Increasing Your Benefit Amount

The only way to increase your monthly benefit amount is to qualify for Supplemental Security Income . This might be possible if your family has a low household income and few assets. This program is for those most in need.

You will not qualify for SSI if you qualify for an average SSDI benefit amount. However, you might qualify if you worked a low-paying job before your impairment. Also, you might only qualify for a relatively small SSDI monthly payment.

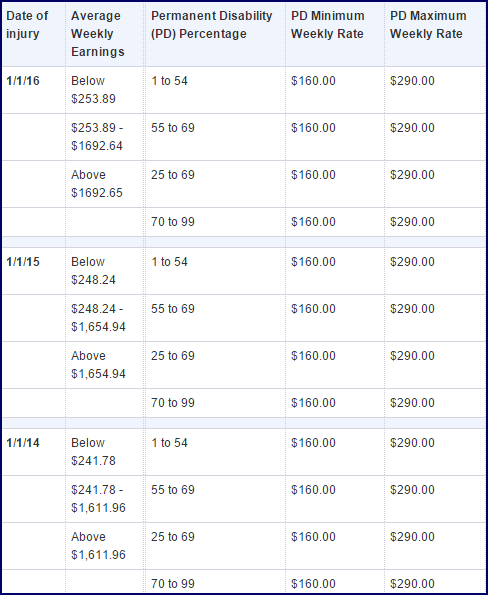

How Is Permanent Disability Pay Calculated

While you could use the same formula the SSA uses to calculate your own benefit amount, this would require first figuring out the numbers used in the formula, including your:

- Average Indexed Monthly Earnings and

- Primary Insurance Amount .

In addition to requiring several steps, it is often difficult to know exactly which numbers the SSA is using, making it hard to get an accurate answer.

You can log into your Social Security account and use the free benefits calculator. This calculator will use the same numbers the SSA would use if you filed for permanent disability benefits today, and it should give you an accurate benefit amount for the current year.

Covered Earnings: Your Past Income

Your past earnings must be covered under the Social Security program to count towards the SSDI benefits you’ll receive. “Covered earnings” are wages you’ve received from jobs that paid into Social Security.

If you’ve received a paycheck that had money withheld for “Social Security taxes” or “FICA,” the wages you made at that job are covered earnings and will count toward calculating your benefit amount. Most wages and salaries are covered earnings.

If you’ve worked for yourself and paid self-employment taxes to the IRS for business income or freelance income, those taxes count just like FICA taxes.

Read Also: Different Types Of Learning Disabilities

Understanding How To Calculate Vacation Pay For Disabled Employees

When calculating vacation pay for disabled employees, employers typically use the same accrual rates as for other employees. This means that if an employee accrues two weeks of vacation pay per year, then a disabled employee should accrue the same amount. However, some employers may place maximum and minimum accrual caps on vacation pay for disabled employees. For example, an employer may limit the amount of vacation pay that a disabled employee can accrue each year to no more than four weeks.

