Whats The Difference Between Short Term And Long Term Coverage Levels

Both long term and short term disability insurance offer some flexibility in the amount of coverage you can choose, but short term disability usually ensures a greater percentage of your incomesometimes up to 70%. Long term disability typically pays benefits equivalent to 40-70% of your income, but for a longer period. To decide how what level of coverage you would need, calculate your monthly expenses, and consider additional medical bills you may have to pay if seriously sick or injured. Then determine what portion of your salary you would need to cover those necessities if you became disabled.

How Much Disability Coverage Should I Have

Ultimately, youll have to balance what you are willing and able to pay in monthly premiums and the amount of disability insurance coverage youll receive should you become temporarily or permanently disabled. The average long-term disability claim is just under three years.3 Most people cannot go without a paycheck for even a few weeks. Keep that in mind when you are putting together your financial protection plan.

How Workers Comp Impacts Short

There are a number of areas where short-term and long-term disability benefits interact with a workers compensation case.

First, the workers compensation rate may be lessened by the amount an individual is receiving in short- or long-term disability benefits, or vice versa. For example, if someone is receiving $500/week in workers comp benefits and they are receiving an additional $500/week in short-term disability benefits, one or the other carriers may choose to reduce the amount of benefits so the injured individual is not receiving the maximum in both instances.

This also comes into play when an individual resolves their workers compensation case. In Georgia, many insurance companies require the injured worker to resign their position as part of a workers compensation settlement, and this may have a direct effect on their long- and short-term disability benefits. This is because an individual must remain employed to receive a long- or short-term disability benefit.

So if a person resigns from their position as a part of a workers compensation claim, they may no longer be eligible for short- and long-term disability benefits. Therefore, it is very important to consult your policy and with your attorney to make sure you are not waiving any of those rights when you settle your workers compensation claim.

Don’t Miss: Health Insurance For Disabled Veterans

Get Legal Advice And Help

Filing a claim for LTD can be a difficult, confusing and lengthy process. Each policy is different. A personal injury or disability insurance lawyer can help you understand your policy, notify you of any deadlines, guide you through the claim process, and deal with the insurance company. This will help ensure that you will get the benefits you deserve in a timely manner.

Even when an individual has a legitimate cause for claiming their long-term disability benefits, often insurance companies will initially deny the claim, or offer an amount much lower than asked for.

If you or someone you care about suffers from a long-term disability and has disability insurance, contact our preferred experts. They can help you get the LTD benefits you are entitled to, even if your claim was denied. They offer a free consultation and do not charge up-front fees:

Short Term Vs Long Term Disability Insurance

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

Your income is one of your biggest assets, and losing it can quickly take a toll on your financial well-being.

According to a Lifehappens.org survey, two-thirds of working Americans could not go six months before financial difficulties would set in, while 14 percent would be negatively impacted immediately.

Disability insurance can offer an important safety net because it pays you a percentage of your salary if an illness or injury ever prevents you from working.

There are two main types of disability insuranceshort term disability insurance, often offered through employers, and long term disability insurance, which may need to be purchased separately.

As their names imply, short term disability insurance lasts for a shorter period of time than long term disability insurance.

But there are other key differences between short term and long term disability , including how quickly coverage kicks in, as well as costs.

Also Check: Long Term Disability Insurance Companies

Choosing A Disability Insurance Policy

Whatever your age or physical condition, injury and illness can create enormous financial challenges. Even a short-term disability can cause a substantial financial strain if you’re unprepared. But if you have short-term or long-term disability coverage, you have a backup plan ready in case of disaster.

Key Differences Between Short

Waiting periods are one of the most significant differences between long-term and short-term disability insurance. Most short-term disability benefits are available almost immediately after injury or illness. That said, an employee might be required to exhaust his or her sick days before claiming disability pay.

However, long-term disability plans typically call for a waiting period of one or more months after the onset of disability. The claimant will not qualify for benefits until this period has expired. For this reason, many employees opt to carry both short-term and long-term disability insurance.

Read Also: New York Life Disability Claim Status

Key Similarities Between Short

There are several similarities between short-term and long-term disability insurance, including:

- the need for medical evidence and

- both claims benefit from the help of a lawyer who can assist with the entire claims process, from initial filing to the appeals process.

