Answer A Few Questions To Check Your Eligibility

It’s not uncommon for veterans to have both Social Security and veterans disability claims going on at the same time. Alternatively, some veterans receive veterans disability benefits before applying for Social Security disability.

An award of VA disability benefits, also known as service-connected disability compensation, is not based on income, so you can receive VA disability compensation and Social Security disability insurance at the same time. There is also the VA pension, which is a needs-based program similar to Supplemental Security Income . VA pension is paid to veterans who have very little or no income and are disabled based on non-service disabilities. It is also possible to receive SSI and VA pensions at the same time.

If you’re eligible, it’s best to qualify for VA disability compensation and Social Security disability insurance, since they generally pay more generous benefits than VA pension and SSI, but you should be aware of the other needs-based programs.

It’s Not Uncommon For Veterans To Receive Both Social Security And Veteran Disability Benefits

There are several kinds of benefits from Social Security that you may be able to get.

1. Social Security Disability Insurance : Benefits to disabled wage earners and some members of their families if the former wage earners are “insured.”

- Must have worked long enough to become insured and work must be recent

- No resource or asset limits

2. Supplemental Security Income : A means-tested benefit program for the aged , blind, or disabled.

- Work history does not matter

- Monthly maximum payment is the Federal Benefit Rate

- Usually $771 for an individual and $1,157 for a disabled couple in 2019

- Resource or asset limit of $2,000 for an individual or $3,000 for a couple

3. Social Security Retirement: Benefits paid once you have reached your full retirement age.

- Your full retirement age is based on when you were born and can be as early as age 62 or as late as age 70

- If you choose to take early retirement” then your monthly benefits will be reduced, and continuing to work can affect your benefit amount

If you are getting VA disability compensation and then apply for Social Security benefits, Social Security will review any evidence that the VA reviewed in making their decision.

NOTE: While you dont need to be totally disabled to be eligible for VA disability compensation, you are either totally disabled or not disabled under Social Security’s definition of disability.

Pose Your Questions To Larry Here

You cannot, in fact, receive both your retirement and your widows benefit at the same time. Youll just receive the larger of the two benefits. But if your widows benefit is larger, Social Security will describe what it gives you as the sum of your retirement benefit plus your excess widows benefit. Your excess widows benefit is the difference, if positive, between your widows benefit and your retirement benefit. If you take your retirement benefit early, it will be reduced permanently And if its less than the widows benefit, your check wont go up. By not filing for your retirement benefit before age 70, you will let it grow potentially to the point that it exceeds or far exceeds your widows benefit.

The bottom line is 1) Go to your local Social Security office and show them the John McAdams column 2) Tell them in writing that you dont want to take your retirement benefit at 65 if, in fact, doing so provides you nothing more or little more and keeps you from waiting until 70 to collect a much larger check and 3) Restrict the conversation to your total check. Just ask them what will happen to your total check if you do one thing versus the other.

Anonymous: I am 50 years old. I was married the first time for 13 years. We got divorced, and I remarried and was married for 19 years. I would like to collect my first husbands benefits when I turn 60, because his benefit is much higher. Will I be able to do that?

However, Ive read elsewhere:

You May Like: Short Term Disability For Mental Health

Potential Impact Of The Brave Act On Di

Our findings definitively show that the BRAVE Act would increase DI program costs by allowing benefits to be paid to disabled veterans with VA ratings of 100% or IU whose impairments do not meet SSA’s current disability standards. The BRAVE Act could create a bifurcated DI program by establishing different medical eligibility standards for disabled veterans and the general population. The allowance rate for veterans with a total-disability rating would increase from its current level of 69 percent to 100 percent. Moreover, if disabled veterans with a VA rating of 100% or IU were automatically eligible for DI, an induced entry effect would likely ensue. That is, some disabled veterans who have not applied for DI would be encouraged to do so, and all of those new applications filed by insured workers not engaging in SGA would result in entitlement to DI benefits. Of the disabled veterans with a VA rating of 100% or IU, the 47 percent who had never before been entitled to DI would now be entitled if they were insured for disability at the point of disability onset and were not working above the SGA level.

The BRAVE Act could also affect the VA disability compensation program. Automatic entitlement to DI disabled-worker benefits could induce more veterans to file an initial benefit claim with VA or to seek a higher disability rating, increasing VA administrative and program costs.

Social Security Disability Claims

The Social Security disability claims process is quite different from the VA in several ways, the least of which being that you do NOT have to prove that your disabilities are service related. Your status as a veteran does not affect your claim, and the nature of your military discharge is not taken into consideration.

