Apply For Survivors Benefits

You should notify us immediately when a person dies. However, you cannot report a death or apply for survivors benefits online.

In most cases, the funeral home will report the persons death to us. You should give the funeral home the deceased persons Social Security number if you want them to make the report.

If you need to report a death or apply for benefits, call 1-800-772-1213 . You can speak to a Social Security representative between 8:00 a.m. 7:00 p.m. Monday through Friday. You can find the phone number for your local office by using our Social Security Office Locator and looking under Social Security Office Information. The toll-free Office number is your local office.

If you are not getting benefits

If you are not getting benefits, you should apply for survivors benefits promptly because, in some cases, benefits may not be retroactive.

If you are getting benefits

If you are getting benefits on your spouse’s or parent’s record:

- You generally will not need to file an application for survivors benefits.

- We’ll automatically change any monthly benefits you receive to survivors benefits after we receive the report of death.

- We may be able to pay the automatically.

If you are getting retirement or disability benefits on your own record:

- You will need to apply for the survivors benefits.

- We will check to see whether you can get a higher benefit as a widow or widower.

How Does The Social Security Administration Calculate Benefits

Benefits also depend on how much money youâve earned in life. The Social Security Administration takes your highest-earning 35 years of covered wages and averages them, indexing for inflation. They give you a big fat âzeroâ for each year you donât have earnings, so people who worked for fewer than 35 years may see lower benefits.

The Social Security Administration also makes annual Cost of Living Adjustments, even as you collect benefits. That means the retirement income you collect from Social Security has built-in protection against inflation. For many people, Social Security is the only form of retirement income they have that is directly linked to inflation. Itâs a big perk that doesnât get a lot of attention.

Applying For Spousal Disability Benefits

If your husband or wife’s disability claim has already been approved, call the Social Security Administration at 800-772-1213 to apply for the spouse’s SSDI benefit. You must provide the SSA with your birth certificate, your marriage certificate, your Social Security number , and your bank’s routing information for direct deposit. If you are applying for a survivor benefit, you will also need to provide your deceased spouse or ex-spouse’s death certificate or other proof from the funeral home.

Recommended Reading: Reed Group Short Term Disability

Social Security Survivor Benefits

When your spouse dies, you may be eligible for survivor benefits. You may also be eligible for your ex-spouses survivor benefits if you were married for at least 10 years or you care for their child whos younger than 16 or disabled.

Survivor benefits are as much as 100% of the benefit the deceased worker was receiving when they died. If the person died before claiming benefits, the survivor benefit is based on their primary insurance amount.

To qualify for the full benefit, you still have to wait until your full retirement age. However, you can claim benefits as early as age 60 . If you claimed survivor benefits as soon as youre eligible at age 60, youd only receive 71.5% of your late spouses benefit. Surviving spouses or ex-spouses who are caring for a child younger than 16 or who has a disability can receive 75% of the deceased workers benefit.

If you remarry before age 60 , you wont qualify for survivor benefits. However, if you remarry after age 60 , remarrying wont jeopardize your survivor benefits.

How Much Do Widowed Spouses Receive

Social Security survivors benefits are especially important to women , because wives tend to earn less than their husbands, and they also typically outlive their husbands. When a retired worker dies, the surviving spouse receives a benefit equal to the deceased workers full retirement benefit.

Depending on the widows or widowers circumstances, however, this benefit may substantially reduce her monthly household income because only one Social Security benefit is now arriving , not the two benefits that the couple received before the spouses death. Women who had worked and earned their own Social Security benefits, in particular, may find themselves struggling to meet the rising fixed expenses that come with aging.

For more information on Social Security and survivor benefits, please visit the Social Security Administration at ssa.gov/benefits/survivors/.

