Nj Workers Would See Higher Family Leave Disability Payments Under Bill

By: Nikita Biryukov– March 8, 2022 7:01 am

Payments for temporary disability and family leave are paid for by taxes on employers and workers.

Less than three years after the enactment of reforms that expanded New Jerseys temporary disability and family leave programs, lawmakers are looking to tweak some numbers.

The Senate Labor Committee on Monday approved a bill that would raise the weekly payment cap for individuals on such leave from 70% of the states average weekly salary to 85%. Under the bill, the maximum weekly benefit for a worker on leave would rise by about $200.

We have a system right now thats being supported where some get 85%, and some get 70%, said Sen. Fred Madden, the committees chairman. I just think its unfair.

New Jersey provides workers with up to 26 weeks of temporary disability insurance and up to 12 weeks of paid family leave, which can be used to bond with new children or care for a sick or injured loved one. In each case, workers are paid a weekly benefit of 85% of their weekly wage, to a cap of $993. The cap represents 70% of the states average weekly wage of $1,418.

At 85% of the average state wage, the maximum benefit would increase to $1,206 per week.

The bill, which cleared the committee in a 3-1 vote with one abstention from Sen. Tony Bucco , faced opposition from one of the panels Republican members and hesitation from another. Critics caution the new plan would cost workers and their employers more in taxes.

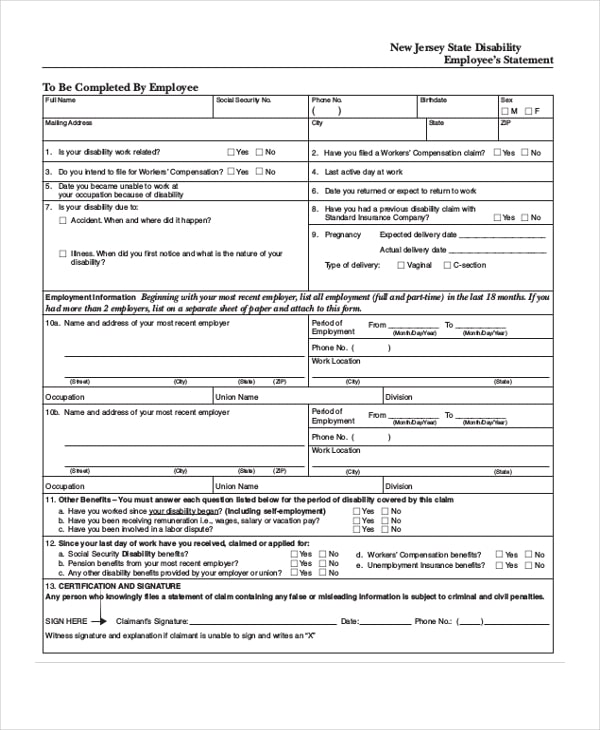

What You Need To Make Your Claim

Before you sit down to fill out your DS-1, especially online, have this information at hand:

- The contact information of any health care provider who treated you within 10 days of the first day you couldnt work.

- The dates of any hospital stay or emergency care.

- Employer contact information for the past year, the addresses you worked, and how long you worked at each. When filling out the DS-1, youll need to know the dates of any paid time off received after becoming disabled.

- The date you recovered and returned to work if you already have, or an estimate for when you will.

To Learn More About New Jersey Short Term Disability Benefits

If youve been denied TDI, received less than you deserved, or have had any other problems, call contactUscher, Quiat, Uscher & Russo, P.C., for a free consultation. We may be able to help you with your disability payment issues. Its bad enough youve been hurt. Dont fall into financial ruin because you were denied the New Jersey short term disability benefits you paid for.

Don’t Miss: Short Term Disability Insurance Individual

Faq: Temporary Disability Insurance

Temporary Disability Insurance provides cash benefits to workers who suffer an illness, injury, or other disability that prevents them from working, and wasnt caused by their job. In addition, if your healthcare provider certifies that you are unable to work because you were diagnosed with COVID-19 or are at high risk for COVID-19 due to an underlying health condition, you may be eligible for Temporary Disability benefits. Most employers in New Jersey are required to have Temporary Disability Insurance for their employees.

- Before You File

- After You Get a Decision

- Pregnancy-Related Questions

Can my employer require me to use paid time off before receiving Temporary Disability benefits?

Employers may be able to require employees to take paid time off before Temporary Disability benefits. It depends on how they meet the requirements of the NJ Earned Sick Leave law. This law requires employers of all sizes to provide full-time, part-time, and temporary employees with up to 40 hours of paid sick time per year so they can care for themselves or a loved one.

Employers who separate NJ Earned Sick Leave from their PTO policy can require employees to take PTO before claiming Temporary Disability Insurance benefits. Employers cannot require them to take time accrued under the NJ Earned Sick Leave law.

This is explained in more detail on our employer information page here.

How do I apply for Temporary Disability Insurance benefits?

What are the Minimum Gross Earnings Requirements?