That is important for those who have punitive discharges who may or may not qualify for VA medical benefits. Social Security payments do not depend on whether your discharge was characterized in a certain way.

Social Security disability requires the applicant to submit proof of a physical or mental health issue resulting in a reduced capacity to work at a substantial gainful level, which may be quantified by a specific earnings amount.

That amount was listed in 2021 as earning $1,310 a month from working. But thats not the only requirement. A second part to be mindful of is that your condition must be disabling for at least 12 months or must be such that it will end in death.

» MORE: Check your VA home loan eligibility with today’s top lenders

Don’t Miss: Can I Work If I Am On Disability

Differences Between Social Security And Veterans Disability

One major difference between Social Security disability and veterans disability is that you don’t need to be totally disabled in order to be eligible for VA compensation. In fact, most veterans who receive VA compensation do not receive a total disability rating. Veterans can receive a compensable rating as low as 10%, and can even have a rating as low as 0%.

Social Security disability, conversely, does not compensate disability claimants based on a partial loss of employability. You are either totally disabled or not disabled under Social Security’s definition of disability.

In the past, another difference between the two programs was due to Social Security’s “treating physician rule.” Until March 27, 2017, a “treating physician’s” medical opinion was generally given a great deal of weight. In VA law, the treating doctor’s opinion is not given deferential weight, because of the important VA principle that decisions be based on the entire file, so as not to give any particular evidence extra weight. After March 27, 2017, neither program gives deference to the opinions of a treating physician.

Speaking With A Disability Attorney

If you are in need of assistance at any point in the application process, it may be helpful to speak with a local disability attorney along the way. Their legal knowledge is not only statistically proven to help you get benefits, but it is financially sound.

In fact, disability attorneys are federally required to work on contingency, meaning they only receive payment if they win your case. Should you be interested, a free consultation with a disability attorney near you is only a phone call away.

Read Also: Texas 100 Disabled Veteran Benefits

Va Disability Vs Social Security Disability For Veterans

The VA and the Social Security Administration use two different methods of determining disability. The amount of VA benefits paid is based on an evaluation of the severity of a veterans disability, which is determined by the evidence they submit as part of their claim or that the VA obtains from their military records.

