provide coverage from the first day after an injury or hospitalization and from the 8th or 15th-day following sick leave. However, the elimination period, or benefit waiting period, could last up to 15 days after hospitalization.

The benefit amount will equal a certain percentage of the employees weekly gross income, up to a maximum amount. A taxable STD plan will typically provide a higher percentage of the workers gross earnings compared to a non-taxable plan.

Who Pays For Short

A company that provides short-term medical insurance can pay for it in two structured ways, the self-funded or insurance method. The self-funded or self-administered method means the employer provides and funds the benefit personally with no external help. The Insurance method allows the employer to work with an insurance company to provide the benefit. Some companies use both methods by funding the income that insurance doesn’t cover for a given period.

Read Also: Free Car Repair For Disabled