How Ssdi And Va Compensation Can Work Together

Fast-track applications

If you have a 100 percent P& T rating from the VA, Social Security will speed up processing of your SSDI claim. To get expedited handling, enter Veteran 100% P& T in the Remarks section of your online application and provide Social Security with the notification letter the VA sent you about your rating.

Regardless of your P& T rating, you may qualify for expedited processing under Social Security’s Wounded Warrior program, which prioritizes claims for veterans who became disabled while on active duty on or after Oct. 1, 2001.

No ‘offset’

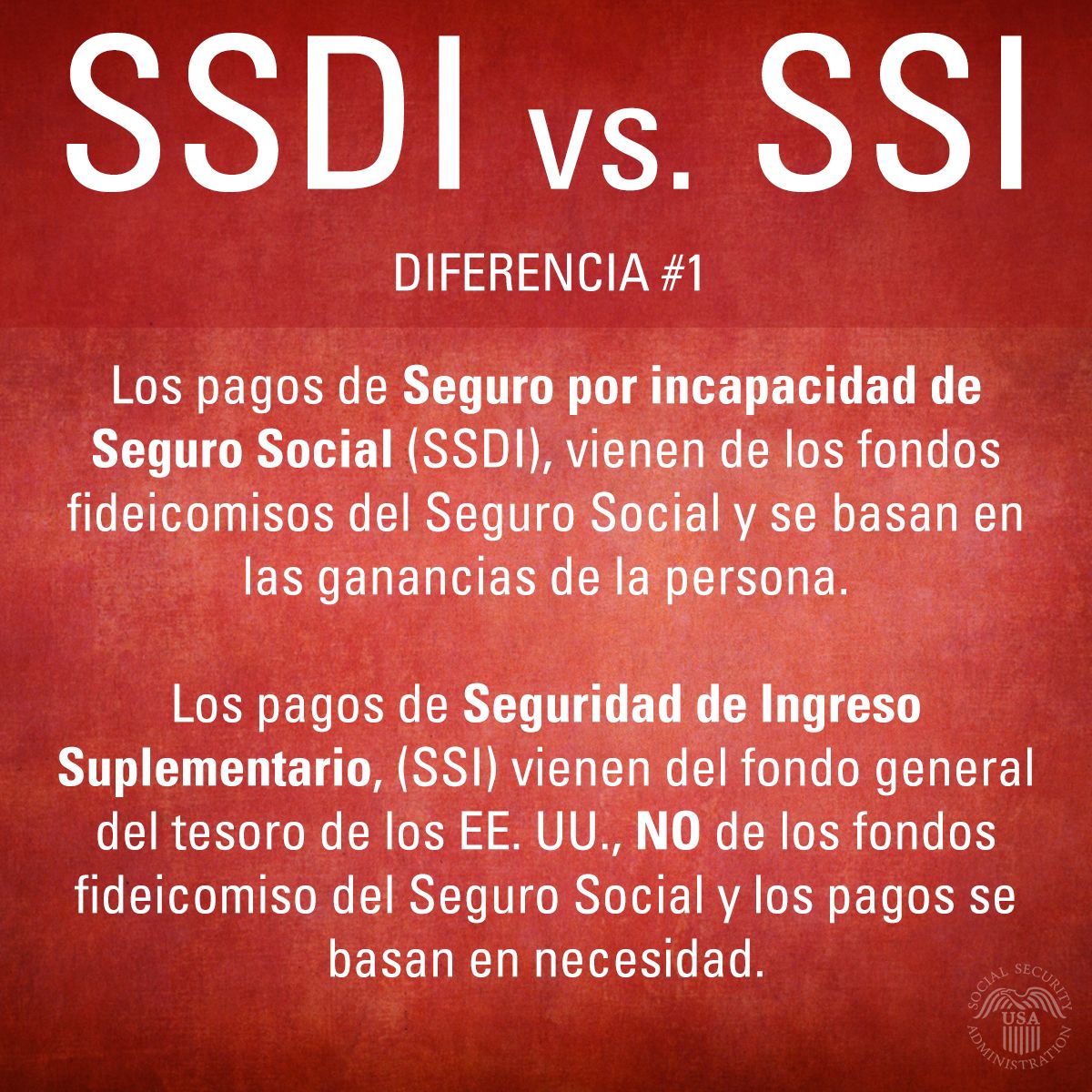

Workers compensation and some other types of public disability benefits can trigger what the SSA calls an offset that reduces your Social Security payments. VA disability benefits don’t affect your SSDI or vice versa if you qualify for both programs, each will pay the full amount to which you are entitled.

Health care coverage

If you get SSDI and VA disability benefits, you can receive medical coverage through both.

SSDI recipients are eligible for Medicare, although in most cases there is a two-year waiting period for coverage to begin. Veterans are eligible for coverage under the military’s Tricare program.

