Who Needs Disability Insurance

Anyone who earns their income from a job and has recurring expenses will benefit from disability insurance. You should especially consider disability insurance if you are your familys sole source of income or you have minor children and other dependents. However, workers of all ages and household sizes have bills that will continue to roll in even if they are sick or injured.

Whats The Difference Between Short

The primary distinction between short- and long-term disability insurance is the coverage period. Short-term policies generally cover just the first few months youre unable to work. Long-term policies, on the other hand, can last for yearsdecades evenafter youre unable to work and may see you through being able to claim Social Security.

With that distinction alone, you might think that just signing up for long-term insurance will have you covered. But heres the catch: long-term disability insurance usually doesnt kick in until 60 or 90 days after youve filled out the necessary paperworkor even longer, depending on the time period you choose when you select the policy. Insurers have designed short- and long-term policies to complement, not compete with, each other.

How Much Coverage Short

You wont match 100% of your salary with either short-term or long-term disability insurance. That would be prohibitively expensive. But you can come close. Short-term disability will usually provide around 80% income replacement, while long-term benefits are usually around 60% income replacement.

However, this is compared to your actual take-home pay. Disability benefits are not taxed in most cases, so your benefits will be pretty close to what you were bringing home.

Lowering the disability coverage amount can also lower the cost of the policy, but be realistic about how much replacement income you need. You may save money on your premiums with a lesser benefit amount, but if you skimp on coverage you run the risk of not having enough money when youre unable to work.

Also Check: New York State Disability Benefits

How Long Do Benefits Last

The amount of time you can receive disability benefits is called the benefit period. Short-term disability insurance is meant to cover you for a short period of time following an illness or injury that keeps you out of work. It typically provides benefits for 3-6 months.

Long-term disability insurance is meant to provide benefits for a longer period like 5, 10, 20 years, or even until you reach retirement age, depending on your policy.

The average long-term disability claim is about 3 years, so a problem with only having short-term disability insurance is that the coverage isnt enough for a lot of people. A short-term policy can be a good supplement to a long-term policy by paying you benefits during the waiting period before your long-term coverage begins.

When Do Disability Benefits Start

How long it takes for disability benefits to begin depends on the elimination period.

The elimination period for short-term disability insurance is usually under 14 days. Long-term policy elimination periods range from 30 days to two years, but the most common is 90 days. The longer the elimination period the longer you can go without accessing your policy benefits the cheaper the policy.

As mentioned previously, this is a good example of how short-term disability insurance can complement long-term insurance. Between short-term insurance and liquid savings, you can increase the elimination period of your long-term policy and lower the cost significantly.

Also Check: Caught Working While On Disability

What Type Of Disability Insurance Do I Need

Disability insurance is one of the most important parts of financial planning. While you may have enough of an emergency fund to cover a few months of expenses if you were unable to work, most people cannot afford to not work for much longer particularly if you cannot work for years.

If you can afford to purchase both types of disability income insurance, then it often makes sense to purchase both short and long-term disability plans. In this way, you will have insurance coverage for relatively short periods of time when you cannot work and have the peace of mind to know that you will have income replacement if you are unable to work for much longer.

If two disability insurance policies are not in your budget, then your best option is to purchase an individual policy for long-term disability coverage. These types of plans are often more expensive but are a more substantial financial safety net. At the same time, focus on building up your emergency fund so that you can cover your basic expenses if you have a shorter-term illness or injury.

Advantages And Disadvantages Of Short Term Disability Insurance

Short term disability insurance is intended to cover individuals who cannot work for brief periods of time. Although some short term policies can last for up to two years, the typical policy lasts between three and six months.

Because the length of time over which these policies pay benefits is relatively small, short term disability insurance policies are usually the most affordable options. Additionally, they tend to begin paying benefits immediately or within the first two weeks once the policy holder has become disabled, and they typically pay close to 100 percent of a worker’s salary for the first few payments.

Short term disability insurance policies can have drawbacks, however. Benefits run out within a few months, leaving disabled individuals on their own for the long term. Short term policies also tend to have fewer options and protections for payouts under certain circumstances, such as the death of the policy holder or a policy holder becoming disabled close to retirement age.

