What Doesnt Long Term Disability Insurance Cover

Long term disability insurance covers a lot, but it canât cover everything. There are almost always coverage exclusions and limitations.

To avoid any confusion or surprises, exclusions and limitations will be listed in your policy contract. The purpose of coverage exclusions is to mitigate the insurance carriers risk of paying a claim resulting from high-risk conditions or activities.

Some common examples of exclusions that apply to all applicants include:

- Self-inflicted acts

- Civil disobedience or rebellion

- Operating a motor vehicle while intoxicated

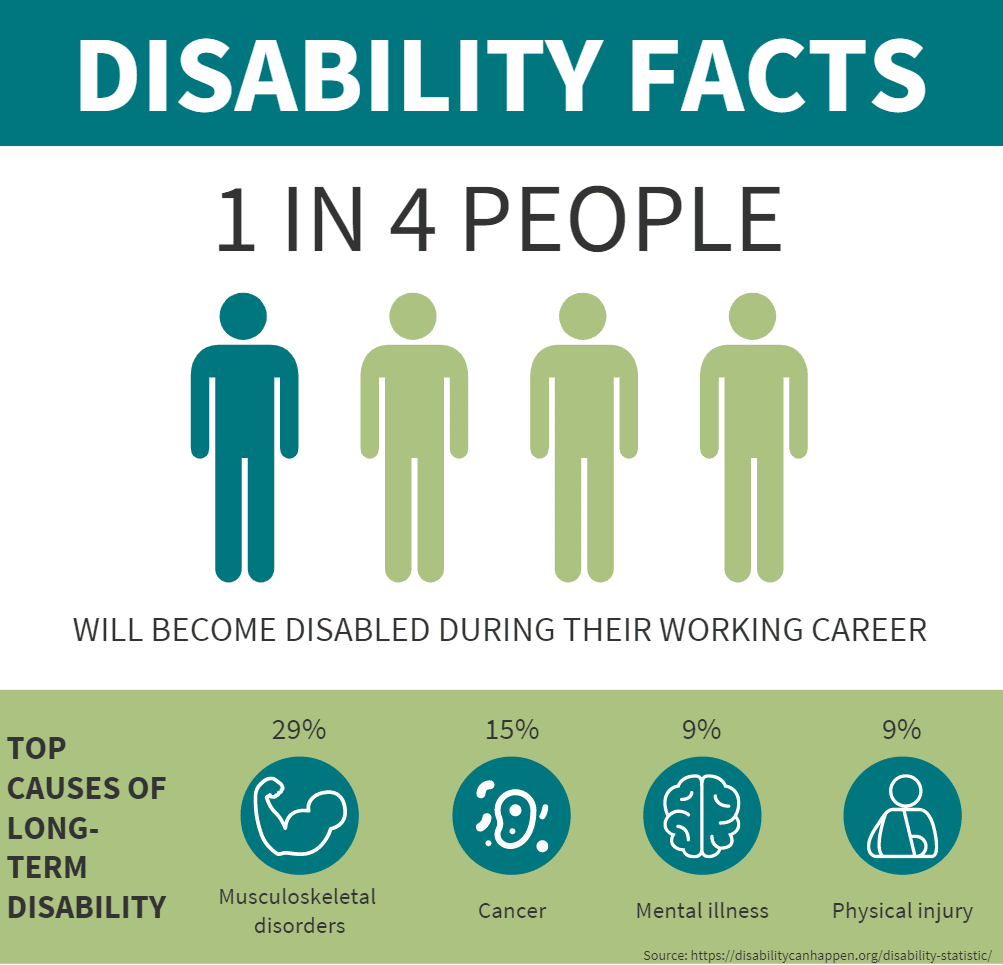

Depending on your medical underwriting and lifestyle choices, you may also receive individual exclusions. For example, if you have had a herniated disc, your policy may exclude claims resulting from spinal injuries. Many policies also limit benefits if a mental illness or nervous disorder limits your ability to work.

Since they are sometimes confused, its important to highlight the difference between long term disability and long term care insurance. A long term care policy will cover the costs of nursing homes, assisted living facilities, or in-home care if you become unable to care for yourself. However, it will not replace lost income like a long term disability policy.

