Do I Need Both Short Term And Long Term Disability Insurance

As you can probably tell, short term and long term disability insurance policies are designed to work together. Short term disability is intended to cover you immediately following a serious illness or injury, and long term disability insurance is intended to maintain income replacement if your condition keeps you out of work past the end of your short term disability benefit period, even to retirement, depending on your plan. If you have both short term and long term disability policies in place, short term disability will pay you benefits during the waiting period before your long term disability coverage begins, at which point youll transition from one policy to the next to receive benefits. For that reason, it makes sense to have both policies to help ensure an unexpected health problem wont derail your financial confidence for a few months or for several years.

Get Payments Of Up To 60% Of Your Income For A Covered Accident Or Serious Illness

You never expect a serious illness or accident to happen, but when it does, it can interrupt your ability to work for months even years. Long Term Disability Insurance can give you the financial support you need to manage your disability and your household.

Already have Unum coverage?

Long Term Disability Insurance

Available through the workplace, this coverage helps maintain your standard of living if you’re unable to earn a paycheck due to an accident or illness

Covers essential living expenses: can help pay for food, clothing, utilities, your mortgage, car payments and more

Direct monthly payments: receive a portion of your salary paid directly to you each month if youre unable to work

Rehab incentives: coverage may include financial incentives designed to help you transition back to work

Easy claims filing: report claims online or by phone

Competitive rates: this group coverage is offered only through your employer

For complete plan details, talk to your companys benefits administrator.

Also Check: Unlock Iphone That Is Disabled

How Long Does Long

Once long-term disability benefits have been approved, an employee can continue to receive benefits for the length of the policy term or until they return to work. Most long-term disability plans provide coverage for 36 months, although some plans can provide coverage for up to 10 years or even for the life of the policyholder.

What Qualifies For Long Term Disability Benefits

Insurance companies typically offer two types of LTD:

-

With an own-occupation disability policy, you will be covered for illness or injury that prevents you from completing your regular job duties. Even if you could do other work, benefits will still be provided. Own-occupation coverage will also provide benefits if you can still work but not to your full ordinary hours.

-

An any-occupation disability policy, on the other hand, will only provide benefits if you are unable to work at all, in any occupation. While these policies tend to be more inexpensive, successfully filing a claim for them is more difficult, since its not easy to prove that you can no longer work any job.

Read Also: What Happens If I Don’t Pay Back Long Term Disability

What Qualifies For Long

The qualifications for long-term disability are usually more stringent than those for short-term disability. With short-term disability, benefits can be awarded if the employee is unable to do their job. With long-term disability, benefits will typically only be awarded if the employee is unable to do any job. What constitutes a qualifying event will be specified in the policy, so it is important to understand when benefits may apply before accepting a long-term disability policy.

Qualifying events may include chronic pain, cancer treatments, or debilitating illness or injury lasting more than 26 weeks. If an employee could qualify for another form of income replacement, such as Social Security Disability Insurance, the long-term disability policy will no longer provide benefits.

What Is A Total Disability

A total disability falls under two main categories: any-occupation and own-occupation.

-

Any-occupation: You cannot perform the main duties of any job that you are reasonably qualified to do. A court reporter who loses a limb may not be able to type, but may be qualified to teach a class, for example.

-

Own-occupation: You cannot perform the main duties of your job, regardless of the employer. A court reporter who loses a limb and is no longer able to type is an example of own-occupation total disability.