Despite these tradeoffs, short term disability insurance may be your best option if you:

- Already have long term disability coverage through an employer

- Have limited savings to cover the first few months of a disability

- Prefer lower monthly payments in exchange for a shorter term of benefit payments

Also Check: Social Security Disability Extra Benefits

Whats The Elimination Period

While short term disability insurance begins paying benefits within a couple weeks following a qualifying illness or injury, long term disability insurance requires a longer waiting period, called an elimination period, before a policyholder begins receiving benefits. The length of the elimination period varies by policy but is often around 90 days. When considering a disability policy, take into account how you will cover your expenses during the elimination period. Do you have an emergency fund to cover your lost income and any medical bills you accrue during this time? If not, you may consider purchasing additional coverage to protect you immediately following a disabling illness or injury.

Need Help Filing A Disability Claim Get Legal Help Today

With so many different types of disability insurance, options, and involved parties, the process of filing a disability claim can be overwhelming for anyone without a law degree. If you have questions, you can learn more on FindLaw’s disability law legal answers page. You can also contact a disability lawyer to learn more about private disability insurance or an ERISA lawyer for questions regarding employer-sponsored disability benefits.

Thank you for subscribing!

You May Like: Homes For Adults With Disabilities

Differences Between Short And Long

Waiting periods

Disability insurance policies usually have a waiting period, sometimes known as an elimination period. This means you have to wait a certain amount of time before you begin receiving payments. The waiting period starts at the onset of your disability. You must wait the specified amount of time until you are eligible to receive benefits.

Short-term benefits might be available immediately, or very soon after you become disabled. Think 1-2 weeks, maximum. Keep in mind, the length of the waiting period might be different if you are sick as opposed to injured. Any waiting periods are set out in your group insurance policy.

Long-term disability waiting periods are longer, as you might expect. They can be anywhere from 3 to 6 months. If your insurance plan includes both short- and long-term disability, they will likely be set up so that the long-term begins when the short-term ends.

Length

The most obvious difference is the one thats right there in the name. Short-term disability benefits cover a shorter period of time. Depending on the plan, the amount of time you can receive benefits is usually 3-6 months. This is the maximum amount. If you have to remain off work for longer, you will need to seek out different disability benefits. Usually, if your place of employment has short-term disability benefits, they will have long-term to follow when you run out.

Payments

Definition of Disability

Advantages And Disadvantages Of Long Term Disability Insurance

Long term disability insurance provides monthly payments in the event of a disability lasting six months or longer, and some policies provide benefits until the policy holder reaches the age of 75 or older.

The primary advantage of long term disability insurance is the peace of mind that comes with knowing that benefits of up to 70 percent of the policy holder’s salary will continue as long as a disability lasts. Additionally, long term policies usually allow for more options, such as coverage for hospital stays and adding supplemental insurance to increase monthly payments.

The main drawback of long term disability insurance is that long term policies cost substantially more than short term insurance. Furthermore, long term policies usually have a waiting period of between three and six months or longer before the insurance company begins paying benefits, leaving disabled individuals to pay their own expenses for the first few months of a disability. Finally, the payment plans of some long term disability policies may change after two years of continuous disability.

Because of these advantages and disadvantages, long term disability insurance is typically best for individuals who have savings or other insurance to cover the first few months of their disability, and workers who can afford higher premiums in exchange for long term benefits.

Don’t Miss: 100 Disabled Veteran Dental Benefits For Family

How Costly Are Disability Insurance Policies

Long-term policies tend to be more expensive due to the potential length of benefit payouts. If you can only afford short-term or long-term disability, long-term is the right choice. A long-term disability policy can protect your income and wellbeing for decades.

In the event of a short-term illness or disability, you have other options. Workers compensation, Social Security and other protections may be available to make ends meet.

Transitioning From Std To Ltd With Different Insurance Companies

Going from short-term disability to long-term disability can be more challenging for those whose LTD coverage is provided by a different insurance company than their STD coverage. This is because the new insurance company will not have immediate access to the medical records, reports, or other documentation that the claimant submitted in support of their short-term disability claim.

In these cases, claimants typically must submit a completely new claim, including claim forms from both the claimant and their treating physicians, as well as medical records. This process can be daunting. You should make sure you have copies of your short-term disability approval letter and any other documentation that supported your STD claim. Submitting documents such as an STD approval letter can help demonstrate to a new insurance company that you meet the definition of disability.

Recommended Reading: Ohio Department Of Developmental Disability

How Do I Purchase Long Term Disability Insurance

Some employers offer subsidized long term disability insurance policies to employees at discounted group rates.

