Getting Long Term Disability Insurance

If your employer does not offer group long term disability insurance, or if the group coverage is not sufficient for your needs, consider buying an individual policy. Buying an LTD policy is no different than shopping for any other life insurance product. First, assess your needs, that is, how much coverage you will need and for how long you want to receive the disability benefits, etc. Next, collect quotes from different providers. Lastly, sign up with the insurance company that is offering you the best coverage at the lowest price.

What Is The Process For Suing The Insurance Company

After discussing the nature of your claim with your lawyer and agreeing that suing is the best way to proceed, your lawyer will deliver a Statement of Claim which sets out the allegations you are making against the insurance company. The insurance company in response will file a Defence and then documents from both parties will be exchanged. During this process, you will be asked questions under oath and will likely have to undergo medical assessments both with your own doctor or a specialist and a doctor chosen by the insurance company. You will have to take part in settlement negotiations and potentially mediation will occur. Going to trial will be the final step, which is usually unnecessary as the majority of all lawsuits settle beforehand.

How Much Does Long Term Disability Insurance Cost

Long-term disability insurance premiums are extremely varied because several factors determine the cost. First, based on your occupation class, a determination is made of how much of your income can be replaced. It may be as low as 40% or as high as 85%. There will also be a benefits cap that determines how much you will receive per month. The length of the benefit payment is also considered, as is the elimination period (the time you wait before benefits pay out. While a longer elimination period can potentially lower your costs a little, you have to self-insure for the elimination time and this could mean needing months of cash savings. Other factors such as age, health, and lifestyle count too. Rely on a professional to help you structure your disability insurance, as these are rather complicated policies to set up.

Recommended Reading: How To Apply For Disability In Arizona

Best For Rider Options: Mutual Of Omaha

Mutual_of_Omaha

If youre looking for long-term disability insurance that lets you really customize your policy and keep coverage for as long as possible, Mutual of Omaha may have what you need. They are our top choice for best policy rider options, allowing you to choose between features like future insurability, critical illness coverage, and return of premium, to name a few.

-

Up to $12,000 per month in benefits

-

Premiums stay level through age 67

-

Many built-in policy benefits

-

Multiple additional riders to choose from

-

Shortest elimination period is 60 days

-

Coverage can be continued through age 75, but premiums will increase

-

Quotes not available online

-

Policies must be purchased through an agent

Providing insurance coverage since 1909, Mutual of Omaha has become a trusted name throughout the United States. They hold an A+ financial strength rating from AM Best and are a Fortune 500 company with more than 13 million members.

Mutual of Omahas long-term disability insurance offers full-scale and personalized income protection for individuals with any budget or preference. Applicants do have to choose between a policy that is either non-cancelable with premiums locked in for the duration of the benefit period or guaranteed renewable with premiums that could be increased if the company’s coverage offerings change.

In order to get a quote or purchase a policy, youll need to go through a Mutual of Omaha agent directly.

I Get Disability Coverage Through Work:

If youre an employee, theres a good chance your employer offers you some Long-Term Disability coverage as part of your employee group benefits plan. However, the benefits and options on these plans can vary significantly and may not be as comprehensive as you would think. We explore this in detail in this article.

You May Like: Employment Agencies For Persons With Disabilities

What Is Supplemental Long

Supplemental long-term disability insurance is the policy you buy to top up existing insurance. For example, perhaps you have employer-sponsored coverage, but it is far below your allowable maximum. You buy an individual insurance policy to make up the difference. The individual policy becomes your supplemental policy. Lets look at more scenarios where a supplemental policy makes sense.

Remember, however, that disability insurance is not stackable and that you can only collect your maximum allowance from all sources. Be careful not to over-insure yourself and wind up paying for coverage you cannot use. Consult with a life insurance broker to discover your best long-term disability insurance plan.

Our Publications related to Disability Insurance

Disability Insurance Benefits And Taxes

Generally, if you pay the entire amount of the disability premium yourself, your disability benefits will be tax-free. This may bring your income while on disability closer to your current take-home pay.

If your employer pays all or part of the disability premium, your disability benefits will be subject to income taxes.

