Social Security Says I Was Overpaid What Should I Do

If you do not think you owe the money, you can ask SSA to reconsider the overpayment by filing a Request for Reconsideration Form . You can also call your local Social Security office and ask them to take your appeal over the telephone. Click here to find the number of your Social Security office.

Whether or not you think you were overpaid, you can also ask SSA to waive the overpayment by filing a Request for Waiver Form . You can also call your local Social Security office and ask them to take your appeal over the telephone. Click here to find the number of your Social Security office.

There is a special process for some overpayments that occurred during COVID-19. SSA might waive your overpayment if it occurred between March 1 and September 30, 2020 and because Social Security did not process an action due to the COVID-19 pandemic. You can call and tell the worker that you think this is what happened.

Richmond Hill Ssd Lawyers Will Fight For You

As a network of Richmond Hill disability attorneys, we know that the road to an award of Social Security disability benefits often is a long and trying one. Dealing with a large government bureaucracy like the Social Security Administration is difficult under the best of circumstances dealing with this bureaucracy when your health is compromised can be overwhelming. Add to this the stress of not being able to work, and it is almost enough to make you think about walking away from the process entirely. We hope you wont do that. At Legal Giant, we have helped hundreds of disabled individuals find a lawyer to navigate the Georgia Social Security system. Whatever stage of the disability benefits process you are in, we can provide steady guidance.

If you are unable to work because of a physical or mental condition that has lasted or is expected to last at least 12 months, then you should consider applying for Richmond Hill Social Security disability benefits. To apply, call the Social Security Administration at 800-772-1213 or visit www.socialsecurity.gov/applyfordisability/. Many people complete the initial application for disability benefits on their own, and so can you, but you dont have to. The Social Security regulations allow for a third-party to complete the application for you. Some Richmond Hill disability attorneys wont do this, but our network of lawyers will. They will review your medical records, evaluate your case, and make sure your paperwork is complete.

How Do I Apply For Disability Benefits

If you need to apply for disability benefits, you have a few options. You can apply online, over the phone, or at your local office. The online application is the quickest and easiest way, but the other methods are available should you need them. Should you need to apply over the phone, simply call the Social Security Administration at 1-800-772-1213 .

Recommended Reading: How To Get Short Term Disability Approved

Fighting A Social Security Overpayment Bill

Recently Carolyn W. Colvin, the acting commissioner of Social Security, released the following comment regarding recovery of debts owed to the Social Security Administration that are 10 years old or older.

I have directed an immediate halt to further referrals under the Treasury Offset Program to recover debts owed to the agency that are 10 years old and older pending a thorough review of our responsibility and discretion under the current law to refer debt to the Treasury Department.

If any Social Security or Supplemental Security Income beneficiary believes they have been incorrectly assessed with an overpayment under this program, I encourage them to request an explanation or seek options to resolve the overpayment.

The SSA typically does a review of all cases to ensure that recipients are receiving the proper monthly benefits. However, like any business, there are times when the system becomes overwhelmed and falls behind on these reviews, and they do not catch the Social Security overpayment until several months, or even years in some cases, have passed. This results in the SSA overpaying you, and this means that you receive more in disability benefits than you are eligible. It does not matter if it is not your fault they will hold you responsible to pay back the overpayment.

I Have Been Charged With An Overpayment What Are My Options

Overpayments can occur for a variety of reasons. The first option is to appeal the decision that an overpayment has been made. You may appeal the overpayment if you feel that the Social Security Administration has made an error. You have a right to continued benefits while your appeal is in review. Second, if the SSA has not made an error, and you were indeed overpaid you may apply for a hardship waiver. A hardship waiver is awarded if the beneficiary is without fault in the overpayment and meets income requirements that prove it would be a hardship to repay the debt. Third, if it is determined that the overpayment is legitimate and there is no hardship, a payment plan can be set up to repay the debt in a manner that is agreeable to both parties.

You May Like: Social Security Disability Attorney Utah

Making A Payment Arrangement

If you have lost all of your appeals or have decided not to appeal any further, you must pay the money back. You can tell SSA that you want to repay it in small amounts each month that you can afford. SSA can withhold all of your Social Security benefits to repay the overpayment. However, unless there is fraud involved, they will usually let you pay it back in smaller amounts. You will have to pay back at least $10.00 a month. SSA tries to get the money back within 3 years. If you want to ask SSA to withhold smaller amounts, you have to fill out the same form you would fill out for requesting waiver.

How Does Ssa Recoup Extra Payments

SSA has a specified process for recovering the overpaid amount. The process varies depending on whether you were overpaid as an SSI or SSDI benefits recipient. Heres a look at the repayment process for both categories.

