Family And Medical Leave Act And California Family Rights Act Faqs

Find answers to the frequently asked questions about the Family and Medical Leave Act and the California Family Rights Act employee leave laws.

For detailed information about FMLA, visit the Department of Labor or call 1-866-487-2365.

For detailed information about CFRA, visit the Civil Rights Department or call 1-800-884-1684.

Can I Be Fired While On Short Term Disability

Unlike the FMLA, short-term disability benefits do not provide for job protection. Therefore, it is possible to be fired from your job while on a short-term disability leave. … Ultimately, however, if you remain unable to return to work due to your disabling condition, your employment could be terminated.

Disability Benefits And Accommodations

Since working with a chronic illness is hard enough, I thought Id share with you my knowledge of the different types of disability accommodations and benefits available so you could have them all in one place.

The accommodations and disability benefits that may be available to you are FMLA, ADA Accommodation, short term disability, and long term disability. Your company may also offer patient advocate services.

Now I know not all companies offer disability benefits, but depending on the size of the company you work for, FMLA and ADA accommodations are available.

Disclaimer: Before we get into all the details, Id like to state that I am not a human resources, insurance or law professional. The information provided is for informational purposes only and is based on my research, experience, and knowledge.

This information does not guarantee you will receive benefits and/or accommodations. Please consult your employers Human Resources department, disability insurance company or attorney for specifics related to your disability accommodations/benefits you might be eligible to receive.

