How Do They Determine How Much Disability You Get

To calculate how much you would receive as your disability benefit, SSA uses the average amount youve earned per month over a period of your adult years, adjusted for inflation. To simplify this formula here, just enter your typical annual income. This income will be adjusted to estimate wage growth over your career.

To Qualify For Ssi You Need Very Low Income And Almost No Assets

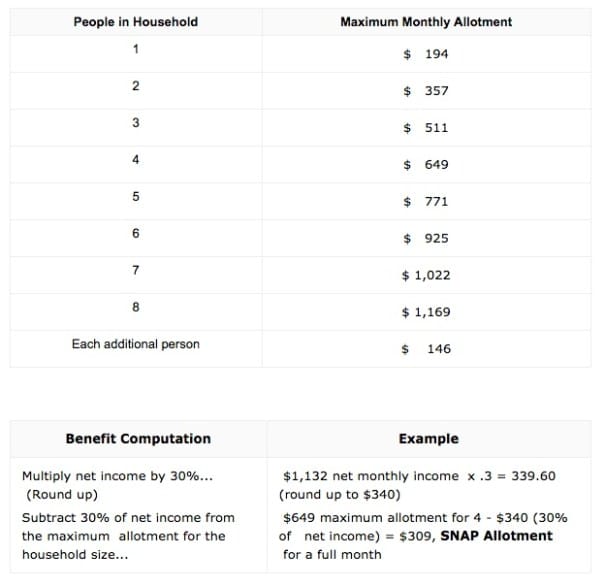

The SSI program also asks several money-related questions when screening Tennessee disability applicants. First, your monthly income cannot be more than $1,350 when you apply. This includes money earned through work as well as any other regular payments you receive. The SSA will count things like alimony, child support, workers comp, interest earned through your savings account, etc. You also cant own more than $2,000 in assets to qualify for SSI. This means anything you can sell for cash, such as jewelry, stocks, bonds, your 401 or IRA funds. Some things the SSA wont count towards this asset limit include:

- Your house and the land it sits on

- One vehicle for household transportation

- Your wedding ring, furniture, clothing and other daily living items

The SSA automatically denies your claim if you own too many things or have more than $2,000 in the bank. If applying as a married couple, you need less than $3,000 in assets and $1,350 in total household income.

How Much Work Do You Need

In addition to meeting our definition of disability, you must have worked long enough and recently enough under Social Security to qualify for disability benefits.

Social Security work credits are based on your total yearly wages or self-employment income. You can earn up to four credits each year.

The amount needed for a work credit changes from year to year. In 2022, for example, you earn one credit for each $1,510 in wages or self-employment income. When you’ve earned $6,040 you’ve earned your four credits for the year.

The number of work credits you need to qualify for disability benefits depends on your age when your disability begins. Generally, you need 40 credits, 20 of which were earned in the last 10 years ending with the year your disability begins. However, younger workers may qualify with fewer credits.

For more information on whether you qualify, refer to How You Earn Credits.

Read Also: Omaha Mutual Short Term Disability

Where Do I Apply For Disability Benefits

You can apply for disability in three different ways in Tennessee, depending on the type of benefit you are eligible for.

Online applications. SSDI applicants can apply online at www.ssa.gov/pgm/disability.htm.

Tennessee field offices. Tennessee has 30 different field offices, where representatives can help you with your application. To find your local field office, see Social Security’s website. You can also call 800-772-1213 to set up an appointment some field offices in Tennessee actually require appointments.

Applying by telephone. You can also apply for disability benefits by telephone at the toll-free number above.

Payment & Timing Of Benefits

These benefits are not usually paid in the employees regular paycheck. Instead, they are most often paid in a separate check by the employers insurance company.

No benefits are due for those first seven calendar days of the disability period unless the disability period lasts at least 14 calendar days. Employees may want to use other paid leave options for those first seven unpaid calendar days if their period of disability doesnt last 14 calendar days.