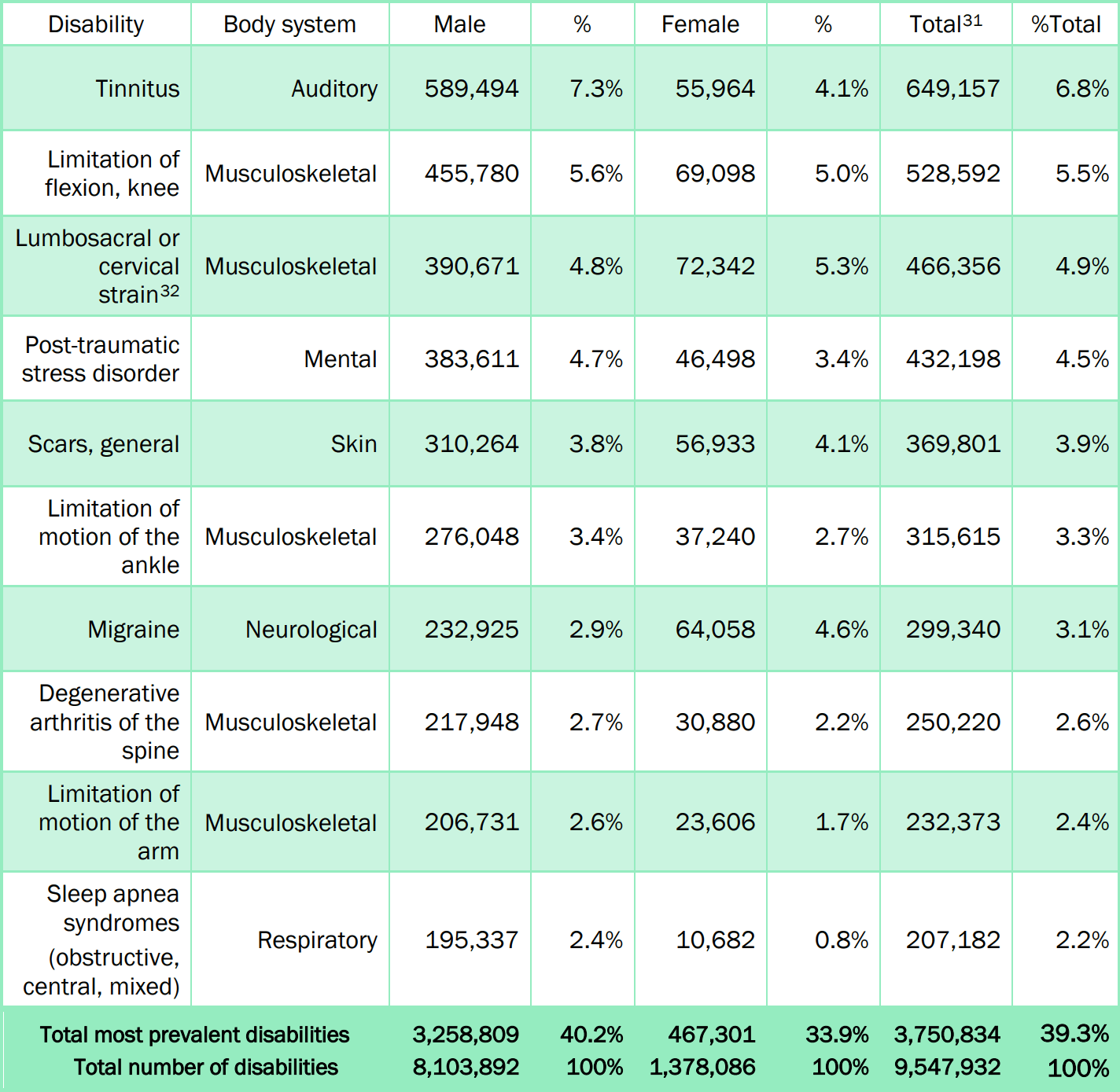

How The Va Calculates Compensation Rates

When you prepare to retire or separate from military service, starting your VA disability claims process is among the things many must do as you out-process. You can also apply after youve left military service.

When you apply for compensation, the VA reviews your claims and assigns disability percentage ratings in 10% increments. For example, if you have a knee injury, the VA will determine the severity of that injury .

The VA may rate your condition between 10% up to 100% based on how it affects your life. Your rating percentage determines your compensation.

Some veterans may be entitled to more disability pay if certain conditions apply such as:

- The veteran is living with severe disabilities

- The veteran has lost one or more limbs

- The veteran has a spouse, children or dependent parents

- The veteran has a spouse who is experiencing a serious disability.

Many veterans have more than one medical issue, disability or disease. Each issue is rated separately, and you may be awarded a combined VA disability.

Combined totals are not the sum of multiple percentages. In cases where the VA must rate a veteran for more than one medical issue, the VA uses a combined ratings table to determine the final percentage.

For example, if you have a 50% disability rating for one condition and a 60% rating for a different condition does not mean you are entitled to a 110% VA disability combined rating. In fact, by law veterans cannot earn more than a 100% disability rating.

Don’t Miss: California Disability Insurance Phone Number

Can You Do Any Other Type Of Work

If you cant do the work you did in the past, we look to see if there is other work you could do despite your medical impairment.