Repayment for SSI Overpayments

If you were overpaid as an SSI recipient and still receive SSI benefits, SSA will withhold 10% of your SSI benefits every month. This deduction will begin 60 days after you receive the overpayment notice. You can use the waiver or change in repayment form linked above to request a lower deduction percentage.

Repayment for SSDI Overpayments

The repayment method for SSDI recipients is different. If you are overpaid as an SSDI recipient and are still receiving SSDI benefits, SSA will withhold the full amount of your benefits every month. This will continue until the full overpaid amount is recouped by the agency. You can request that a lower amount be deducted each month. This request will be subject to SSAs approval.

Read Also: How Does Disability Lawyer Get Paid

What Is An Overpayment Of Social Security Disability Benefits

Home»Blog Archives»Social Security Disability»What is an Overpayment of Social Security Disability Benefits?

When you are receiving Supplementary Security Income benefits or Social Security Disability Insurance benefits, it is possible for the Social Security Administration to overpay you. Overpayment is when SSA pays you more than what you have been entitled to as per SSA rules.

Overpayments can become quite a hassle for you as an SSI or SSDI benefits recipient. This is why it is important to understand why overpayment occurs in the first place and your options once you have been overpaid.

Ssa Notice For Overpayment And Deadlines

If you were overpaid while receiving SSDI or SSI benefits, SSA will send you a notice of overpayment. The notice confirms that an overpayment has occurred and also explains what caused the overpayment in the first place. SSA will then start deducting the overpaid amount from your SSDI benefits 30 days after the receipt of the notice, or from your SSI benefits 60 days after you have received the notice. You typically have a 60-day window after the receipt of the notice to respond to it.

Read Also: How To Get Disability For Anxiety

Your Options After Receiving A Social Security Overpayment Notice

When you receive an overpayment notice from Social Security, you can respond in several ways. If you agree that you were overpaid and you’re still receiving SSDI or SSI benefits, you can simply allow the repayment terms in the notice to take effect. If you’re no longer getting Social Security benefits or you want to repay the entire overpayment in one lump sum, you can do so in one of the following ways:

- Pay the balance by credit card, debit card, or electronic check from your bank account on the pay.gov website .

- Use your bank’s online bill pay feature to make a payment to the “Social Security Administration.”

- Send the SSA a check for the entire amount of the overpayment within 30 days.

If you can’t repay the overpayment within 30 days , you have three options. You can:

- appeal the overpayment

The overpayment notice will include instructions for each option.

