Social Security Works Aggressively To Prevent Detect And Prosecute Fraud

Social Security, along with the Office of the Inspector General, identifies and aggressively prosecutes those who commit fraud. Our zero tolerance approach has resulted in a fraud incidence rate that is a fraction of one percent.

One of our most effective measures to guard against fraud is the Cooperative Disability Investigations program. Under the program, we investigate suspicious disability claims early, before making a decision to award benefits. In effect, we proactively stop fraud before it happens. In fiscal year 2018, with the help of state and local law enforcement, the program reported nearly $188.5 million in projected savings to the disability programs. This resulted in a return on investment of $17 for each $1 spent.

Eradicating fraud is a team effort. We need people who suspect something to say something. If you suspect fraud, please visit the Office of the Inspector General and select Report Fraud, Waste, or Abuse or call 1-800-269-0271.

What If You Earn More Than The Limit

Earning more than the maximum allowable amount for the year will result in you losing disability benefits. However, losing the disability benefits might be temporary. Some disabled workers might earn more than the maximum for a month or two, but once their income returns to the lower level, the benefits will be reinstated.

The benefits exist to help disabled individuals financially while they aren’t able to perform tasks necessary to earn a living. Earning more than the limit indicates to the Social Security Administration that your disability doesn’t hinder your ability to earn an income anymore.

Iii: Who Receives Ssdi

Eligibility criteria are strict, and most SSDI applicants are rejected. Applicants for SSDI benefits must be

- Insured for disability benefits .

- Suffering from a severe, medically determinable physical or mental impairment that is expected to last 12 months or result in death, based on clinical findings from acceptable medical sources.

- Unable to perform substantial gainful activity anywhere in the national economy regardless of whether such work exists in the area where the applicant lives, whether a specific job vacancy exists, or whether he or she would be hired.

Lack of education and low skills are considered for older, severely impaired applicants who cant realistically change careers but not for younger applicants.

There is a five-month waiting period for SSDI, but Supplemental Security Income may be available during that period for poor beneficiaries with little or no income and assets.

SSA denies applicants who are technically disqualified and sends the rest to state disability determination services for medical evaluation. Applicants denied at that stage may ask for a reconsideration by the same state agency, and then appeal to an administrative law judge at SSA. Roughly half of people who get an initial denial pursue an appeal.

SSA monitors disability decisions at all stages of the process. SSA conducts ongoing quality reviews at all stages of the application and appeal process. Many reviews occur before any benefits are paid, thus reducing errors.

Don’t Miss: How To Disable Passcode On Iphone

Talk To A Social Security Disability Lawyer For Free Today

At John Foy & Associates, we know how vital SSDI is for individuals and families. Were here to help if you need assistance with your claim. We do not collect a fee unless we win you money, so there is no risk when working with us.

Contact us today to schedule a FREE, no-risk consultation. Well listen to your concerns and answer any questions. To get started for FREE, call , or contact us online.

Call or text or complete a Free Case Evaluation form

Arc Guide To Social Security Disability Income

SSDI is a Social Security Administration program. It pays benefits to people who used to work, but no longer can because of a physical or mental impairment. SSDI provides benefit payments to individuals and certain family members.

Eligibility

People who meet the following requirements:

- Are younger than full retirement age.

- Are unable to work because of a medical condition expected to last at least one year, or result in death. This does not include partial or short-term disability

- Earned enough work credits, based on total yearly wages or self-employment income. You can earn up to four credits each year.

- Have earnings below the Substantial Gainful Activity . SGA is the amount of monthly earned income that shows a person is doing significant work.

- In 2020, if you work and your earnings average more than $1,260 a month , you generally will not be considered disabled.

Medical Definition of Disability

- SSA focuses on inability to engage in any Substantial Gainful Activity. The SSA Blue Book lists qualifying impairments.

- You must be able to show medical reports that confirm you have a disability. If no reports are available, Social Security will send you to a doctor to confirm your disability.

