Advantages And Disadvantages Of Long Term Disability Insurance

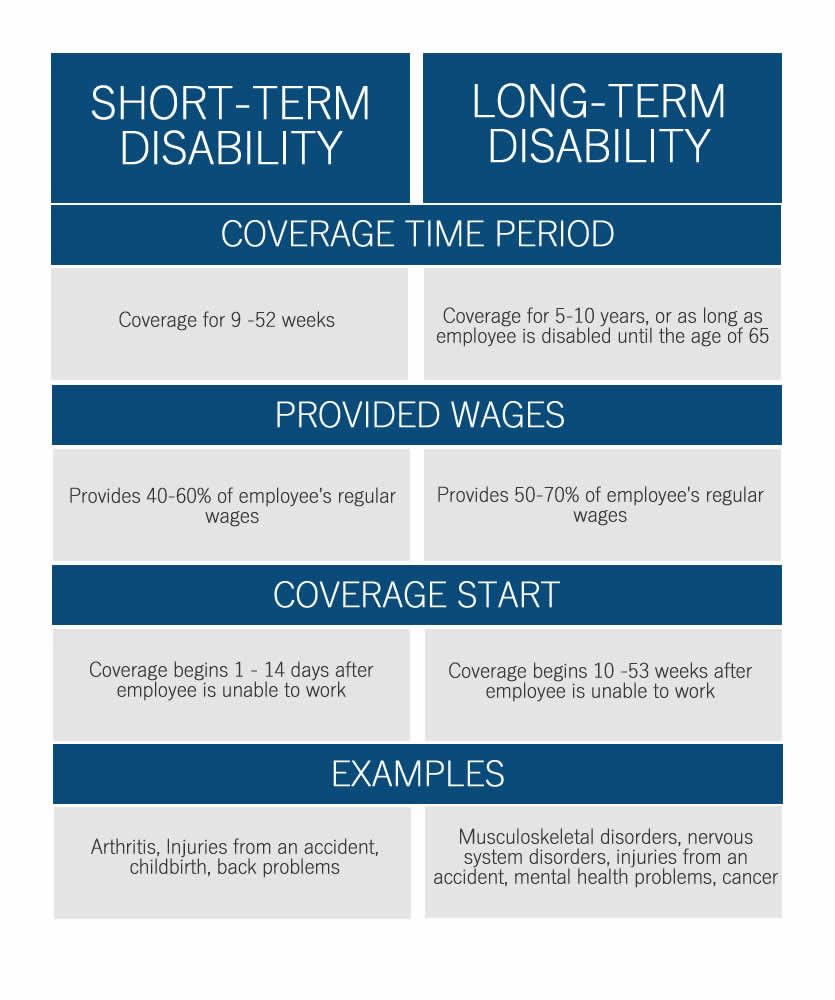

Long term disability insurance provides monthly payments in the event of a disability lasting six months or longer, and some policies provide benefits until the policy holder reaches the age of 75 or older.

The primary advantage of long term disability insurance is the peace of mind that comes with knowing that benefits of up to 70 percent of the policy holder’s salary will continue as long as a disability lasts. Additionally, long term policies usually allow for more options, such as coverage for hospital stays and adding supplemental insurance to increase monthly payments.

The main drawback of long term disability insurance is that long term policies cost substantially more than short term insurance. Furthermore, long term policies usually have a waiting period of between three and six months or longer before the insurance company begins paying benefits, leaving disabled individuals to pay their own expenses for the first few months of a disability. Finally, the payment plans of some long term disability policies may change after two years of continuous disability.

Because of these advantages and disadvantages, long term disability insurance is typically best for individuals who have savings or other insurance to cover the first few months of their disability, and workers who can afford higher premiums in exchange for long term benefits.

How Long Will My Short

If you have a short-term disability insurance policy, either purchased privately or through your New Jersey employer, you may be able to claim benefits if you have a medical condition that prevents you from working for the time being. That said, these benefits are generally only available for a short time.

Short-term disability benefits are temporary. Suppose you are expected to recover from a medical condition that currently prevents you from working. In that case, short-term disability benefits can compensate you for lost income for a short time.

How long your short-term disability benefits last will largely depend on your policy. New Jersey insurance companies can set their own timeframes for short-term disability benefits. Generally, individuals can expect their short-term disability benefits to last around six months. However, that is not guaranteed.