Learn more about what a lawyer can do for you during a free case consultation. Call the Preszler Injury Lawyers at 1-800-JUSTICE®.

Short Term Vs Long Term Disability Insurance Explained

Have you seen your short-term disability rates?

It takes 30 seconds.

Youâve probably met more life insurance salespeople than disability insurance salespeople. The reason? People buy much more of the former than they do the latter. But is that a sound buying decision?

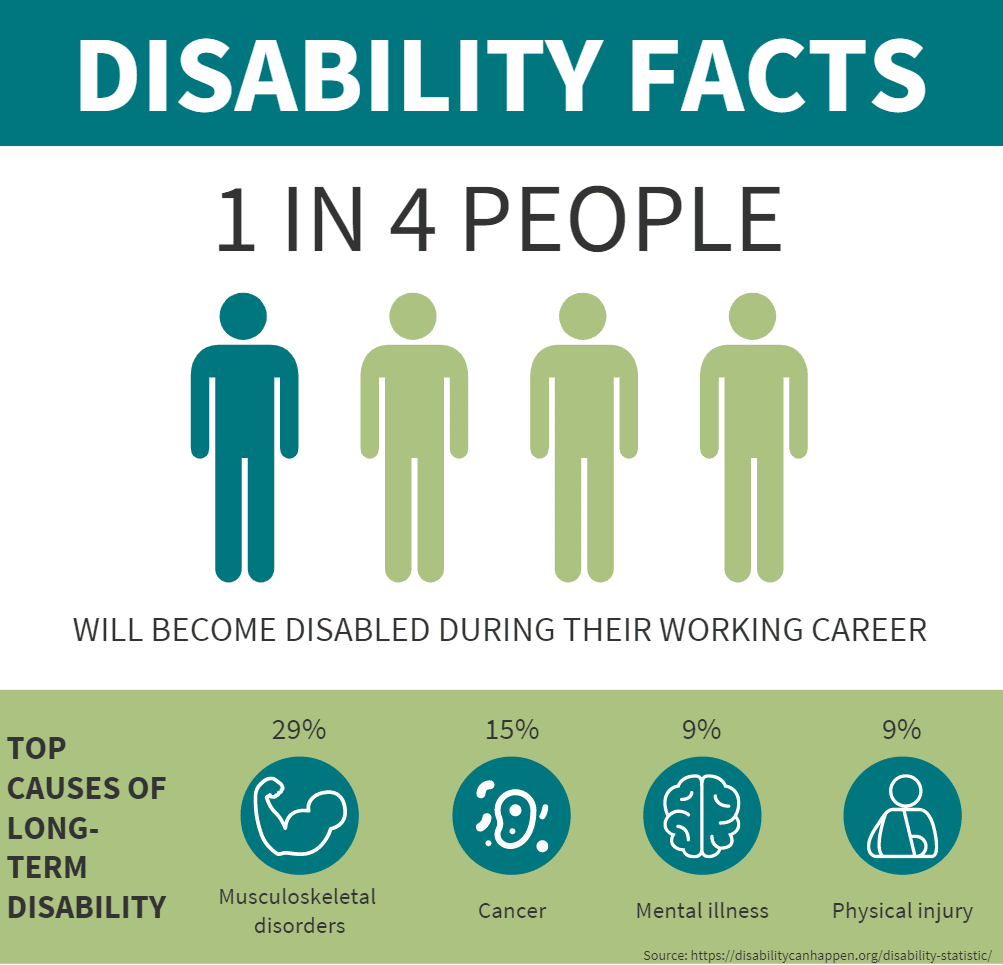

Statistically, youâre actually more likely to become disabled during the course of your career than you are to die.

According to the National Safety Council, a fatal injury occurs every 5 minutes whereas a disabling injury every 1.5 seconds. At the same time, the Social Security Adminstration esitmates that one-in-four working Americans experience a disabling event that prevents them from earning an income in their working years.

The numbers say it all. But when it comes to taking action and purchasing a policy, confusion hits quickly. For starters, which type of disability insurance â short-term vs. long-term â is better for your income protection needs? Here, we cover the key differences between each to help you decide.

Read on to learn more.