Recommended Reading: American Association Of People With Disabilities

Can You Go On Short

Short-term disability generally covers behavioral health issues, which can include anxiety, depression and stress. However, the claims process for these conditions tends to be more difficult. Claims analysts may need all of the medical records pertaining to the diagnosis so they can evaluate what is preventing the employee from working.

Total Disability Vs Partial Disability

Insurance policies have different definitions of disability. The two most common definitions are total disability and partial disability.

Total disability means you cannot perform the essential or regular duties of your occupation or any occupation.

Partial disability means you can still work to some extent. Meaning you are able to do some of the important duties of your occupation , or your income has dropped by more than 20%. Partial disability is usually only available with individual insurance policies. All policies include total disability.

You May Like: Can I Work While On Social Security Disability

What Totally Disabled Means In The Context Of Long Term Disability Insurance

There are 2 definitions or standards of disability that are used in your long term disability policy to define the period of time you are totally disabled from working.

The assessment by the insurance company of what is considered totally disabled changes over time. When you first apply for long-term disability benefits, the assessment of total disability is based on whether you can perform your own occupation. After 2 years of being on long-term disability benefits, however, the insurer will assess whether you can perform any occupation. Most commonly, the long-term disability policy has its own occupation period of 2 years, but it may be less or more depending on the policy.

To recap, the difference between own occupation and any occupation is:

How Much Disability Coverage Should I Have

Ultimately, youll have to balance what you are willing and able to pay in monthly premiums and the amount of disability insurance coverage youll receive should you become temporarily or permanently disabled. The average long-term disability claim is just under three years.3 Most people cannot go without a paycheck for even a few weeks. Keep that in mind when you are putting together your financial protection plan.

Don’t Miss: Social Security Disability Medicare Part B

How Long Can You Collect Long

The length of time youll receive benefits depends on the term you selected when applying for your policy and whats written in your policy. The benefit period for individual long-term disability insurance is usually 2, 5, or 10 years, or until ages 65 or 67.

The insurance company is obligated to continue to pay you every month for as long as the contract stipulates, unless or until you can return to work, at which point benefit payments will end.

» MORE:

Why Do Premium Rates Vary By Employee Group

Effective July 1, 2016, a provision was introduced resulting in premium rates that are experience-based by employee group meaning that rates are set for participating employee groups based on the volume and duration of claims incurred by members of that group. This change resulted in each participating employee group paying a different premium rate. The representatives of the employee groups participating in the LTD plan were involved in the discussions about moving to experience-based premium rates by employee group.

Read Also: California Disability Insurance Phone Number

If The Insurance Company Agrees That I Am Still Entitled To Benefits What Are The Different Ways That My Settlement Can Be Paid To Me

If your disability benefits claim goes to court and is successful then you will be awarded some or all of the outstanding disability benefits that you should have, plus interest and costs, all of which is paid by the insurance company. The judge hearing your case may also order that the insurance company continue to pay for your benefits into the future as long as you are entitled to receive such benefits under your policy.

However, many cases settle on the basis of an agreed amount of money that represents a full and final payment to you for past and future benefits. This agreed amount is determined between you and the insurance company.

If your LTD has been denied or terminated, contact us for a free consultation. Call us at or fill out our form on this page.

Short Term Disability Insurance

- Short term disability insurance covers non-job-related injuries or temporary disabilities that make you unable to work for a short period.

- It is normally offered as a benefit by your employer and can cover up to 60% of your earnings.

- The kind of disabilities covered by this insurance is specific to the individual plan or the policy.

- They usually cover maternity leave, complications after major surgery, an illness that requires around the clock treatment, and injuries sustained in certain accidents. Some short term disability plans also cover mental health disorders.

Don’t Miss: List Of Disabilities For Ssi

How Long Does Long

Even after coverage is approved, your long-term disability insurance benefits wont kick in until youve satisfied the waiting period requirement. For most policies, this is at least 30 days, though it can easily be 60, 120, 365, or even 720 days.

Once benefits start, they will continue until your predetermined benefits limit is reached. This is the period of time you chose when you purchased the policy, and can last for a specific number of years or through retirement. The longer the benefits period, the more youll pay in premiums for your coverage.