Unfortunately, New Jersey residents may be unaware just how short their short-term disability benefits are. Suppose youre under the impression that your short-term disability benefits will last for months, but your policy states that they cease in a matter of weeks. If you arent prepared for benefits to lapse, you may face challenges. Your Mount Laurel disability lawyer can help you understand how long your short-term disability benefits will last according to your insurance policy, so that there are no surprises.

What Doesn’t Short Term Disability Insurance Cover

Your short term disability insurance policy will likely include coverage exclusions. These will be listed in your policy contract.

Exclusions mitigate a carrierâs risk of paying a claim resulting from high-risk conditions or activities, and typically include:

- Intentionally self-inflicted injuries

- Neurological disorders

Furthermore, donât count on short term disability policies to cover time off to care for a sick family member or adopt a child.

If you have short term disability insurance through your employer, many of these plans require that you’ve worked a certain amount of time before coverage begins. Many employers also require that you exhaust paid sick leave or use paid time off before you are eligible for short term disability benefits.

Read Also: Transportation Services For Elderly And Disabled

How Long Is Short Term Disability

As with most optional benefits , there are no hard rules. Short term disability can range from as short as 30 days to as long as a year. It all depends on what you want to offer, if youre self-funding it, or what your insurance company offers.

One way to start tackling duration is by looking to the medical community and common guidelines for how long various types of recovery take. Its always an option to work with your individual employees doctors recommendations if you have the ability to be accommodating.

Other Types Of Benefits And Programs For The Unemployed

Educational Help

Federal agencies offer many unemployment education and training programs. They are generally free or low cost to the unemployed.

Self-Employment Help

Self-employment assistance programs help unemployed workers start their own small businesses. Delaware, Mississippi, New Hampshire, New York, and Oregon offer this program.

Also Check: Michigan Workers’ Compensation Permanent Partial Disability

Transitioning From Std To Ltd With Different Insurance Companies

Going from short-term disability to long-term disability can be more challenging for those whose LTD coverage is provided by a different insurance company than their STD coverage. This is because the new insurance company will not have immediate access to the medical records, reports, or other documentation that the claimant submitted in support of their short-term disability claim.

In these cases, claimants typically must submit a completely new claim, including claim forms from both the claimant and their treating physicians, as well as medical records. This process can be daunting. You should make sure you have copies of your short-term disability approval letter and any other documentation that supported your STD claim. Submitting documents such as an STD approval letter can help demonstrate to a new insurance company that you meet the definition of disability.

Wages Paid Instead Of Notice Of Layoff

Wages paid instead of notice of layoff are payments an employer makes to an employee who is involuntarily separated without receiving prior notice.

You must report any wages paid instead of notice of layoff to TWC when you apply for benefits or by calling a Tele-Center at 800-939-6631. Under Texas law, you cannot receive benefits while you are receiving wages paid instead of advance notice of layoff. We will mail you a decision on whether your wages paid instead of notice of layoff affect your unemployment benefits.

Read Also: Are Unemployment Benefits Taxable In 2020

You May Like: Omaha Mutual Short Term Disability

Does Short Term Disability Expire

Short-term disability insurance provides cash benefits for workers who are temporarily unable to work due to illness, injury, or pregnancy. For employees with both short-term and long-term disability coverage, short-term benefits usually last for until the waiting period of the long-term disability policy is over.

Can I be fired while on short term disability?

A: Your employer has the right to fire you while youre on short-term disability. The employer must give proper notice or pay severance. This means the reason for your firing cannot be your disability. To avoid violating human rights law, most employers will avoid firing someone on short-term disability.

What happens when you run out of short-term disability?

Long-term disability coverage begins after short-term disability or EI benefits run out. The illness or disability usually means the individual is completely unable to return to work. Depending on the policy, benefits can cover income replacement as well as coverage for medical treatment and rehabilitation.

Can I get another job while on short-term disability?

Q: Can I work another job while on short-term disability? A: If your insurance policy has an own occupation definition of disability you can work another job while on disability and still collect benefits as long as the duties of the other job are substantially different from your job.

California Paid Family Leave

California employees can also receive benefits for time off spent caring for a seriously ill family member or bonding with a new child, through the paid family leave program. The requirements for receiving PFL are similar to the rules for receiving SDI for a disability: You no longer must be off work for a seven-day waiting period before you’ll receive paid leave benefits. Like SDI, your benefits will generally be 60-70% of your earnings in the highest-paid quarter of the base period. But PFL is available for a maximum of six weeks.