We consider your medical conditions, age, education, past work experience, and any transferable skills you may have. If you cant do other work, well decide you qualify for disability benefits. If you can do other work, well decide that you dont have a qualifying disability and your claim will be denied.

Whats A Disability Rating

We assign you a disability rating based on the severity of your disability. We express this rating as a percentage, representing how much your disability decreases your overall health and ability to function.

We then use your disability rating to determine your disability compensation rate, so we can calculate how much money youll receive from us each month. We also use your disability rating to help determine your eligibility for other benefits, like VA health care.

Don’t Miss: Power Of Attorney For Disabled Adults

How Are Disability Payments Calculated

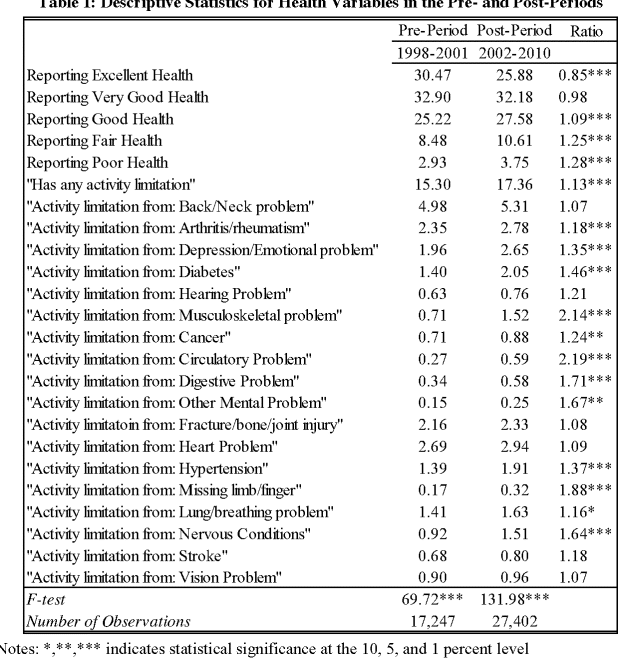

There is a common misconception that disability payments are based on an employees salary, the disability, or even the severity of the disability.

No account yet? Register

Despite the importance and prevalence of disability payments, many employers are still uncertain as to how these payments work. This is particularly true because payments and what qualifying factors change over time. Heres what all employers should know about how disability payments are calculated.

How The Ssa Calculates Your Monthly Ssdi Payment

When you apply for SSDI benefits, the SSA will look at what youve paid into Social Security taxes from your income. The formula starts with your Average Indexed Monthly Earnings . The AIME is your average earnings from Social Security-covered income, adjusted for wage growth.

However, the SSA doesnt use every year that youve worked. First, they count up the number of years from age 22 to the year before you were disabled, drop a certain number of years, then take that number of your highest-earning years to make the AIME.

After getting your AIME, the SSA will determine your Primary Insurance Amount , also known as your full retirement benefit. The SSA uses your PIA to determine a base point for your benefits. This is a complicated calculation that, for non-retirees, depends on the age you become unable to work.

Read Also: How Much Does Disability Pay In Texas

Are Social Security Payments Taxed

Yes and No. First, we are attorneys and not CPAs. Any tax question should be directed at your CPA or your tax preparer.

Generally, the IRS will tax your SSDI benefits when half of your benefits, plus other income, exceeds an income threshold on your tax filing status.

If youre filing single, head of household, married filing separately, or qualifying widower, the threshold is $25,000.

If youre filing married and jointing, that threshold is $32,000. And if youre filing separately but lived with your spouse during the tax year, the threshold is $0

Supplemental Security Income Benefits are not taxable.

Note: Visit irs.gov to learn additional information on paying taxes social security benefits.

How Do Ratings Work For A Disability I Had Before Entering The Service That Got Worse Because Of My Service

If you get disability benefits for a preservice disability, we base your monthly compensation amount on the level of aggravation. Level of aggravation means how much worse your preservice disability got because of your military service.