Recommended Reading: How Many Hours Can I Work On Disability 2021

Other Disability Options For Mental Illness

Mental health issues are getting more exposure from healthcare professionals, and they are emphasizing the importance of getting help and treatment for these conditions. Especially with the recent pandemic, there has been a surge in mental health issues across America. So, since many disability insurance plans do not cover these conditions, what other options do you have? Here are a few options you can consider.

Women Pay More Than Men

Even with all other factors being equal, women can pay up to 40 percent more in premiums than men for disability insurance. Thatâs because women suffer disabilities that impact their careers, such as breast cancer, autoimmune disorders, and depression, more than men. Disability claims for women also typically last longer than those for men.

For example:

- A 40-year-old male applying for a $3,300 monthly benefit will pay $61 a month.

- A 40-year-old woman getting the same coverage will pay $80 a month.

For what its worth, the gender price gap for disability insurance is the opposite of life insurance. Women consistently live longer than men, which means they get the same preferential treatment you see men getting here.

Also Check: Social Security Disability Income Limits

Also Check: Social Security Disability Attorney Oregon

Your Employment And Returning To Work

When you are ready to return to work, please contact your claims specialist, who will work with you on your return-to-work plan.

Most plans include a recurrent disability provision. If an employee becomes disabled again due to the same condition within a specified number of days, the recurrent disability provision allows continued disability payments under the original claim.

The number of days for the recurrent disability provision is stated in the policy.

If an employee becomes disabled after the number of days in the recurrent disability provision, or due to a new medical condition, a new claim would need to be filed.

Depending on the definition of disability as defined in the policy, an employee may be able to receive benefits and work part time.

Many policies will allow employees to work part time while on claim. Typically, an employee will need to have a certain percentage of their earnings lost due to disability for a claim to remain active.

Please review the definition of disability, outlined in the certificate of coverage.

1. Unum internal data, 2016. Note: Causes are listed in ranked order.

Group Long Term Disability:

Read Also: 90 Percent Va Disability How To Get 100

Can I Travel While On Short

Technically, yes. You wont find it written anywhere in your policy that you cant travel. However, this may not be a good idea if you want to maintain good relations with your employer. Taking a trip to Cozumel after youve filed a claim stating that youre physically unable to work isnt sending your boss or insurer the message that youre committed to your recovery.

Also Check: Idea Individuals With Disabilities Education Act

Short Term Disability Example #1

$105 per month for somebody between the ages of 18 and 35. The hypothetical policy has a 14-day waiting period, a 6-month benefit period, and a $3,500 monthly benefit . It would be:

- $126 per month for the same policy with a 7-day waiting period.

- $135 per month for the same policy with a $4,500 monthly benefit .

- $150 per month for the same policy with a 12-month benefit period instead of six months.

Documentation Required For Your Mental Health Disability Claim

Whether you are getting a health insurance claim approved or attempting to get approved for disability benefits, you will be required to submit documentation to support your claim. So, what types of documentation are required when it comes to mental illness? The answer is that there is not much difference between a mental health claim and any other claim. First, make sure that you are seeking medical treatment for your mental health condition. If you claim benefits for a mental health disorder but have not sought medical treatment and do not have a treatment plan in place, your claim will not likely be approved.

You will need to show the same types of evidence to support your mental health disability claim as you would for a physical injury. You should be able to show medical records and doctors notes that prove your condition. If you have any records from a vocational expert that help prove your inability to work with your condition, that would be great evidence as well. The more medical evidence that you can provide, the more likely your claim will be approved. If you have any questions about the disability process or how to prove your claim, most disability attorneys offer free consultations. You can speak to an attorney about your situation, and they can advise you on the best approach for getting help.

Don’t Miss: What Disabilities Qualify For Medicaid Under 65

Can You Go On Short

Short-term disability generally covers behavioral health issues, which can include anxiety, depression and stress. However, the claims process for these conditions tends to be more difficult. Claims analysts may need all of the medical records pertaining to the diagnosis so they can evaluate what is preventing the employee from working.

The Difference Between Short

There are three significant differences between short-term and long-term disability insurance:

- The illnesses and injuries they cover

- The length of time you can receive benefits

- How long you have to wait to start receiving compensation following a disabling event

Heres a chart comparing the coverages :

|

COVERAGE COMPARISON |

|

|

1, 7, 14, 30 days |

30, 60, 90, 180, 365 days |

Most financial advisors recommend that you dont forgo buying long-term disability insurance because you have an STD policy. Short-term coverage isnt adequate if you suffer a serious illness or injury. Once your STD coverage runs out, you could find yourself without any income after just a few months.

