A Look At The Ssdi Program

You may have heard that you must be insured to qualify for SSDI benefits. Insured may be misleading because it brings to mind an insurance policy of some sort. What it means is that you must have worked long enough before becoming disabled and contributed to the Social Security System through the payment of Social Security payroll taxes. For self-employed workers, insured means that you paid Social Security taxes on your self-employment income.

If you meet the work requirement and have a disability that meets the definition that federal regulations use to determine eligibility for SSDI, then you may qualify for monthly benefits. Depending on the onset date of your disability, you may not receive a monthly payment immediately after being notified that your application has been approved.

There is a five-month waiting period from the onset date until you receive your first SSDI monthly payment in the sixth full month of disability. However, it takes a while for Social Security to process your application, so you should have an SSD lawyer file the application as soon as you know that you meet the work and disability requirements. The five-month waiting period only applies to the time between the onset of the disability and the first payment, so filing early lets the waiting period run while the SSA processes the application.

How To Make Sure You Dont Lose Your Ssdi Benefits

If youre thinking about applying for disability but are still employed, or if youve been receiving benefits but are considering part-time work to help make ends meet, its crucial that you get all the facts before making any decisions that could put your disability benefits in jeopardy.

To get help with applying for Social Security programs, appealing a decision, or just to talk about all your legal options, consider contacting an experienced Social Security disability lawyer at Social Security Disability Advocates USA.

Our friendly legal team will schedule a free consultation to review your case and help you understand the possible impacts of SSDI income limits. Call us today at , chat with us via LiveChat, or send us a message using our secure contact form.

How Does The United States Compare With Other Countries

According to a recent analysis by the Organisation for Economic Co-operation and Development, or OECD, the United States has the least generous disability-benefit system of all OECD member countries except Korea. The OECD describes the U.S. disability-benefit system, along with those of Korea, Japan, and Canada, as having the most stringent eligibility criteria for a full disability benefit, including the most rigid reference to all jobs available in the labor market and the shortest sickness benefit payment duration. In addition, the United States spends less as a share of its economy on incapacity-related benefits than other nations. In 2009 public expenditures on incapacity-related benefits comprised just 1.5 percent of U.S. gross domestic product, or GDP, compared to an average of 2.4 percent for all OECD nations.

Proponents of cutting disability benefits in the United States sometimes point to particular elements of disability program reforms in Europeparticularly in Germany, the Netherlands, and the United Kingdomas potential models for changes to the Social Security disability programs. In general, however, such proposals fail to take into account that these nations have much more generous disability systems, less rigorous disability standards, higher levels of social expendituresnot just on incapacity benefits but on social assistance generallyand more regulated labor markets than the United States.

You May Like: Disability For Arthritis In Spine

Do I Need An Ssdi Lawyer

You are not required to hire a lawyer to apply for Social Security Disability benefits. There are several ways you can apply on your own:

- You can apply online directly through the Social Security Administrationâs website.

- You can call the Social Security Administration at 1-800-772-1213 from 7 a.m. to 7 p.m. Monday through Friday.

- You can apply in person at your local Social Security office, though we recommend calling in advance to make an appointment.

There is a clear financial benefit to applying on your own–if your application is successful, you wonât have any legal fees deducted from your award.

But keep in mind that less than â of SSDI applications are approved, and many fail due to incomplete forms or information. The application process can be overwhelming and confusing. Having a Social Security disability lawyer guide you through the process will increase your chance of success.

Many Social Security disability lawyers offer free consultations, so it may be worth speaking with a few SSDI attorneys and asking them some questions to help you evaluate your options.

How To Lose Ssdi Benefits

The commonest reason why the SSA would stop a persons Social Security Disability payments is because the recipient has gone back to work, even though this isnt always the case. If you go back to your normal job when in receipt of SSDI benefits the SSA will decide if you are taking part in substantial gainful activity .

The key factor in deciding if work is considered to be SGA is the amount someone is paid. In 2020, somebody is typically considered to be engaging in SGA if his/her earnings exceed $1,260 or $2,110 for someone who is blind.

For example, if you are earning $200 weekly in a part-time job, you are not working above the SGA limit. If you are spending a lot of time at work but what you are doing constitute SGA despite the earnings being below the SGA threshold you could have your SSDI stopped.

However, if you are working and make over SGA you can be entered into a trial work period. This period allows somebody who is receiving SSDI benefits to try to go back to work without being told they will lose their SSDI eligibility.

