Disability Is Unpredictable And Can Happen To Anyone At Any Age

Disability is something many Americans, especially younger people, think can only affect the lives of other people. Tragically, thousands of young people are seriously injured or killed, often as the result of traumatic events. Many serious medical conditions, such as cancer or mental illness, can affect the young as well as the elderly. The sobering fact for 20-year-olds is that more than 1-in-4 of them becomes disabled before reaching retirement age. As a result, they may need to rely on the Social Security disability benefits for income support. Our disability benefits provide a critical source of financial support to people when they need it most.

Connect With Berger And Green For Help With Your Disability Benefit Claim

The attorneys at Berger and Green have more than 40 years of experience handling all aspects of disability claims. We work hard to get our clients the benefits that they deserve. If you want to file a disability claim or the SSA denied your initial application, we can help.

If your disability was the result of someone elses careless or reckless actions, you mighthave a valid personal injury case. Our attorneys might be able to help you recover damages in addition to your Social Security benefits. Contact us today at for a free consultation.

Average Indexed Monthly Earnings

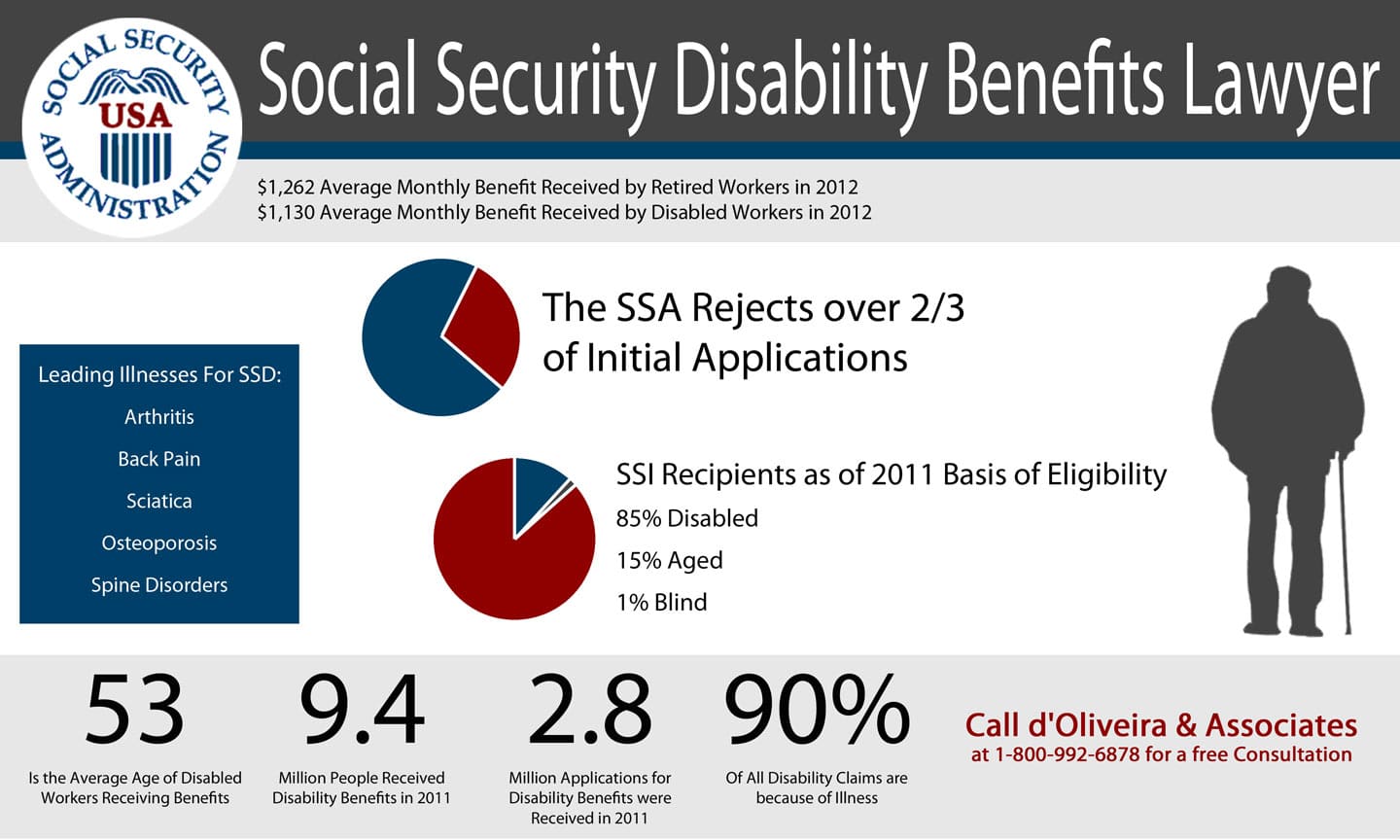

In 2022, the average Social Security disability payment totalled $1,358 per month, with some high income earners receiving as much as $2,681. The Social Security Administration will use your earnings history to determine the exact amount youâll receive, but this is a good number to start with.