For example: If you had an illness or injury that was rated as 10% disabling when you entered the military, and it became 20% disabling due to the effects of your service, then the level of aggravation would be 10%.

Don’t Miss: Va Disability Rate For Sleep Apnea

How Much Can You Get On Disability

How much can you get on disability? The answer depends on your medical condition, as well as factors such as cost of living and past work history.

How much the Social Security Administration approves for disability benefits is based on what is called your covered earnings, otherwise known as the earnings for which you paid Social Security taxes before you received a diagnosis stating that you suffer from a disability.

Social Security Disability Insurance represents the federal program that provides financial assistance to qualified applicants that can no longer hold down a job. The amount of money you receive for Social Security disability benefits might decline if you receive financial assistance from other sources like workersâ compensation.

The SSA refers to your Primary Insurance Amount and Average Indexed Monthly Earnings to calculate disability benefits.

Because the formula used by the SSA is complicated for calculating disability benefits, you should ask a disability attorney to provide you with an estimate on how much you deserve in financial assistance.

For 2022, the average payment for Social Security disability benefits is expected to be $1,358 per month. Applicants that earn substantially more than most other workers might qualify for a monthly disability check that is as high as $3,345.

Do You Get Full Pay While Out Of Work

No, short-term disability does not pay 100% of your income. Each policy has different parameters for the percentage of pay and the maximum monthly benefit.For example, the New York State plan covers 50% of earnings and tops out at $170 per week, while the California program replaces up to 70% and maxes at approximately $1,357 weekly.

You May Like: Why Is My Cash App Card Disabled

How Much In Disability Benefits Can I Receive

Author: Attorney Lonnie Roach

If you have or are attempting to secure disability benefits from the Social Security Administration or from a private Long-Term Disability insurer you may be wonder how much you can receive and how that total is determined.

You may be wondering how much in SSDI or LTD benefits you can receive if you qualify for disability. The way they determine amounts can be confusing a disability lawyer explains.

Social Security Disability Benefits Pay Chart

Each year, the Social Security makes adjustments to recipients payments based on the cost of living adjustment. In 2023, those on SSI and SSDI benefits will receive an 8.7% increase in their Social Security disability benefits. Below is a Social Security disability benefits pay chart that shows what changes SSDI and SSI recipients can expect.

| Recipient |

|---|

| $1,483 |

Don’t Miss: Americans With Disabilities Act Lawyer

Analyzing State Laws Governing Vacation Pay For Disabled Workers

State laws can also play an important role in determining vacation pay for disabled employees. To ensure that you are aware of any local regulations, it is important to research your states laws regarding vacation pay for disabled employees. Additionally, if you are unsure of your rights or need legal advice, it is recommended that you reach out to a qualified attorney who specializes in disability law.

How Much Will You Receive From Social Security Disability

Each and every year, millions of Americans suffer from a disabling condition. It is not uncommon for a disability to interfere with an individual’s ability to work and earn an income. As a result, these disabled individuals must rely on Social Security Disability benefits to make ends meet. Many of the people who are applying for SSDI find themselves uncertain as to how much money do they get on disability.

If you are approved for Social Security Disability benefits, how much money do you get on disability? Unfortunately, the answer to this question isn’t always cut and dry. There are, however, ways that you can estimate what you might expect from the Social Security Administration. If you are wondering how much money you are eligible to receive through Social Security Disability benefits, the following information can help you understand the ways of determining your monthly disability benefit amount may be.

Also Check: Social Security Disability Overpayment Statute Of Limitations

Calculating Social Security Backpay

As per the SSAs policy, your disability payments should start on the day you become disabled. But since it takes some time for the SSA to process your claim, youll usually receive your benefits after a few months. This is why most disability claims include back payments. Its the amount you should have received from the start of your disability to the time you actually received the money. In most cases, your back pay will be included in your first disability check.

So how are disability back payments calculated?

Your monthly SSDI benefits determine the amount of your social security back pay. But first, you need to figure out your disability onset date and when your benefits are released. This will determine how many months of back payment youll get.

Just add all your SSDI benefits in all the months youre entitled to a back payment to come up with your social security back pay.