In the majority of cases, you should be able to work for up to 9 months during a trial work period and you will still continue to receive your SSDI regardless of the amount you are earning. When the trial work period comes to an end and you are still taking part in a job earning above the SGA level the SSA is likely to decide you are no longer disabled so your Social Security Disability payments will stop.

Recommended Reading: How To Apply For Disability In Arizona

What Are The Maximum Social Security Disability Benefits

The monthly benefits issued for 2022 include:

- The current maximum Supplemental Security Income for an individual is $841 per month.

- The current maximum amount for Social Security Disability Insurance benefits is $3,148 per month.

- The average disability payment for a disabled worker receiving SSDI is $1,358 per month.

Disorders That Qualify For Social Security Disability Benefits

In order to receive Social Security Disability benefits, you must have a disability that is recognized by theSocial Security Administration Blue Book. Some of which include:

- Musculoskeletal disorders, e.g., burns, craniofacial injuries, pathologic fractures

- Respiratory disorders, e.g., cystic fibrosis, asthma, respiratory failure

- Cardiovascular disorders, e.g., aortic aneurysm, ischemic heart disease, symptomatic congenital heart disease

- Digestive system disorders, e.g., inflammatory bowel disease , chronic liver disease

- Skin disorders, e.g., dermatitis, Bullous disease, burns

- Neurological disorders, e.g., cerebral palsy, epilepsy, multiple sclerosis, Parkinsonian syndrome

- Mental disorders, e.g., schizophrenia, intellectual disorder, depressive, bipolar, or a related disorder

If you dont have a disorder or disability specifically noted by the SSA, you still have other options. With your medical records, including doctors notes, and other forms of documentation, the program might make an exception.

Also Check: How To Disable Comments On WordPress

What Do I Need To Know About Advance Designation

You should be aware of another type of representation called .

Advance Designation allows capable adult and emancipated minors who are applying for or receiving Social Security benefits, Supplemental Security Income, or Special Veterans Benefits the option to choose up to three people in advance who could serve as their representative payee, if the need arises.

In the event that you can no longer manage your benefits, you and your family will have peace of mind knowing that someone you trust may be appointed to manage your benefits for you. If you need a representative payee to assist with the management of your benefits, we will first consider your advance designees. We must still fully evaluate them and determine their suitability at that time.

You can submit and update your advance designation request when you apply for benefits or after you are already receiving benefits. You may do so through your personal account, contacting us by telephone at 1-800-772-1213 , or at .

Ssd Benefits And Investment Income

Income can be earned or unearned. Earned income is money that you make while actively working, for either an employer or yourself. It includes wages, salaries, tips, bonuses, net earnings from self-employment, contract work, certain royalties, and union strike benefits. This type of income counts against your monthly maximum for SSD eligibility.

Unearned income is money that you make or receive through something other than employment or active work, and it doesnt count against the monthly income limits.

Examples of unearned income include:

Some of our clients who receive SS disability checks also have investment income from financial documents , rental property, or other passive income sources, says Gantt.

Keep in mind that if you have investment income, the SSA is likely to want a closer look. Current technology helps flag questionable investment income info, says Gantt. I tell my clients who move in investment arena to expect questions and review.

One way to prepare for questions is to use an affidavit. Financial investments are generally passive by nature. For true passive income earnings, we encourage SSD clients to be prepared to sign affidavits that they took no action on the investment income subject that could convert the income to the earned legal category, says Gantt.

Don’t Miss: Social Security Disability Medicare Part B

Is Di Out Of Sync With The Americans With Disabilities Act

The Social Security Advisory Board, which was created by Congress to advise the President, the Congress, and the Commissioner of Social Security, posed the question of whether the DI program and its test of disability is out of sync with the Americans with Disabilities Act . In April 2004, the Academy drew on findings of its Disability Policy Panel report, Balancing Security and Opportunity, to testify before the Board as follows:

The need for a disability wage-replacement program does not go away because we have the Americans with Disabilities Act . Nor is the need for such a program eliminated by advances in medicine, changes in the demands of jobs, new assistive technology, or other environmental accommodations. These developments may increase employment opportunities for some categories of individuals with disabilities. For example, the ADA expands opportunity for people who have highly valued skills whose main impediments to work had been based on discrimination, architectural barriers, or other impediments that the ADA alleviates. But other individuals may face increasing impediments to work as the work environment and demands of work change. For example, in an increasingly competitive world of work, emphasis on versatility and speed may impede employment prospects for people with mental impairments. Because the phenomenon of work disability will remain with us in a competitive economy, wage replacement programs remain essential.