Also Check: Social Security Disability Extra Benefits

Whats The Difference Between Long Term And Short Term Disability Insurance

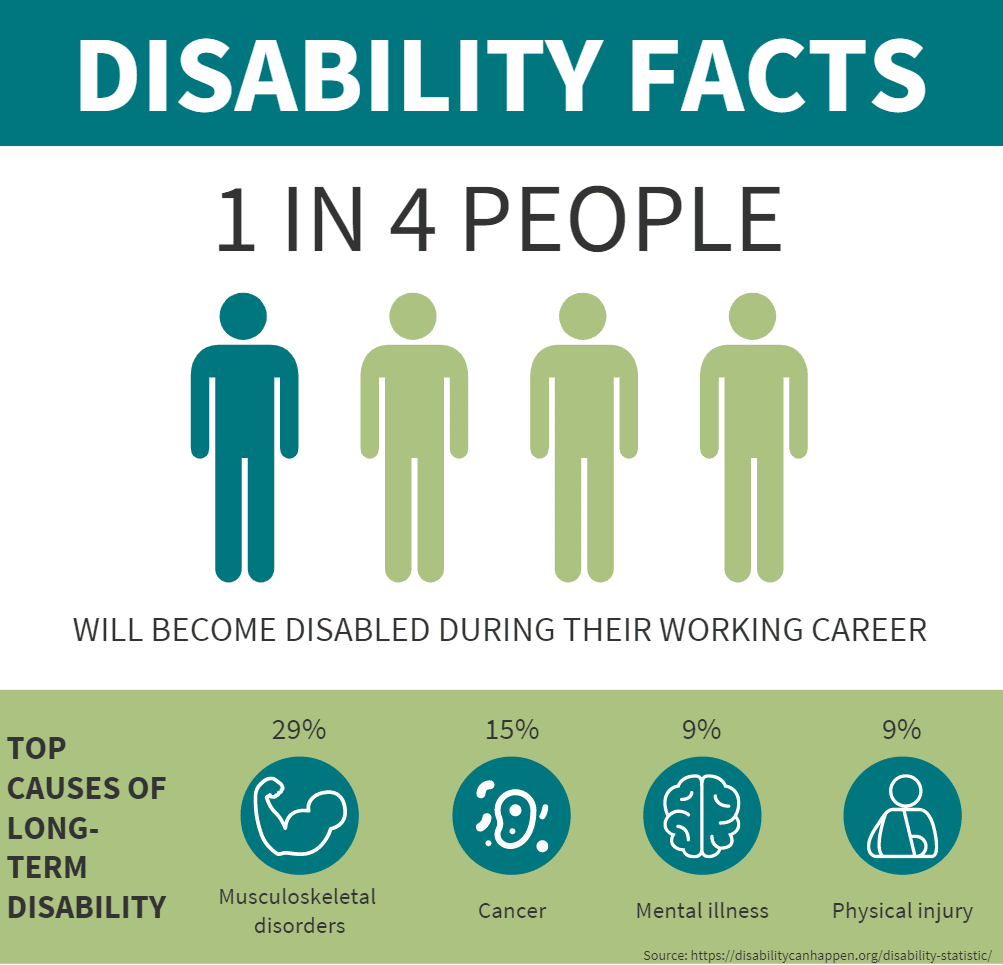

Most people think disability is something that happens to other people, but its more common than you may think. More than a quarter of todays 20-year-olds can expect to be out of work for at least a year before they reach retirement age due to a disabling condition.1 And some of the most common reasons for disability claims include pregnancy, mental health issues and cancer2 conditions that might not be top-of-mind when you think about disability. Thats why its so important to protect yourself in case an unexpected illness or injury keeps you out of work for an extended period of time. But before you can choose the right protection for a potential disability, you first need to understand the difference between the two primary types of disability insurance: short term and long term.

Application And Approval Process

An employee who is out of work due to a Disability should file a disability claim by entering an application for leave in the Universitys Workday on-line system:

- Go to Workday “Time Off and Leave” application,

- Enter the “First Day of Leave” and the “Estimated Last Day of Leave,” and

The employee will then be directed to download the appropriate forms from the . Please note that the employee’s leave request is not complete until the employee provides the FMLA Administrator with the required information, including an updated Physician Certification Form.

The employee must have the employees physician complete a Physician Certification Form and submit the form to the FMLA Administrator within 20 calendar days of the leave request. A delay in the return of the completed Physician Certification Form may cause a delay in the payment of STD benefits.

On the basis of information received, the FMLA Administrator will determine in a timely manner whether the employees health condition constitutes a Disability that may entitle the employee to STD benefits . If such condition exists and all requirements are met, the FMLA Administrator will provide the effective date of the disability and pay any retroactive short-term disability benefits that are due. FML will run concurrently with any STD benefits to which the employee is determined to be entitled but since FML is unpaid, will not result in any additional benefits.

Read Also: Chances Of Winning Disability In Federal Court

What Does Disability Insurance Do

Disability insurance is sometimes called disability income insurance because it is designed to replace a portion of your income if you are unable to work because of a serious illness or injury. Disability insurance pays benefits directly to you, so you can cover your expenses with no limitation on how the money can be spent. Policies vary, but disability insurance can protect up to 70% of your income for a period anywhere from 3 months to the time you reach retirement age. While every policy is different, the two main differences between long term and short term disability policies are the length of the benefit periods and the level of coverage each type of policy offers.

Whats The Difference Between Short Term Disability And Taking An Employee Leave

Wednesday, February 7th, 2018

Whether it is a planned life event, a sudden illness or an injury, an employee may need to take a leave from work. Employees considering taking a leave should understand the commonly confused short term disability and Family Medical Leave Act benefits.

Short term disability

STD is not an employee leave rather it is a wage replacement benefit. The benefit can be purchase by the employee through their employer benefits company of through a private vendor. STD benefits act as income replacement when an employee is unable to work for a period of time. The coverage can last for a few weeks to upwards of 52 weeks depending on the employees policy. Although STD is a wage replacement benefit, typically employees only receive 40-60 percent of their regular wages.

Unlike other forms of employee leave, STD benefits are not guaranteed job protection and continuing health care coverage is not assured. Eligibility for STD benefits has no impact on eligibility for FMLA leave.

Employee leaves

FMLA is a federally backed job protected leave from work. Eligible employees can take up to 12 weeks of unpaid leave each year. In order to be eligible, an employee must have worked at least 1,250 hours over the last year and been employed with the company for 12 months or more.

Don’t Miss: How Much Money For Disability

Qualifying For One The Other Or Both

The decision to apply for short-term disability and FMLA leave often comes down to factors such as these:

- Is the time off needed for a personal injury or illness, or will it be used for taking care of a new child or an ailing family member?

- Can the person requesting the time off afford to sacrifice receiving an income, or is continuing to get paid some amount of money necessary?

- Is 12 weeks enough, or does the employee need a slightly more flexible timeframe?

- What kind of documentation can the person requesting a leave of absence provide?

There’s also the possibility of combining the two, so at least part of the employee’s FMLA leave is paid although there are very specific rules for when that is possible.

