How Long Is Long Term Disability

How long your long term disability lasts depends on the plan you’ve purchased. You’ll select the duration at enrollment, usually in increments of five years. Plans may last as little as one year, or carry you to retirement age. The average long term disability claim in the US is about three years.

Another thing to consider is that you won’t receive your benefits right away. Long term disability comes with an elimination period. This is a span of time where you are disabled but do not receive benefits. It does not factor into your final benefit limit, but is still a long wait. Thankfully, the elimination period for long term disability is usually about the length of a short term disability benefit commonly for periods of 3, 6, or 12 months.

How Much Does Long

Many factors influence the cost of an LTD policy. They include personal factors like:

- The results of a medical exam you took as part of the application process

In addition to these personal factors, there are several choices youll make when you apply for your policy that will influence what your monthly premium will be:

Benefit period: this is the amount of time that the insurer is obligated to pay you a benefit if you cant work . The longer the insurance company will have to write you a check every month, the higher your premium will be. Most insurance agents recommend a five-year benefit period as the most cost-effective.

Elimination period: also known as the waiting period, the elimination period is similar to the deductible on a health insurance policy. Premiums run the opposite of the elimination period you select: the longer you wait for the insurer to begin to pay, the lower your premium will be.

Elimination periods for LTD policies can be as short as 30 days or as long as 365 days. The standard length is 60 or 90 days.

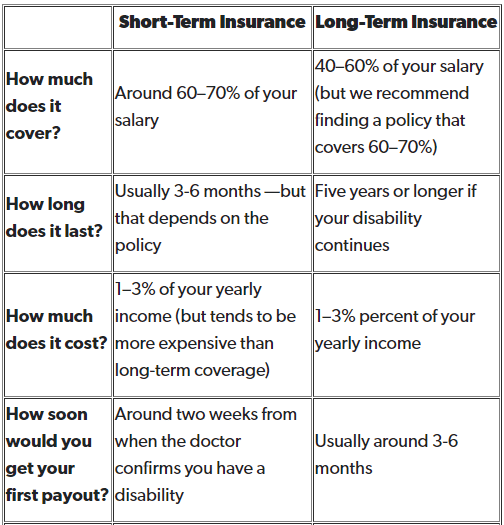

Whats The Difference Between Short Term Vs Long Term Benefit Periods

The biggest difference between short term and long term disability insurance is the period of time youll receive benefits if youre unable to work. This period is called the benefit period. As the name indicates, short term disability insurance is intended to cover you for a short period of time following an illness or injury that keeps you out of work. While policies vary, short term disability insurance typically covers you for a term between 3-6 months. On the other hand, long term disability is intended to provide benefits for a longer period, and benefit periods for long term disability insurance are usually stated in years: 5, 10, 20 or even until you reach retirement age, depending on your plan.

Don’t Miss: How Much Disability Can I Draw

How Can I Get Approved For Short Term Disability

To qualify for short-term disability benefits, an employee must be unable to do their job, as deemed by a medical professional. Medical conditions that prevent an employee from working for several weeks to months, such as pregnancy, surgery rehabilitation, or severe illness, can qualify to receive benefits.

When Am I Considered Disabled

That depends on how your policy defines a disability. Though the SSA has strict guidelines on what is deemed a disability, private long-term disability insurance definitions can vary. Some policies may consider you disabled if you are no longer able to perform the same type of work you have done in the past. For instance, if you are a construction worker and suffer a severe broken leg, you might not be able to return to the construction site. However, you could probably work at a desk job just fine. Your policy might consider you disabled or you could have a policy that defines disability as being unable to perform any type of work.

This is why it is so important to understand your policy and how it works. The definition of disability is an extremely important part of your contract, and you should know exactly what it says before signing up and starting to pay your premiums.

You May Like: Should I Get Disability Insurance

Contact Chisholm Chisholm & Kilpatrick Ltd

While most people begin the long-term disability process after becoming unable to work due to a medical condition, you may be able to begin the long-term disability process earlier, depending on the terms of your policy, if you are working in a reduced capacity due to your medical condition and the resulting loss of income.

At Chisholm Chisholm & Kilpatrick LTD, our team of experienced attorneys and professionals understand how important it is to get your long-term disability benefits in a timely manner. We understand that you rely on these benefits to support you and your family. Contact us now at 237-6412 for a FREE consultation to see if we can help you get the benefits to which you are entitled.

Short And Long Term Disability

Employees have option to enroll in Short and/or Long Term Disability coverage on themselves only through The Standard.

Short-Term Disability With The Standard

If you choose short-term disability coverage, this plan will work with other income benefits to replace 60% of your Benefit Salary up to $1,000 per week. If you receive other benefits, that total 60% of your Benefit Salary, the short-term disability plan will not pay for this disability.

Available Options

- Seven Day Benefit Waiting Period

- Thirty Day Benefit Waiting Period

Enrolling For Short-Term Disability Coverage

Your premiums will be based on your coverage level and Benefit Salary. Since you pay for this coverage with after-tax premiums, you wont pay taxes on the benefits you receive. Short-Term disability does not pay while you are using accrued sick leave but will pay while on annual/compensatory leave or while on leave without pay.