Disability Insurance Coverage: How Do You Enrol

Applying for insurance coverage is how you enrol in a plan or policy. Without coverage, you cannot file a claim should the need arise. How you apply for coverage will depend on the type of disability policy:

Applying for Group Insurance Coverage

You apply for group insurance coverage through your employer, union or association. You are eligible to enrol because of your status as a full-time employee or member of a union or professional association.

The application involves filling out a form. If the group covered by the insurance is small, you may also have to fill out a medical questionnaire. Or undergo medical tests. With large organizations there are no barriers to enrolment other than your status as being a member of the group. Once enrolled in the plan, you are considered a covered person under the plan. If you later become unable to work, you can file a long-term disability claim under the insurance policy.

Applying for Individual Insurance Coverage

Applying for individual insurance is more complicated than group insurance. You will have to provide detailed information about your medical history and undergo a medical assessment and bloodwork.

The insurance company then reviews your medical information to determine if they will agree to offer you a long-term disability insurance plan.

You May Like: How To Change Va Disability Direct Deposit

Chambers Plan Is Built For Business Owners Who Value Stability

Because our group Disability insurance benefits plans are used by thousands of businesses in Canada, premiums are based on the average of claims of all businesses, not just the experience in your business. Not only that, your employees can count on efficient claim processing and stable premiums. And because we are a not-for-profit program working with small-to-medium-sized businesses, surpluses are reinvested in the Plan to help reduce and stabilize premiums for our members.

Can An Employer Terminate An Employment Agreement For Frustration Of Contract

In some cases, an employer may be able to terminate the employment agreement for frustration of contract. Frustration of contract in this context of disability leave can occur if it becomes unlikely that the employee will be able to return to work within a reasonable amount of time. If frustration of contract has occurred, an employer is only required to pay the employee their minimum entitlements under the Employment Standards Act.

In this video âBasics of Long Term Disability Insuranceâ , Employment Lawyer Andrew Monkhouse covers what long term disability insurance is, how it helps employees, and what it means for employees with disability insurance.

Given the complexity of these issues, please contact a Long Term Disability Lawyer at Monkhouse Law for guidance. Monkhouse Law is an employment law firm located in Toronto with a focus on employee issues. Give us a call at 416-907-9249 or fill out this quick form. We offer a free 30-minute phone consultation.

You May Like: Another Word For Disabled Person

When Will Premium Rates Be Evaluated Next

Premium rate renewals take effect July 1st each year. Plan experience and rates continue to be closely monitored and are discussed with the respective representatives of each participating employee group. Any change in rates will be communicated to employees in the participating employee groups prior to the new rates taking effect in July.