If you’re getting both benefits, Medicare becomes your primary payer and Tricare serves as a supplement, covering some cost-sharing, such as copayments and deductibles.

Va Csrc Pay And 100% Va Disability

What is Combat Related Special Compensation ?

A benefit with significant tax advantages that compensates both disability and non-disability related military retirees with disabilities that were deemed to be as a result of combat-related service. CRSC essentially reduces a portion of the veterans taxable pension, and replaces it with a tax-free payment from the Department of Veterans Affairs .

In order for the retirees disabilities to be deemed combat-related they must have been incurred as a direct result of one of the following:

- As a direct result of armed conflict

- While engaged in hazardous service

- In the performance of duties while under simulated conditions of war

- Through an instrumentality of war

Who qualifies for CRSC Pay?

Veterans who are receiving and/or entitled to military retired pay with a VA disability rating of at least 10% must file an application using form DD form 2860 with their branch of service in order to receive benefits. You must provide evidence that your disabilities are deemed to be combat-related. Veterans whose applications are approved must be willing to waive the CRSC compensation amount from their retired pay.

Can I get back pay?

Yes, retroactive payments are authorized as far back as June 1, 2003, but will be limited to six years from the date the VA awarded compensation for the disability.

What is the benefit of being approved for CRSC?

Want to learn more about CRSC?

Why Don’t I Already Receive My Full Dod Retirement And Va Disability Benefits

Legally, the maximum a veteran is allowed to receive is their full military retirement. Since money that comes from the VA is not taxable, however, the government decided that if a veteran qualifies for VA disability compensation, then it would be better for the veteran to receive the money from the VA than the DoD. Thus, any money received from the VA is subtracted from DoD money unless the veteran qualifies for CRSC or CRDP.

Don’t Miss: Different Types Of Learning Disabilities

Va Disability And Divorce

In our VA Waiver article, we discuss how the retirement payments waived to receive VA disability payments are not divisible, per 10 U.S. Code § 1408. But what about when the member is receiving disability payments when there has been no waiver?

Federal law does not authorize states to treat VA disability payments as marital property and divide them in a dissolution of marriage action. Mansell. Contrast that to retirement, where the Uniformed Services Former Spouses Protection Act explicitly authorizes states to divide military retirement at divorce.

A 20 Years Or More Of Military Service Or Otherwise Entitled To Retired Pay

For purposes of military retirement plans, the 20-year service requirement is calculated using a retired pay multiplier. The DoD multiplier chart shows different retirement plans based on active or reserve duty and disability retirement programs.

For example, members retired under Public Law 102-484 or Temporary Early Retirement Authority may make the 20-year requirement if they are credited with a 50 percent service multiplier, or if they return to active duty long enough to achieve 20 years . Documentary evidence of TERA retirement is generally sufficient to qualify as retired for purposes of CRSC eligibility.

Here is a video explaining how the VA combined ratings table works from one of our Veterans Disability Lawyers.

CRSC Calculation for Chapter 61 Retirees

Title 10 USC Chapter 61 defines different categories of medical leave and retirement. Chapter 61 retirees are those who have medically retired from military service with a VA disability rating of 30 percent or above. This includes those on the Temporary Disabled Retirement List.

However, military departments are not bound by the DoD retirement pay multiplier. Instead, they will look at the supporting information submitted with the application to determine whether Chapter 61 and TERA retirees are eligible for CRSC qualifications.

You May Like: Can You Go On Disability For Anxiety

I Received A Letter From Dfas Confirming Entitlement But Have Not Received A Payment Who Should I Contact To Check Its Status

If the payment will come from the VA, call 800-827-1000. If the payment will come from DFAS, call 877-327-4457 or 800-321-1080. Prior to calling, please confirm the payment has not yet been posted by your financial institution.

After speaking with a Customer Service Representative please allow 10 business days if you are expecting a physical check. If after 10 business days you have not received your check, please alert DFAS in writing. Include your name, Social Security Number, address, missing payment type, the expected amount, and date.

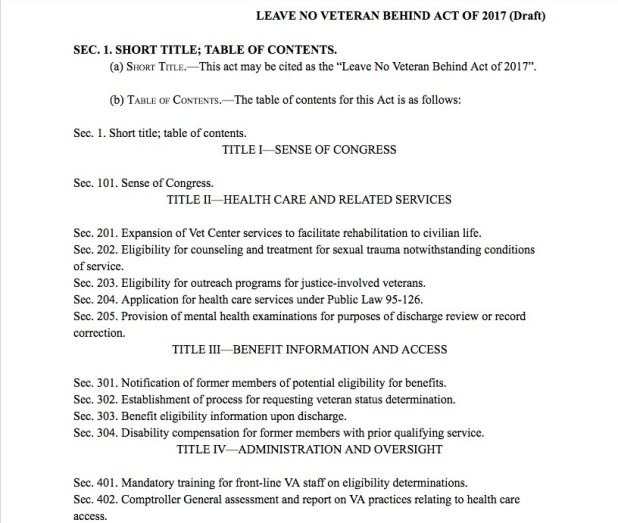

How To Apply For Crsc Benefits

Combat-Related Special Compensation is not automatic. You will need to apply for these benefits with your respective branch of service. They will assess your claim and determine your eligibility. To apply, you will need to fill out DD form 2860, along with the required documentation mentioned below, and send it to your respective military branch.

