Ssi Eligibility And Eligibility For Certain Former Ssi Recipients

You may qualify for SSI /Medicaid, or you may be able to remain eligible for Medicaid after your SSI payments stop if you meet certain eligibility guidelines.

SSI EligibilityIf you qualify for Supplemental Security Income , you automatically receive Medicaid. SSI makes monthly payments to individuals with low income and few resources that are either age 65 or over or blind or disabled. Blindness and disability are determined using Social Security rules. An application for SSI is filed with the Social Security Administration.

If you have unpaid medical bills in any of the 3 months prior to the month you apply for SSI, you can apply for Medicaid to cover these month by filing an application with the Division of Medicaid.

For more information, see the Medicaid Eligibility Guide for SSI Recipients and Certain Former SSI Recipients brochure.

Medicaid Eligibility for Certain Former SSI RecipientsCertain former SSI recipients may continue to receive Medicaid. You must be eligible in one of the groups briefly described below:

Ssd Benefits And Investment Income

Income can be earned or unearned. Earned income is money that you make while actively working, for either an employer or yourself. It includes wages, salaries, tips, bonuses, net earnings from self-employment, contract work, certain royalties, and union strike benefits. This type of income counts against your monthly maximum for SSD eligibility.

Unearned income is money that you make or receive through something other than employment or active work, and it doesnt count against the monthly income limits.

Examples of unearned income include:

Some of our clients who receive SS disability checks also have investment income from financial documents , rental property, or other passive income sources, says Gantt.

Keep in mind that if you have investment income, the SSA is likely to want a closer look. Current technology helps flag questionable investment income info, says Gantt. I tell my clients who move in investment arena to expect questions and review.

One way to prepare for questions is to use an affidavit. Financial investments are generally passive by nature. For true passive income earnings, we encourage SSD clients to be prepared to sign affidavits that they took no action on the investment income subject that could convert the income to the earned legal category, says Gantt.

Income Excluded By The Monthly Limit

There are certain forms of income you may be able to exclude from being counted in your monthly income. This way, you can remain within or below the income limits outlined by the SSA. For example, SSI applicants do not have to include the following in their monthly income limits:

- The first $20 of any income you receive from any source

- The first $65 you receive from your job if you still work

- Certain educational scholarships

- Money you spend on work-related items

Understanding and calculating what forms of income apply to your monthly limit for Social Security Disability can be confusing. A lawyer who handles Social Security Disability cases may be able to help you figure out whether you qualify for benefits based on monthly income.

Don’t Miss: Va Disability Rates By Condition

What Does This Mean For Individuals And Businesses

For individuals who are on disability, the general benefit theyll receive is that they wont have to worry quite as much about working too many hours each month in order to still qualify for disability benefits. Likewise, theyll be able to experience an almost 6% increase in benefits reflecting the increased cost of living and inflation of 2022, which will likely not contract much as the year progresses.

More practically, this means that people on disability will have more opportunities than before to still do dignifying and meaningful work and make a living while living a life of independence, and not having to miss out on as many work opportunities as before. For families with a disabled family member or a disabled child, the overall increases for the income and benefit thresholds will give them more flexibility as they plan out their lifestyles and take care of whats needed.

For employers, the increases to both incomes and benefits will mean that they will need to work closely with their human resources departments to accommodate more employees who want to work and want to retain their benefits, they will have more freedom to employ these employees for more hours each month, which cumulatively will add up on their payroll, so important considerations will need to be made.

All in all, the net result will be a positive one, for families and employers alike who want to work with motivated, passionate people!

When You Need To Notify The Social Security Administration Of Additional Income

So, when should retirees notify the Social Security Administration that they will have additional earned income? A good rule of thumb is to always notify the Social Security Administration if you are working while receiving benefits. If you have already reached full retirement age, then you do not need to worry about notifying them. But if you have not yet reached full retirement age, you should let them know that you are earning income that could count toward the earnings limit.

You need to tell the SSA so that they can adjust your benefits correctly if they need to. Failure to notify the Social Security Administration of your income could lead to an overpayment. In that case, they will demand repayment of the overpayment, and you might only have 30 days to repay the money. You could find yourself stuck in a bad spot if you allow them to overpay your benefits, and then you need to quickly repay the overage. Its always best to notify the SSA upfront so that your benefits can be decreased once you hit the earnings limit. This is especially crucial when you have self-employment income, otherwise, they will not know about this income until you file your taxes. This could lead to you owing a big check to the Social Security Administration when tax season rolls around.

Don’t Miss: Social Security Disability Earnings Limit 2022

What Is The Social Security Income Limit

The earnings limit is also known as the income limit, or the earnings test. The official term is earnings test, but income limit and earnings limit are the terms that youll hear most often.

For our purposes, know that all these terms mean the same thing and there are four quick facts about the Social Security income limit that you should know before we jump all the way into explaining the test or limit:

How Do You Qualify For Disability Benefits

To qualify for benefits, you must have a medical condition that meets the SSAs definition of disability. The organization considers you disabled if:

- Your medical condition prevents you from working as you once did and

- You cannot adjust to other work because of your medical condition and

- Your disability is expected to last for at least one year or result in death.