You May Like: Dating Sites For People With Disabilities

Where To Buy Disability Insurance

Long-term disability and short-term disability insurance are both popular employee benefits. Employer-sponsored disability insurance is often subsidized and if youre able to get either for free through your employer, its worth it. For many people this is the only way to get short-term disability few carriers offer private short-term insurance and, as mentioned, its not the most cost-effective option.

On the other hand, you shouldnt have any problem finding an insurance company to buy long-term disability insurance from, and if you can only afford one, its usually the better option.

Editor & Licensed Life Insurance Expert

Amanda Shih is a licensed life, disability, and health insurance expert and a former editor at Policygenius, where she covered life insurance and disability insurance. Her expertise has appeared in Slate, Lifehacker, Little Spoon, and J.D. Power.

Questions about this page? Email us at .

Life

Are You Covered Through Your Job

Your employer may offer Long-Term Disability Insurance as part of your benefits package or offer it as an option. If you take this option, you will pay the premium. Very commonly, these policies are filled with exclusions and can make you feel like you are protected, when your are really not.

It is highly recommended to purchase an Individual Disability Insurance policy through a private insurance adviser. They will be able to customize the policy for you according to you lifestyle, needs, and budget. Policies purchased through your employer very often work for the insurance company and not you.

If you have Disability Insurance policy through your employer, we highly recommend investing in a Supplemental Disability Insurance policy tofill in the holes of the policyyou purchased through your job, This way, you will be fully protected when you really need it.

Read Also: Cell Phones For Disabled Hands

How Long Does Coverage Last

As the names suggest, short-term disability insurance is designed to provide a portion of an employees income when the employee cannot work for a while. These policies, usually covering a few weeks to a few months, vary by state and by company, so check to see what your coverage is.

Long-term disability insurance, on the other hand, is meant to be a financial safety net that can help protect you from missing out on income during a difficult time and protect your lifetime earning potential. The length is typically several years, like five, 10, or 20. Some policies even last until your retirement age.

How Much Do They Pay While Youre Disabled

One of the great things about both types of disability insurance is that they pay benefits directly to you, and you can use them to cover expenses however you like. Benefits will vary by policy, but most short-term disability insurance pays around 70% to 100% of your salary. If you rely on commissions or other non-salary bonuses for a significant part of your income, you may want to check with your employer to see if commissions and bonuses are covered. Sometimes, they are not.

Individual long-term disability insurance usually covers anywhere from 50% to 70% of your income, and it more often includes non-salary income in the calculation. In addition to providing coverage for a longer period, this difference makes it more effective for people with commission-based jobs or for those who are self-employed. Some long-term disability policies will also include partial benefits as you recover and return to work, to help ease the transition back.

Related: Can I get disability insurance if self-employed?

Also Check: Assisted Living For Disabled Adults

The Council For Disability Awareness Lists The Most Common Long

- Musculoskeletal/connective tissue disorders

- Cardiovascular/circulatory disorders

- Mental disorders

If you experience a debilitating injury, you may have a more extended waiting period before receiving benefits. Long-term disability claims typically take up to 90 days to process, or even longer. After your claim is settled, you can receive benefits for several years or until you recover. Some policies pay benefits for the rest of your life, although this varies by policy and insurer.

Are Employers Required To Offer Disability Insurance

In most states, employer-sponsored disability insurance is optional. However, some states require employers to offer disability insurance to their employees. For example, California, Hawaii, New Jersey, New York, and Rhode Island require employers to provide some form of disability insurance coverage. Puerto Rico also requires employers to take out a disability insurance policy for workers.

Recommended Reading: What Is The Difference Between Fmla And Short Term Disability

The Benefits Of Individual Disability Insurance

Individual disability insurance is a policy purchased through a private insurance company. You may already have a life insurance policy or retirement annuity, and often you can add disability insurance to your financial protection plan. There are many reasons you may want to consider individual long-term disability insurance, even if you already have short-term disability insurance from your employer.

- Your current protection is inadequate.

- You dont plan to stay with your current company.

- Youd like more comprehensive coverage.

- You are self-employed or planning to be.

Get Hr Support And Benefits

Offering employees benefits like an employer-sponsored disability insurance policy can be a great way to attract top talent. Additionally, a disability insurance policy can ensure that your employees are able to support themselves should sickness or injuries strike. Yet, an insurance policy is almost useless if it cant be administered effectively and in a timely manner.