Long-Term Disability With the Standard

The Flexible Benefits Programs Long-Term Disability coverage works with other benefits you are eligible to receive, including Social Security, workers compensation, other disability plans and programs, including the State retirement systems. The plan assures that your combined disability benefits from all these sources will equal 60% of your Benefit Salary up to $4,000 a month.

How Long LTD Benefits May Be Payable

Enrolling For Long-Term Disability Coverage

Detailed plan information can be found in the FlexibleBenefit Rate Chart

You May Like: Edd Disability Phone Number Shortcut

How Much Does Long Term Disability Insurance Pay

Your policyâs benefit amount determines how much you will receive in long term disability benefits if you become disabled.

In most cases, your benefit amount will be a percentage of your income. The size of your disability insurance benefit amount will depend on the policy. Generally, long term disability policies can replace anywhere from 60 percent to 80 percent of your income.

In addition, many policies replace the income that is lost if you have to take a lower-paying job due to an injury or illness.

Employment Status While On Long

Once disability benefits are approved, the Benefits office will process a Personnel Action Form terminating your employment.

You may consider the following options to gain access to health care:

- You may be eligible for Medicare. TN SHIP offers free Medicare information and counseling: Call 877.801.0044 .

- The new state health exchanges may be an option to consider. Visit for more information.

- If you want to continue your Vanderbilt health care benefits, you must complete the COBRA which will be mailed to your home. Your first monthly payment will be due within 45 days of electing COBRA.

Recommended Reading: How To Disable Guided Access On Ipad

What Qualifies As A Long

Almost any disability that prevents you from working may be considered a disability for purposes of an LTD policy. This includes a wide range of medical conditions as well as mental health conditions. However, some policies have specific exclusions or limitations on coverage, so you will want to review your policy carefully.

One of the most critical aspects of any disability application is proving that you have an impairment that prevents you from working. Insurance companies will examine the evidence, such as medical records, to determine if you qualify as disabled and may even send private investigators to conduct surveillance to check up on you. If you are considering applying for disability benefits, consult with a skilled attorney before starting the process.

What Is Provided:

Long-term disability insurance provides two standard payment benefits. Those benefits include:

- an income payment of a percentage of covered monthly earnings exclusive of overtime pay, bonuses and other types of extra compensation, and

- a contribution of 10% of retirement eligible salary to your Vanderbilt University Retirement Plan account.

Read Also: Chances Of Winning Disability In Federal Court

When Will My Long

Your long-term disability benefits will kick in immediately after the expiration of the elimination period. This is the waiting period between the occurrence of the disability and the start of your benefits. This amount of time varies between insurance policies. Some are as short as 30 days while others are as long as 12 months. On average, you should look for a policy with an elimination period no longer than 90 days. This helps to balance a lower premium without an extended delay in the start of your benefits.

Which Do I Need: Need Short Term Disability Insurance Or Long Term Disability Insurance

There are a few things to keep in mind when choosing disability insurance. First of all, do you have an emergency savings fund that could cover your expenses for a few months if you lost your job or were unable to work? If not, short term disability insurance is an essential financial protection, even if you are disabled for only a short period of time. If you have significant emergency savings on hand, though, you may focus on how a long term disability could impact your financial wellbeing and your retirement plans. If you were permanently disabled, could you cover your expenses until retirement? If not, look into long term disability protection.

Read Also: Disability Pass At Disney World

Can I Be Fired While On Short Term Disability

Unlike the FMLA, short-term disability benefits do not provide for job protection. Therefore, it is possible to be fired from your job while on a short-term disability leave. … Ultimately, however, if you remain unable to return to work due to your disabling condition, your employment could be terminated.

Whats The Elimination Period

While short term disability insurance begins paying benefits within a couple weeks following a qualifying illness or injury, long term disability insurance requires a longer waiting period, called an elimination period, before a policyholder begins receiving benefits. The length of the elimination period varies by policy but is often around 90 days. When considering a disability policy, take into account how you will cover your expenses during the elimination period. Do you have an emergency fund to cover your lost income and any medical bills you accrue during this time? If not, you may consider purchasing additional coverage to protect you immediately following a disabling illness or injury.

Don’t Miss: What Type Of Disability Is Adhd

What To Do If You Have Chronic Laryngitis

Self-care measures also can help improve symptoms. Chronic laryngitis treatments are aimed at treating the underlying causes, such as heartburn, smoking or excessive use of alcohol. Medications used in some cases include: Antibiotics. In almost all cases of laryngitis, an antibiotic wonÕt do any good because the cause is usually viral.

Does Long Term Disability Last Forever

No. The benefit period is always limited to a certain number of years which is clearly stated in the policy. Standard choices include 2, 5, or 10 years to age 65 and to age 67. A few companies, offer coverage to age 70.

1 The Social Security Administration Fact Sheet, June 2022

2 Integrated Benefits Institute, 2018 Health and Productivity Benchmarking, Long-Term Disability.

3 Council for Disability Awareness ,

2022-144418 20241031

Recommended Reading: Can You Get Disability For Congestive Heart Failure

What Type Of Disability Insurance Do I Need

Disability insurance is one of the most important parts of financial planning. While you may have enough of an emergency fund to cover a few months of expenses if you were unable to work, most people cannot afford to not work for much longer particularly if you cannot work for years.