What Is A Long

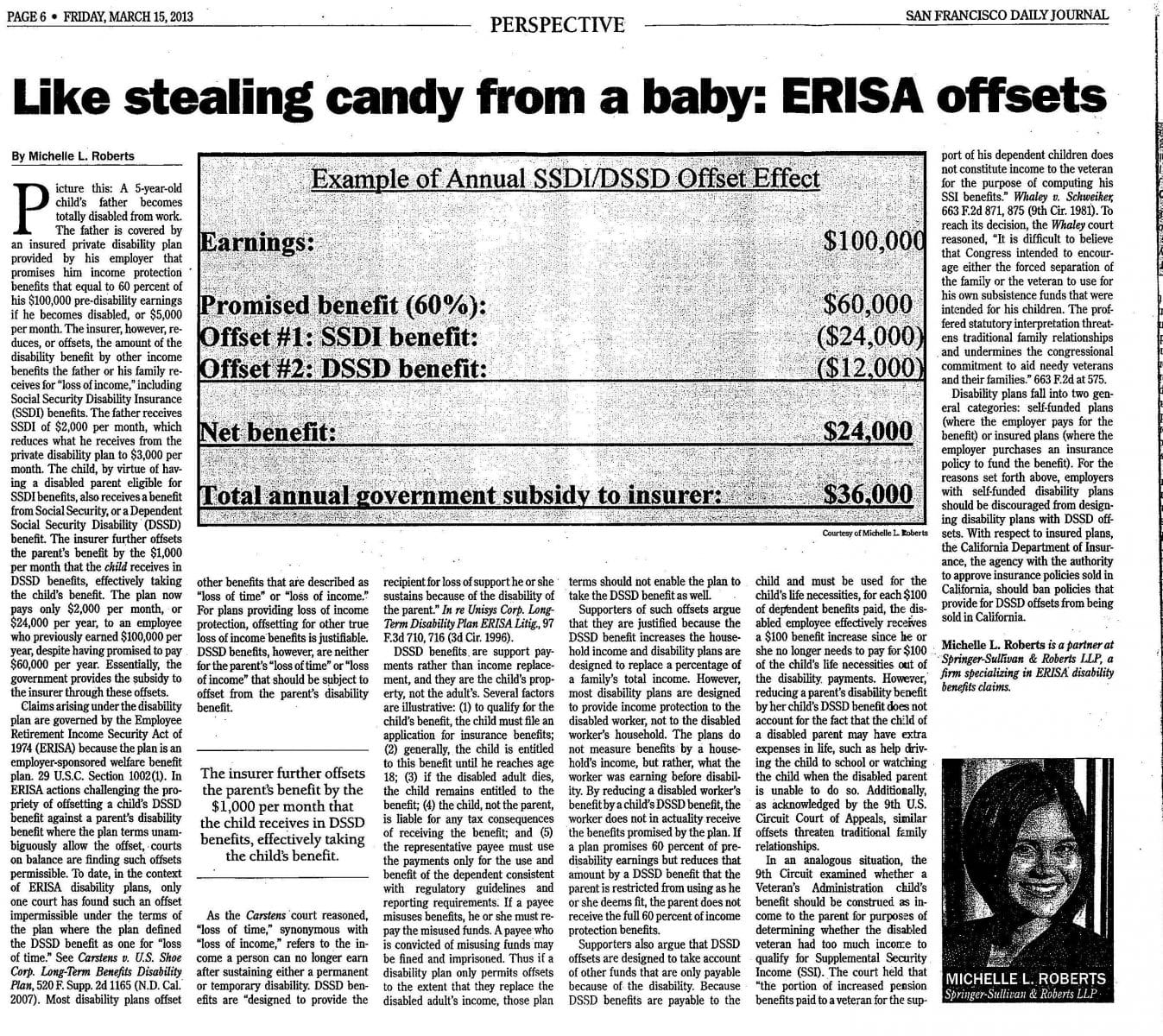

In many cases, the offsetting income is not immediately applicable and therefore not initially deducted from your monthly benefits.

Lets take an example with these facts:

- You receive $2,500 per month for long-term disability benefits.

- You have been receiving these benefits for a period of 24 months

- You were recently awarded social security disability benefits paid in the amount of $1,000 per month

- The SSDI award found you disabled as of 18 months prior to the decision

- You will receive a lump-sum payment from social security of approximately $18,000 .

According to the terms of the long-term disability insurance policy, you will have been overpaid by the insurance company by $18,000.

How is this? Because the policy calculates the amount payable as your maximum benefit minus any offsets.

Also Check: How To Apply For Veterans Disability

Repay Your Social Security Overpayment Online

- Before You Begin

- Review & Submit

- You will need your remittance ID in order to repay your Social Security overpayment on Pay.gov.

- Your remittance ID is displayed on the first page of your overpayment notice and at the top of the payment stub.

- Your Remittance ID will change for every overpayment notice you receive, so if you have more than one overpayment, make sure to use the remittance ID from the most recent notice for the overpayment you intend to repay.

- Please do not enter your Social Security Number or BNC in the Remittance ID fields. Only the Remittance ID will ensure proper posting of your payment.

- Do not use this form to make a payment to Social Security Administration for any reason other than to repay an overpayment.

- Please allow up to five business days for processing.

- Do not use this form to make payments to other federal agencies. If you need to make a payment to another agency, please return to the Pay.gov home page.

Accepted Payment Methods:

With an account you can:

- See the payments you made since you created an account.

- Store payment information so you don’t have to re-enter it.

- Copy a form you already submitted the next time you need to make a payment.

To take advantage of these benefits, you can or Create an Account . To continue as a guest user, click the ‘Continue to the Form’ button.

How Can I Respond To A Notice Of Overpayment

You have three options to respond. They are:

- File a Request for Reconsideration If you disagree with the overpayment or believe that the amount is incorrect. This seeks to have the amount of the overpayment computed again.

- File a Request for Waiver If the overpayment was not your fault and you cannot repay it or repaying it would be unfair. This seeks to have the overpayment forgiven.

- Negotiate a Payment Plan If you do not dispute the overpayment, you need to work out a payment plan.

Also Check: How Much Money Can You Make On Disability Social Security

Retainer Fees For Overpayment Cases

When attorneys take Social Security overpayment cases, they will almost always ask you to pay a retainer fee upfront before they will start work. A retainer represents an estimate of the number of hours it might take the attorney to work on your case. For example, if an attorney thought it would take him 15 hours to handle your overpayment case, and his usual rate is $200 per hour, then he might decide to charge you a $3,000 retainer fee before beginning work on your case . If he spends more than 15 hours, you will owe him $200 per hour for the additional work. If he spends less than 15 hours, he will return money from your retainer to you at the end of the case.