Temporary disability payments for work missed due to a compensable work-related injury or illness must be received by the injured employee no later than 15 calendar days after the notice of injury. Unpaid or untimely paid benefits may be subject to a penalty.

You May Like: How To Apply For Disability In New Mexico

Special Rules For People Who Are Blind Or Have Low Vision

We consider you to be legally blind under Social Security rules if your vision cannot be corrected to better than 20/200 in your better eye. We will also consider you legally blind if your visual field is 20 degrees or less, even with a corrective lens. Many people who meet the legal definition of blindness still have some sight and may be able to read large print and get around without a cane or a guide dog.

If you do not meet the legal definition of blindness, you may still qualify for disability benefits. This may be the case if your vision problems alone or combined with other health problems prevent you from working.

There are several special rules for people who are blind that recognize the severe impact of blindness on a person’s ability to work. For example, the monthly earnings limit for people who are blind is generally higher than the limit that applies to non-blind workers with disabilities.

In 2022, the monthly earnings limit is $2,260.

What To Do If You Receive An Ssd Denial

If you have the frustrating experience of receiving a social security benefits denial letter or weren’t compensated fairly, you can always appeal. This usually has to be done in writing and within 60 days of receiving that initial decision. There are four stages in this process you should be aware of, including:

Don’t Miss: California Disability Insurance Phone Number

Can I Work And Collect Social Security Disability

It’s doubtful that the SSA will approve your SSD application if you are still able to work. It is possible that you can continue working in some situations, like earning less than the Tennessee substantial gainful activity limit. But, if you exceed the income limit for SGA, you probably can’t continue receiving SSD benefits.

Benefits For Children With Disabilities

A child under age 18 may have a disability, but we don’t need to consider the child’s disability when deciding if he or she qualifies for benefits as a dependent. The child’s benefits normally stop at age 18 unless they are a full-time student in an elementary or high school or have a qualifying disability.

Children who were receiving benefits as a minor child on a parents Social Security record may be eligible to continue receiving benefits on that parents record upon reaching age 18 if they have a qualifying disability.

Recommended Reading: How To Disable Fire Alarm

Does Your Injury Qualify As An Automatic Disability

As discussed above, some injuries are considered so severe that the SSA always considers them a qualifying impairment for SSD benefits. Below are just a few of the categories and conditions included in the List of Impairments :

- Autoimmune disorders Lupus, multiple sclerosis or rheumatoid arthritis

- Musculoskeletal impairments Degenerative disc disease, spinal injuries, herniated disc, ruptured disc, carpal tunnel syndrome and arthritis

- Neurological disorders Traumatic brain injury, stroke or seizure disorder

- Respiratory disorders Chronic Obstructive Pulmonary Disease , asthma or emphysema

- Sensory impairments Hearing loss or vision loss

- Mental disorders Anxiety, depression, post-traumatic stress disorder or autism

- Endocrine disorders Obesity, diabetes or neuropathy

- Cardiovascular disorders Heart failure, high blood pressure or coronary artery disease

- Digestive disorders Crohns disease, liver disease or irritable bowel disorder

The Basic Ssd Requirements

In order to qualify for Social Security Disability benefits, you must have a physical or mental impairment that prevents you from doing any substantial gainful work. In addition, thedisability must be expected to last at least 12 months or be expected to result in death.

To determine if you meet these requirements, the U.S. Social Security Administration will review all the evidence submitted in connection with your claim. The process generally involvesfive main considerations:

- Are you working? If you are working and your earnings average more than a certain amount each month, we generally will not consider you disabled.

- Is your medical condition severe? Your medical condition must significantly limit your ability to perform basic work activities for at least one year.

- Is your medical condition on the List of Impairments? The SSA maintains a list of medical conditions that are considered so severe that they automatically designate you asdisabled. If your condition is not on the list, it must meet or equal a condition on the list in severity.