- Your disability must have lasted or be expected to last at least a year

- If you are blind, there are special rules SSA uses to consider you blind. Learn more about those rules.

How to Apply

Take the following steps and fill out all documents to help your chances of approval.

Appeals

You May Like: Va 100 Permanent And Total Disability

Special Rules For People Who Are Blind Or Have Low Vision

We consider you to be legally blind under Social Security rules if your vision cannot be corrected to better than 20/200 in your better eye. We will also consider you legally blind if your visual field is 20 degrees or less, even with a corrective lens. Many people who meet the legal definition of blindness still have some sight and may be able to read large print and get around without a cane or a guide dog.

If you do not meet the legal definition of blindness, you may still qualify for disability benefits. This may be the case if your vision problems alone or combined with other health problems prevent you from working.

There are several special rules for people who are blind that recognize the severe impact of blindness on a person’s ability to work. For example, the monthly earnings limit for people who are blind is generally higher than the limit that applies to non-blind workers with disabilities.

In 2022, the monthly earnings limit is $2,260.

Who Pays For Disability Insurance Benefits

Workers and employers pay for the DI program with part of their Social Security taxes. Workers and employers each pay a Social Security tax that is 6.2 percent of workers earnings up to a cap of $127,200 in 2017. The cap is adjusted each year to keep pace with average wages. Of the 6.2 percent, 5.015 percent goes to pay for Social Security retirement and survivor benefits and 1.185 percent pays for disability insurance. The combined tax paid by workers and employers for disability insurance is 2.37 percent of wages, while the combined tax for retirement and survivor benefits is 10.03 percent, for a total of 12.4 percent.

Recommended Reading: Short Term Disability And Maternity Leave

Is The Social Security Definition Of Disability Out Of Date

The Social Security Advisory Board has asked whether the Social Security definition of disability should be changed in some fundamental way. The Academys Disability Policy Panel studied this question at length and reached the following conclusions:

Programs for people with disabilities should use definitions of disability as eligibility criteria that match the purpose of the program. A single, one-size-fits-all definition would not suit the varied needs of the highly diverse population of people with disabilities, nor would it match the particular purposes of different programs.

If the purpose of the program is to establish civil rights protections, a broad definition of disability, such as in the ADA is used: Disability means a physical or mental impairment that substantially limits one or more major life activities, a record of such an impairment, or being regarded as having such an impairment.

If the purpose is to define eligibility for vocational rehabilitation, then the legal definition of eligibility is based on need for and likelihood of benefiting from such services.

Programs that provide personal assistance or long-term care services generally define eligibility in terms of the need for those particular services, such as need for assistance with activities of daily living.

The Social Security test of work disability is very strict. A less strict test of inability to work would benefit people with partial disabilities and it would cost more.

How To Get Low Income Housing Fast With Minimum Cost

The rising rent cost is number one issue for those who have lower income level. They dont afford to meet up the housing rent and fulfill basic needs like food, childrens education, transport and minimum living cost. This is really suffocating condition to the low income individual and seniors as well. The reality in this terms is solely insufficient income. But it does not mean that they cant get housing as basic needs in their life.

So the government understands this issue and takes some steps as programs to ease housing for seniors on social security , low income people and rental assistance for disabled on social security. There are also different programs of the government to help the low income people and seniors for getting low income housing fast. So we are going to discuss how to get low income housing fast from the government and other means.

Don’t Miss: Independent Living Programs For Adults With Learning Disabilities

There Are Income Limits On Earned Income But Not On Passive Investments

If you receive Social Security benefits due to a disability, theres a strict limit on how much income you can earn each month from working before you risk losing your benefits. Still, theres no limit to the amount of unearned income you can have, which means investments can be a valuable way to build wealth.

What Kind Of Income Counts As Earnings

The Social Security income limit applies only to gross wages and net earnings from self-employment. All other income is exempt, including pensions, interest, annuities, IRA distributions, and capital gains.

