Who Is Eligible For Nj Disability Benefits

If you work in NJ for an employer who must offer temporary disability insurance benefits to workers, then you may be eligible for disability benefits provided that you earned at least $240 a week for more than 20 weeks, or you must have annual earnings of at least $12,000 during your base year.

The base year is determined from the five quarters of employment prior to the onset of your disability with the first four of them being the base year. For example, if you apply for disability benefits in November 2022, your base year for earnings is July 1, 2021, through June 30, 2022. Weekly benefits that you receive and the total amount that will be paid to you are calculated based on what you earned during the base period.

You must be under the care of a physician or other health care provider within 10 days of the disability onset date. The medical professional must certify that you are disabled and unable to work. Once you are approved to receive disability benefits, the state has the right to periodically request proof from the medical provider that you remain under the providers care and continue to be unable to work because of a disability.

Although you are under the care of your own medical provider, the state reserves the right to arrange for an examination by an independent medical professional. If you refuse to schedule the exam or fail to keep the appointment, it may affect your eligibility or continued eligibility for benefits.

How Much Will Your Disability Benefit Be

Every Social Security Disability Insurance recipient receives a different monthly benefit payment. The benefit amount is based on the claimants 35 highest annual incomes over the course of their working life. Before we cover the formula the Social Security Administration uses to figure out your benefit amount, lets look at what the government considers to be a disability.

People suffer from disabilities in varying degrees of severity. Disabilities can also affect people for different lengths of time. Given this wide range of variation in the disabilities people experience, the Social Security Administration needed to define what disability would qualify someone to receive disability benefits. The SSA applies the following definition to distinguish between disability claims that qualify for benefits and those that do not qualify:

A disability is a medically determinable physical or mental impairment that lasts or is expected to last for 12 months , and that prevents the person from performing substantial gainful activities .

What Do I Need To Know About Advance Designation

You should be aware of another type of representation called .

Advance Designation allows capable adult and emancipated minors who are applying for or receiving Social Security benefits, Supplemental Security Income, or Special Veterans Benefits the option to choose up to three people in advance who could serve as their representative payee, if the need arises.

In the event that you can no longer manage your benefits, you and your family will have peace of mind knowing that someone you trust may be appointed to manage your benefits for you. If you need a representative payee to assist with the management of your benefits, we will first consider your advance designees. We must still fully evaluate them and determine their suitability at that time.

You can submit and update your advance designation request when you apply for benefits or after you are already receiving benefits. You may do so through your personal account, contacting us by telephone at 1-800-772-1213 , or at .

You May Like: Jobs For People With Physical Disabilities

What Conditions Are Considered For Disability

The SSA considers both mental health and medical conditions when evaluating applications for SSDI and/or SSI benefits. The Listing of Impairments contains fourteen broad categories of disabilities: musculoskeletal disorders, special senses and speech, respiratory disorders, cardiovascular system, digestive system, genitourinary disorders, hematological disorders, skin disorders, endocrine disorders, congenital disorders that affect multiple body systems, neurological disorders, mental disorders, cancer , and immune system disorders. Each category contains a number of impairments.

If you have a question about whether your condition meets or exceeds a condition on the Listing of Impairments, reach out to a Social Security disability benefits lawyer for a free consultation.

Permanent Placard Or Plate Renewal

If you have permanent disabled parking privileges, you must renew your certification every 3 years. Disability placards are free to renew.

NOTE: You may also have to renew your vehicle registration in addition to re-certifying your disabled status.

To renew a permanent disabled permit, you must reapply by submitting:

- Medical re-certification on the application form, completed within the last 60 days.

- A copy of your vehicle registration IF you’re re-certifying wheelchair license plates.

You can submit your recertification in person at your local New Jersey MVC office or to:

Also Check: Temporary 100 Va Disability For Knee Replacement

Neurological Or Psychiatric Testing

Not every impairment or medical condition negatively impacts your physical abilities. Some impairments diminish your mental capacity or concentration. In these cases, it is vital to have the results of neurological or psychiatric tests included in your medical documentation. If your mental health condition can be evaluated through an objective test, the SSA will want to review the test results. It is also in your best interests to present a comprehensive picture of your medical condition. For example, for some disabilities, it is necessary to provide the results of an IQ test.