- Can you do the work you did before? If your condition does not meet the severity requirements above, your medical condition must prevent you from being able to do the workyou did before.

- Can you do any other type of work? If you can do other, less demanding work, you will not be found disabled. The SSA will consider your medical status, age, education andprior work experience.

Recommended Reading: Definition Of Specific Learning Disability

Can My Doctor Put Me On Disability

If you believe you might qualify for Social Security disability benefits, you need your doctor to support your claim for disability. Youll need your doctor to send your medical records to Social Security as well as a statement about any limitations you have that prevent you from doing work tasks.

Can You Do Any Other Type Of Work

If you cant do the work you did in the past, we look to see if there is other work you could do despite your medical impairment.

We consider your medical conditions, age, education, past work experience, and any transferable skills you may have. If you cant do other work, well decide you qualify for disability benefits. If you can do other work, well decide that you dont have a qualifying disability and your claim will be denied.

Recommended Reading: Assisted Living For Young Adults With Disabilities

How Long Does It Take For Disability To Be Approved

Generally, it takes about 3 to 5 months to get a decision. However, the exact time depends on how long it takes to get your medical records and any other evidence needed to make a decision. * How does Social Security make the decision? We send your application to a state agency that makes disability decisions.

What Automatically Qualifies You For Disability

Special senses and speech, such as impaired hearing, sight or speech. Respiratory illnesses, such as asthma, chronic obstructive pulmonary disease and cystic fibrosis. Cardiovascular illnesses, such as arrhythmia, congenital heart disease and heart failure. Digestive system, such as bowel or liver disease.

Recommended Reading: Can You Get Disability For Diabetes

How Long Do Ssd Benefits Last

This really is dependent on the classification used for your medical condition. If your disability is categorized as “medical improvement possible,” you can expect the SSA to review your case again a few years after being approved. If you didn’t receive this status, you wouldn’t undergo a case review for at least five years. So long as you remain debilitated to the point you can’t work, you can expect to continue receiving SSD benefits in TN until you reach retirement age. At that point, you will transition to the social security retirement program.

More Specific Conditions That Could Entitle You To Benefits

It is important to note that every applicant presents individual circumstances that could qualify or disqualify them for benefits. With this in mind, some of the specific conditions the SSA lists under its broader medical categories include:

- Depressive disorder

- Bipolar disorder

These are just some of the many conditions the SSA lists as potential prerequisites for receiving disability benefits through one or more federal programs. Additional context may be required to determine your eligibility and the number of benefits you could receive if you are eligible. As such, these conditions do not automatically qualify you for disability benefits.

Don’t Miss: Short Term Disability Insurance Individual

How Our Lawyer Could Handle Your Disability Benefits Application Process

The process of proving your disability will take time, but you dont have to go through it by yourself. The SSA allows you to assign a representative who can:

- Correspond with the SSA on your behalf

- Access and collect your medical records for the purpose of applying for benefits

- Fill out paperwork on your behalf

- Accompany you to any interviews or hearings required to complete your application

Many Initial Ssdi Applications Are Denied

Most initial applications for SSDI benefits are denied by SSA. The reason for many of these denials is that technical errors or omissions were made when filling out the application. SSA might also deny your application if it believes you do not qualify for benefits because you do not meet their criteria.

If an applicant wishes to remedy an error that led to the denial or to make the case that their condition does meet the SSAs criteria, they can then begin the process of an appeal. Appeals are common, but they are just as likely to lead to a denial as the first application if the errors arent addressed or a better argument isnt made about the qualifications of the applicant. If an appeal is made, it is vital to determine why an application was denied so adjustments can be made.

As a general rule, you have 60 days to file for reconsideration after receiving a denial letter. Reconsideration is essentially the first stage of appeal. If your claim was denied, it is imperative that you consult with a Tullahoma SSDI lawyer right away. Do not give up on your rights. A lawyer will help you build a compelling appeal.