In addition, you need to meet the technical requirements for Social Security Disability Insurance or Supplemental Security Income benefits.

Don’t Miss: How Long Is Long-term Disability

Talk To A Social Security Disability Lawyer For Free Today

At John Foy & Associates, we know how vital SSDI is for individuals and families. Were here to help if you need assistance with your claim. We do not collect a fee unless we win you money, so there is no risk when working with us.

Contact us today to schedule a FREE, no-risk consultation. Well listen to your concerns and answer any questions. To get started for FREE, call , or contact us online.

Call or text or complete a Free Case Evaluation form

How Many People Currently Receive Social Security Disability Benefits And What Is The Value Of The Benefits They Receive

About 8.8 million workers with disabilities currently receive Disability Insurance. The amount of Disability Insurance benefits that a disabled worker receives is based on his or her earnings before becoming disabled. As Table 1 shows, Disability Insurance benefits typically replace less than half of a disabled workers previous earnings.

As of March 2013, the average monthly benefit for a disabled worker was about $1,129, with male workers receiving $1,255 per month and female workers receiving $993 per month on average. About 1.9 million children of disabled workers and 160,000 spouses of disabled workers also receive supplemental benefits from Social Securityroughly $300 a month on average.

For most beneficiaries of Disability Insurance and Supplemental Security, disability benefits make up most or all of their income. For the vast majority of Disability Insurance beneficiariesabout 71 percenthalf or more of their income comes from Disability Insurance. And for nearly half of beneficiaries, 90 percent or more of their income comes from Disability Insurance. Given the modest extent to which benefits replace lost earnings and the limited sources of other income upon which they can depend, people who receive Disability Insurance are rarely able to maintain the same standard of living they had before becoming disabled. Disability Insurance provides a floor, however, that moderates the decline in their living standards.

You May Like: How To Get Ssi Disability

Disability Income Limits In 2021

It is possible to both receive disability benefits and earn income at the same time, provided that you earn under a certain amount and conform to other Social Security Administration requirements. As of 2021, the maximum amount of money an individual can earn while receiving SSDI benefits is $1,310 for non-blind disabled workers.

If you dont have enough work credits to qualify for SSDI but are still disabled and low income, you may qualify for Supplemental Security Income instead. SSI income limits are based on the federal benefit rate , which is currently $794 per month for individuals or $1,191 for couples. Earned income exclusions may make it easier for you to qualify for SSI.

Special Rules For People Who Are Blind Or Have Low Vision

We consider you to be legally blind under Social Security rules if your vision cannot be corrected to better than 20/200 in your better eye. We will also consider you legally blind if your visual field is 20 degrees or less, even with a corrective lens. Many people who meet the legal definition of blindness still have some sight and may be able to read large print and get around without a cane or a guide dog.

If you do not meet the legal definition of blindness, you may still qualify for disability benefits. This may be the case if your vision problems alone or combined with other health problems prevent you from working.

There are several special rules for people who are blind that recognize the severe impact of blindness on a person’s ability to work. For example, the monthly earnings limit for people who are blind is generally higher than the limit that applies to non-blind workers with disabilities.

In 2022, the monthly earnings limit is $2,260.

Recommended Reading: State Of New Jersey Temporary Disability

Iii: Who Receives Ssdi

Eligibility criteria are strict, and most SSDI applicants are rejected. Applicants for SSDI benefits must be

- Insured for disability benefits .

- Suffering from a severe, medically determinable physical or mental impairment that is expected to last 12 months or result in death, based on clinical findings from acceptable medical sources.

- Unable to perform substantial gainful activity anywhere in the national economy regardless of whether such work exists in the area where the applicant lives, whether a specific job vacancy exists, or whether he or she would be hired.

Lack of education and low skills are considered for older, severely impaired applicants who cant realistically change careers but not for younger applicants.

There is a five-month waiting period for SSDI, but Supplemental Security Income may be available during that period for poor beneficiaries with little or no income and assets.

SSA denies applicants who are technically disqualified and sends the rest to state disability determination services for medical evaluation. Applicants denied at that stage may ask for a reconsideration by the same state agency, and then appeal to an administrative law judge at SSA. Roughly half of people who get an initial denial pursue an appeal.

SSA monitors disability decisions at all stages of the process. SSA conducts ongoing quality reviews at all stages of the application and appeal process. Many reviews occur before any benefits are paid, thus reducing errors.

Social Security Disability Insurance

Social Security Disability Insurance is available for individuals who are severely disabled and not expected to be able to work for at least another year. You can continue to receive payments until you reach the Social Security full retirement age of 66 or 67, depending on the year you were born. If you want to attempt to resume working before then, you are allowed to participate in a trial work period during which you can receive employment income as well as your SSDI payments.