How Long Does Long

Once long-term disability benefits have been approved, an employee can continue to receive benefits for the length of the policy term or until they return to work. Most long-term disability plans provide coverage for 36 months, although some plans can provide coverage for up to 10 years or even for the life of the policyholder.

Also Check: How To Apply For Disability In New Mexico

California Disability Insurance And Paid Family Leave

California provides short-term Disability Insurance and Paid Family Leave wage replacement benefits to eligible workers who need time off from work for qualifying reasons. Workers may be eligible for DI if they are unable to work due to a non-work-related injury or illness, during pregnancy and/or childbirth. Workers may be eligible for PFL to care for a seriously ill family member, to bond with a new child, and for a qualifying military exigency.

Additionally, the San Francisco Paid Parental Leave Ordinance requires employers to pay supplemental compensation for a covered employees full duration of leave when receiving the CA State Paid Family Leave to bond with a child.

Coverage Options: Employers can participate in the state-run program or self-insure the DI and PFL coverages with a voluntary plan. MetLife provides administrative services for employers who have state approved voluntary plans or Voluntary Paid Family Leave ).

Job Protection: The CA PFL and DI plans do not provide job protection, only monetary benefits. However, job protection may be provided through other federal or state laws such as the federal Family and Medical Leave Act or the California Family Rights Act .

Benefits:

- PFL: 8 weeks in a 12-month period up to $1,540/week

- DI: 52 weeks up to $1,540/week. The maximum benefit amount is $80,080.00.

Contributions: In 2022, the contribution rate is 1.1% of the first $145,600 for a maximum employee contribution of $1,601.60.

As of May 1, 2022

For More Informative Articles About Office Supplies Subscribe To Our Email Newsletter

Never fear, you won’t begin receiving daily sales emails that belong in a spam folder. Instead, we promise a fun weekly roundup of our latest blog posts and great finds from across the web. And if you lose interest, it’s always easy to unsubscribe with a single click.

ABOUT THE AUTHOR

Jordan works remotely, from home or abroad, on projects that increase brand awareness, online engagement, and website traffic. She specializes in clear and concise writing that helps businesses conquer their online messaging. Through human-centered content, she aims to delight both human readers and Google bots. Spark an immediate and detailed conversation by mentioning Mad Men or Game of Thrones.

You May Like: Non Profit Organization For Disabled

How Long Does It Take For Short Term Disability To Kick In

Short term disability insurance typically starts paying benefits within two weeks of a qualifying illness or injury and covers you for a benefit period that’s usually between 13-26 weeks. You’ll continue to receive benefits until you’re able to return to work or until you reach the end of your benefit period.

Social Security Disability Insurance And Fmla

Social Security disability insurance is a government-run program that pays you benefits if you become disabled and lose your job, just like private disability insurance but with smaller payments.

You can apply for SSDI as soon as you become disabled, but you can’t receive SSDI payments concurrently with your FMLA leave, since you’re still technically employed. Approval for Social Security disability benefits can also take months or even years.

The Social Security Administration also typically grants benefits only to people whose disability is expected to last 12 months, or which has already lasted 12 months, in which case your FMLA period would have long since ended.

Don’t Miss: Working Part Time On Disability

Income Protection Kept Michelle In The Game

Michelle was showing her nephew how to block a kick when she took an unexpected fall and broke her ankle. She needed minor surgery and a cast, which kept her away from work for several weeks. Michelle’s Short Term Disability Insurance paid her a portion of her lost income, so she could manage expenses while she was unable to work.

What To Know About The Family Medical Leave Act Disability Leaves And Other Regulations

There are a number of government regulations that help employees when they need time away from work to handle important life events and responsibilities. One of these is the Family Medical Leave Act . These types of regulations offer benefits and help protect an employees job while theyre away from work. Examples can be a planned leave for pregnancy, time away to care for a loved one or an unplanned leave for medical concerns, disabilities or other reasons.

This type of leave is especially important amid COVID-19. Federal guidelines encourage people to stay home as much as possible, especially when sick or caring for an ill loved one. Information about COVID-19 is available in our COVID-19 Resource Center.