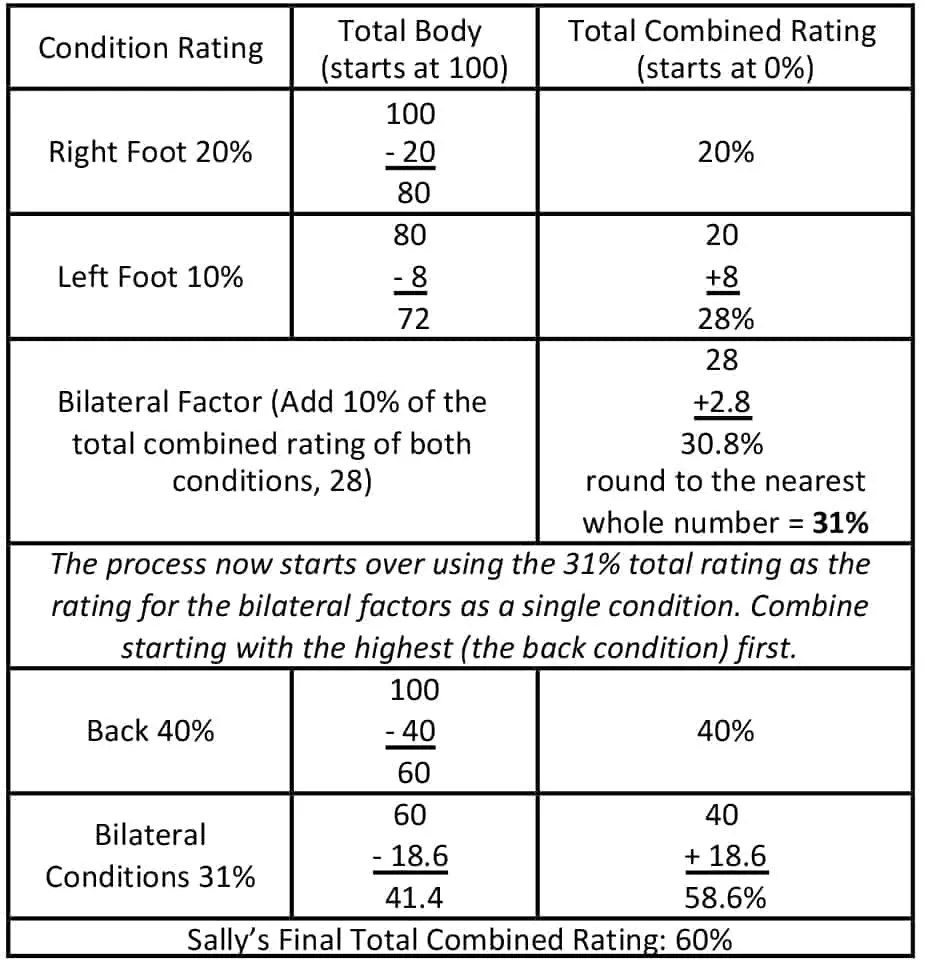

The VA rates disability from 0 percent to 100 percent in 10 percent increments. When a veteran has more than one disability, the VA uses a combined ratings table to determine a veterans disability rating. This is not simple math.

When the VA combines ratings to determine a disability rating, disabilities are arranged in order of severity and then combined with the use of a combined ratings table. The degree of one disability will be in the left column and the degree of the other in the top row. The space where the column and row intersect represents the combined value of the two.

The combined value is rounded to the nearest 10 percent, such that a combined value of 65 becomes 70 percent. According to the VA, if it finds that a veteran has multiple disabilities, it uses the combined ratings table to calculate a combined disability rating. Disability ratings are not additive, meaning that if a Veteran has one disability rated 60% and a second disability 20%, the combined rating is not 80%. This is because subsequent disability ratings are applied to an already disabled Veteran, so the 20% disability is applied to a Veteran who is already 60% disabled.

Income And Work Requirements

There are also different requirements for each. For VA disability benefits, you must demonstrate:

- A current diagnosis of a qualifying condition and

- An in-service event, injury, or illness and

- A nexus between that diagnosis and the in-service event.

To receive SSDI, you must show:

- You have a medical condition that the SSA finds potentially disabling and

- An inability to engage in substantially gainful employment and

- You have a sufficient work history and have paid a minimum amount into Social Security via your payroll taxes.

To receive SSI, you must show:

- You are disabled, blind, a child under 18, or an adult over 65, and

- You have limited income and assets.

Read Also: Michigan Workers’ Compensation Permanent Partial Disability

Example : Establishing Service

In another example, Paul applied for Social Security disability benefits for degenerative disc disease and spinal stenosis. During the hearing, he testified that he injured his back while on active duty. Pauls testimony included specific details how his injury occurred. The judges decision included Pauls testimony. Paul was able to use his Social Security hearing decision to help establish that his back condition was connected to his service.

What If My Social Security Disability Application Is Denied

There is an appeals process for those denied for SSA benefits. The SSA official site says there are two basic categories for denial of SSA benefits: medical reasons and nonmedical reasons.

Those who need to appeal based on medical reasons must submit an Appeal Request and Appeal Disability Report. This report requires the applicant to furnish updated medical information including any tests, treatments, doctor visits, etc. since the SSA decision was made.

Those who need to appeal an SSA decision based on nonmedical reasons must contact their nearestSocial Security Office and request a review of the case and get an appeal. This can also be done by calling 1-800-772-1213 to request the appeal.

A TTY number for hearing impaired applicants is also available: 1-800-325-0778.

Recommended Reading: The New Rules Of Retirement Strategies For A Secure Future

Read Also: How To Apply For Disability In Arkansas

Veterans Eligibility For Ssdi

SSDI benefits are available for both veterans and other workers. They are calculated based on work credits accumulated throughout the veterans or other workers working life. However, SSDI is only awarded to people who qualify as totally and permanently disabled . The disabled veteran needs to check to see if their condition meets the requirements for SSDI. This can be found in the Blue Book compiled by the SSA.

This book contains a list of all conditions and the requirements needed in order to qualify for disability benefits. Most veterans who qualify for SSDI have their claim fast tracked as a reward for the time they have sacrificed representing their country.

A veterans claim for SSDI does not affect their VA benefits and each benefit is applied for separately. Any veteran who has paid Social Security taxes may apply for SSDI independently of VA benefits. You need to have accumulated 40 work credits and 20 of those need to have been earned in the last 10 years leading up to the date you were diagnosed with your disability.

Can I Get Military Retirement Pay And Retirement Benefits

Military retirement pay after 20 years or more of service. The pay is based on your length of time in service and is calculated at 2.5% times your highest 36 months of basic pay. Military retirement benefits are taxable while VA disability benefits and VA pensions are not.