Attorneys in Social Security overpayment cases are conscious that their clients are usually lower-income individuals due to their disability, and they know that it might be hard for the client to pay the attorney’s bill. By asking for a retainer, they can assure themselves that the money to pay their bill exists and will be available at the end of the case.

Attorneys must hold their retainers in special bank accounts called client trust accounts. After the attorney has completed all of the work on your case, he will submit a petition to Social Security to review the fee agreement and approve his fee. Once Social Security approves the fee , the attorney can take money to pay the fee out of the trust account.

What Social Security Will Do When An Overpayment Is Found

If the SSA determines that you’ve been overpaid, the agency will send you a notice telling you how much you were overpaid and why you weren’t entitled to the amount of money you received. Social Security will ask for a full refund within 30 days of the notice.

If you’re currently getting SSI and you don’t pay back the overpayment in full, the overpayment notice will propose deducting money from your SSI monthly benefit until you’ve repaid the entire overpayment. The notice you receive from Social Security will include the date when the withholding will start .

If you’re currently receiving SSDI and you don’t back the overpayment in full, Social Security will stop paying your benefits until the overpayment is paid off. The SSA will begin holding back your benefits 30 days after the date of the overpayment notice.

The overpayment notice you receive will also explain how you can appeal the overpaymentthat is, ask Social Security to review and reconsider whether there was in fact an overpayment. The letter will also tell you how to ask for a waiver so that you might not have to pay all or some of the money back.

Also Check: Do Spouses Of 100 Disabled Veterans Get Dental Benefits

So What Are Your Options For Repayment Of Disability Benefits

If you remain eligible for the long-term disability insurance benefits, you can ask that the insurer apply your currently due amounts to the overpayment.

While it is not ideal because you are losing out on much-needed funds, you may often have ancillary benefits dependent upon you remaining on long-term disability insurancesuch as medical, pension, or waiver of premium insurance.

If the long-term disability insurance company is demanding repayment either because you are no longer on benefits or because they claim you need to repay to stay on benefit, you may be able to say Leave Me Alone and mean it.

Overpayments The Social Security Administration Wants Back

There are several reasons why you might owe the Social Security Administration money. This happens when it is determined that at some point in the past you received money from the Social Security Administration that you were not rightfully due. Sometimes this is the case when you have received disability benefits in the past, and it was later determined that you were working while you were receiving disability benefits. This is why it is always so important to report your earnings to the SSA. If you are working while receiving disability benefits, then you need to go through the SSAs Ticket to Work program. This program has strict requirements that you need to carefully follow if you want to work while receiving disability benefits.

If you are awarded disability benefits on your current application and your claim is awarded, then you will be required to pay back your overpayment out of your monthly disability checks. You can opt to pay the total amount, or in many cases the SSA will agree to reduce your monthly checks by a set percentage until your overpayment is paid back. It is typical for instance that an SSI check will be reduced by 10%.

Recommended Reading: Protection And Advocacy For Persons With Disabilities

Is There A Time Limit For Filing These Requests

Follow the time limits given in your Notice of Overpayment. Generally, you have only 60 days from the date of the Notice of Overpayment to file a Request for Reconsideration. If your request is late, tell them what good cause reason you have. However, you may file a Request for a Waiver at any time.

When Both Appeal And Waiver Requests Are Denied

SSA will try to recover the overpayment from you. It usually does this by reducing the amount you get each month.

If you get SSI, SSA can lower your benefits by up to 10% to recover the overpayment. The current SSI benefit is $783 per month. The most SSA could lower your benefit by is $78.30 per month. If you get SSDI, SSA will lower your monthly benefit to $0 until the overpayment has been paid back.

SSA will ask you to repay the overpayment within 30 days. If you cannot afford to pay the full amount all at once, you can ask SSA to pay back the overpayment in installments.

If you do not repay the overpayment, SSA may do one or more of these:

-

Garnish your wages

-

Reduce the overpayment amount from your tax refund

-

Reduce future SSA benefits may you receive, including retirement benefits

-

Report your nonpayment to credit bureaus

You can ask SSA for a compromise or change in repayment rate.

Asking for a compromise means asking to pay SSA less than the full amount of the overpayment. SSA will not compromise the overpayment if you still have the money that was overpaid, or they found you were at fault in causing the overpayment. You can make an offer of compromise in writing and give it to your SSA office.

Asking for a change in repayment rate means asking SSA to collect the full overpayment but in smaller amounts at a time. You can ask for a change even if you agree that you were overpaid and with the amount of the overpayment.

Don’t Miss: Reasons For Short Term Disability