Don’t Miss: Power Of Attorney For Disabled Adults

How Much Is Disability In Tennessee

| Nashville | $733 |

- The maximum Tennessee disability payment anyone can get under the federal SSDI program is $3,148/month. But to get that amount, youll need to earn a six-figure salary before becoming too disabled to work. Nationwide, the average monthly SSDI payment for disabled workers is $1,277.

Contents

Calculating Your Monthly Ssdi Payment

The exact amount of money people get for SSDI each month is unique for every individual. The Social Security Administration uses a complex weighted formula to calculate benefits for each person, up to 2022’s maximum benefit of $3,345.

Doing the math yourself is difficult, but here’s how the formula works.

AIME. Social Security bases your retirement and disability benefits on the amount of income on which you’ve paid Social Security taxescalled “covered earnings.” Your average covered earnings over the past 35 years are known as your “average indexed monthly earnings” .

Bend points. The SSDI formula uses fixed percentages of different amounts of income. These percentages, called “bend points,” are adjusted each year. In 2022, here are the bend points and how they come together:

- 90% of the first $1,024 of your AIME

- plus 32% of your AIME from $1,024 to $6,172

- plus 15% of your AIME over $6,172.

PIA. Adding those three figures together gives the SSA your primary insurance amount . Your PIA is the base figure the SSA uses in setting your benefit amount.

Don’t Miss: Guardian Short Term Disability Claim

Back Payments For Disability Benefits

After the SSA approves you for SSDI or SSI, you might receive back payments. You might be eligible for back pay if your disability started well before you start receiving benefits.

Your back pay amount will depend on:

- When your disability started

- When you applied for benefits

- Whether you are eligible for SSI, SSDI, or both

What Qualifies For Disability

What will qualify you for disability is that you will need to be unable to work for at least 12 months. You will need to provide medical evidence that your condition is keeping you from making a substantial gainful living. You can use the Blue Book to determine what medical evidence you need to support your claim.

You will also need enough work credits to qualify for disability benefits. These are earned by working and paying into Social Security taxes. Generally, if you have worked 5 of the last 10 years, you will likely have enough work credits to qualify for disability benefits.

Read Also: Can You Get Disability For Hearing Loss And Tinnitus

Do You Get Back Pay For Disability

You will receive back benefits at least going back to the date you applied for disability benefits. If your EOD is before the date you filed your SSDI application, you may receive a maximum of twelve months of retroactive benefits payment for benefits during the twelve months before you applied.

How Much Does Disability Pay In Tennessee

| Nashville | $733 |

- The maximum Tennessee disability payment anyone can get under the federal SSDI program is $3,148/month. But to get that amount, youll need to earn a six-figure salary before becoming too disabled to work. Nationwide, the average monthly SSDI payment for disabled workers is $1,277.

Contents

Also Check: Companies That Hire People With Disabilities

Work Credit Requirements For Ssd

The SSA will review if they have earned enough work credits to qualify for benefits for many applicants. This is done by converting your earnings into these credits. When you work for a year, you typically receive four credits, depending on how much social security taxes you paid on your income during that period.

Currently, you have to have at least 20 credits to meet SSD eligibility requirements, though there are exceptions.

How Your Ssdi Payments Are Calculated

The severity of your disability will not affect the amount of SSDI benefits you receive. The Social Security Administration will determine your payment based on your lifetime average earnings before you became disabled. Your benefit amount will be calculated using your covered earnings. These are your earnings at jobs where your employer took money out of your wages for Social Security or FICA.

Your SSDI monthly benefit will be based on your average covered earnings over a period of time, which is referred to as your average indexed monthly earnings . The SSA uses these amounts in a formula to determine your primary insurance amount . This is the basic amount used to establish your benefit.

SSDI payments range on average between $800 and $1,800 per month. The maximum benefit you could receive in 2020 is $3,011 per month. The SSA has an online benefits calculator that you can use to obtain an estimate of your monthly benefits.

Read Also: Transportation Services For Elderly And Disabled