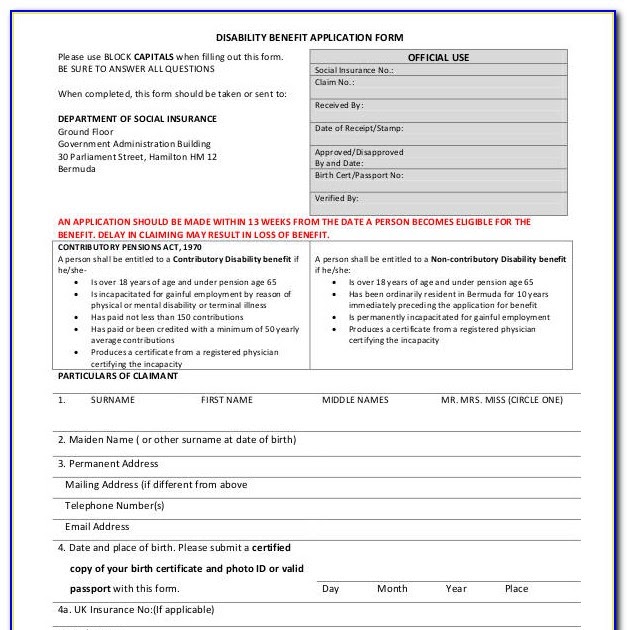

The New Jersey Disability Benefits Application Process

To apply for social security disability in New Jersey, you can take one of three routes:

- Apply online via the SSAs website.

- Apply over the phone.

- Apply in person at a social security office.

- When you apply, you will be required to present:

- Forms of valid personal identification.

- Employment records .

- Information about your work history.

- Contact information for former and current physicians.

Applicants should be aware that, on average, the entire application process in New Jersey can take anywhere from 12 to 17 months. If your initial application is rejected, you can either apply again from scratch, or appeal the decision. Provided no deadlines have already passed, it is generally preferable to appeal a decision rather than create an entirely new application, in terms of both time and expense. It should be noted that if you wish to appeal in New Jersey, you have a window of 60 days to request a Reconsideration.

Recommended Reading: Social Security Disability And Working

Who Is Eligible For New Jersey Disability Benefits

To qualify for TDI in New Jersey in 2022, you must have worked 20 weeks. Also, you had to earn at least $240 weekly, or have earned a combined total of $12,000 in the base year.

To have your claim approved for New Jersey TDI, you need to have paid into the program through your employment and meet minimum gross earnings requirements. TDI is available to most New Jersey workers.

Exemptions include federal government employees and some local government employees like school district employees, out-of-state employees, faith-based organization employees, and workers that are not technically employees .

If you believe you are covered under the program but payroll contributions have not been made, you are still encouraged to apply as it may have been an error. If you became unemployed recently and have a need for TDI, you still may be eligible for benefits.

New Jersey Disability Benefits Lawyer

Between car accidents, rough weather, hereditary illnesses, and all the unexpected twists and turns of life, anyone can become critically injured with little or no warning. If you have been injured or are suffering from an illness and can no longer generate income through work, you may be eligible to receive social security disability benefits. However, the Social Security Disability benefits process is not for the faint of heart. Approximately 42% of initial disability claims are approved in New Jersey. This means that over half of the claims are denied. By having our experienced New Jersey social security disability attorneys handling your case, you increase your chances of approval.

Your journey does not end because your initial disability claim was denied. The Social Security Administration has a process in place to appeal denied claims. However, if you approach your appeal with the same documentation you used in your initial claim, you will most likely be denied again.

Our team of New Jersey social security disability attorneys and staff understand what is necessary to strengthen your case. If you did not have legal representation the first time, it is highly advisable to have a skilled social security disability attorneys at your side during your appeal.

Don’t Miss: Center For Autism And Developmental Disabilities

Division Of Disability Determination Services

Need long-term disability benefits? We may be able to help.