You May Like: 100 Percent Va Disability Pay

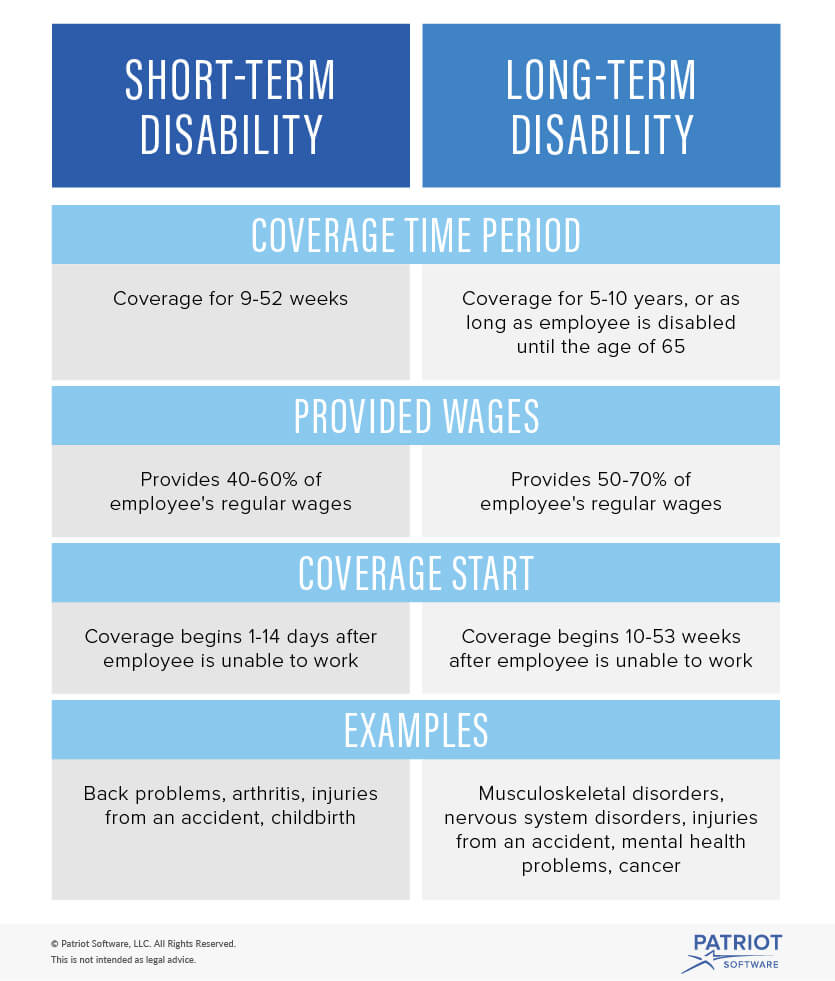

Whats The Difference Between Long Term And Short Term Disability Insurance

Most people think disability is something that happens to other people, but its more common than you may think. More than a quarter of todays 20-year-olds can expect to be out of work for at least a year before they reach retirement age due to a disabling condition.1 And some of the most common reasons for disability claims include pregnancy, mental health issues and cancer2 conditions that might not be top-of-mind when you think about disability. Thats why its so important to protect yourself in case an unexpected illness or injury keeps you out of work for an extended period of time. But before you can choose the right protection for a potential disability, you first need to understand the difference between the two primary types of disability insurance: short term and long term.

Long Term Disability Vs Long Term Care: Understanding The Differences

Many individuals confuse Long Term Disability and Long Term Care Insurance. It may be because they both are triggered by health-related causes. However, these two insurance plans serve vastly different purposes in helping you manage the financial risk in your personal life:

- Long Term Disability Insurance is used to help protect your future earnings. It is designed to replace a portion of your income when you are not able to work due to a covered debilitating illness or disabling accident.

- Long Term Care Insurance pays a daily or monthly benefit towards the costs of care services from a skilled nursing home, assisted living facility, adult daycare or home assistance when you can no longer take care of yourself for the acts of daily living, e.g. bathing, dressing, or eating .

We have outlined the differences between the two types of insurance to help you better understand the differences between these two important plans.

Many people overlook both Long Term Disability and Long Term Care Insurance thinking that they wont need it. You can play the odds or be prepared for the future by purchasing insurance protection. Having protection can be invaluable when you need it.

The Group Long Term Disability Insurance Plan is underwritten by New York Life Insurance Company, 51 Madison Avenue, New York, NY 10010 on Policy Form GMR.

Also Check: 7 Day Waiting Period For Short Term Disability

Long Term Disability Insurance Takes A Weight Off Your Shoulders

If you experience a covered illness or disability that leaves you unable to work for an extended period of time, Unum Long Term Disability Insurance can pay a monthly benefit of up to 60% of your normal income. You can use this benefit however you need, whether its to pay out-of-pocket treatment costs or to cover personal bills and day-to-day expenses.