In order to arrive at the amount youâll receive on a monthly basis, the SSA will use your Average Indexed Monthly Earnings and Primary Insurance Amount to determine the exact amount. Itâs a complicated series of calculations, which is why many people use the average amounts to gauge how much they will receive.

Your AIME is based on up to 35 working years of your earnings history. The SSA will take the highest indexed earnings over the years, add them up and divide them by the number of months in those years. The resulting average is rounded down, and this is your AIME.The SSA will also use your PIA to calculate your disability payments. Your PIA is based upon three fixed percentages – 90%, 32% and 15% – of your AIME. The resulting figures are your âbend pointsâ, which represent the base amount of your benefits.

If this information is overwhelming, the SSA provides the exact amount you would receive if you became disabled in your Social Security Administration statement. You should receive a copy of this document each year, or you can log into the SSA website to access it.

What If You Receive A Denial

Generally, the SSA denies disability benefits because applicants do not provide the evidence needed to prove their medical condition. If you were initially denied benefits, it is important not to delay. You have 60 days to appeal your denial. Before you file your request, you might want to consider contacting our law firm.

We can explain the appeals process to you. We can help you meet your appeal deadlines and represent you at a hearing with an Administrative Law Judge .

If the ALJ approves you for benefits during this process, you will begin receiving your benefits shortly after the approval. You could also qualify for back benefits that pay you for the time you had to wait to begin receiving your monthly award. We can determine how far back these benefits might go.

Complete a Free Case Evaluation form now

What Is The Disability Standard For Disability Insurance And Supplemental Security

Disability Insurance and Supplemental Security are reserved for workers with the most severe disabilities and conditions, and both use the same strict disability standard: inability to engage in substantial gainful activitydefined as being able to earn $1,040 a month in 2013due to one or more severe physical or mental impairments that are expected to last at least a year or could result in death. A workers impairment or combination of impairments must be so severe that the applicant is not only unable to do his or her previous work but also unableconsidering his or her age, education, and work experienceto engage in any other kind of substantial gainful work that exists in significant numbers in the national economy.

Medical evidence is the cornerstone for the determination of disability in both programs. To qualify, there must be medical evidence from a doctor, specialist, or certain other licensed or certified medical sources that documents a severe impairment. Evidence from other health care providerssuch as nurse practitioners or clinical social workersis not sufficient to document a severe medical impairment. And statements from the applicants themselves, their families, co-workers, friends, or neighbors are not treated as medical evidence.

Here Is The Formula Used To Determine Your Monthly Social Security Disability Amount

First, your Average Indexed Monthly Income is determined in the manner we outlined above. Next, that figure representing the average amount you earned each month over your lifetime, indexed for todays dollars, is fed into the following equation to produce your Primary Insurance Amount . Your PIA is the amount of your monthly benefit within a few cents: PIA =

- 90% of the first $1,024 of your AIME, plus

- 32% of the amount of your AIME between $1,024 and $6,072, plus

- 15% of the amount of your AIME over $6,072

Rounding Down to Next Whole Dollar

The Primary Insurance Amount figure produced by the equation just illustrated is almost your final monthly SSD benefit amount. The last step in the process is to round down that PIA amount to the next lowest whole dollar. That final figure is your SSD Benefit Amount.

To get a genuine idea of how the formula works, lets put a couple of sample incomes through the equation to understand how the first dollars earned are weighted more heavily than those earned in the higher income brackets.

Example #1 of $4,166.32In this example, Betsy has a higher monthly income to see how the formula works with larger salaries.

- 90% of the first $1,024 of $4,166.32=1024 x 0.90 = $921.60 plus

- 32% of Alans AIME between $1,024 and $6,072 = 4166.32 1024 = $3,142.32 x 0.32 = $1,005.54, Plus

- 15% of Alans AIME over $6,072 = 0

- Add $912.60 + $1,005.54+$0 = $1,927.14

- Round Down to Next Whole Dollar = $1,927 = Alans Final Monthly SSD Benefit Amount

Iv: What Financing Issues Does Ssdi Face

SSDI costs have leveled off, but the program faces a long-run funding gap. SSDI costs have stabilized as the baby boomers move from their peak disability-prone years to their peak retirement years. But SSDIs costs will still exceed its revenues. Over the next 75 years, its shortfall is projected to be about 6 percent of the programs costs or income.