CRSC can be a complicated benefit because each case is unique. As always, it would be a good idea to consider using a Veterans Service Officer to help you with your benefits claims. They are often well-versed in applying for military and veterans benefits, and usually offer free assistance to veterans.

Documentation of Combat-Related Injury Required: You must be able to show a causal link between your service-connected disability rating and a combat-related event. You will need to provide documentation of your military service, including your Form DD-214 or Form DD-215, military medical records pertaining to your injuries, military personnel files, line of duty determinations, safety mishap reports, military personnel data system printouts, prior military disability board decisions, casualty reports, official orders or travel vouchers, VA summary letters, or other official documents that can substantiate your claims. Here is the important thing to remember: your records must clearly show your injury is combat-related.

Here is the contact info for submitting your CRSC claim:

Air Force

Recommended Reading: How Much Is Disability In Illinois

Concurrent Retirement Disability Pay

Concurrent Receipt Laws: Until 2004, the law prevented military retirees from receiving part or all of their military pay if they also received disability compensation from the VA. Military members had to choose which payment they wanted to receive: military retirement pay or VA disability compensation. If they chose to receive both forms of payment, they had to offset, or waive, a portion of their military retirement pay equal to the amount they received from the VA. It prevented service members from double-dipping and receiving compensation from both the VA and the military.

In 2004, the law changed, and military retirees were eligible to receive both military retirement pay and VA disability compensation, but only if they had a VA service-connected disability rating of 50% or higher.

Here is how the compensation breaks down if you are eligible to receive both types of compensation:

The difference between a disability rating of 40% and 50% can mean a difference of thousands of dollars per year because the difference comes in the form of the increased disability compensation at the higher rate, along with the full military pension that is not offset by the concurrent receipt laws.

Am I Eligible For Combat

CRSC is a program that provides compensation for eligible retired veterans with combat-related injuries. The injuries must warrant between a 10% and 100% disability rating. It is intended to help mitigate the loss of income resulting from a veterans inability to receive disability compensation from both the DOD and the VA.

Unlike Concurrent Retirement an Disability Pay , CRSC is available to both service members who retire with 20 or more years of creditable service and those who have less than 20 years.

CRSC helps retired veterans by replacing the VA disability compensation that is subtracted from retired pay. It also restores military retired pay with tax-free monthly payments and is paid retroactively.

To be eligible a veteran must:

And must have at least ONE of the following combat-related VA disabilities:

You May Like: Property Tax Relief For Disabled

Va Disability And Child Support In Colorado

Colorado’s definition of income for purposes of calculating child support and maintenance is expansive: Gross income’ means income from any source and includes, but is not limited to, followed by a long laundry list of items which covers basically everything, including non-taxable payments such as trust income and gifts. C.R.S. 14-10-114 and C.R.S. 14-10-115 .

Perhaps more useful, VA disability payments are not on the very, very short list of payments excluded from the definition of income in either statute.

In a 1990 case, neither party disputed that the VA disability benefits counted as income to the spouse. Accordingly, and without any analysis, the Colorado Court of Appeals concluded that disability benefits are expressly included as gross income under Colorado law. Fain, at 1087.

The Colorado Court of Appeals was a bit more explicit in 1991, rejecting a husbands argument that counting VA disability payments as income to calculate alimony was effectively an impermissible division of the disability payments in violation of federal law:

Finally, in 2020, the Colorado Court of Appeals gave this issue a full analysis, and held that under Colorado law, Veterans Administration disability payments are properly included as income for purposes of child support and maintenance: “we conclude that veteran’s disability benefits fall within the broad definition of gross income.”M.E.R.-L., ¶ 21.

Concurrent Retirement And Disability Pay Recipients And Costs

In January 2019, the Congressional Research Service released a report titled, Concurrent Receipt of Military Retirement and VA Disability, which looked at CRDP recipients and costs. According to the report, as of September 2017, there were 577,399 CRDP recipients at an annual cost of $11.4 billion. The Congressional Budget Office has previously estimated that eliminating CRDP would save $139 billion between 2018 and 2026. CBO also estimates that extending the CRDP program to those with a VA disability rating of 40 percent or less would cost $30 billion over a 10-year period.