If you are disabled and cant work, you can apply for cash benefits through the federal Social Security Disability Program. We handle New Jersey residents’ claims for these Social Security Disability and Supplemental Security Income benefits. Your disability must be permanent to qualify for the program.

If your disability is short-term, you should apply for Temporary Disability Insurance benefits. This state program pays cash benefits when you can’t work for a week or more for instance, when you have surgery, get injured, are sick, or give birth.

Apply for Social Security Disability benefits

Find out if you qualify and how to start an application.

What Other Income Could Reduce Your Ssdi Payment In New Jersey

Any disability benefits you receive from a private long-term disability insurance policy will not affect your SSDI benefits. Likewise, Supplemental Security Income and Veterans Administration benefits will not impact your SSDI amount. However, if you receive any government-regulated disability benefits, that could affect your SSDI amount. The Social Security Administration will reduce your SSDI or other benefits if the amount in SSDI plus the amount from government-regulated disability benefits exceeds eighty percent of the amount you earned before you became disabled.

Recommended Reading: What Insurance Do You Get With Social Security Disability

Why Do You Need A New Jersey Social Security Lawyer

While millions of Americans may receive social security benefits on a yearly basis, hundreds of thousands more will submit their first, second, or even third applications, only to be denied by the SSA. The social security application process is designed to be rigorous, and in roughly half of all cases, applicants claims will be denied even with documentation such as medical records and work history. Its incredibly easy to make a tiny error or omission on an application, or to phrase a statement disadvantageously, at the ultimate expense of being rejected for benefits.

Even where no application mistake has necessarily been made, the SSA may nonetheless determine that while the applicant is unable to perform their previous job, they should theoretically be able to pick up a job in a different industry or work environment. While that might seem reasonable to the SSA, we understand where it isnt reasonable to our clients, who shouldnt be asked to pick up unfamiliar work when theyre already managing a long-term injury or illness.

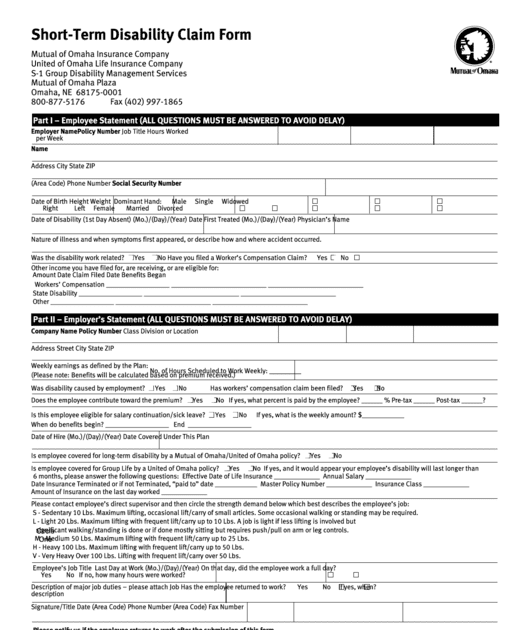

How To Get Tdis New Jersey Short Term Disability Benefits

To get TDI, you have to apply through the states Department of Labor and Workforce Development. You can do this through snail mail, but its easier to do it online. Follow the rules for filling out the form on this page. Remember, as it says at the top of the page, you can only file if pregnancy or an injury not caused by your job prevents you from working.

So for example, if youre eight months pregnant with twins and your doctor prescribes bed rest until the babies are born, youre eligible for TDI. If someone drops a heavy tool on your foot at work, you have to turn to workers comp for your disability benefits.

Applying for TDI online is much faster and easier than applying by mail, and you can return to the site to check the state of your application. If you know you will be incapacitated you can even apply up to 14 days in advance.

You May Like: Applying For Disability In California

How To Apply For Disability Benefits In Nj Online

You apply for disability in NJ by completing an online application. An immediate confirmation of the application will be given to you as soon as you submit it, but it will take longer before a decision is made. The length of time it takes for a decision can be delayed because of omissions in the application or because of delays in getting information from your medical provider.