Don’t Miss: How To Apply For Va Disability

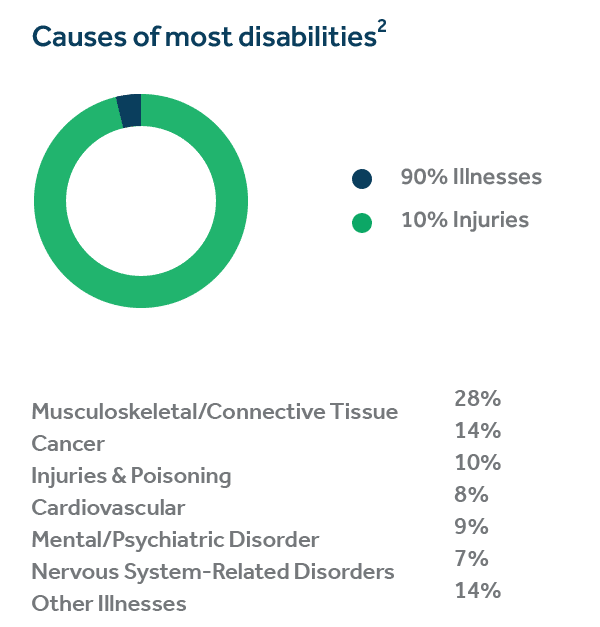

Should I Purchase Short

Although illnesses and injuries can’t be predicted, they’re likely to affect your workplace at some point in the future. For comprehensive protection, employers may consider offering a combination of both short-term and long-term disability insurance to employees. These policies are an important complement to any group health insurance plan or general liability insurance plan and help to minimize the impact of debilitating illnesses and injuries on both your employees and your business.

Tags

How Much Do You Get Paid On Short Term Disability In Ny

After a seven-calendar-day waiting period, you receive 50 percent of your average salary for the eight weeks prior to disability, up to the maximum benefit established under the New York State Disability Benefits Law, currently $170 per week. You can receive benefits up to a maximum of 26 weeks.

Read Also: Assisted Living For Mentally Disabled Adults

How Does Short Term Disability Work

There are 2 main ways that short term disability works. Self-administered short term disability means that youll fund the disability program yourself. While that means making a lot of decisions about how you want to fund and structure the benefit, it does offer maximum control over its parameters.

The other option is through insurance. You can choose to work with an insurance provider that offers short term disability benefits to your employees.

If you elect to do neither, your employees arent out of luck. People have the ability to purchase short term disability insurance for themselves. But as with all insurance that isnt subsidized by an employer, the costs will be high roughly 1 to 3% of a persons yearly earnings depending on the structure of the coverage. A shorter elimination period , for example, means paying more money.

What Qualifies For Short

The most common reasons for a short-term disability claim are:

- Pregnancy/maternity leave

To meet short-term disability qualifications, the medical condition must not be related to the work environment or job-related responsibilities, otherwise, it might be covered under the employers workers compensation insurance.

Recommended Reading: Reasons For Short Term Disability

How Long Does Long

Once long-term disability benefits have been approved, an employee can continue to receive benefits for the length of the policy term or until they return to work. Most long-term disability plans provide coverage for 36 months, although some plans can provide coverage for up to 10 years or even for the life of the policyholder.

How Does Coming Back To The Office After Short Term Disability Work

While this isnt typically a formal part of short term disability insurance offerings, its a good idea to think about the various ways you can transition employees back into work after being away. There can be various tolls, from emotional to mental issues, that can pop up when coming back to work.

Think about if and how youll want to keep your employee up to date while theyre out. Or how youll get them up to speed in a reasonable way when they return. Even if it seems like everything is the same, it probably isnt to the person who has been away. Businesses are always evolving chances are something is different.

Read Also: Property Tax Relief For Disabled

How Long Can You Receive Short

If you qualify for short-term disability benefits, the length of time that you will receive benefits will depend on the terms of your policy. While you may receive benefits for anywhere between 9 and 52 weeks, most policies provide benefits for 3 to 6 months. This is known as your benefit period.

If you return to work before the expiration of your benefit period, your benefits will terminate. Otherwise, if your disability continues, you can apply for long-term disability benefits. Once approved, long-term disability benefits may last anywhere from 2 years to retirement age.

For New Jersey residents who qualify for state disability benefits, there is a non-specific limit on the length of time that you can receive benefits. Instead, it is calculated based on the number of benefits that you receive. The maximum amount that may be paid for each period of disability is the lesser of 26 times the weekly benefit amount or one-third of the total wages in New Jersey covered employment paid to the worker during the base-year.

