A Disability Lawyer Can Help You Determine What Benefits You Can Get

If you are wondering what benefits 100% disabled veterans get, a disability lawyer can help you find out. They also have a good understanding of VAs methods for determining eligibility for a 100% disability rating.

You also get legal guidance and assistance with procedures like the decision review process. Call today to receive a free consultation and learn more about how a disability lawyer can help you.

Call or text or complete a Free Case Evaluation form

Questions And Answers About The 100% Disabled Veterans Homestead Exemption

If you qualify as a 100% Disabled Veteran, you will be interested in the answers to the most commonly asked questions below.

Q. What are the qualifications for this exemption?

- You qualify for this 100% homestead exemption if you meet these requirements:

- You own a home and occupy it as your residence homestead.

- You are receiving 100% disability compensation from the US Department of Veterans Affairs for a service-connected disability.

- You have a disability rating of 100% disabled or of individual unemployability.

To get this exemption, you must fill out Form 11.13, checking the box for 100% Disabled Veterans Exemption, as well as all boxes that apply to you. You must attach documentation as well. You may attach a copy of your award letter, a VA tax letter, or another document from the United States Department of Veterans Affairs showing 100% disability compensation due to a service-connected disability and a rating of 100% disability or of individual unemployability. The documents you attach must be current documents.

Q. How much of my homes value will it exempt?

If you qualify, your home will be totally exempt from property taxes in all jurisdictions, regardless of the homes value. If you co-own the home with someone other than your spouse, your share of the homes value will be exempted.

Q. I already have a homestead exemption. Do I need to apply for the 100% Disabled Veteran Homestead Exemption?

Yes. This exemption is not given automatically.

Yes.

Discuss Your Benefits As A Veteran In Texas With Experienced Va Claims Attorneys

Our firm works with Veterans in Texas and across the United States. While the national nature of our work means we are not experts on each stateâs veterans benefits, we are experts on the subject of VA disability benefits claims and appeals. Contact us today for a free screening of your VA disability benefits appeals.

You May Like: Social Security Short Term Disability

The Fund For Veterans Assistance

The Fund for Veterans Assistance is a special fund in the state treasury outside the general revenue fund. The Fund is composed of money deposited from a Texas Lottery Commission Veterans Assistance game, donations from vehicle registration and drivers license renewals, donations from License to Carry renewals, donations from hunting and fishing license renewals, gifts and grants contributed to the Fund, and the earnings of the Fund.

TVC is authorized to administer the Fund and make reimbursement grants to address the needs of veterans and their families, as determined through veteran needs assessment studies. All grant awards are made through a competitive grant selection process.

TVC annually announces funding opportunities for five different grants including General Assistance Grants, Housing for Texas Heroes Grants, Veterans Mental Health Grants, Veteran Treatment Courts Grants, and Veteran County Service Office Grants.

Find more information about this program on the TVC grants Website.

Va Disability Compensation Pay

One of the best disabled veteran benefits available is VA disability compensation pay. If you have a disability condition that was caused or made worse by your active-duty military service, you may be eligible to receive tax-free monthly compensation. Veterans can prepare and file their own VA disability compensation claim for FREE by opening a Notice of Intent to File on the VA.gov website for a VA disability increase or first-time filer.An Intent to File puts the VA on notice that youre planning to file a VA claim, which is important because it sets an effective date for when you could start getting benefits while you prepare your disability claim and gather supporting documents . Click HERE to view the 2022 VA disability compensation pay rates.

You May Like: Social Security Disability Spousal Benefits Calculator

Texas Veteran Health Care Benefits

Texas Veterans Homes

There are 8 veterans homes in Texas. They are:

- William R. Courtney Texas State Veterans Home in Temple

- Frank M. Tejeda Texas State Veterans Home in Floresville

- Ambrosio Guillen Texas State Veterans Home in El Paso

- Ussery-Roan Texas State Veterans Home in Amarillo

- Alfredo Gonzalez Texas State Veterans Home in McAllen

- Lamun-Lusk-Sanchez Texas State Veterans Home in Big Spring

- Clyde W. Cosper Texas State Veterans Home in Bonham

- Watkins-Logan Texas State Veterans Home in Tyler.