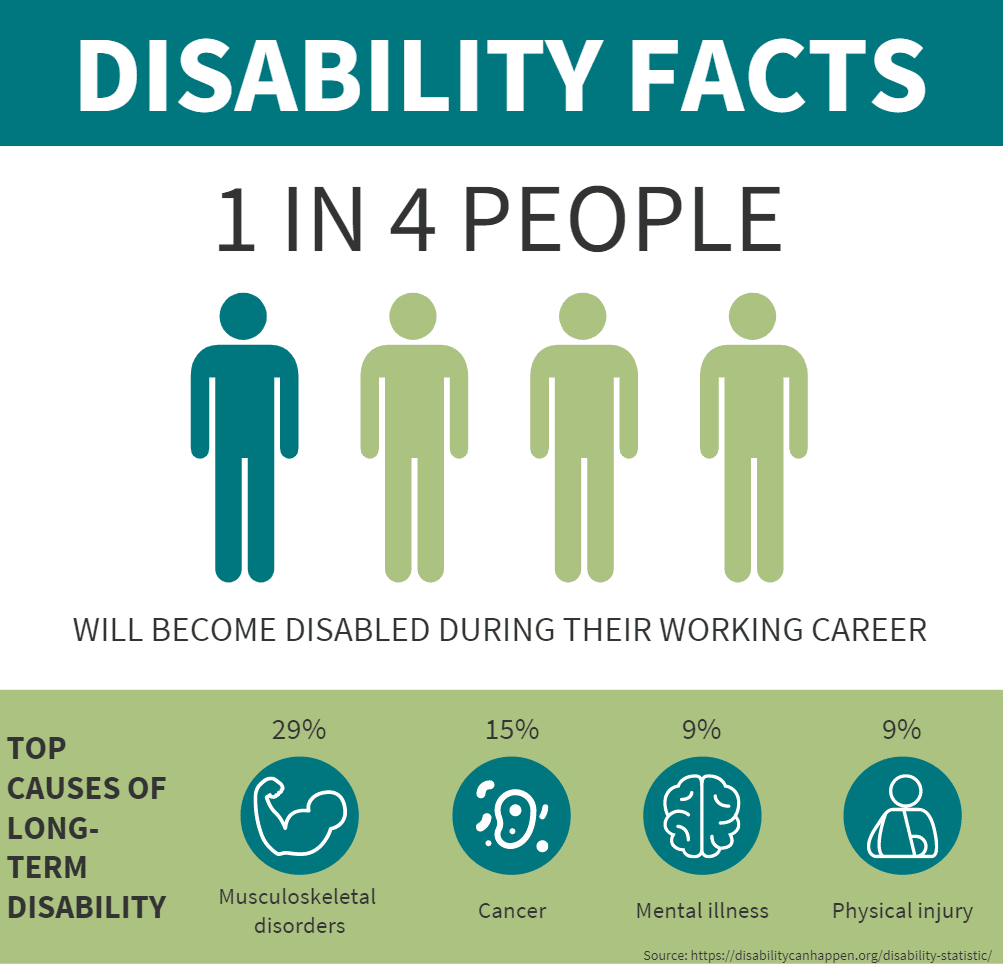

Do I Need Long Term Disability Insurance

If you earn an income, you should strongly consider purchasing a long term disability insurance plan. This is especially true under the following circumstances:

- You have dependents who rely on you financially, such as a spouse, kids, or aging parents.

- You have debt that you need to pay off, such as student loans or a mortgage.

- You have a high-paying job occupation that is not easily replaceable .

- You are self-employed .

- You have a technical job occupation that requires skills that couldn’t be performed if disabled.

Other types of coverage exist to help people through periods of disability, such as short term disability insurance, workers’ compensation insurance, and Social Security Disability Insurance . However, only long term disability insurance will cover the following circumstances:

- Disabilities that occur outside of work

- Disabilities that last longer than a few months.

- Disabilities that are serious enough to prevent you from working your regular job, but still allow you to work in other capacities

- Individuals who earn well above what SSDI pays in monthly benefits

It’s pretty clear why long term disability insurance is such a valuable component of your financial safety net. But is the cost actually worth it?

Don’t Miss: Disabled Veteran Plates Handicap Parking

How Do You Know If You Need Long

Most people can benefit from long-term disability insurance. It’s particularly helpful if you have limited savings and investments the monthly benefits make it easier to pay for your home, car and essentials for living. Disability benefits defray costs, so you don’t have to withdraw money from retirement accounts.If your employer offers long-term disability insurance, it doesn’t mean you’re in the clear. These group plans may have low monthly benefits that may not provide adequate funds. When that’s the case, you can supplement the coverage by purchasing an individual plan.

Making Changes After The 31

At any time, employees may reduce to the 50-percent coverage level or decline employee-paid LTD coverage by completing and submitting the LTD Enrollment/Change form to their payroll or benefits office for processing.

Employees who later decide to enroll in or increase coverage after the 31-day eligibility window must submit the LTD Enrollment/Change form to their payroll or benefits office for processing and the Evidence of Insurability form to Standard for approval.

Recommended Reading: Protection And Advocacy For Persons With Disabilities

Can You Be Fired Or Terminated While On Long

Yes, but its a much more complicated process than a simple firing. The guidelines vary based on province or territory. In Ontario, for example, an employer can terminate an employee on long-term leave if the employee is unlikely to return to work. The rationale is that there is an employment contract between the two parties, and its not being fulfilled because the employee cant work.

Now, heres the complicated part. According to Diamond and Diamond Lawyers, before an employee can be terminated, an extensive, factual investigation and an expert medical opinion are needed. If the employer doesnt get the evidence required, they may be obligated to continue paying benefits plus legal costs.