Minutes To See If You Qualify

Social Security can be complicated and very intimidating to apply for. It is also vital that everything is completed correctly so that your chances of receiving benefits are their highest. In addition to meeting financial requirements, you will need to meet a Blue Book listing for a disabling condition.

To maximize your potential to receive benefits, consider getting assistance from a Social Security attorney or disability advocate. They can help in filing paperwork and presenting cases can make all the difference you need to qualify for the benefits you deserve. If you are denied disability, an attorney can help you file an appeal.

Also Check: Inclusion Of Students With Disabilities

Premium: How Much Makes Sense

A big deterrent to the purchase of private long-term disability coverage, especially for those starting out at an older age, is the premium, particularly when viewed in contrast to the benefit that may be received. Suppose a policy with a maximum two-year benefit coverage that will pay out $3,000/month or a maximum of $72,000 overall. How many years would it make sense for a 50-year-old to pay a premium of $3,000/year for this coverage? Would it make more sense to simply save $3,000/year instead, as a form of self-insurance? These are difficult choices to make. Ideally they would be made with the assistance of a financial advisor who can evaluate the whole financial picture and gauge the risks.

Income Limits For Social Security Disability Benefits

For 2022, the monthly income limit is $1,350 for non-blind and $2,260 for blind people. These amounts increase to $1,470 and $2,460, respectively, for 2023. If you can earn more than these amounts, then the SSA deems you capable of engaging in substantial gainful activity, which prevents you from qualifying for benefits.

If you work while receiving SSD benefits, you have to report that income to the SSA, no matter how little you earn. During a trial work period of up to nine months , you can have unlimited earnings and still receive full benefits. Once the trial work period is over, the SSA will determine if youre still entitled to disability benefits.

SSD recipients are allowed to earn some income for a limited time and limited amount, mainly to fully test their potential ability to return to work and leave the SSD rolls, says David Gantt, an Asheville, North Carolina, lawyer who handles a large volume of SSD cases. Once these very limited times and amounts are exceeded, the Social Security Administration will review any reported income and make inquiry and/or an investigation.

Don’t Miss: Texas 100 Disabled Veteran Benefits

Can You Work While On Disability

The SSA has specific rules regarding your ability to work while on disability, although it should be noted that people on SSDI are initially approved because they are truly unable to work for a variety of reasons.

Since many people with disabilities would prefer to work rather than receive benefits, the SSA will allow a nine-month Trial Work Period to determine if your earnings are substantial. A trial work month is any month where earnings exceed $970, and the trial work period continues until you have nine cumulative trial work months within a 60-month period.

After your trial work period, your benefits will stop if Social Security considers your earnings substantial. In 2022, Social Security considers your earnings substantial if you earn more than $1,350 per month over the following 36 months. At that income level, youre considered able enough to gainfully work and will no longer receive cash payments. This is sometimes referred to as substantial gainful activity, or SGA.

Remember that if you do decide to go back to work — or if your medical condition has improved — you must alert the SSA. While you can earn minimal income while receiving SSDI payments, earning more than the $970 monthly threshold will lead to a more thorough review of your circumstances.