What Is The Fmla

While short-term disability replaces a portion of the employee’s income, the FMLA protects the employee’s job. In fact, the FMLA provides up to 12 weeks of job-protected leave. Specifically, it allows an employee to take time off to deal with a serious medical issue or help care for a family member suffering from a medical condition.

Typically, an employee can use FMLA leave if:

- They work for a public agency or company with at least 50 employees

- They have worked for the company at least 12 months

- They have logged at least 1,250 work hours during the 12 months before taking leave

- They work at a location which has at least 50 employees within 75 miles

You May Like: Activities For Adults With Disabilities

How Alex Can Help

Understanding the complexities of short- and long-term disability isnt always easy. ALEX is here to help you explain the differences to your employees. Backed by behavioral science, ALEX helps employees understand all their options and make an educated decision on their benefits. In fact, 85% of users say ALEX helped them better understand tax savings related to their benefits choices.

Find out how ALEX boosts benefits understanding and saves you time and money.

How Long Does Short

We insure our home, our car, our health. What about your ability to earn an income? It can be easy to overlook, but thereâs a way to insure that too. And given the value of a lifetime of income, itâs important to insure. Short- and long-term disability insurance provide protection should an illness or injury ever prevent you from working.

While you might think youâre healthy and would be able to shoulder anything that comes your way, the chance of a disability is more common than you realize. According to the Social Security Administration, more than 1-in-4 of todayâs 20-year-olds can expect to be out of work for at least a year before they reach the normal retirement age because of a disabling condition.

Read Also: Disabled American Veterans Donation Pickup

Can You Contact Your Employees While Theyre On Short

You have the right to contact employees while theyre on short-term disability as long as you dont ask them to perform any sort of work. For example, if you have a quick question or two about their benefits, or about a work-related procedure, you can reach out.

Unlike some other programs like the Family Medical Leave Act and the Americans with Disabilities Act that provide time off for employees, short-term disability doesnt offer any sort of job protection. Employees on short-term disability also arent entitled to the same job position when they return from it. Its up to your company how youd like to set return-to-work policies.

Where Do I Get Short

While there are ways to get some short-term disability insurance through a private insurer, itâs more common to get it as part of a group plan thatâs offered through your employer.

Each employer will have different rules for how the coverage will work if you ever need it. Sometimes employers will combine a mixture of coverage and paid time off to help replace your income during the period that you would use your short-term disability insurance. Other times, the policy will pay out a certain percentage of your pay for a set period of time.

Also Check: Can You Get Disability For Congestive Heart Failure

Filing A Tdi/sdi Claim With Your State

To file a claim, call or go to the website of your state’s department of labor or employment development department to get the application form. Your company’s human resources department may also be able to provide you with one. Complete your section of the form and give the form to your employer and/or doctor to complete the remainder.

Can You Get Disability Insurance Benefits If You Are Pregnant

Many short term disability policies through an employer offer pregnancy and maternal benefits which give you 50-70% of your income, typically for six to eight weeks after you give birth, depending on the type of delivery. If you have a complication during pregnancy that keeps you from working, that should also be covered and the benefit period could well be longer. Policies have different benefits and requirements, so its important to look at your STD policy to find out what the exact terms are.

Also Check: How Do I Prove My Disability To The Irs

Application And Approval Process

An employee who is out of work due to a Disability should file a disability claim by entering an application for leave in the Universitys Workday on-line system:

- Go to Workday “Time Off and Leave” application,

- Enter the “First Day of Leave” and the “Estimated Last Day of Leave,” and

The employee will then be directed to download the appropriate forms from the . Please note that the employee’s leave request is not complete until the employee provides the FMLA Administrator with the required information, including an updated Physician Certification Form.

The employee must have the employees physician complete a Physician Certification Form and submit the form to the FMLA Administrator within 20 calendar days of the leave request. A delay in the return of the completed Physician Certification Form may cause a delay in the payment of STD benefits.

On the basis of information received, the FMLA Administrator will determine in a timely manner whether the employees health condition constitutes a Disability that may entitle the employee to STD benefits . If such condition exists and all requirements are met, the FMLA Administrator will provide the effective date of the disability and pay any retroactive short-term disability benefits that are due. FML will run concurrently with any STD benefits to which the employee is determined to be entitled but since FML is unpaid, will not result in any additional benefits.