Recommended Reading: Chances Of Winning Disability In Federal Court

When To Apply For Benefits How Much Youll Get

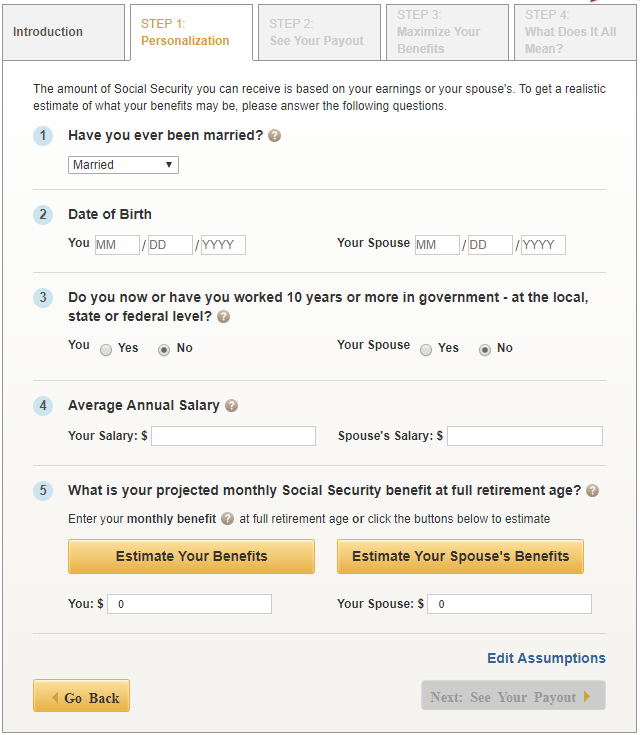

AARP, Updated May 25 , 2022

All the information presented is for educational and resource purposes only. It is not intended to provide specific or investment advice. We don’t guarantee the accuracy of the tool and suggest that you consult with your advisor regarding your individual situation.

Whose Earnings Record Should You Collect On

If your ex qualifies for Social Security benefits, you were married for at least 10 years, and you’re not remarried, you have options.

You can claim Social Security on your own earnings record or on your ex’s record. If your ex qualifies for Social Security but isn’t already collecting, you can still collect on his or her record if you’ve been divorced for at least 2 years.

You’re entitled to half of your ex’s benefits if you start collecting once you reach your full retirement age . But you won’t receive increased benefits by waiting past your FRA.

If the benefits you’d receive by collecting on your own earnings record are more than what you’d collect on you ex’s record, consider collecting on your own record.

The history of your earnings for the years you worked.

Read Also: My Personal Facebook Account Is Disabled

Complicating Factors: Spousal Benefit Reductions

An assortment of other factors can come into play, which could reduce your benefit as a spouse. For example:

- If you are receiving a retirement benefit of your own, your spousal benefit will be reduced.

- If you file for spousal benefits prior to your full retirement age, your spousal benefit will be reduced.

- If you are receiving a government pension from work that wasnt covered by Social Security taxes, your spousal benefit will be reduced by the government pension offset.

- If your spouse is disabled or if you have a minor child or adult disabled child, the family maximum rules may result in your spousal benefit being reduced.

- If you are collecting a spousal benefit while under full retirement age and you are working, the earnings test may result in some or all of your spousal benefit being withheld.

We will discuss the GPO, family maximum rules, and earnings test in other articles. For now, we will discuss only the first two potential sources of reduction: entitlement to your own retirement benefit and filing prior to full retirement age.

Bridge To Medicare At Age 65

Remember that while you are eligible for reduced Social Security benefits at 62, you won’t be eligible for Medicare until age 65, so you will probably have to pay for private health insurance in the meantime. That can eat up a large chunk of your Social Security payments.

Read Viewpoints on Fidelity.com: Your bridge to Medicare

You May Like: Short Term Disability Pregnancy Florida

Spousal Benefit Reduction Due To Early Entitlement

If you file for a spousal benefit prior to your full retirement age, that spousal benefit will be reduced due to early filing. The reduction is 25/36 of 1% for each month early, up to 36 months. For each month in excess of 36 months, the reduction is 5/12 of 1%.