Advisors recommend concentrating on buying a long-term disability policy and supplementing it with an STD policy through your employer. Combining the coverages gives you the best possible protection against just about any illness or injury that would impact your ability to earn an income.

Recommended Reading: Best Disability Lawyers In Michigan

Can My Employer Contact Me While Im Out On Short

Yes, they can. Youre still considered an employee while youre out on a claim. Your employer can periodically check in with you about your readiness to return to work, accommodation requirements, or other issues related to your job.

That being said, repeated contact urging you to get back to work prematurely over a short period could constitute harassment. If that happens, you might want to consider getting legal representation.

» MORE:

Does Short Term Disability Protect Your Job

Short term disability insurance does not necessarily guarantee you job protection. You can be terminated while on disability leave. However, there are employment laws to protect you, like the Americans with Disabilities Act if you feel your termination was due to discrimination. If you are on FMLA leave, you are entitled to your job when you are able to return to work.

You May Like: How To Add Dependent To Va Disability

Short Term Disability Vs Fmla

People also sometimes confuse short-term disability with the Family and Medical Leave Act . The FMLA is a federal law that protects workers who need time off for various family and medical reasons. It stipulates that you must be given up to 12 weeks of unpaid time off for:

- Having children

- Health problems

- Taking care of sick family members

The law also protects you from being dismissed from your jobs while taking a leave of absence that is covered by the law.

However, the law does not provide a replacement for any income you might lose while taking leave . Plus, there are several qualifications to be eligible for FMLA leave:

- Employees must have worked at the employer for 12 months and 1,250 hours.

- Also, it only applies to employers with 50 or more employees.

Learn More:Short-Term Disability vs. FMLA

Group Short Term Disability Plan Details

Salary Replacement: Up to 70 percent for employer-paid plans

Weekly Benefit: Up to $5,000 per week

Duration: Up to 52 weeks

Benefit Waiting Periods: Starting at zero days for accidents and seven for illnesses and pregnancies

Return-to-Work Incentives: Financial support for employees who are ready to come back to their jobs

Coverage Options: Non-occupational or 24-hour

Performance Guarantee: For groups with at least 1,000 insured employees

Reporting: Administrative claims reports available

Also Check: How To Apply For Disability In New Mexico

What Is Group Short Term Disability

Group short term disability is insurance coverage provided by employers to employees for illnesses, injuries, or conditions that are considered to be temporary. This type of coverage is used to help partially pay for these unplanned instances, including paying your salary for an allotted amount of time.

This type of plan is only available as part of a group insurance plan.

Although group short term disability coverage is only required in a handful of states, it is a good idea for employers to offer this coverage as a back-up to support employees while they are experiencing life-altering changes.

The employees will be protected in the event of unforeseeable changes that will have an impact on their lives. There are a few short-term disabilities that can be covered by this type of insurance.

Mandated State Disability And Paid Family & Medical Leave Plans

Some states offer state-sponsored disability or medical leave income protection for their residents, but you have to live and / or work in that state to qualify. Its paid for via mandatory employee payroll deductions, and the plans provide short-term wage-replacement benefits for non-work-related disabilities . To see if your state offers this type of program, contact your states Department of Labor or Employment.

Don’t Miss: At What Age Does Disability Become Social Security

Social Security Disability Benefits

Social Security disability benefits are funded through payroll taxes, and people are considered insured because they have worked for a certain number of years and have made contributions to the Social Security trust fund through Social Security taxes. Being eligible for SSDI benefits does not have to do with current employment circumstances, but rather financial need.

Disability Benefits Dont Come Automatically You Have To File A Claim

Even if your injury or illness is obvious, you cant just decide for yourself that youre unable to work. Youll need evidence medical records and so forth showing that you have a condition that meets the policys definition of disability. The specific process and paperwork requirements vary from plan to plan if you have coverage through work, your first step should be to contact your HR department. If you have an individual plan , your plan documents should clearly state how to contact the company in order to file a claim.