The term wages refers to your gross wages. This is the money that you earn before any deductions, including taxes, retirement contributions, or other deductions.

If you want to see a more in-depth conversation about what counts as income for the earnings limit, see my article on the Social Security Income Limit: What Counts as Income?

Recommended Reading: Social Security Disability Benefits Pay Chart 2020

Limit On Substantial Gainful Activity

A person with a disability applying for or receiving SSDI can’t earn more than a certain amount of money per month by working this isn’t because of an income limit, but rather because the SSA wouldn’t consider that person disabled.

If you can do what the SSA calls “substantial gainful activity” , you aren’t disabled. A person who earns more than a certain monthly amount is considered to be “engaging in SGA,” and thus not eligible for SSDI benefits. In 2022, the SGA amount is $1,350 for disabled applicants and $2,260 for blind applicants.

The rules differ for business owners, since their monthly income may not reflect the work effort they put into their business. For more information, see our article on SGA for small business owners.

How To Make Sure You Dont Lose Your Ssdi Benefits

If youre thinking about applying for disability but are still employed, or if youve been receiving benefits but are considering part-time work to help make ends meet, its crucial that you get all the facts before making any decisions that could put your disability benefits in jeopardy.

To get help with applying for Social Security programs, appealing a decision, or just to talk about all your legal options, consider contacting an experienced Social Security disability lawyer at Social Security Disability Advocates USA.

Our friendly legal team will schedule a free consultation to review your case and help you understand the possible impacts of SSDI income limits. Call us today at , chat with us via LiveChat, or send us a message using our secure contact form.

Don’t Miss: How To Disable Guided Access On Iphone Without Passcode

How To Qualify For Low Income Housing

Surely it is not believable and true in case you dont go for much research and information. You need to collect some related information as primary eligibility condition. This information include your names according to your social security card, incomes level, assets and social security numbers. These information are required to fill up the application form wherever you are going to apply like HUD, Privately owned program and any other places.

The application form is really important issue to consider. An application form may vary according to state to state. Whatever may happen, you need to be careful and honest to submit your information. Any falsification of information may lead to lose your future chance.

How Can The Social Security Disability Programs Be Improved To Increase Economic Security And Work Opportunities For Beneficiaries

Disability Insurance and Supplemental Security increase economic security for millions of disabled workers. For beneficiaries whose conditions improve, the programs also provide important incentives and supports for returning to work. Still, the programs could be further strengthened to increase disabled workers economic security and provide a more seamless transition for those who are able to return to work.

Modernize Supplemental Security

The value of Supplemental Security benefits has eroded considerably since the programs inception in 1972, as the programs income exclusions and asset limits have not kept pace with inflation and living standards. The current maximum benefit is equivalent to just three-quarters of the also-outdated federal poverty line for a single person. The general income exclusion and earned income exclusion have never been increased. To address this erosion, H.R. 1601, the Supplemental Security Restoration Act, sponsored by Rep. Raul Grijalva and introduced in Congress in April 2013, would increase the monthly maximum benefit to $937, which is 100 percent of the current federal poverty line, and would increase the general income disregard to $110 per month and the earned income disregard to $357 a month. Increasing the income exclusions and indexing them to inflation going forward would restore the monthly benefit amount to its intended value and significantly increase beneficiaries economic security.

Read Also: Disability For Arthritis In Spine

Social Security Income Limit Summary

Heres the bottom line:

If you collect Social Security early, say at 62, and earn income from work that exceeds the income limit, Social Security will deduct $1 from your benefit payments for every $2 you earn above the annual limit.

For 2022, that limit is $19,560.

In the year you reach full retirement age, Social Security will deduct $1 in benefits for every $3 you earn above a different limit.

In 2022, this limit on your earnings is $51,960.