Who Is Eligible For New Jersey Short

New Jersey uses a quarterly base year to determine if you’re eligible for TDI benefits. The state divides the year into calendar quarters:

The base year for TDI benefits in New Jersey refers to the first four of the last five completed calendar quarters before you file a claim. For instance, if you file a short-term disability or TDI claim in April, your base year would be January through December of the prior year. And if you file a claim this November, your base year would be July of last year through June of this year.

During the four quarters that make up your base year, to be eligible for TDI in New Jersey, you must have:

- worked at least 20 calendar weeks and earned at least $240 per week, or

- earned at least $12,000 total .

To qualify for short-term disability, you must have been working for a covered New Jersey employer for at least two weeks before becoming disabled.

Don’t Miss: Inclusion Of Students With Disabilities

The Way To Create An Electronic Signature Straight From Your Smartphone

Get form disability signed right from your smartphone using these six tips:

The whole procedure can last less than a minute. You can download the signed to your device or share it with other parties involved with a link or by email, as a result. Because of its universal nature, signNow works on any gadget and any operating system. Choose our signature solution and leave behind the old days with efficiency, affordability and security.

Benefit Provisions For 202:

You May Like: Disability For Arthritis In Spine

Division Of Temporary Disability And Family Leave Insurance

Step 1: Create an Account

If you don’t already have an account for our secure online system, and follow the prompts from the “First Time User?” button.

Step 2: Start an Application

You’ll then be directed to the first page of the application. Read it and click the box to confirm you agree with the terms before filling out the rest of the pages.

Step 3: Print Instruction Forms

After your parts are complete, you’ll be prompted to print instructions with a unique Online Form ID number. Give them to your healthcare provider so they can complete their part online.

Step 4: Await Your Decision

Applications are processed in the order in which they are received. You can stay up-to-date by checking your claim status here.

Step 5: If Approved, Access Your Funds

If we approve your application, we’ll mail you a debit card to access your benefit payments. For more information about how the debit card works, .

- Before You Apply

- Private Plan Insurance

About the Program

Who Qualifies for State Benefits

New Jersey workers are encouraged to apply.In order to have a valid claim for Temporary Disability Insurance, you need to have paid into the program through your employment and meet minimum gross earnings requirements. Temporary Disability Insurance is available to most New Jersey workers.

Exemptions include:

How Much I Need to Earn to Qualify

| If your claim is dated in: | Your claim is based onearnings from: |

How the Program Is Funded

How Benefits Are Calculated

Who Can Use It

- Need to have paid into the program through their employer and must meet minimum earnings requirements.

- Are required to have worked at least 20 weeks , or

- Must have earned in the base year prior to the first day of Temporary Disability Leave or Paid Family Leave.

- Private plans can use the eligibility requirement or choose to waive it.

Read Also: High Value Va Disability Claims

How To Get Tdis New Jersey Short Term Disability Benefits

To get TDI, you have to apply through the states Department of Labor and Workforce Development. You can do this through snail mail, but its easier to do it online. Follow the rules for filling out the form on this page. Remember, as it says at the top of the page, you can only file if pregnancy or an injury not caused by your job prevents you from working.

So for example, if youre eight months pregnant with twins and your doctor prescribes bed rest until the babies are born, youre eligible for TDI. If someone drops a heavy tool on your foot at work, you have to turn to workers comp for your disability benefits.

Applying for TDI online is much faster and easier than applying by mail, and you can return to the site to check the state of your application. If you know you will be incapacitated you can even apply up to 14 days in advance.

What Tdi Benefits Are Available In Nj

If you’re eligible, you’ll receive 85% of your average weekly salary for your base year, up to a maximum amount set by law. The maximum TDI benefit amount generally changes every year for 2022, it’s $993 per week.

New Jersey determines your average weekly salary by dividing your total TDI base year earnings by the number of weeks you worked and earned the base amount .

Also Check: Can You Work If On Disability

Appealing A Demand For Refund

If the hearing is in regard to a Demand for Refund the appeal tribunal determines that you do owe the money back, you must begin making payments toward that refund amount. If repaying us causes you a hardship, you can arrange for a payment plan with our Division of Benefit Payment Control by or by calling 609-633-7663. It is better that you pay us back in amounts that are comfortable for you rather than not paying us at all.

How Much Can I Get In Short

Your weekly benefit rate is calculated by dividing your “base year” earnings by the number of “base weeks” . Your WBR is 85% of this average. For 2022, the most you can get is $993 per week, and part of the payment is taxable. Here’s an example:

You filed a claim for disability on June 15, 2022. Your TDI claims examiner will review your wages for the last five completed quarters. Your earnings history is as follows:

- During Quarter 5 , you earned $1000 per week.

- During Quarter 4 , you earned $800 per week.

- During Quarter 3 , you earned $600 per week.

- During Quarter 2 , you earned $750 per week.

- During Quarter 1 , you earned $500 per week.