If your employer doesnt offer this, you may be able to purchase long term disability insurance from a private insurer. Unlike short term disability insurance, these policies are widely available.

Also unlike short term disability insurance, private insurers typically offer individuals a range of long term disability policies to choose from.

Long term disability insurance is also sometimes available for purchase through professional associations, potentially at discounted group rates.

The cost of long term disability insurance can vary depending on the benefit period, the elimination period, your age, health, occupation, along with other factors. In general, these policies tend to run between one and three percent of your annual salary.

This is about the same as if you purchased a short-term disability policy outside of your employer.

If you were to use the insurance, however, you would benefit for years, not months, making long term disability insurance more cost-efficient than short term disability insurance.

What Are The Elimination Periods For Long

The most common elimination period for long-term disability is 90 days, but the exact terms of the elimination period will be specified in the policy. If short-term disability coverage is available, the effective waiting period before receiving benefits will be relatively short. When a short-term policy is not available, however, employees may have to wait several months with no income before qualifying for long-term benefits. Due to the longer elimination periods, many employees opt for a combination of short-term and long-term disability coverage.

Don’t Miss: Mental Health Short Term Disability

What Is Long Term Disability Insurance

Long-term disability insurance is an insurance policy that protects employees from loss of income in the event that they are unable to work due to an illness, injury, or accident for a long period of time.

The benefit period for long term disability insurance is often a choice of five, 10, or 20 years, or even until you reach retirement age, depending on the plan. In general, the longer the benefit period, the more youll pay in premiums.

Long-term disability insurance typically pays about 50 to 60 percent of your pre-disability salary, depending on the policy. In most cases, the higher that number, the higher the premium.

Some policies will also make up the gap in your income if you must return to work at a lower wage job because of an illness or injury. That coverage may also come with a higher premium.

The elimination period for long term disability insurance usually includes several options, including 30, 60, 90, 180 days, or a full year.

In general, the longer the elimination period, the less you will pay in premiums. The most common elimination period is 90 days.

But if you cant afford a policy with that elimination period, you may be able to reduce your premium costs by electing a longer period of time until benefits start.

You may want to keep in mind, however, that a longer elimination period means that you would have to go without income for a longer period of time, and might need to have savings or other resources to cover living expenses.

How Long Do Disability Benefits Last

The amount of time someone can receive disability benefits is called the benefit period, and a natural place to start comparing short- and long-term disability policies is how long they last. Going by their names its obvious that one lasts longer than the other, but what exactly do short-term and long-term mean?

Short-term disability benefits typically last between three to six months. Long-term benefits are measured in years you can apply for a benefit period that lasts two, five, or 10 years, or until retirement age.

Broadly speaking, the shorter the benefit period, the cheaper the disability policy. But because the average disability lasts around three years,short-term disability insurance isnt adequate for most people. At best, short-term disability insurance should supplement long-term disability insurance, the former providing income protection until the latter kicks in.