These homes provide affordable and long-term nursing care for Texas veterans, their spouses, as well as Gold Star parents.

Texas Veterans Legal Assistance Project

Provided by: Texas Legal Services Center

The Texas Veterans Legal Assistance Project is a Texas Legal Services Center statewide project to expand the availability of legal assistance to low-income Texas Veterans and their families, with a focus on outreach to the disabled Veterans who live in rural areas of the state. There is no charge for their service, which is provided by telephone to eligible Veterans, at 1-800-622-2520, Option 2.

Read Also: Assisted Living For Young Adults With Disabilities

Burial And Plot Allowance

A surviving dependent can qualify for allowances to help pay for burial and funeral costs for a disabled veteran. If the veteran died of a service-connected disability ON or AFTER September 11, 2001, the maximum VA burial benefit allowance is $2,000 or $1,500 for a Veteran who died BEFORE September 11, 2001.

Home Loans For Texas Veterans

The Texas Veterans Land Board offers three different loan programs for veterans:

- Land Loan Program, offering long-term loans at a low interest rate for the purchase of land

- Veterans Housing Assistance Purchase Program, to help veterans buy homes, and

- Veterans Home Improvement Loan Program, providing low-interest loans to help veterans make changes to their homes, including those that may be needed due to disability.

For more information about these loans, visit the Veterans Land Board website.

Also Check: High Blood Pressure Va Disability

Veterans County Service Offices

All counties with a population of 200,000 or more have a veterans county service office that is:

- staffed by at least one full-time employee and

- report directly to the commissioners court.

In a county with a population of less than 200,000, the commissioners court may maintain and operate a veterans county service office if the commissioners court determines that the office is a public necessity to enable county residents who are veterans to promptly, properly, and rightfully obtain benefits to which they are entitled.

Find a list of veteran service offices.

Texas Disabled Veteran Benefits Financial Assistance

Disabled Veteran Property Tax Exemption Texas

Disabled Veteran Property Tax Exemption Texas

Property taxes in Texas are locally assessed and administered by each county.

Disabled Veterans in Texas with a 10% to 90% VA disability rating can get a reduction of their homes assessed value from $5,000 to $12,000 depending on disability percentage.

The deadline for filing for a disabled veterans exemption is between January 1 and April 30 of the tax year.

However, you may file for a disabled veterans exemption up to one year from the delinquency date.

To file for a disabled veterans exemption, you must complete the Application for Disabled Veterans or Survivors Exemptions form and submit it to the appraisal district in which the property is located.

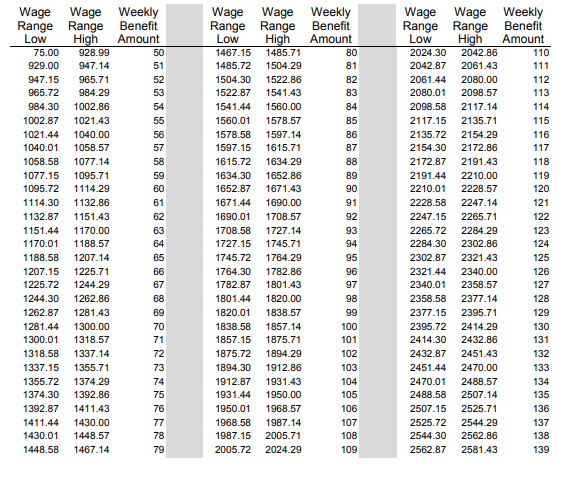

The table below lists the exemption by VA disability rating.