You May Like: Short Term Disability For Pregnancy

Whats The Elimination Period

While short term disability insurance begins paying benefits within a couple weeks following a qualifying illness or injury, long term disability insurance requires a longer waiting period, called an elimination period, before a policyholder begins receiving benefits. The length of the elimination period varies by policy but is often around 90 days. When considering a disability policy, take into account how you will cover your expenses during the elimination period. Do you have an emergency fund to cover your lost income and any medical bills you accrue during this time? If not, you may consider purchasing additional coverage to protect you immediately following a disabling illness or injury.

What If Your Short

The first thing to do is to carefully read the correspondence thats saying its not being approved, Bartolic says. That will tell the person a lot, and will tell them what to do if they disagree with the decision.

Most disability plans in America are covered under the Employee Retirement Income Security Act , which means claims are reviewed through the lens of this federal law. If your plan is covered by ERISA, the law requires that the denied individual be presented with a right to appeal that decision, McDonald says. So be sure to take advantage of the appeals process within the designated time frame.

Recommended Reading: Filing For Social Security Disability

Policy Terms And Responsibilities

As an employer, you can create a policy dictating that employees use sick days before going on short-term disability for an extended illness. You can also require documentation from a doctor to prove an illness or injury.

During the time that an employee misses work, the employer may also request that the employee visit an approved medical provider or an occupational medicine center for regular updates on the progress of the employee’s health.

A third-party claims administrator will be in charge of managing these aspects while the employee takes time out of work. Employees must report any changes in their status immediately. These rules are in place to help prevent insurance fraud, a problem that costs employers billions of dollars annually.

Various short-term disability plans dictate different terms for qualifications. The main terms typically include:

- Employees need to work for the employer for a certain amount of time before coverage kicks in.

- Employees need to work full-time, usually 30 hours or more a week.

The following components may be included in a short-term disability plan benefits package:

- Percentage of weekly salary paid out .

- Duration of short-term disability benefits .

- The maximum amount of time covered under the disability program

Its also important to know the rules of the states in which employees reside.

How Do I Apply For Short

The first step is to get claim forms from your employer, the claims administrator, or the insurance company. There are usually three forms for STD:

Once the paperwork is received, the insurance company will assign a case manager to handle your claim. Theyll contact you to get further information, discuss your claim with you, and answer any questions you have. Then, your claim will be approved or denied based on the eligibility requirements written in your policy.

Read Also: How Long Does Disability Take

Ensuring Your Job Is Available When You Return

Florida disability insurance protection is available to replace your wages but cannot provide job protection. You would need approval for your leave under the Family and Medical Leave Act or the Americans with Disabilities Act to confirm that your employer will accept you back after your time of impairment.

How To Apply For Short Term Disability Benefits

To receive benefits, you will have to submit a claim to the insurance company. This involves filling out a form, be it a printed version or online. The form will ask the date you last worked, a description of your medical condition, and other pertinent information. Your employer and physician will have to complete sections of the form as well.

Once you submit the claim form, the insurance company will review medical records to determine if you meet the definition of disability as defined in the policy. If your policy does not cover pre-existing conditions, the insurer will look for evidence of undisclosed conditions.

You May Like: Does Short Term Disability Cover Mental Health

What Circumstances Qualify For Short

The circumstances that qualify you for Florida disability insurance depend on how the policy. Yet, the standard conditions of getting this coverage require that you cannot accomplish your routine job duties. Also, you must have documentation signed by a doctor or other approved healthcare professional. Typical situations that permit you to use short-term disability include severe illness, painful injuries, mental health issues, and recovery from accidents, surgeries, pregnancies, and childbirth.

Short Term Disability Vs Long Term Disability

The main differences between short term and long term disability insurance are:

- The injuries and illnesses they cover

- How long you can receive disability benefits

- How long you have to wait following a disabling event to receive compensation

| Coverage Comparison | |

|---|---|

| 1, 7, 14, 30 days | 30, 60, 90, 180, 365 days |

You shouldn’t skip long term disability insurance coverage in lieu of having just a short-term policy. Short term coverage will not be adequate in the event you suffer a serious injury or illness. Without long term coverage, you could find yourself without any kind of income after just a few months.

The best strategy is to buy an individual long term disability insurance policy then supplement it with any short term and/or long term group plans your employer may offer. By combining different types of coverage, you can protect your income against just about any type of injury or illness that would affect your ability to earn an income.

Learn More:Short Term vs. Long Term Disability

Don’t Miss: Guardian Short Term Disability Claim