Read Also: How Do I Extend My Temporary Disability In Nj

Why Is There A Shortfall In The Disability Insurance Trust Fund And What Can Be Done About It

As described above, Disability Insurance is funded by a dedicated share of payroll tax contributions0.9 percent of taxable wages paid by workers and the same amount by employers. Since the mid-1990s the Social Security Administration has consistently projected that the Disability Insurance trust fund would have sufficient reserves to cover all scheduled benefits until 2016, but that after that date, additional funds would be needed to avoid a shortfall in the necessary funds to continue paying full benefits. If no action is taken to address the shortfall, the Disability Insurance trust fund will only be able to pay 80 percent of scheduled benefit levels after 2016.

Congress has addressed similar shortfallsin both the Disability Insurance trust fund and the Old Age and Survivors Insurance trust fund, which pays retirement benefitsnearly a dozen times in the past by temporarily reallocating the share of overall payroll tax revenues that is dedicated to each trust fund. In some cases, they have reallocated funds from the Disability Insurance trust fund to the Old Age and Survivors Insurance trust fund in others, they have reallocated funds from the Old Age and Survivors Insurance trust fund to the Disability Insurance trust fund.

Don’t Miss: Chances Of Winning Disability In Federal Court

Ssi Federal Payment Amounts For 2023

|

Maximum Federal Supplemental Security Income payment amounts increase with the cost-of-living increases that apply to Social Security benefits. The latest such increase, 8.7 percent, becomes effective January 2023. SSI amounts for 2023 The monthly maximum Federal amounts for 2023 are $914 for an eligible individual, $1,371 for an eligible individual with an eligible spouse, and $458 for an essential person. In general, monthly amounts for the next year are determined by increasing theunrounded annual amounts for the current year by the COLA effective for January of the next year. The new unrounded amounts are then each divided by 12 and the resulting amounts are rounded down to the next lower multiple of $1. |

What Are Social Security Disability Benefits

Social Security disability benefits come from payroll deductions required by the Federal Insurance Contributions Act to cover the cost of Social Security benefits, such as retirement and spousal and survivor benefits. Some of this funding goes into the Disability Insurance Trust Fund and pays for disability benefits.

According to the Social Security website, to qualify for Social Security disability benefits, you must have worked a certain length of time in jobs covered by Social Security. Generally, you need 40 credits, 20 of which were earned in the past 10 years, ending with the year you became disabled. You must also have a medical condition that meets Social Securitys definition of disability.

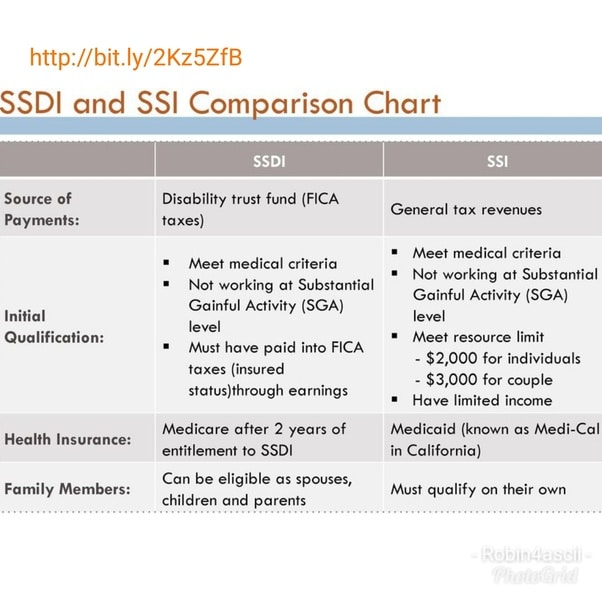

SSDI should not be confused with Supplemental Security Income , which pays benefits to those who have financial needs regardless of their work history. Although these two names sound similar, the qualifications to get the payments and what you might receive are very different.

Younger workers may qualify for SSDI with fewer credits.

You May Like: Lawyer For Social Security Disability