You May Like: This Device Is Disabled Code 22

Social Security Disability Income Limits In Ny

August 29, 2018 By Paul Giannetti

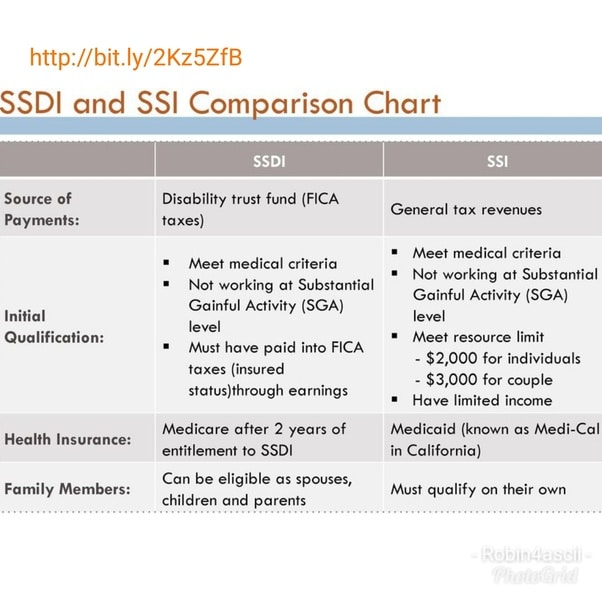

There are two types of Social Security disability programs that provide disabled individuals cash benefits. In many ways, they look very similar, but they are not. There are several significant difference, especially regarding the financial eligibility requirements. Social Security Disability Income and Supplemental Security Income are both managed and overseen by the Social Security Administration. Most people dont realize they are different, but they are. However, the determinations for medical eligibility are the same for both programs.

Does Ssdi Look At All Forms Of Income

No, not all income counts towards SSDI limits. The SSA does not count the following income:

- Spouses income

- Any other assets

Even if you make SGA, you can still apply for SSDI benefits. Every situation is unique. The details of your income and disability might still mean that you qualify. Its worth it to apply even if youre not sure.

If you have questions about your eligibility, contact a Social Security Disability lawyer. Your lawyer can help you file a strong application and determine your options. If the SSA has denied your claim, but you think you should qualify, contact a lawyer.

To schedule a FREE consultation with our SSDI lawyers at John Foy & Associates, call or contact us online.

Recommended Reading: Day Programs For Adults With Disabilities In Nj

Forms Of Evidence You Can Include In Your Disability Claim

Whenever you submit a claim for disability benefits, you must have proof of identification, citizenship, and work history. However, the most important information is medical history. The SSAsays that such evidence should include professional documentation of:

- Existence/diagnosis of your impairment

- How long you have endured this impairment

- The severity of your impairment

- Your complaints of this impairment

The Social Security Administration will often also set up a consultative examination with an independent medical or vocational professional.

our personal injury lawyers today

Social Security Income Limit Summary

Heres the bottom line:

If you collect Social Security early, say at 62, and earn income from work that exceeds the income limit, Social Security will deduct $1 from your benefit payments for every $2 you earn above the annual limit.

For 2022, that limit is $19,560.

In the year you reach full retirement age, Social Security will deduct $1 in benefits for every $3 you earn above a different limit.

In 2022, this limit on your earnings is $51,960.

Dont Miss: How Much Am I Allowed To Make On Social Security

Read Also: How Do I Extend My Temporary Disability In Nj

Maximum Taxable Earnings Will Increase For Those Still Working

Anyone who has ever received a paycheck knows that part of that check is withheld to pay Social Security taxes. There is a limit on the amount of your annual earnings that can be taxed by Social Security, called the maximum taxable earnings. That limit will rise to $160,200 in 2023 from $147,000 in 2022.

Minutes To See If You Qualify

Social Security can be complicated and very intimidating to apply for. It is also vital that everything is completed correctly so that your chances of receiving benefits are their highest. In addition to meeting financial requirements, you will need to meet a Blue Book listing for a disabling condition.

To maximize your potential to receive benefits, consider getting assistance from a Social Security attorney or disability advocate. They can help in filing paperwork and presenting cases can make all the difference you need to qualify for the benefits you deserve. If you are denied disability, an attorney can help you file an appeal.

Don’t Miss: How Much Money For Disability

The Earnings Test & Social Security Income Limit

The Social Security earnings test is typically applied on an annual basis. There are some situations that allow Social Security to use a monthly earnings test, but this usually only applies during a persons first year of retirement. Using this method, they will examine your monthly income instead of your annual income. This method typically works in favor of the Social Security beneficiary.

So, how much can you earn while collecting Social Security? If you have not yet reached full retirement age, the earnings limit for 2022 is $19,560. For 2023, this will increase to $21,240. Your benefits will be reduced by $1 for every $2 you earn above the limit. Since you pay Social Security taxes on your earnings, the Social Security Administration typically does a good job of tracking how much you have earned during the year. Once you hit the annual earnings limit, your benefits will be reduced accordingly.

Remember that these limits apply to Social Security retirement benefits. The rules concerning working while receiving disability benefits are much different. By definition, if you are eligible for disability benefits , you are unable to work. Therefore, working while receiving disability benefits will most likely cause your benefit payments to stop.

| Benefit decreases by $1 for every $3 over the limit |