Veterans can receive military retirement pay and Social Security retirement benefits at the same time. Veterans can also be entitled to Concurrent Retirement and Disability Pay , which allows military retirees to receive both military retired pay and VA disability compensation.

You May Like: What Insurance Do You Get With Social Security Disability

Additional Compensation For Dependents

Veterans with a combined disability rating of 30 percent or higher and one or more qualifying dependents are eligible for additional monthly compensation for each dependent. Qualifying dependents include:

- Children under the age of 18

- Children between the age of 18 and 23 who are in school

- Children who were severely disabled prior to reaching the age of 18

Veterans can reference this 2022 VA disability pay chart for the current disability rates for 70 percent disabled veterans based on dependency status.

Is Ptsd A Disability Under Va Compensation And Social Security

Yesif you are a veteran diagnosed with PTSD you may qualify for Veterans Affairs disability benefits, Social Security Disability Insurance benefits, or both.

Each programs eligibility criteria are different and must be met. Basically,

- PTSD can be the basis for a successful VA compensation claim if the PTSD is service-connected and properly diagnosed.

- For SSDI benefits, assuming Social Security FICA requirements are met, the veteran needs to satisfy the criteria under SSAs new medical listing for PTSD or the veteran may be granted disability benefits through SSAs medical-vocational allowance

Also Check: Military Retirement And Va Disability Calculator

Va Disability Payments May Reduce Ssi Payments

Unfortunately, regardless of the anti-windfall provisions, the Social Security Administration treats VA disability payments the same as any other income when considering Supplemental Security Income payments. This is because of the position SSI payments take in priority order. Since SSI payments are needs based and not a program individuals pay into, Social Security considers themselves the payer of last resort. This means that they pay after all other income you receive is accounted for. Then they will determine first if you are eligible to receive any payments from SSI at all and, if so, how much those payments should be reduced given your other income.

So, its not that you cant receive both VA disability payments and SSI payments. Its that they will interfere with each other and cause a reduction in SSI payments up to precluding the payments of benefits. Under Supplemental Security Income, the most the Social Security Administration can pay someone monthly is $841.00 per month . They then reduce SSI for other payments, income, or resources you receive.

Percent Va Disability Pay Rate

70 VA Disability Pay

In 2020, a 70 percent VA disability rating is worth aminimum of $1,426.17 per month and is tax free at both the state and federallevels.

The 70% VA rating is often the tipping point for a higherVA rating, especially as disabled veterans become aware of the additionalbenefits available at the 100% VA rating.

According to VBA data reported to congress, 9.4% of disabled veterans or 447,330 out of 4,743,108 currently have a 70 percent VA disability rating.

A comprehensive 2020 70% VA disability pay chart is shownhere for quick reference:

You May Like: How Do I Extend My Temporary Disability In Nj

Va Disability For Ptsd Criteria

70 PTSD Rating

Occupational and socialimpairment, with deficiencies in most areas, such as work, school, familyrelations, judgment, thinking, or mood, due to such symptoms as: suicidalideation obsessional rituals which interfere with routine activities speechintermittently illogical, obscure, or irrelevant near-continuous panic ordepression affecting the ability to function independently, appropriately andeffectively impaired impulse control spatial disorientation neglect of personal appearanceand hygiene difficulty in adapting to stressful circumstances inability to establish and maintain effectiverelationships.

Whereas the 50 PTSD rating is noticeably lesssevere, and includes the following symptoms:

Ssdi And Va Disability How Do They Compare

Social Security and the U.S. Department of Veterans Affairs pay disability benefits to eligible people and their qualified dependents. However, the programs, processes, and criteria for receiving benefits are very different. Each agency must follow its own definition and requirements.

See the fact sheet for a side-by-side comparison of the differences between SSDI and VA compensation.

| Disability Criteria | SSDI |

|---|---|

| Injury/Illness must be due to military service | |

| Impairment must prevent the ability to work at substantial gainful activity level at time of application | |

| Disabling condition must last at least 12 months or end in death | |

| Age, education, and work history can affect eligibility | |

| Monthly benefit amount and eligibility are not affected by the other program | |

| Offers partial payments based on scale of disability | |

| All or nothing disability payment |

Social Security pays disability benefits to people who cant work because they have a severe medical condition that is expected to last at least one year or result in death. Federal law requires this very strict definition of disability. While some programs give money to people with a partial disability or a short-term disability, we do not.

The VA pays disability compensation to veterans who have a service-connected disability resulting from a condition that was incurred during or aggravated by active military service.

Don’t Miss: Supplemental Long-term Disability Insurance