Returning To Work With Changes To Your Schedule

You should immediately notify your manager if your physician has certified that you are able to return to work, but that you are:

- no longer able to carry out the duties of the position

- in a rehabilitation program

- recommended for a reintegration process

- not able to return to work on a full time basis

What If I Can Only Work Part

If your medical conditions prevent you from working full time, but you can still work part-time, youll need to check your insurance policy to make sure benefits are payable for partial disability. The exact definition of partial disability will vary between policies. Some policies may not pay any benefits for partial disability. If youre not sure if your policy includes benefits for partial disability then contact us to request a free case evaluation.

Is A Disease A Disability

There is also a whole group of problems that fall under disability called diseases. These diseases include conditions such as diabetes, cancer, HIV, muscular dystrophy and so on. There are requirements for each of these diseases to qualify for disability benefits.

Occupational Illnesses that Qualify for Disability Benefits

Then there are occupational illnesses like emphysema, lung cancer and other conditions that can come from long-term exposure to certain substances. The disability entity will have certain requirements in terms of illness severity and activity level. Anexperienced attorney can help you to process the paperwork in a way that positions you to obtain approval.

Obtaining approval can take several weeks, months or years depending on what type of benefits you are trying to obtain.

Recommended Reading: Negatives Of Getting Social Security Disability

What Medical Conditions Qualify For Long Term Disability

While you may purchase long-term disability insurance from an insurance broker, it is typically offered by employers as part of a compensation package, but what medical conditions does long-term disability cover? A debilitating injury from an acute accident is the qualifying option. This assumption is only slightly true since there are a variety of physical, psychological, and medical conditions that could potentially qualify an applicant for long-term disability.

What Types Of Disabilities Are Covered Under My Ltd Insurance

Every LTD policy is different, and your insurer will closely examine your medical diagnosis to see if you meet the requirements set out in your policy to receive LTD benefits.

Common Medical Conditions Covered by LTD Insurance

Some common medical conditions that may qualify for long-term disability benefits include:

| · Arthritis |

You May Like: Can You Go On Disability For Anxiety

What Does My Policy Cover

In general, your long-term disability insurance benefits include any condition that:

Before we talk more about which conditions might qualify, we will debunk some common myths about long-term disabilities.

- Myth #1: The disability must come from a physical injury. Many people mistakenly believe that to qualify for long-term disability, they need to have suffered a physical injury to their body. In fact, almost all policies accept that a wide variety of illnesses qualify as disabling. Covered illnesses often include conditions such as:

- infectious diseases

- digestive disorders

- mental and psychological disorders

What Does Disability Insurance Do

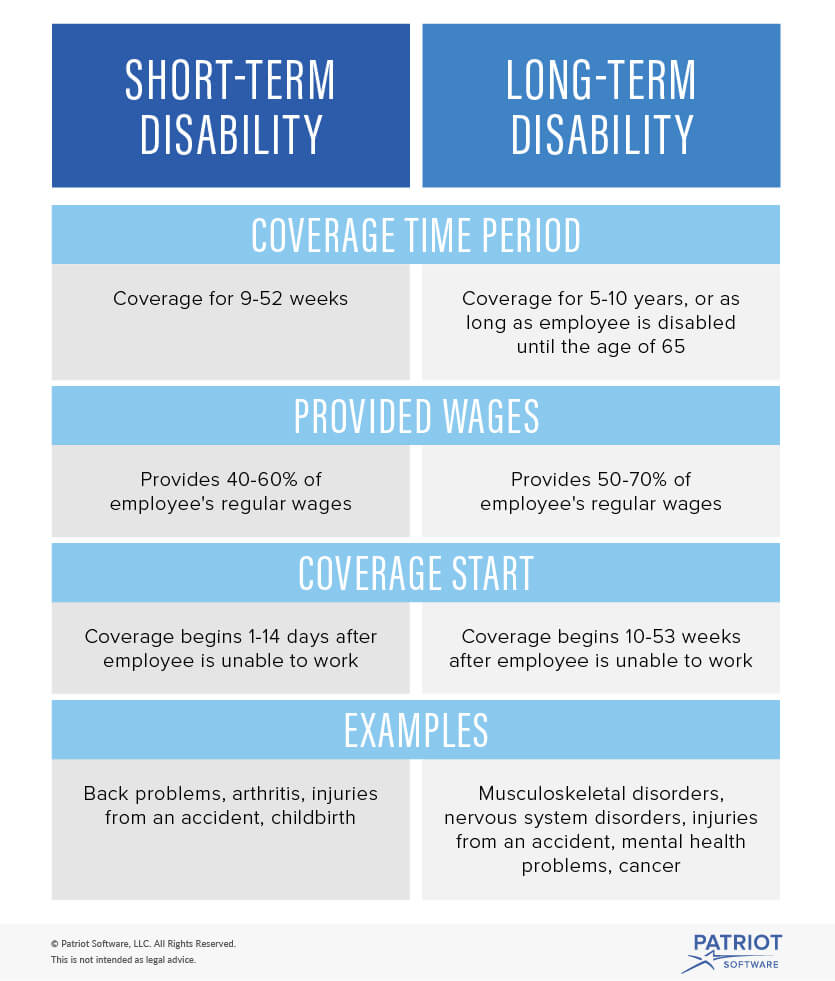

Disability insurance is sometimes called disability income insurance because it is designed to replace a portion of your income if you are unable to work because of a serious illness or injury. Disability insurance pays benefits directly to you, so you can cover your expenses with no limitation on how the money can be spent. Policies vary, but disability insurance can protect up to 70% of your income for a period anywhere from 3 months to the time you reach retirement age. While every policy is different, the two main differences between long term and short term disability policies are the length of the benefit periods and the level of coverage each type of policy offers.

Don’t Miss: How To Disable Pop Up Blockers On Mac

Who Pays For Long Term Disability Coverage

Long term disability insurance can be purchased privately by individuals through an insurance broker or directly through an insurance company. Long term disability insurance can also be made available for purchase through your employer through a group disability insurance policy. In cases of group insurance through your employer, the insurance premiums could be paid by the employer, the employee or shared between the employer and the employee. Depending on what applies to you there are different implications for tax purposes.

If the employee pays the premiums for the long term disability insurance then disability payments are not taxable. If the employer pays for the disability insurance premiums then when the payments are made to the disabled employee they are taxable. The law is more complicated when the premiums are shared between an employee and employer.

How Do I File A Claim

If youre covered and are injured or become ill, you can file an LDT claim. Youll need to provide information about your condition, your medical history, and your occupation. Youll likely also need to provide documentation from your physician regarding your diagnosis and prognosis. If youre not approved, you will either be denied or asked for more information.

If youre approved, you may still need to wait through an elimination period, typically 90 days. This elimination period is to ensure that you indeed have a long-term disability. Once you have completed this period and submitted any doctor recommendations that may be required, you can begin to receive benefits. Remember that until your benefits begin, youll be paying out-of-pocket for bills or treatment.

The claims process varies from insurer to insurer, so be sure you understand the process for your policy ahead of time. If you are not able to receive LTD benefits, you may still qualify for short-term disability or workers compensation.

Read Also: Unlock Iphone That Is Disabled

I Was Approved For Social Security Disability But My Long Term Disability Claim Was Terminated

Qualifying for short-term or long-term disability benefits is very different from qualifying for Social Security Disability benefits. We frequently receive calls from claimants whose long-term disability claims were terminated, but they continue to receive Social Security Disability benefits. For example, The Social Security Blue Book is the Social Security Administrations listing of disabling impairments. The Blue Book lists specific criteria under which claimants who suffer from a disabling condition can qualify for Social Security disability benefits. Your long-term disability insurance company will not use the same criteria to evaluate your claim.

The Definition Of Disability

Long-term disability insurance policies will generally use one of two definitions of disability:

- Own occupation: An own-occupation policy covers you if your symptoms prevent you from fulfilling the work obligations of the current job that you are trained to perform. You can work a different type of job and still receive full disability benefits.

- Any occupation: Under an any-occupation policy, symptoms must leave you totally disabled and unable to perform any job to which you are reasonably suited. This is a much tougher standard than an own-occupation policy. The any-occupation definition can result in denied benefits and claimants being forced to take lower-paying, less fulfilling work.