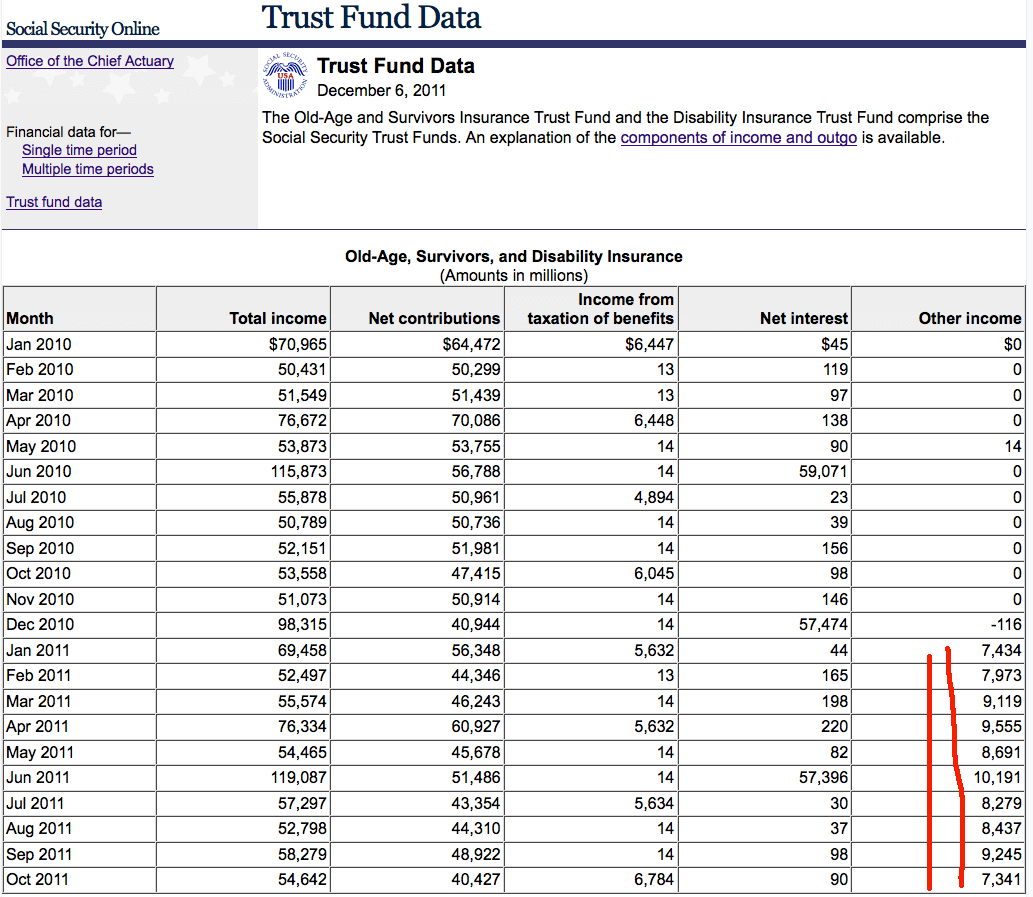

How Are Disability Insurance And Supplemental Security Benefits Funded

Disability Insurance is funded by payroll tax contributions from workers and their employers. Workers currently pay a tax of 0.9 percent of their wages up to $113,700, and their employers pay an equal amount. These tax contributions go into the Disability Insurance trust fund. Funding for Supplemental Security comes from the federal income tax and other federal revenues.

The Social Security Administration administers both of these programs. State agencies, usually called disability determination services, make the initial determination of whether applicants meet the disability standard. These state agencies are federally funded and follow federal guidelines.

Don’t Miss: Aflac Short Term Disability Forms

There Are Income Limits On Earned Income But Not On Passive Investments

If you receive Social Security benefits due to a disability, theres a strict limit on how much income you can earn each month from working before you risk losing your benefits. Still, theres no limit to the amount of unearned income you can have, which means investments can be a valuable way to build wealth.

How To Get The Maximum Social Security Retirement Benefit

Now that you know how your Social Security payout is calculated, what can you do to receive the maximum amount once you claim Social Security benefits? There are a couple of things that you absolutely must do if you want to receive the highest amount possible from Social Security. Here is what you have to do.

You May Like: The Americans With Disabilities Act

Ssi Payment Amounts: 2022

Supplemental Security Income, or SSI, is paid based on financial need. In Pennsylvania, you must have little income and few assets. The total value of your assets must be less than $2,000 . A person applying for SSI does not need to meet work requirements or even have any employment history at all to qualify, as long as he or she has a disabling mental or physical condition that prevents him or her from working.

In Pennsylvania, the maximum SSI disability amounts for 2022 are:

- For an individual living independently: $841 monthly

- For a couple living independently: $1,261 monthly

- For an individual living in someone elses household: $522 monthly

- For a couple living in someone elses household: $783.34 monthly

These figures are adjusted regularly for inflation. You may also be entitled to money from the state of Pennsylvania, which supplements federal SSI benefits for disabled residents. If you receive SSI, you can also apply for Medicaid and the Supplemental Nutrition Assistance Program , which can help you get more food without spending your SSI benefit. You may also be eligible for other benefits and services.

October 13, 2022 by Brad Collins

Well cover how that cost-of-living increase impacts disability payments in detail below.