SSDI has financial challenges but doesnt face bankruptcy. The payroll taxes that workers contribute out of every paycheck fund most of SSDIs costs. In addition, SSDI has built up trust fund reserves, which Social Securitys trustees estimate will last until 2065. At that point, tax revenues will be enough to pay for 92 percent of benefits even if policymakers do nothing to strengthen Social Securitys financing .

Though the SSDI trust fund has enough funding for more than three decades, policymakers must address overall Social Security financing before then.Overall, Social Security can pay full benefits for 16 more years, the trustees annual report shows, but then faces a significant, though manageable, funding shortfall. Policymakers should address Social Securitys long-term shortfall primarily by increasing Social Securitys tax revenues. Social Security will necessarily require an increasing share of our nations resources as the population ages, and polls show a widespread willingness to pay more to strengthen the program.

Can I Receive Both Disability And Retirement Benefits From Social Security

In most cases, the answer is no. The benefits you receive through Social Security Disability Insurance, also known as SSDI, are the same amount that you would receive in regular Social Security benefits at your full retirement age. When you reach this milestone, the Social Security Administration will convert your current disability benefits into retirement benefits. For most people, the amount received in benefits will not change because of this conversion.

Need Help Determining Your Disability Benefit Amount

We understand that applying for disability benefits can be confusing and frustrating. Knowing that most applicants are denied the first time around may seem discouraging, but it doesnt have to be. To get help with applying for Social Security programs, appealing a decision, or just to talk about your legal options, contact Social Security Disability Advocates USA.

Well schedule a free consultation to review your case and help you zero in on your potential disability benefits amount. Call us today at , chat with us via LiveChat, or send us a message using our secure contact form. We are committed to serving our clients as safely and effectively as possible during the COVID-19 pandemic.

Looking for more information? Check out the ultimate disability secrets the SSA doesnt want you to know and follow us on .

This is attorney advertising. SSDA, LLC is a group of attorneys that pursues claims for Social Security Disability benefits on behalf of its clients against the Social Security Administration. SSDA, LLC is in no way a part of the Social Security Administration. Further, the information on this blog is for general information purposes only. Nothing herein should be taken as legal advice. This information is not intended to create, and receipt or viewing does not constitute, a representative-client relationship.

Which Disability Benefits Can Affect Your Ssdi

If you were injured on the job and you’re receiving workers’ compensation benefits, the SSA might reduce the amount of your SSDI benefit. That’s because the SSA has set a limit on how much public disability income you can have. And worker’s comp isn’t the only public benefit that can affect the amount of your SSDI.

Other disability benefits that aren’t job-related and are paid for by the federal, state, or local government might also reduce your SSDI benefit amount. Examples of these include:

- temporary disability benefits paid by the state

- military disability benefits, and

- state or local government retirement benefits that are based on disability.

But some public benefits aren’t counted toward the disability benefits limit, including SSI and VA benefits.

What Are The Maximum Social Security Disability Benefits

The monthly benefits issued for 2022 include:

- The current maximum Supplemental Security Income for an individual is $841 per month.

- The current maximum amount for Social Security Disability Insurance benefits is $3,148 per month.

- The average disability payment for a disabled worker receiving SSDI is $1,358 per month.

What Is The Difference Between Ssi And Ssdi

Both SSI and SSDI provide income for those in need. However, each program has different requirements. According to the Georgia Department of Public Health , SSI pays disability benefits to:

- Disabled adults with low income and few assets

- Disabled children with low income and assets

- Adults age 65 and older who meet certain financial requirements

Those on SSI would have difficulty paying for necessary living costs without benefits. SSI benefits depend on financial needs and disabilities. If you apply for SSI, the SSA will look at your earned income and assets. It will also see if you have a medical condition that will last for at least 12 months.

SSDI is only available to those who have paid into Social Security taxes. If you earned wages or self-employment income, you have probably contributed to Social Security. If you have enough work credits from paying into taxes, you might be eligible for SSDI benefits.

Like SSI, you must have a disabling condition to qualify for SSDI. The severity of your condition does not determine how much SSI or SSDI pays.

How Have The Number And Share Of People Receiving Disability Benefits Changed Over Time And What Accounts For These Changes

There has been little change over the past two decades in the share of nonelderly adults receiving Supplemental Security due to a disability. In 2011, 2.4 percent of nonelderly adults received Supplemental Security for a disability, compared to 2.1 percent in 1996. This comparison does not, however, take into account demographic and economic changes, particularly the aging of the population and the increase in poverty, which both have increased the number of people who are potentially eligible for Supplemental Security.