Unfortunately, most long-term disability policies use the any-occupation standard. If you have the option, we strongly encourage you to purchase any-occupation coverage, especially if you earn a high wage or work in a highly skilled profession .

Some long-term disability policies initially offer own-occupation coverage but transition to the any-occupation standard after a certain amount of time. If you are not aware of your policy conditions, this transition could lead to benefits being unexpectedly cut off even after being previously approved.

Don’t Miss: How To Get Social Security Disability Approved

What Qualifies A Person To Be Disabled And Get Long Term Disability

People whose physical, mental, or emotional health makes them unable to work are considered disabled. A long-term disability is generally understood to be a condition that lasts more than 12 months or which is likely to result in death within a year or two.

Some disabilities do not automatically preclude working altogether, such as blindness, deafness, missing limbs, chronic diseases, or partial paralysis. But a condition that would be merely limiting for one person can qualify as a long term disability for another when the condition makes it impossible for the second person to do the jobs for which he or she has the appropriate education, skills, and experience. For instance, losing a leg would not necessarily stop a person from working as a teacher, but it would make a career in roofing no longer viable.

All government programs take the nature of a claimed disability into account along with a consideration of what work a person is capable of doing, has done in the past, and could do in the future.

Advise Of Any Reportable Income

You must inform your insurance company if you are receiving any income other than your long-term disability benefit in order to avoid an over-payment of LTD benefits.

Examples of Reportable Income Are:

- CPP Disability Benefits, WSIB payments, Income Replacement Benefits from a car accident.

- Severance payment from your employer if you are terminated.

- You should also inform your claims adjuster if you return to your job or to any other job and have reportable income such as earnings from employer, or self-employment income.

Overpayment

Be sure to check your policy for what counts as reportable income as this affects your benefit amount and if it turns out that your LTD payment needs to be adjusted, you could end up in a situation where your insurance company overpaid you and they have to recover money from you.

You May Like: Can I Collect Unemployment While Waiting For Disability

Whats The Elimination Period

While short term disability insurance begins paying benefits within a couple weeks following a qualifying illness or injury, long term disability insurance requires a longer waiting period, called an elimination period, before a policyholder begins receiving benefits. The length of the elimination period varies by policy but is often around 90 days. When considering a disability policy, take into account how you will cover your expenses during the elimination period. Do you have an emergency fund to cover your lost income and any medical bills you accrue during this time? If not, you may consider purchasing additional coverage to protect you immediately following a disabling illness or injury.

The Difference Between Std And Ltd

An employers group insurance may provide for a short term or long term disability policy. Short term disability insurance provides benefits for a short period of time, typically up to six months, while the employee is sick or injured. Short term disability applies where the employee is temporarily disabled and cannot work or make an income during the recovery period.

Each long term disability policy contains a test for entitlement that needs to be met in order to receive benefits. While each test for entitlement is unique to the specific policy, there is typically an own occupation test at the outset of disability. This means that a person will meet the test for long term disability benefits if they are unable to perform the essential tasks of their own occupation. Many policies contain a change in definition of disability to an any occupation test, typically after a person has received 2 years of long term disability payments. The any occupation test typically requires a person to show that they are unable to engage in any occupation that they are reasonably suited to by virtue of their education, training and experience in order to receive disability benefits. There are numerous factors that are considered in determining the reasonableness of an alternative occupation including the level of responsibility and compensation associated with the alternative occupation in comparison to the previous position held by the person.

Read Also: Supplemental Long-term Disability Insurance

Medical Conditions That Qualify For Long

Most medical conditions can qualify for long-term disability . However, some LTD plans will exclude certain medical conditions.

Assuming you dont have an excluded condition, you can qualify for LTD benefits if your medical conditions prevent you from doing your regular work. You wont qualify to apply right away. Most LTD plans require you to be continuously disabled for several weeks before you are eligible to apply.

The most common length of the waiting period is 17 weeks, but this can be different for each plan.

Most LTD plans have a two-tier requirement for disability. For the first two years: you can qualify for benefits if your medical condition prevents you from doing your regular work.