If you do not want to apply online, you have the option to complete a paper application that you must download and print it at the website for the Division of Temporary Disability Insurance, which is the same place to go for online applications. Upon complication of the paper application, mail it to the address displayed at the top of the first page of the application.

You have the right to appeal any decision made in regard to your claim for disability benefits. If you receive a notice about a denial of benefits or other adverse action taken with regard to your claim for NJ disability, contact a disability benefits lawyer at London Disability.

Learn more about disability benefits

Applying For Social Security Disability Benefits In New Jersey What You Need To Know

There are generally three stages in the application process for Social Security Disability benefits: initial application, reconsideration, and the hearing. In this table, you can see how New Jersey compares to the national average when it comes to approval rates at each of those stages.

| Initial Application |

|---|

Read Also: Free Legal Aid Social Security Disability

New Jersey Temporary Disability And Family Leave Insurance

New Jersey Temporary Disability Benefits is a division of the Department of Labor and Workforce Development. This program provides a cash benefit to those who temporarily cant work due to an illness or injury that is not work related.

If your employer has a state plan youâll apply online, and if they have a private plan from an insurance company your employer will instruct you how to apply. The program also provides paid maternity or paternity leave for a worker to bond with a new child, or medical leave to take care of an ill family member or one who has been exposed to a communicable disease.

To qualify, you need to have made payments into the program, and also meet gross earning requirements . The employee contribution rate is currently at 0.47% of an employees taxable wage base. The payroll deduction to pay these cannot exceed $649.54 per year. An eligible employee is then paid 85% of their average weekly wage with a maximum of $903 per week.

Also Check: How To Disable Guided Access On Iphone Without Passcode

Plans To Achieve Self

Usually, if you have too many resources or too much income, you stop qualifying for SSI. A PASS is a way to go over these limits without losing your benefits.

To set up a PASS, you must qualify for SSI, have a specific work goal, and have expenses that you need to pay to reach your goal, such as school tuition, transportation, books, and services. You must also show that after you start putting money into your PASS, youll still have enough money left over to pay for your basic living expenses.

Once your PASS is set up, any money you put into it doesnât count as income or resources for SSI. In this way, a PASS lets you earn more and save more without having your SSI benefits go down. You can also put unearned income into your PASS, which means that you can start saving even if you dont have a job yet. Note: You cannot put your SSI benefits into your PASS.

You May Like: Social Security Disability Medicare Part B

New Jersey Temporary Disability Benefits And Family Leave Insurance

The New Jersey Temporary Disability Benefits law, enacted in 1948 and later amended in 2008 to include Family Leave Insurance , allows for NJ covered workers to take paid time off for their own non-occupational related injury or illness or to care for a family member with a serious health condition or bond with a new child .

Most New Jersey employers subject to the provisions of the Federal Unemployment Tax Act are also subject to NJ TDB law and are required to provide coverages for their employees working in NJ. There are some employment classes considered exempt from Unemployment Compensation Coverage and likewise be exempt from the coverage requirements under NJ TDB law. Please refer to the NJ DOL Employer Handbook on the state website for more details on Exempt Employment.

NJ Temporary Disability Benefits provides partial wage replacement to eligible employees who suffer from their own non-work-related injury, illness, or other disability, including pregnancy. TDB benefits are available to most New Jersey workers with the exception of federal government employees, out of state employees and select exempt employment classes.

Substantial Gainful Activity Income Levels

In determining if work is substantial gainful activity, the New Jersey Social Security Administration averages income according to rules that consider the nature of the work, the period of time worked, and whether the SGA level changed during the time the claimant worked.

The SGA level, which was $300 per month during all of the 1980s and $500 per month from 1990 until July 1999, when it was raised to $700, is becoming considerably more generous than it used to be because of cost-of-living increases that have been applied beginning with the year 2001. For example, for the year 2010, average countable earnings of more than $1,000 per month show that work was substantial gainful activity.

You can find the substantial gainful activity amount for the current year at www.ssa.gov/cola/.

Don’t Miss: Portable Lift For Disabled Person