You May Like: New York State Disability Benefits

What Is Family And Medical Leave

The Family and Medical Leave Act was a law passed by Congress in 1993 to protect employees who needed to be off work for a period of time from being fired by their employers. The FMLA allows employees up to 12 weeks of leave in a 12-month period for the following:

- The birth of a child or caring for a newborn

- Adoption of a child or placement of a child for foster care

- The serious illness of an employee that prevents the employee from working

- The need to care for an employees spouse, child, or parent who has a serious health condition

- An exigency arising out of an employees spouse, child, or parent who is in military service

Not every employee is eligible for FMLA. First, the FMLA only applies to employees who have at least 50 employees employed within 75 miles of the employees place of work. An employees eligibility for FMLA leave is also dependent on having worked for the employer for at least 12 months or 1,250 hours in the 12 months before taking leave.

FMLA leave is unpaid. However, if the employee has health insurance coverage through their employment, the coverage must be continued during FMLA leave. If an employee seeks FMLA leave due to a serious illness or injury, the employee may be required to submit a certification of the need to take leave completed by a physician.

How Do I Get Individual Disability Insurance

If youre self-employed, your employer doesnt offer disability insurance, or you want to supplement the policy your employers does offer, you can apply for an individual disability policy. Individual disability insurance elimination and benefit periods may differ from group disability insurance, but a financial representative can help you choose the right coverage for your situation. If youd like some help understanding what type of coverage makes sense for you and applying for a policy, get in touch with a financial representative who can help you make a decision.

You May Like: Short Term Disability For Mental Health

What Is Fmla Or Family Medical Leave Act

According to the Department of Labor, FMLA is a federal law that provides you up to 12 weeks of unpaid, job-protected leave within a 12-month period for

- Your own serious health condition,

- The care of a spouse, child, or parent with a serious health condition,

- The birth and/or care of a newborn child, or

- The placement of a child via adoption or foster care.

The catch is:

- Your employer has to employ more than 50 employees within 75 miles of your job site,

- You need to have worked for your employer for at least 12 months, and

- You need to have worked at least 1,250 hours over the past 12 months for you to take advantage of this accommodation.

FMLA can cover you if you have to miss entire days of work or if youre on a consistent reduced schedule called intermittent leave.

The key here is FMLA protects you from getting fired for not being able to work your full work schedule.

When you need to be out of work because of your chronic illness, the first step is to contact your Human Resources department. If your company uses a disability insurance company your FMLA will most likely be processed and tracked through the disability insurance company as opposed to someone in HR. Once you contact HR, theyll be able to walk you through the process specific to your company/organization.

State FMLA

Whats The Difference Between Short Term And Long Term Coverage Levels

Both long term and short term disability insurance offer some flexibility in the amount of coverage you can choose, but short term disability usually ensures a greater percentage of your incomesometimes up to 70%. Long term disability typically pays benefits equivalent to 40-70% of your income, but for a longer period. To decide how what level of coverage you would need, calculate your monthly expenses, and consider additional medical bills you may have to pay if seriously sick or injured. Then determine what portion of your salary you would need to cover those necessities if you became disabled.

Recommended Reading: Disabled Veteran Plates Handicap Parking

States With Paid Family Leave

Paid family leave isn’t necessarily for medical conditions, but extends to bonding with a newborn child in the first weeks or months of their life or with a foster child or adoptee as they begin living in your home. In addition to the FMLA’s 12 weeks of unpaid leave, the following states offer a certain number of weeks of paid family leave benefits:

More From Blue Summit Supplies

Transparent communication inside and outside of the workplace helps businesses set their own narrative, build trust, and foster meaningful relationships. Learn how to foster Transparent Communication in the Workplace.

Discrimination at work of any type should not be tolerated. Learn how to spot discrimination in the workplace and what to do about it if it happens to you.

Were passionate about helping workplaces improve trust, collaboration, and wellness. Follow our office supplies blog for the latest industry trends, business strategies, leadership advice, and more.

If you have any questions or want to talk to someone about office supplies,send us an email or connect with us on , , or .

Also Check: How To Apply For Disability In Arizona

Can Fmla Be Denied

It is against the law for a covered employer to deny an eligible employee’s proper request for FMLA leave. Your employer can’t require you to perform any work while you are on approved FMLA leave. It is also illegal for a covered employer to retaliate against an eligible employee who requests FMLA leave.