If you can afford to purchase both types of disability income insurance, then it often makes sense to purchase both short and long-term disability plans. In this way, you will have insurance coverage for relatively short periods of time when you cannot work and have the peace of mind to know that you will have income replacement if you are unable to work for much longer.

If two disability insurance policies are not in your budget, then your best option is to purchase an individual policy for long-term disability coverage. These types of plans are often more expensive but are a more substantial financial safety net. At the same time, focus on building up your emergency fund so that you can cover your basic expenses if you have a shorter-term illness or injury.

Six Things You Need To Know About Employer

Long-term disability insurance is one of the many benefits you may be entitled to from your employer. This type of insurance can provide you with a steady income in the event injuries, illnesses, or chronic health conditions prevent you from working. Unfortunately, just because a policy is in place, it does not mean obtaining these benefits will be easy. The following are six important things employees need to be aware of:

Employer-provided long-term disability policies have very specific eligibility requirements. These include time limits in regards to length of employment and exclusion of workers in certain positions. Under the Employee Retirement Income Security Act of 1974 , you have the right to be provided with all policy related documents, free of charge and at your request. Review these documents carefully to determine if you are indeed eligible for benefits.

Even if you are eligible for long-term disability payments, your condition may not be covered. There may also be so variance in how the insurer defines disability. Generally, a disability is any type of physical or mental health condition that prevents you from performing tasks at your specific job. Some policies have provisions that specify your condition must prevent you from performing any job to be eligible.

Let Us Help You Today

You May Like: New York Life Disability Claim Status

What Is The Definition Of A Disability

Disability is defined as being unable to perform with reasonable continuity the duties of your own occupation as a result of sickness, injury, or pregnancy during the benefit waiting period and the first 24 months for which LTD benefits are payable. During this period, you are considered partially disabled if you are working but unable to earn more than 80 percent of your indexed predisability earnings.

After the first 24 months, disability as a result of sickness, injury, or pregnancy, means being unable to perform with reasonable continuity the material duties of any gainful occupation for which you are reasonably able through education, training, or experience. During this period, you are considered partially disabled if you are working but unable to earn more than 60 percent of your indexed predisability earnings in that occupation and in all other occupations for which you are reasonably suited.

The More You Earn The More There Is To Insure

Disability insurance benefits are based on a percentage of your income. Therefore, a key part of the underwriting process and a determining factor of your premium is how much you earn. This is done through financial underwriting.

For underwriting purposes, income is earned if a disability would stop or reduce it. Investment or business income that doesnât require work on your part will not be factored into your financial underwriting.

Underwriters will assess your salary, wages, regular overtime, bonus, and commissions. They may consider contributions to your retirement plan made by your employer. If you own a business, the underwriter will consider your share of the businessâs earnings.

Also Check: Senior And Disability Services Albany Or

Individual Vs Group Coverage

The main difference between individual long term disability and group long term disability is cost. Participating in a group plan is typically cheaper than buying an individual policy. This is especially true if the sponsor of the group plan offers to pay some or all of the policy cost.

Another key difference is that group disability plans are guaranteed issue. This means if you apply for coverage, you are automatically enrolled without having to go through the underwriting process. Insurance companies can do this because they spread their risk among a large group of policyholders.

On the other hand, buying individual long term disability insurance will require you to:

- Fill out an application

- Go through underwriting

- Be approved by the insurance carrier

And for good reason. With an individual policy, the insurance company has to assess the risk of a single applicant. If the company considers you high-risk, you will pay more in premium. Itâs possible for an insurer to consider somebody so risky that they deny coverage altogether.

Although this process may seem like a downside to individual coverage, it pales in comparison to the cons of group coverage.

The biggest downside of group policy is that itâs possible to lose coverage in two ways that are mostly out of your control.

When you buy an individual policy, you own it for as long as you pay the premium. You control your own destiny.

How Do I Prove That Im Disabled

If youre thinking about filing an LTD claim, you should first consult the summary plan description in your long-term disability policy for the policys precise definition of disability. Generally, you will be found totally disabled if youre unable, due to illness or injury, to substantially perform the duties of your occupation. If your LTD policy provides for partial disability, you may qualify for benefits if you can no longer work full-time at your own occupation, even if youre capable of working full- or part-time at another job.

Many policies state that you cannot file an LTD claim if you are still on your employers payroll.

As in Social Security disability cases, the most important factor in proving your disability in an LTD claim is the opinion of your treating doctor. As part of your application for LTD benefits, your doctor will be asked to complete a form or write a statement regarding his or her opinion on your condition. Your physicians opinion is critical, but the claims administrator will also want objective proof of your disability. Therefore, the administrator will also request all the medical records related to your disability, including relevant clinic notes, lab results, x-rays, MRIs, exam findings, and surgical reports.

You May Like: Sample 504 Plan For Celiac Disease

Read Also: Short Term Disability Pregnancy Florida