Our coverage includes treatment for serious forms of cancer, as well as recovery from severe injuries. The most common reasons our customers use this benefit are1:

- Cardiovascular disorders

- Joint disorders

A disability can drastically impact your financial situation if youre not prepared. If youre the primary income provider in your home, a disability can place a huge stress on your loved ones. Protect what youve worked so hard to build. Talk with your HR representative to see if Long Term Disability Insurance is available through your workplace.

Your Employment And Returning To Work

When you are ready to return to work, please contact your claims specialist, who will work with you on your return-to-work plan.

Most plans include a recurrent disability provision. If an employee becomes disabled again due to the same condition within a specified number of days, the recurrent disability provision allows continued disability payments under the original claim.

The number of days for the recurrent disability provision is stated in the policy.

If an employee becomes disabled after the number of days in the recurrent disability provision, or due to a new medical condition, a new claim would need to be filed.

Depending on the definition of disability as defined in the policy, an employee may be able to receive benefits and work part time.

Many policies will allow employees to work part time while on claim. Typically, an employee will need to have a certain percentage of their earnings lost due to disability for a claim to remain active.

Please review the definition of disability, outlined in the certificate of coverage.

1. Unum internal data, 2016. Note: Causes are listed in ranked order.

Group Long Term Disability:

Read Also: 90 Percent Va Disability How To Get 100

How Do You Apply For Short

If you are interested in applying for short-term disability insurance, the first step is to contact the human resources department at your place of employment. They will be able to provide information about the availability of short-term disability insurance and the specific terms of the policy.

In order to apply for short-term disability insurance, you will typically need to provide medical documentation to support your claim. This can include a note from your doctor outlining the nature of your disability and the expected length of time you will be unable to work.

Once you have gathered the necessary documentation, you will need to follow the application process outlined by your employer. This may involve filling out an application and submitting it along with the required documentation. Your employer may also have specific requirements for how to apply for short-term disability insurance, so it is important to follow their guidelines.

Overall, the process for applying for short-term disability insurance will depend on your employer and the specific policy. It is important to understand the requirements and to follow the steps outlined in order to ensure a smooth and successful application process.

What Doesn’t Long Term Disability Insurance Cover

Long term disability insurance covers a lot, but it canât cover everything. There are almost always coverage exclusions and limitations.

To avoid any confusion or surprises, exclusions and limitations will be listed in your policy contract. The purpose of coverage exclusions is to mitigate the insurance carrier’s risk of paying a claim resulting from high-risk conditions or activities.

Some common examples of exclusions that apply to all applicants include:

- Self-inflicted acts

- Civil disobedience or rebellion

- Operating a motor vehicle while intoxicated

Depending on your medical underwriting and lifestyle choices, you may also receive individual exclusions. For example, if you have had a herniated disc, your policy may exclude claims resulting from spinal injuries. Many policies also limit benefits if a mental illness or nervous disorder limits your ability to work.

Since they are sometimes confused, it’s important to highlight the difference between long term disability and long term care insurance. A long term care policy will cover the costs of nursing homes, assisted living facilities, or in-home care if you become unable to care for yourself. However, it will not replace lost income like a long term disability policy.

Recommended Reading: How Many Hours Can I Work On Disability 2021

Health Resources For People With Disabilities

Federal, state, and local government agencies and programs can help with your health needs if you have a disability.

-

Explore the Disability and Health section of CDC.gov for articles, programs, tips for healthy living and more.

-

Learn more about benefits for people with disabilities from the Social Security Administration.

-

Contact your local city or county government to find out what medical and health services are available locally for people with disabilities.

-

Your state social service agency can help you locate medical and health programs.

Visit USA.govs Government Benefits page to learn more about government programs and services that can help you and your family.

Women Pay More Than Men

Even with all other factors being equal, women can pay up to 40 percent more in premiums than men for disability insurance. Thatâs because women suffer disabilities that impact their careers, such as breast cancer, autoimmune disorders, and depression, more than men. Disability claims for women also typically last longer than those for men.

For example:

- A 40-year-old male applying for a $3,300 monthly benefit will pay $61 a month.

- A 40-year-old woman getting the same coverage will pay $80 a month.

For what it’s worth, the gender price gap for disability insurance is the opposite of life insurance. Women consistently live longer than men, which means they get the same preferential treatment you see men getting here.