Example : Bobs full retirement age is 67. Bob files for his retirement and spousal benefits at age 65 . As a result, his spousal benefit will be reduced by or 16.67%.

The final calculation of Bobs spousal benefit will be 83.33% x . And to that, we would add Bobs own retirement benefit to find the total amount of his monthly benefit.

Apply For Social Security

You can file for Social Security benefits online, over the phone, or in person at a local Social Security Administration office.

*The amount of your monthly benefits also increases for each month you wait between age 62 and your full retirement age , but the rate is lower than 8% per year and varies depending on your age.

All investing is subject to risk, including the possible loss of the money you invest.

Advice services are provided by Vanguard Advisers, Inc., a registered investment advisor, or by Vanguard National Trust Company, a federally chartered, limited-purpose trust company.

The services provided to clients who elect to receive ongoing advice will vary based upon the amount of assets in a portfolio. Please review the Form CRS and Vanguard Personal Advisor Services Brochure for important details about the service, including its asset-based service levels and fee breakpoints.

Don’t Miss: List Of Accommodations For Students With Disabilities

The Downside Of Claiming Early: Reduced Benefits

Consider the following hypothetical example. Colleen is 62 as of 2022. If Colleen waits until age 67 to collect, she will receive approximately $2,000 a month. However, if she begins taking benefits at age 62, she’ll receive only $1,400 a month. This “early retirement” penalty is permanent and results in her receiving 30% less year after year.

However, if Colleen waits until age 70, her monthly benefits will increase another 24% over what she would receive at her FRA, to a total of $2,480 per month.1 If she were to live to age 89, her lifetime benefits would be about $112,000 more, or at least 24% greater, because she waited until age 70 to collect Social Security benefits.2

Strategy For Late Claimers

If one partner has little or no earnings history, the best strategy is for the wage earner to postpone applying for Social Security retirement benefits until age 70 to get the highest amount possible. Full retirement age is 66 for most baby boomers and 67 for everyone born in 1960 or later, but by delaying claiming benefits until age 70, the wage-earner will accrue delayed retirement credits that will increase the monthly payments by 8% for each year of delay.

Keep in mind that this won’t affect the spousal benefit amount. Spousal benefits differ from personal benefits when it comes to delaying payments. If you delay claiming for personal retirement benefits past full retirement age, the benefit increases over time, as explained above. However, that will have no impact on your spouse’s benefits, since they max out at full retirement age . In other words, there is no benefit for your spouse in delaying the spousal benefit claim past your full retirement age.

On the other hand, if both partners work, and their earnings are more or less equal, their individual Social Security benefits will each be greater than the spousal benefit, so the best strategy for both is to postpone applying for benefits until age 70.

Don’t Miss: Va Disability Percentages For Conditions

Strategy For Divorced Spouses

If you have been divorced for at least two years, you can apply for spousal benefits if your marriage lasted 10 or more years. If, on the other hand, you are still married and considering a divorce, and are near retirement age, try to apply for spousal benefits before your divorce is final. If you have been married and divorced multiple times, you can choose to receive whichever spousal benefit is highest. Saving your ex-spouses Social Security numbers and dates of birth will make the enrollment process easier.