With QuickBooks Payroll, managing employee benefits for small businesses has never been easier. Using our software, you can run payroll, administer benefits, and take charge of human resources for your small business , all in one place. This makes it simple to support your workers when they need it the most. Best of all, its a payroll system that can save you valuable time, money, and energy as a small business owner.

Don’t Miss: Americans With Disabilities Act 1990

Which Do I Need: Need Short Term Disability Insurance Or Long Term Disability Insurance

There are a few things to keep in mind when choosing disability insurance. First of all, do you have an emergency savings fund that could cover your expenses for a few months if you lost your job or were unable to work? If not, short term disability insurance is an essential financial protection, even if you are disabled for only a short period of time. If you have significant emergency savings on hand, though, you may focus on how a long term disability could impact your financial wellbeing and your retirement plans. If you were permanently disabled, could you cover your expenses until retirement? If not, look into long term disability protection.

Can You Have Long

Yes, you can.

With most employer-sponsored disability policies, you get both LTD and STD insurance. However, many people dont have access to group disability income insurance. These include:

- Employees where employers dont offer group coverage

- Business owners

These individuals cant buy individual short-term disability benefits. As a result, they would only have long-term disability benefits if they purchased it privately.

You May Like: Can I Receive Disability And Social Security

How Long Does Long

Once long-term disability benefits have been approved, an employee can continue to receive benefits for the length of the policy term or until they return to work. Most long-term disability plans provide coverage for 36 months, although some plans can provide coverage for up to 10 years or even for the life of the policyholder.

Do I Need Both Short Term And Long Term Disability Insurance

As you can probably tell, short term and long term disability insurance policies are designed to work together. Short term disability is intended to cover you immediately following a serious illness or injury, and long term disability insurance is intended to maintain income replacement if your condition keeps you out of work past the end of your short term disability benefit period, even to retirement, depending on your plan. If you have both short term and long term disability policies in place, short term disability will pay you benefits during the waiting period before your long term disability coverage begins, at which point youll transition from one policy to the next to receive benefits. For that reason, it makes sense to have both policies to help ensure an unexpected health problem wont derail your financial confidence for a few months or for several years.

Also Check: How To Apply For Veterans Disability

How Much Does Disability Insurance Cost

Short- and long-term disability insurance policies generally cost about the same. For 1 to 3 percent of your income, you can lock in a portion of your salary after you are confirmed to have a disability. Remember, though, that policies purchased through your employer may charge smaller amountsor may even be provided as a workplace benefit free of charge.

The fact that most short-term and long-term policies actually have similar monthly premiums of 1 to 3 percent, despite their drastically different coverage lengths, can make short-term disability insurance comparatively very expensive. Youre paying the same premium for potentially years less coverage, after all.

Those considering short-term disability insurance may explore self-insuring instead by saving enough money in a bank account to cover three to six months of expenses, so that money can last them until long-term disability kicks in.

Is Disability Insurance The Same As Workers Compensation

No. Workers compensation is a program that is mandated by most state governments for large employers. It covers only injuries and sicknesses that happen on the job, or because of the job. Thats an important distinction because most disabling events happen outside of the work environment. Workers compensation usually includes partial wage replacement for the time the employee cannot work, but these benefits vary greatly by state. Its also important to understand that when you accept workers comp, you waive the right to recover damages from your employer through legal means.

Read Also: Core Value Of American Disability Act

How Long Does Short

While benefit periods may vary across different providers, most short-term disability policies provide benefits for three to six months. Some policies, especially those connected with a long-term disability policy, may provide short-term coverage for a full year. If an employee needs additional coverage beyond the initial short-term disability period, a long-term disability policy may be needed to extend the benefits.

How Much Does Short

Generally, short-term disability benefits pay between 40 and 60 percent of your weekly gross incomeusually closer to 60%. However, this amount can vary depending on the coverage. Its not unheard of for some short-term disability plans to pay 100% of an injured workers salary, but its best not to plan on that being the case.

As for workers comp pay rates in Georgia, the maximum coverage is 66% of wages .

You May Like: Universal Studios Disability Pass 2022