Quarters 1-4 are the base year that will be used to calculate your benefits. The total amount you earned during the base year is $34,450. The TDI claims examiner will divide your base year earnings by the number of base weeks you worked . Your average weekly wage for that period was $662. Taking 85% of your average weekly wage will give you your benefit amount of $562.

You can get benefits for up to 26 weeks. This means that even if your injury or illness lasts more than 26 weeks, your benefits will stop. However, if you suffer a newdisabling medical condition and apply for TDI, the 26 weeks will start again.

You May Like: California Disability Insurance Phone Number

What Are The New Jersey Programs

- New Jersey Family Leave Insurance was signed into law in 2008, extending the benefits of New Jersey Temporary Disability Benefits Insurance.

- With few exceptions, all employers are required to participate in the state program or choose to opt out of the state program via a state-approved private plan.

Can I Work During Paid Family Leave

If you need to take time off from work to care for a seriously ill family member or for an injury you suffered that wasnt related to your job, you might be eligible to take paid leave in New Jersey. New Jersey offers two programs to workers through which they can take paid leave, including paid family leave and temporary disability insurance. If you work at a second job, you might wonder whether you can continue working there while you take paid leave from your first job. Heres what you need to know about both of these programs and your rights from the employment lawyers at Swartz Swidler.

Recommended Reading: Guardian Short Term Disability Claim

Understanding Paid Leave In New Jersey

Paid leave in New Jersey is made up of New Jerseys family leave insurance and temporary disability insurance . You can use FLI to take time off from work to bond with a newborn, newly adopted, or new foster care child, to deal with problems related to sexual or domestic violence, or to care for a seriously ill family member.

You can use TDI to care for your own injury, disability, or illness, including time to recover after giving birth or to deal with pregnancy complications. Both types of insurance pay 85% of your average weekly wage up to $993. This amount is adjusted each year. You contribute to both FLI and TDI through deductions from your paychecks.

You must meet the minimum requirements for how long you have worked and how much you earn to qualify for these programs, including having worked for your employer for a minimum of 20 weeks for a minimum of $240 per week. Alternatively, you must have earned at least $12,000 from your employer during the 18 months before your requested leave.

Heres some more information about both of these programs.

How To Create An Signature For A Pdf Document In Google Chrome

Google Chromes browser has gained its worldwide popularity due to its number of useful features, extensions and integrations. For instance, browser extensions make it possible to keep all the tools you need a click away. With the collaboration between signNow and Chrome, easily find its extension in the Web Store and use it to design nj your disability right in your browser.

The guidelines below will help you create an signature for signing form disability in Chrome:

Once youve finished signing your nj temporary disability forms, choose what you should do next download it or share the doc with other parties involved. The signNow extension offers you a range of features for a better signing experience.

Read Also: Benefits For 100 Disabled Veterans In Texas

Handy Tips For Filling Out Nj Your Disability Online

Printing and scanning is no longer the best way to manage documents. Go digital and save time with signNow, the best solution for electronic signatures. Use its powerful functionality with a simple-to-use intuitive interface to fill out Form disability online, design them, and quickly share them without jumping tabs. Follow our step-by-step guide on how to do paperwork without the paper.

Understanding New Jerseys Temporary Disability Benefits Insurance

Overview

Since 1948, New Jersey has required employers and employees to pay payroll taxes to fund a wage replacement insurance program for employees who suffer a non-work related sickness or injury that prevents them from working. The Temporary Disability Benefits Law provides qualified employees with up to 26 weeks of partial wage replacement. New Jersey is one of five states, and Puerto Rico, to offer this benefit.

Learn how you can access Disability Insurance with your NJBIA membership

Background

During the Depression in the 1930s, the United States began implementing social insurance programs such as unemployment and Social Security benefits. Federal statutes provided no basis for a system of compensation for wage loss due to short-term sickness or disability that was comparable to the Federal-State system of unemployment insurance. As a result, some states enacted laws that became known as temporary disability insurance or cash sickness insurance. In New Jersey, most workers whose employment is covered by the New Jersey Unemployment Compensation Law are also protected by a mandatory disability insurance program which covers an illness, injury, or disability that is not work related.

How are TDBL benefits funded?

Who is eligible for benefits under the TDBL?

How is an employees weekly benefit amount calculated?

What is the limitation of benefits under the State Plan?

Under the State Plan, no benefits are payable:

Also Check: How Is Social Security Disability Calculated

The Best Way To Generate An Signature For Signing Pdfs In Gmail

Due to the fact that many businesses have already gone paperless, the majority of are sent through email. That goes for agreements and contracts, tax forms and almost any other document that requires a signature. The question arises How can I design the nj your disability I received right from my Gmail without any third-party platforms? The answer is simple use the signNow Chrome extension.

Below are five simple steps to get your form disability designed without leaving your Gmail account:

The signNow extension was developed to help busy people like you to decrease the burden of putting your signature on papers. Start putting your signature on nj temporary disability forms by means of tool and join the millions of satisfied clients whove previously experienced the advantages of in-mail signing.