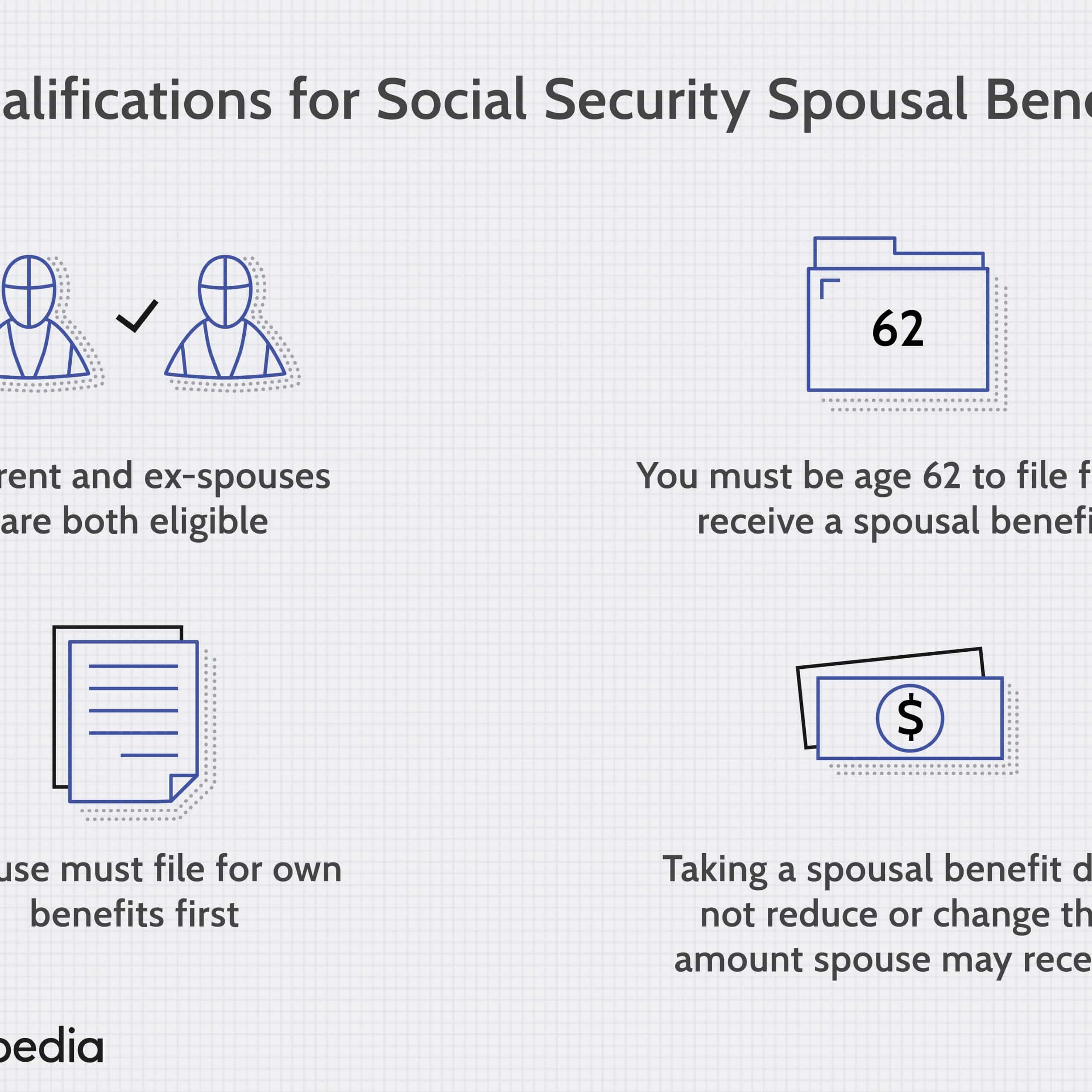

How Do Social Security Spousal Benefits Work

You’re eligible for spousal benefits if you’re married, divorced, or widowed, and your spouse is or was eligible for Social Security. Spouses and ex-spouses generally are eligible for up to half of the spouse’s entitlement. Widows and widowers can receive up to 100%.

You can claim benefits based on your own work history or on that of your spouse. You’ll automatically get the larger amount.

If you are no more than three months away from age 62, you can apply online or by phone. If you plan to put off applying to get the largest payment possible, wait until you’re no more than three months from full retirement age. That’s 66 or 67, depending on your year of birth.

Don’t Miss: Benefits For 100 Disabled Veterans In Texas

Strategies For Maximizing Spousal Benefits

Every married couple has to figure out the best way to maximize their benefits depending on their own circumstances.