However, after two years, you can only qualify for LTD benefits if your medical conditions prevent you from doing any gainful work .

Activities Of Daily Living Form

The Long Term Disability carrier has asked you to complete an Activities of Daily Living form in which you are asked to document what you are physically capable of doing. In that form, or even in a statement, you might tell the Long Term Disability insurance company that you always use a cane or that you always limp. If surveillance shows that you are walking without a cane or without a limp you are in trouble! While walking without a cane or a limp doesnt mean you can work, it does destroy your credibility.

Don’t Miss: What Is The Difference Between Fmla And Short Term Disability

What Type Of Disability Allows Me To Qualify For Long Term Disability Benefits

Most long term disability policies cover you regardless of the severity or type of illness or injury you are suffering from that prevents you from working. However, some policies exclude certain illnesses, and others may exclude injuries or illnesses which are compensable under a Workplace Safety Insurance Board claim, if it is available through your workplace.

Generally, if you are not able to do all or substantially all of the tasks required by your current job then you will qualify for long term disability benefits. Essentially, the threshold is that your disability prevents you from being able to work. However, depending on your policy it may state that in order to qualify for disability benefits you must prove that it is not only your own job that you are unable to do, but any job that you may be qualified to do in consideration of your education, training or experience. Refer to your policy to see what applies to you.

Important Terms You Need To Know

Insurance policies are drafted with very technical terms and unfamiliar jargon that insurance companies repeatedly use in their letters when they deny and terminate claims.

We understand how difficult it can be to receive a letter that says your application is denied or your long-term disability benefits are being terminated when you are in a challenging financial situation. When you dont understand what some of the terms mean in the denial letter it makes the situation that much more stressful.One of the many ways a disability lawyer can help you is by explaining what all the terms mean in the denial letter you receive from your insurance company.

This section discusses some commonly used terms that are important to understand:

You May Like: Student Loan Forgiveness For 100 Disabled Veterans

Adults With A Disability That Began Before Age 22

An adult who has a disability that began before age 22 may be eligible for benefits if their parent is deceased or starts receiving retirement or disability benefits. We consider this a “child’s” benefit because it is paid on a parent’s Social Security earnings record.

The Disabled Adult Child who may be an adopted child, or, in some cases, a stepchild, grandchild, or step grandchild must be unmarried, age 18 or older, have a qualified disability that started before age 22, and meet the definition of disability for adults.

Example

It is not necessary that the DAC ever worked. Benefits are paid based on the parent’s earnings record.

- A DAC must not have substantial earnings. The amount of earnings we consider substantial increases each year. In 2022, this means working and earning more than $1,350 a month.

Working While Disabled: How We Can Help

Is Your Condition Found In The List Of Disabling Conditions

For each of the major body systems, we maintain a list of medical conditions we consider severe enough to prevent a person from doing SGA. If your condition is not on the list, we must decide if it is as severe as a medical condition that is on the list. If it is, we will find that you have a qualifying disability. If it is not, we then go to Step 4.

We have two initiatives designed to expedite our processing of new disability claims:

- Compassionate Allowances: Certain cases that usually qualify for disability can be allowed as soon as the diagnosis is confirmed. Examples include acute leukemia, Lou Gehrigs disease , and pancreatic cancer.

- Quick Disability Determinations: We use sophisticated computer screening to identify cases with a high probability of allowance.

For more information about our disability claims process, visit our Benefits for People with Disabilities website.

Read Also: How To Change Va Disability Direct Deposit

When Do Long Term Disability Policies Pay Benefits

Most long term disability policies will pay a percentage of your income when you cannot work due to health reasons. Generally, you must be out of work three to six months before the long term disability benefits will kick in.

But, beware, some long term disability policies will actually limit the length of time that you can get your long term disability benefits. So, for example, if you suffer from fibromyalgia, a psychiatric condition, or even soft tissue muscular-skeletal problems, your policy may limit the payment of those benefits to just 24 months.

You should understand your benefits package so that you can provide you and your family with peace of mind if you become disabled. You can learn more about the disability provisions that you dont want to see in your disability policy by ordering a copy of Robbed of Your Peace of Mind.