Disabled Veteran Property Tax Exemption Texas Quick Calculator

| VA DISABILITY RATING |

| $12,000 from the propertys value |

Read Also: Negatives Of Getting Social Security Disability

Use Of Commissaries Exchanges And Morale Welfare And Recreation

Veterans who have a 100 percent disability rating, their dependents and unmarried surviving spouses are entitled to unlimited commissary and exchange store privileges. The VA can aid in completing a DD Form 1172, Application for Uniformed Services Identification and Privilege Card, which you will need to access these benefits.

North Dakota Dmv Benefits For 100% Disabled Veterans

North Dakota veterans with a service-connected 100% disability rating are eligible for Disabled American Veteran license plates.

DAV license plates exempt veterans from paying sales tax on up to two vehicles. Additionally, there is no annual license or registration fee. An unremarried surviving spouse can retain one DAV plate for their own use.

Don’t Miss: Universal Studios Hollywood Disability Pass

Dependent Or Spouse Of A Veteran Who Is Rated 100% Disabled For The Purpose Of Employability Kia Or Mia No Age Limit For Dependent

- Visit the Checklists page on this website, click Hazlewood Dependent or Spouse of a 100% Disabled, KIA or MIA Veteran Checklist for more information and instructions.

- MVP wants to ensure your application is complete and processed efficiently. Confirm you are submitting required items by printing and using the checklist.

- Submit the application and supporting documents to MVP immediately following registration of classes via the MVP Forms portal.

Audit Note: TTU may perform an audit of your records at any time. If during an audit it is found you are not meeting a requirement, Hazlewood will be removed from your account and you will be responsible for all account balances.

Things To Remember When Buying Life Insurance

When considering the purchase of life insurance its possible you may think you dont need it until youre older.

When considering the purchase of life insurance its possible you may think you dont need it until youre older. Unfortunately, that can be a costly conclusion. Life Insurance rates are typically less expensive the younger you are. As you get older, you could develop an illness or disease, or a hazardous occupation that can make you uninsurable to most companies.

When people look for insurance, its easy to underestimate the amount it will cost to replace their income if something happens. Evaluating your financial needs helps to provide your family with the money they need to survive. Accurately count what you need by adding together the cost of a funeral, mortgage, credit card debt, income replacement and any other debt that you may have.

Be sure when investigating life insurance policies, you compare prices as well as companies. Check the companys financial stability by reviewing their rating with the Better Business Bureau and independent insurance analysts. Review what life insurance products they offer and what options they make available.

You May Like: How To Get Short Term Disability Approved While Pregnant

I Only Get Va Disability Can This Be Claimed For Child Support Payments

Yes, child support payments can be deducted from VA disability payments. This process is called “apportionment” and is very similar to “garnishment“. A portion of your VA disability is deducted from your paycheck and sent to another person. The parent with physical custody can claim a portion of the disability payments as child support from the parent who has visitation.

Apportionment is not automatic. The parent who is asking for child support must apply for apportionment by filling out VA Form 21-0788 and submitting it to the listed address on the form.

The VA considers the following when deciding apportionment for child support:

- Is the child support claim so small that it isn’t worth apportioning?

- Has your child been legally adopted by another person?

- Is your child at least 18 or has you child entered active military service?

Most likely, whatever the court order set as the child support amount will be apportioned for your child’s benefits.

Children/spouses Of A Veteran Requirements:

Children and Spouses of a Texas Veteran, who is totally and permanently disabled, missing in Action, Killed in action or died as a result of service. . Spouses and dependent children of eligible Active Duty, Reserve, and Texas National Guard who died in the line of duty or as a result of injury or illness directly related to military service, are missing in action, or who became totally disabled for purposes of employability as a result of a service-related injury or illness are entitled to each receive a 150 credit hours exemption, DD214 shows place of entry is Texas or Home of Record is Texas or proof veteran was a Texas resident at the time of entry or DD1300 with all required information. Have no federal veteranâs education benefits, or have federal veterans education benefits dedicated to the payment of tuition and fees only such as: Chapter 33/Post 9/11, for the term or semester enrolled that do not exceed the value of Hazlewood benefits. Recipient must be admitted by the university admissions office as a Texas resident, not in default of student loans .