The three strategies below will help you make the most of your Social Security spousal benefits, depending on your circumstances. However, keep in mind that, regardless of your circumstances, the most a spouse can get is 50% of the amount that the higher-earning partner is entitled to at full retirement age.

How To Calculate Your Own Social Security Spousal Benefits

The spousal benefit calculation is straightforward if you dont have a benefit of your own. Remember, in that case, its between 32.5% and 50% of the higher-earning spouses full retirement age benefit, depending on your filing age.

However, it can seem a little more complicated if you have Social Security benefits from your work history.

And to keep things interesting, the Social Security Administration decided that a different calculation method should be used to determine how much each benefit should increase/decrease based on your filing age.

Fun, right?

As complicated as Social Security benefits can seem, there is a way to correctly calculate how much your spousal benefit will be if you qualify to receive it.

Check out this section of my video that goes over this calculation step-by-step. VIDEO: How To Calculate Spousal Benefits The RIGHT Way

If you understand how they break down the individual benefits, its not hard to use the table above to quickly figure out what your approximate benefit will be. Heres an example.

Joe and Julie each have a Social Security benefit from work they individually performed. Julies benefit at her full retirement age is $800 per month. Joes benefit at his full retirement age is $2,000.

Assuming they are both full retirement age when they file, Joe will be entitled to a benefit of $2,000 and Julie will be entitled to the greater of her own benefit or half of Joes benefit.

Sounds simple, right?

Also Check: How To Disable Mcafee Popups

Born Before January 2 1954

At FRA, Maria will be eligible to receive $1,200 a month based on her own record, and Tom will be eligible to receive $2,000 a month based on his record.

- She can collect on her own record, which will pay her $1,200 a month.

- She can collect on Tom’s record, which will pay her half of Tom’s benefits $1,000 a month.

Why might Maria consider taking the lower payment at FRA? Because that decision could pay off for her in the long run.

If she collects on Tom’s record first, Maria’s own benefits would increase to $1,584 a month at age 70. Maria has a family history of longevity, and she’s in relatively good health at age 66. So she decides to claim on Tom’s record first, then switch to her own record at 70.

Tom never needs to know that Maria is claiming based on his record, and Maria’s claim doesn’t affect his ability to claim. But if Maria remarries between 66 and 70, she won’t be able to claim on Tom’s record.

The option to claim on Tom’s record first and allow her primary insurance amount to grow is only available to Maria because she was born before January 2, 1954.

Had she been born on or after that date, at FRA she would have qualified for $1,200 a month based on her own record or $1,000 a month based on Tom’s record. If she delayed Social Security until age 70, her own benefits would increase 8% for each year she waits past her FRA. But her benefits based on Tom’s record wouldn’t grow.

If Your Spouse Also Worked Under Social Security

If your spouse is eligible for retirement benefits on their own record, we will always pay that amount first. But, if the spouses benefit that is payable on your record is a higher amount, they will get a combination of the two benefits that equals the higher amount.

If your spouse will also receive a pension based on work not covered by Social Security, such as government or foreign work, their Social Security benefit on your record may be affected.

Don’t Miss: How Much Disability Can I Draw

A Guide On Taking Social Security

Deciding when to take Social Security depends heavily on your circumstances. You can start taking it as early as age 62 , or you can wait until you’ve reached full retirement age or age 70 based on your work history. While there’s no “correct” claiming age for everybody, the rule of thumb is that if you can afford to wait, delaying Social Security can pay off over a long retirement. Here are some guidelines to consider.

Spousal Benefit Reduction Due To Own Retirement Benefit

If you are receiving a retirement benefit of your own, your benefit as a spouse will be reduced by the greater of:

Example: In addition to receiving a benefit as Janes spouse, Bob is also receiving a retirement benefit of his own. Because he is entitled to a retirement benefit of his own, he will not receive the full spousal benefit . Instead, his spousal benefit will be reduced by the greater of a) his own PIA or b) his monthly retirement benefit.

Don’t Miss: Free Car Repair For Disabled