Controlling just for income, participation in Supplemental Security by working-age adults who are potentially eligible because of low income has actually declined over the past decade and a half. In 2011 there were 17.6 nonelderly adults receiving Supplemental Security for every 100 nonelderly adults with incomes below 100 percent of the poverty line, compared to 18.5 nonelderly adults in 1996. In other words, the number of nonelderly adults receiving Supplemental Security grew at a slower rate than the number of nonelderly adults with very low incomes.

The share of nonelderly adults receiving Disability Insurance has increased over time. This is largely due to demographic factors, including:

A number of factors account for this one-percentage-point increase in the disability-prevalence rate after accounting for the changes in the age and gender distribution of the workforce, including the following:

What Do I Need To Know About Advance Designation

You should be aware of another type of representation called Advance Designation. This relates to the Strengthening Protections for Social Security Beneficiaries Act of 2018, which was signed into law on April 13, 2018.

Advance Designation allows capable adult and emancipated minor applicants and beneficiaries of Social Security, Supplemental Security Income, and Special Veterans Benefits to choose one or more individuals to serve as their representative payee in the future, if the need arises.

To help protect whats important to you, we now offer the option to choose a representative payee in advance. In the event that you can no longer make your own decisions, you and your family will have peace of mind knowing you already chose someone you trust to manage your benefits. If you need a representative payee to assist with the management of your benefits, we will first consider your advance designees, but we must still fully evaluate them and determine their suitability at that time.

You can submit your advance designation request when you apply for benefits or after you are already receiving benefits. You may do so through your personal account, by telephone, or in person.

Maximum Ssdi Benefits In 2022

Unlike SSI benefits, SSDI benefits are not needs-based benefits. Instead, these benefits can be paid to any disabled person who has a long enough and substantive enough work history, whether that person earned minimum wage or a significant annual salary. A persons benefit is determined based on the disabled persons average indexed monthly earnings , so each persons benefit amount will be different.

Like SSI benefits, however, there is a maximum benefit amount. The maximum benefit amounts for 2022 are $1,350 per month for a non-blind person, $2,260 per month for a blind person, and $970 per month for a person in a trial work period .

When Do Social Security Payments Begin

SSDI Cases

Social Security disability benefits begin five full months after your disability date, known as your Alleged Onset Date.

Your payment would begin on the 6th month after your Alleged Onset Date. However, the furthest SSA will pay back due benefits on SSDI cases is 12 months before the filing date.

SSI Cases

SSI payments begin the first full month after the Alleged Onset Date. However, the furthest SSA will pay back due benefits is to the first month after the protected filing date of the claimants SSI application.

Whats My Social Security Disability Benefit Amount

How much will you receive every month as your Social Security Disability benefit payment? That is often the first and most pressing question people want to be answered when they begin the process of applying for SSD benefits.

The Clauson Law Firm is dedicated to keeping all our clients fully informed about every aspect of their SSD claim. That includes explaining how the amount of your monthly SSD benefit payment is determined. If you have any questions about SSD benefits or SSI benefits, contact Clauson Law immediately for a free review of your case and to get all the answers you need.

As we explain in this blog post, the number of years an SSD claimant worked and their average earnings over those years will determine the amount of their SSD monthly benefit amount.

Other Income That Could Reduce Your Ssdi Payment

Any disability benefits you receive from a private long-term disability insurance policy won’t affect your SSDI benefits. Nor will SSI or VA benefits impact your SSDI amount. But government-regulated disability benefits, such as workers’ comp or temporary state disability benefits, can affect your SSDI benefits. Here’s how that works: If the amount in SSDI plus the amount from government-regulated disability benefits is more than 80% of the amount you earned before you became disabled, the SSDI or other benefits will be reduced.

Before Inez became disabled, her average earnings were $5,000 per month. Inez, her spouse, and her two children would be eligible to receive a total of $3,000 a month in Social Security disability benefits. But Inez also receives $2,000 a month from workers’ compensation.

The total amount of benefits Inez and her family would receive$5,000is more than 80% of her average earnings. So, her family’s Social Security benefits will be reduced by $1,000, from $3,000 to $2,000. That way, the $2,000 a month from workers’ comp and the $2,000 in disability benefits means they will receive a total of $4,000 per month, which is 80% of the earnings figure of $5,000.

The following types of government benefits could lower your SSDI payment:

- workers’ comp payments

- civil service disability benefits, and

- state or local government retirement benefits based on disability.