Recommended Reading: Disability For Arthritis In Spine

Who Is An Eligible Veteran

To be eligible for CRSC, a veteran must be entitled to retired pay from a military service branch as a result of being medically retired, or as the result of serving at least 20 years. A deceased veteran is not eligible for CRSC. However, if a veteran applied for CRSC benefits before their death, the veterans estate is entitled to the CRSC benefits that would have been paid to the veteran.

When Do I Start Receiving Payment

Once DFAS receives a copy of your CRSC award letter from your branch of service, it should take about 30-60 days to receive your first payment.

Checks are issued on the first business day of the month. Pay will be direct deposited into the same account as your retired pay. If you are not receiving retired pay, it will be deposited into the same account as your VA pay. If you have your retired pay checks mailed, the payment will be sent to your mailing address that is on record at DFAS.

Recommended Reading: California Disability Insurance Phone Number

Application For Va Disability Benefits

VA disability payments are not automatic – as with everything else in the military, there is a process, and this one requires that the retiree affirmatively apply for disability payments. 38 U.S. Code § 5101. The specific form used is the VA Form 21-526, Veteran’s Application for Compensation and/or Pension. While disability applications often come contemporaneous with separation from the military, as long as the condition was service-connected, there is no deadline to apply. So when addressing VA disability and divorce issues, do not assume there will be no future VA benefits simply because the veteran is not currently receiving them.

A VA disability election is revocable, per DOD Financial Management Regulation, Volume 7B, Section 120205. Presumably a veteran would have little incentive to do this, unless to facilitate receipt of Combat-Related Special Compensation . Revoking a VA disability election requires filling out the same VA Form 21-526.

How Much Money Does Crsc Pay

You will receive all of the benefits youre currently receiving from the VA, and the DoD will pay you the full retirement benefits for which you qualify. In other words, your retirement income wont be offset by your VA disability pay.

CRSC is not a set amount and depends on your specific situation. Since the benefit is designed to restore the combat-related portion of the money deducted from your retirement pay by the VA waiver, the benefit amount depends on both your waiver and your disability rating. The big takeaway here is you will not receive more than your VA offset.

Also Check: Disability Social Security Income Limits

Disabled Veterans May Be Eligible To Claim A Federal Tax Refund Based On:

- an increase in the veteran’s percentage of disability from the Department of Veterans Affairs or

- the combat-disabled veteran applying for, and being granted, Combat-Related Special Compensation, after an award for Concurrent Retirement and Disability.

To do so, the disabled veteran will need to file the amended return, Form 1040-X, Amended U.S. Individual Income Tax Return, to correct a previously filed Form 1040, 1040-A or 1040-EZ. An amended return can be e-filed or filed by paper for most returns. For tax years 2019 and later, a paper filed original return can be amended electronically or by paper. Disabled veterans should include all documents from the Department of Veterans Affairs and any information received from Defense Finance and Accounting Services explaining proper tax treatment for the current year.

Please note: It is only in the year of the Department of Veterans Affairs reassessment of disability percentage or the year that the CRSC is initially granted or adjusted that the veteran may need to file amended returns.

Under normal circumstances, the Form 1099-R issued to the veteran by Defense Finance and Accounting Services correctly reflects the taxable portion of compensation received. No amended returns would be required, since it has already been adjusted for any non-taxable awards.

Colorado Will Not Plus Up Va Disability Payments To Account For Taxes

Colorado does not plus up disability payments to take into account their tax-free status. So while receiving $2000/mo disability might be the equivalent of a salaried person receiving $2400 and paying taxes, the court must only use the $2000/mo, and not impute additional income for the fact that the VA disability is not taxable. Fain..

This is inconsistent with the way Colorado treats tax-free maintenance, which isplussed up by either 20% or 25%, depending upon incomes, for purposes of the child support worksheet. No one ever accused the law of being completely principled!

Don’t Miss: Social Security Disability Attorney Utah

How Do I Apply For Crsc

CRSC isnt automatically so youll need to apply for this benefit. If a new condition/rating is added to your VA disability that also qualifies, you can submit a new application for that condition.

Your application should include medical records related to eligible medical conditions, as well as Purple Heart citations or other documents that prove the conditions were caused by combat or combat-related activities. Retirement information , and your VA rating decision, should also be included.

If you are a reservist, also include a copy of your 20-year letter or statement of service.

You might also consider submitting copies of previous VA rating decisions, copies of DD 214s and DD 215s and any other documented evidence supporting how the disability being claimed is linked to a combat-related event.

When applying with your branch of service, youll be required to show proof that your injuries fall into one of the authorized categories. This proof must be officialeither in your service records or a news article. Buddy letters can help substantiate the proof, but arent enough to prove the link on their own.

Including as much supporting documentation with your CRSC claim will improve your chances that youre approved for CRSC when you first apply.

Complete instructions are found on the application form, including the correct mailing address for processing.