Also Check: Social Security Disability Income Limits

Whats The Elimination Period

While short term disability insurance begins paying benefits within a couple weeks following a qualifying illness or injury, long term disability insurance requires a longer waiting period, called an elimination period, before a policyholder begins receiving benefits. The length of the elimination period varies by policy but is often around 90 days. When considering a disability policy, take into account how you will cover your expenses during the elimination period. Do you have an emergency fund to cover your lost income and any medical bills you accrue during this time? If not, you may consider purchasing additional coverage to protect you immediately following a disabling illness or injury.

Group Disability Insurance Through Your Work Or An Association

Your company may offer STD or LTD insurance as part of your employee benefit package. If youre self-employed you may be able to get disability insurance through a professional association. Either way, group disability insurance can be an excellent choice: Because the company or association is buying for a large group of people, the premium is typically lower than for an individual policy. In addition, your HR department will likely have more expertise and leverage to negotiate favorable terms.

An added benefit to getting a policy through your employer is that they may also subsidize a portion of the premiums, further lowering your cost. On the other hand, because the company or association is effectively buying in bulk, you will probably have less opportunity to tailor the policy to your needs. If the premiums are paid with pre-tax dollars then the income benefit you get down the road will typically be taxed. Finally, if you leave the company or association, in most cases youll also lose your coverage.

Read Also: Spinal Cord Stimulator And Disability

What Wont Long Term Disability Cover

Depending on your plan, certain injuries and illnesses may be excluded from coverage or may provide limited benefits. Consult your plan details for a full list of exclusions as each policy is different. However, there are a few exclusions that almost every plan has:

-

Intentionally self-inflicted injuries

-

Injuries sustained in the course of committing an illegal act, such as drunk driving

-

Injuries sustained at work, which would be covered by workers compensation

-

Temporary injuries or illnesses lasting less than 6 months are generally covered instead by short term disability

-

Pre-existing conditions may result in limited benefits

-

Mental health limits may be in place to limit the benefits you receive for diagnoses like depression or anxiety

Long Term Disability And Its Benefits

Long Term Disability can be used following Short Term Disability plans or alone.

Long Term Disability coverage provides wage replacement that is between 50-70% percent of your earnings before a non-work related injury impacted your ability to work.

If a LTD plan is offered through your employer, it is very important to sign up during the initial enrollment period, when you cannot be denied coverage for a pre-existing condition. Read the plan summary for definitions detailing what is covered as well as specific details required by your plan.

Most LTD plans include a waiting period that lasts from 3-26 weeks, which coincides with the length of time you can be paid for STD benefits, before you are eligible to begin receiving LTD benefits.

In order to continue to qualify for benefits detailed medical information must be provided to the LTD carrier initially and then throughout the life of the claim as requested. Failure to do so will result in termination of your benefit. If you are considered disabled longer than 90 days, most policies do not require you to continue paying premiums.

Most LTD policies have two definitions of disability: Own Occupation and Any Occupation.

- During the Own Occupation period, benefits are payable if the employee is unable to perform his or her regular job or a similar job. This period can last up to two years.

Recommended Reading: Best Short Term Disability Companies

Total Disability Insurance Benefits

With long-term disability insurance, the insurer starts paying a monthly income after you are disabled for the length of the elimination period, usually 90 to 120 days. It pays the disability benefit for as long as youre disabled, up to the benefit period. The maximum benefit period is age 65, so you could receive benefits until retirement if youre permanently disabled.

The amount you receive depends on the degree that youre disabled, so lets start by discussing a total disability.

Why Is Offering Disability Insurance Important For Employers

Employers and employees both benefit when disability insurance is offered in a comprehensive benefits package. Reasons are as follows:

- Helps the employee financially. Disability insurance provides monetary advantage to an employee who is temporarily unable to work due to accident, illness or disability.

- Improves recruiting success. Including disability insurance in a benefits package helps an employer be competitive in recruitment, and both attract and retain top talent.

- Provides peace of mind. Disability insurance can provide peace of mind to an employee who will be out of work for medical reasons.

Don’t Miss: What Type Of Doctor Does Disability Evaluations