You May Like: Short Term Disability For Mental Health

The Importance Of Short And Long

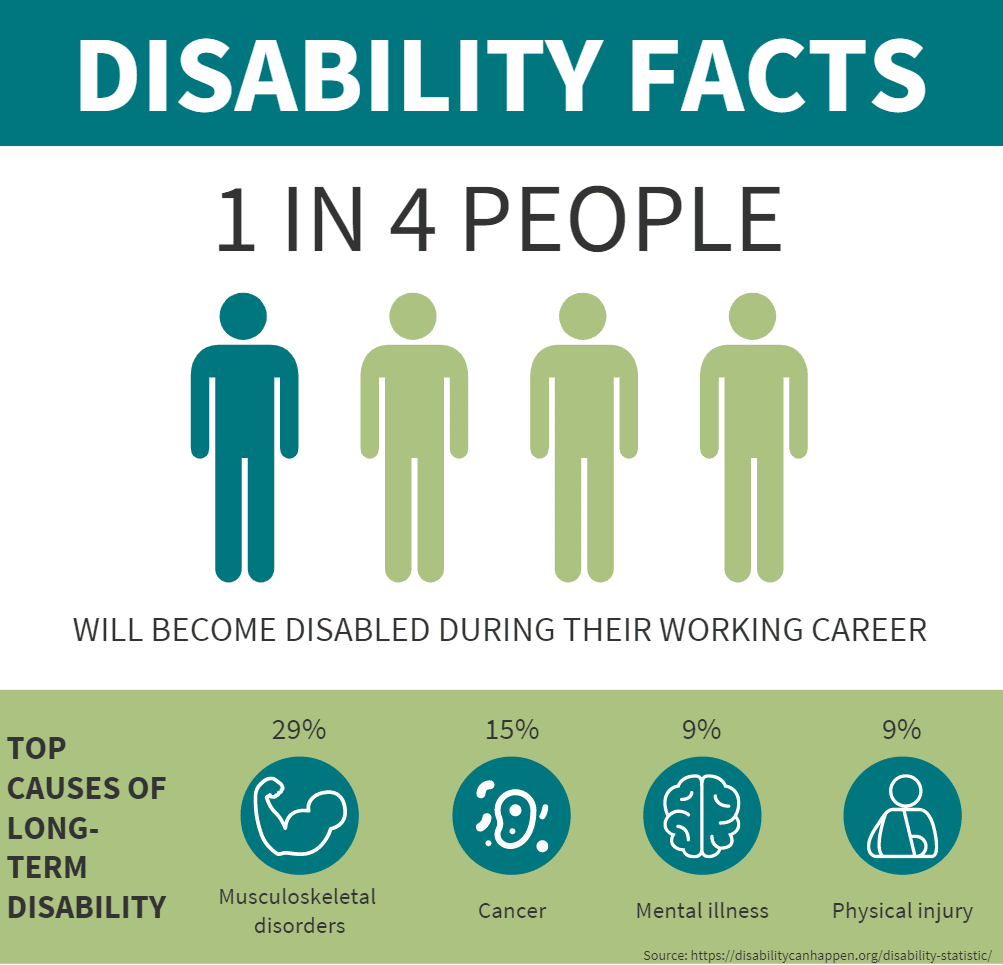

Its important that employees have a plan in place. One in four people in their 20s will become disabled before they turn 67, according to the Social Security Administration.

Providing short-term and long-term disability insurance at your business is a great benefit. Dealing with an illness or injury for an extended period of time is stressful on its own before factoring in the loss of wages.

Keep track of employee benefits and deductions with Patriots online payroll software. We make it easy to run payroll with our simple 3-step process. Try it for free today!

This article has been updated from its original publication date of September 27, 2017.

This is not intended as legal advice for more information, please

Leading Causes Of Claims

Even though many people only think of a disability being caused by an accident, illness is also a leading cause of claims.

According to the Council for Disability Awareness, the most common reasons for short term disability claims are:

The council cites the most common reasons for long term disability as being:

One study of bankruptcy filings in the state of Washington found that cancer patients were 2.65 times more likely to go bankrupt than people without cancer. Disability doesnât discriminate between illness and injury.

Read Also: Americans With Disabilities Act Lawyer

What Qualifies For Short

To qualify for short-term disability benefits, an employee must be unable to do their job, as deemed by a medical professional. Medical conditions that prevent an employee from working for several weeks to months, such as pregnancy, surgery rehabilitation, or severe illness, can qualify to receive benefits. Since employers in most states must legally provide workers’ compensation insurance to all employees, any injuries incurred on the job are typically covered under a workers’ comp policy and are therefore not eligible for short-term disability.

While most non-work-related temporary medical conditions are covered by a short-term disability policy, there can be exclusions for preexisting conditions or intentional and foreseeable injuries . While employees can qualify for time off under the Family and Medical Leave Act to care for a sick relative, most short-term disability policies would not provide benefits if the covered employee is not the one with the illness.

Which Is Better To Have

The Texas Medical Association has determined that an individual’s average length of a disability insurance claim lasts 31.6 months. Itâs apparent that a short-term disability policy with a benefit period of 3-6 months is not going to be sufficient to protect someone for the average length of disability. Very few people have two or more years of liquid savings to draw upon if they have short-term disability insurance but donât have long-term disability coverage.

A good question to ask yourself: âIf I was to become permanently disabled, could I cover my expenses until retirement?â Your answer to this question is the best determinant of your need for long-term disability insurance.

The information and content provided herein is for educational purposes only, and should not be considered legal, tax, investment, or financial advice, recommendation, or endorsement. Breeze does not guarantee the accuracy, completeness, reliability or usefulness of any testimonials, opinions, advice, product or service offers, or other information provided here by third parties. Individuals are encouraged to seek advice from their own tax or legal counsel.

Also Check: Negatives Of Getting Social Security Disability