Don’t Miss: How Much Money For Disability

How To Apply For Educational Assistance

If your child or spouse wishes to apply for the DEA program, they can apply online or apply by mail. If they wish to apply by mail, they must fill out VA Form 22-5490 and mail it to their states regional processing office. You can .

If you wish to apply for the Fry Scholarship, youll first need to make sure that your school of choice has a program that is approved for VA benefits. Then you may apply online and fill out VA Form 22-5490 as with the DEA program. Children applying for the program who are not legally adults must have a parent or guardian sign the application.

Va Guaranteed Home Loans

The Department of Veterans Affairs offers home loan guarantees for eligible veterans that may result in lower interest rates and loan origination and closing costs. The veteran is required to submit a “Certificate of Eligibility” issued by the DVA to the lending institution to verify eligibility for the loan guarantee. Applications for Certificates of Eligibility may be picked up at our office or obtained from the local DVA Benefits Office at 5788 Eckhert Rd, San Antonio, TX 78240. For additional information you may call the toll free DVA number, 1-888-232-2571. For a complete discussion and information on the VA Home Loan program, you may also visit the DVA Home Loan Guaranty Services web site at .

You May Like: What Is The Difference Between Fmla And Short Term Disability

Special Policy For Residents Of Harris County:

Residence Homestead: “Residence homestead” means a structure or a separately secured and occupied portion of a structure that: is owned by one or more individuals, either directly or through a beneficial interest in a qualifying trust is designed or adapted for human residence is used as a residence and is occupied as the individual’s principal residence by an owner, by an owner’s surviving spouse who has a life estate in the property, or, for property owned through a beneficial interest in a qualifying trust, by a trustor or beneficiary of the trust who qualifies for the exemption.

10-90% Disabled veterans that are over 65 may apply for three exemptions:

A disabled veteran may also qualify for an exemption of $12,000 of the assessed value of the property if the veteran is age 65 or older with a disability rating of at least 10 percent totally blind in one or both eyes or has lost use of one or more limbs.

May I file for a disabled veteran’s exemption after the deadline has passed?Yes. The deadline for filing for a disabled veteran’s exemption is between January 1 and April 30 of the tax year. However, you may file for a disabled veteran’s exemption up to one year from the delinquency date. To file for a disabled veteran’s exemption, you must complete the Application for Disabled Veteran’s or Survivor’s Exemptions form and submit it to the appraisal district in which the property is located.

Course Credit For Military Service

An institution of higher education will award to an undergraduate student course credit for all physical education courses required by the institution for an undergraduate degree and for additional semester credit hours that can be applied to satisfy any elective course requirements for the student’s degree program for courses outside the student’s major or minor if the student:

- graduated from a public or private high school accredited by a generally recognized accrediting organization or from a high school operated by the United States Department of Defense and

- is an honorably discharged former member of the armed forces of the United States who:

- completed at least two years of service in the armed forces or

- was discharged because of a disability.

Recommended Reading: What Qualifies You For Social Security Disability

Specific Health Care Services You May Receive

The healthcare benefit for 100% disabled vets covers a wide range of services. For example, it may help you pay for primary care and consultation fees. It also covers preventative care and the cost of buying assistive devices.

More expenses the healthcare benefit can help you with are:

- Paying a licensed caregiver

- Living in a nursing home

- Transportation to medical appointments

Spouse Or Dependents Benefits

Spouses and dependents are an integral part of active duty Servicemembers and Veterans families. We encourage you to utilize the services available at South Texas College to achieve your educational goals. Several benefits are available for qualifying spouses and dependents through federal and state programs to pursue your education.

Read Also: How Do I Get On Disability