For example, if your disability started on June 1, 2022, and your benefits are released on September 1, 2022, you are entitled to 3 months of back pay. If your monthly SSDI payment is $1,200, then your backpay is $3,600.

How Is The Social Security Disability Payment Calculated

Are you applying for Social Security Disability Insurance benefits in Illinois? If so, you may be wondering: What will my monthly SSDI payment be? The answer depends on your past earnings. In this article, SSDI disability attorney Harold W. Conick provides a more comprehensive explanation of the most important things you need to know about how payments are calculated.

Social Security Disability Payment: How is it Calculated?

There are many myths and misconceptions regarding how Social Security Disability Insurance benefits are determined. Here are four key things you need to know about how SSDI payments are calculated:

Read Also: Can I Work And Collect Disability

What Other Factors Does The Va Take Into Account For Disability

When deciding on a disability claim, the VA looks at your eligibility first. Then, it considers your conditions overall impact on your daily life, activities and employability.

If you think your VA rating is too high or too low, you can file an appeal to try to get the VA to increase your rating. Be sure to include evidence of your conditions impact on your life, like statements from doctors, employers or others close to you.

» MORE: Check your VA home loan eligibility with today’s top lenders

How Are Disability Benefits Calculated

January 27, 2022 by Andrew Price

Before applying for Social Security Disability, many claimants question how much they will receive monthly and how disability benefits are calculated. In this post, well walk you through the calculations the Social Security Administration uses for their Supplemental Security Income and Social Security Disability Insurance programs.

Don’t Miss: How To Get Short Term Disability Approved While Pregnant

Who Is Entitled To Va Compensation For Medical Issues

Veterans who apply for VA disability compensation must have medical conditions that are the result of an injury or disease that was incurred or aggravated while on active duty or active duty for training or from injury, heart attack or stroke that occurred during inactive duty training, according to the VA.

Such disabilities may apply to medical conditions such as Lou Gherigs Disease, mental health issues including post-traumatic stress disorder , and more, according to the VAs guidelines.

Rules Of Calculating Disability Benefit

The disability benefit is equivalent to 66 percent of your average income, based on the three best payed of the last five years before you became disabled. Former income is adjusted to todays value.

Income up to 6 times the National insurance basic amount for each year is included when calculating the disability benefit.

Cash benefits for care is counted as Income. The same applies to foster care allowance.

Also Check: Opm Disability Retirement Approval Rate

Talk To An Ssdi Lawyer During A Free Consultation Today

The SSDI process is often confusing and stressful. At John Foy & Associates, we want to make the experience as simple as possible for you. We can help calculate your SSDI benefits, improve your claim, or appeal an SSDI denial.

Our lawyers do not charge a fee unless we win your case. Plus, the consultation is always 100% free. So, get in touch with us today, and well match you with the best disability attorney for your situation. Call us or contact us online to schedule an appointment.

Call or text or complete a Free Case Evaluation form

Ssi/ssdi And Va Disability Benefits

Veterans may be eligible for Supplemental Security Income or Social Security Disability Insurance , in conjunction with, or as an alternative to VA disability payments. They may also use the Medicaid and Medicare health benefits that come with SSI/SSDI to supplement VA health services.

The definition of disability and application process is different for SSA and VA disability benefits, and Veterans may begin receiving SSA benefits while they are waiting on a VA benefit decision.

Don’t Miss: Social Security Disability Rules On Cars

Which Disability Benefits Can Affect Your Ssdi

If you were injured on the job and you’re receiving workers’ compensation benefits, the SSA might reduce the amount of your SSDI benefit. That’s because the SSA has set a limit on how much public disability income you can have. And worker’s comp isn’t the only public benefit that can affect the amount of your SSDI.

Other disability benefits that aren’t job-related and are paid for by the federal, state, or local government might also reduce your SSDI benefit amount. Examples of these include:

- temporary disability benefits paid by the state

- military disability benefits, and

- state or local government retirement benefits that are based on disability.

But some public benefits aren’t counted toward the disability benefits limit, including SSI and VA benefits.