What If You Already Have Disability Insurance Through Work

Many Canadians havedisability coverage from their employers, but it might not be enough to cover your lost income. It might be a good time to lookathow much coverage you have through your employer.

- Footnote 1

- 1 Canadian Institute of Actuaries 86-92 & 2012 Society of Actuaries Individual Disability Experience Committee Table. These examples are for illustrative purposes only. Situations will vary according to specific circumstances. Actual amounts are subject to your age and occupation. Some limitations apply. This information is general in nature, and is intended for informational purposes only. For specific situations you should consult the appropriate legal, accounting or tax advisor.

How Much Will It Cost To Sue My Insurance Company

Roger Foisy, as do most disability insurance lawyers, works on a contingency fee basis. This means that the lawyer only collects their legal fee if they are successful in your claim. In addition, Roger R. Foisy Professional Corporation offers an initial free consultation to potential clients. For a helpful explanation on how fees are determined please see my video blog How Ontario Injury Lawyer Fees are Determined.

Questions About Disability Benefits

Your benefits are generally based on a percentage of your monthly income at the time you become disabled. Please refer to your benefit booklet to confirm your coverage, which can be found on our plan member website.

We will mail a slip annually, provided the benefits you are receiving are a taxable income. To confirm this, you can reference your benefit booklet or ask your Group Administrator.

No. Any medical information obtained by your Disability Claims Specialist is strictly confidential and will not be shared with your employer unless authorization or consent is provided.

During your claim, you are required to maintain contact with your Disability Claim Specialist and Human Resources Representative. Some examples of your responsibilities include, but are not limited to:

- Providing updates regarding your situation

- Providing updates regarding your contact or banking information

- Participating in discussions regarding your return to work, which may include returning to modified work that is deemed reasonable based on your functional status

Long Term Disability payments are made once a month via direct deposit. Short Term Disability payments are made weekly, either by cheque or via direct deposit.

Read Also: Omaha Mutual Short Term Disability

What Are The Pros And Cons Of Short

At Bryant Legal Group, we know how short-term disability benefits can provide much-needed peace of mind and financial security while you deal with a disabling illness, injury, or chronic condition.

However, short-term disability insurance policies have their imperfections too. If you dont understand your plans shortcomings from the beginning, you may have unpleasant surprises later on.

Here, Bryant Legal Groups team of respected short-term disability lawyers outlines the power and challenges of short-term disability coverage.

Read Also: Discrimination Against People With Disabilities

What Happens At The End Of The Coverage Period

Some disability insurance policies have options to convert them to long-term care coverage at the end of the coverage period. You would typically need to be between the ages of 55-65 when your coverage period ends to take advantage of this option. It activates in your twilight years if you need assisted-living options, whether in your own home or in a group setting.

Read Also: Independent Living Programs For Adults With Learning Disabilities

Insurance Is About Risk Not Return

Like with term life insurance, disability insurance is all about mitigating risks that you cannot afford to self-insure against. It doesn’t make sense to calculate your return because you really do have a need for this insurance. If you become disabled as a resident or young attending , it is a financial catastrophe. Even if the insurance costs twice as much, that doesn’t change your need for it.

Do I Lose My Life Insurance If I Use My Disability Insurance

Life insurance and long-term disability coverage both provide income protection. However, they still remain two separate policy types.

For life insurance coverage to pay out ones beneficiaries, the insured person needs to be deceased. In contrast, disability payouts can only be paid to a living policyholder.

Receiving a disability insurance benefit should not interfere with your life insurance coverage as long as you dont stop paying your life insurance premiums.

Some life policies give you the option to add optional riders to your life insurance policy. These riders can provide you with variations on disability insurance coverage. For example, an accelerated death benefit rider will allow you access to all or a portion of your death benefit in the event that you develop a disabling or terminal illness.

Recommended Reading: 100 Disabled Veteran Education Benefits

Disability Insurance Could Provide Enough Income To Cover Bills While Recovering

Hopefully, if you do need disability insurance, it isnt a permanent disability. Most disability insurance pays around 60% of your income. So if you normally make $4,000 per month, your disability insurance would pay $2,400 per month. That is a long-shot from what you made before but hopefully is enough to get by when factoring in emergency savings.

The Social Security Administration says that about 25% of people who are 20 years old today will be disabled at some point before reaching age 67. Thats too high of a chance to ignore.

Read more:Emergency Funds: Everything You Need To Know

The Financial Strength And Reputation Of The Company You Buy From Matters

When you purchase disability insurance, the company you buy from is making a long-term commitment to you. If you become disabled, there is a chance you will receive benefits for an extended time period. So, it makes sense to buy from a company with experience, financial strength, and a solid reputation. Talk to financial professional to find out if disability insurance should be included in your financial plan.

Read Also: How Much Is Disability In Illinois

# 2 Residents Get Disabled

The most important reason to buy a policy in residency is that you may get disabled during residency. It happens all the time. The whole point of a policy is to protect your income in the event of a disability. While most 17-year-olds think they’re invincible, a 28-year-old resident taking care of ill and injured people all day should know better.

Coverage Is Not Offered By Your Employer

Though both long-term and short-term disability insurance are available through many employers, you should never assume that they are. As I wrote at the beginning, most people are most concerned with health insurance and retirement plans. Disability insurance is often considered to be a throw-away benefit, especially if youre young.

Never assume that you have short-term disability insurance at work. Find out if you do, and what kind of benefit provisions you have. If not, a private plan is an outstanding idea.

Recommended Reading: Applying For Disability New York

What Is Disability Insurance And How Does It Work

Lets say you suddenly fell ill or sustained an injury that prevented you from working and earning a paycheck. Would you be able to keep yourself afloat with the money in your emergency fund for three months, six months, 12 months or even longer?

If the answer to that question is no, then you need to think about getting a disability insurance policy in place.

Other Ways To Find Disability Insurance

The following programs also offer financial help in case of a disability, but they have limitations.

-

Social Security pays disability benefits, but its difficult and time-consuming to qualify, and the payments are low. The average monthly disability benefit in 2017 was $1,172.

-

State disability programs are offered in California, Hawaii, New Jersey, New York and Rhode Island. They provide short-term disability coverage, in most cases for up to six months, according to Life Happens, an insurance industry trade group.

-

Workers’ compensation insurance replaces a portion of income if youre disabled because of a work-related injury. All states require employers to have workers compensation coverage for their employees. Most long-term disabilities, however, are not the result of work-related injuries.

Although these programs can help, they dont fully cover the risks of losing the ability to work after an illness or injury. Disability insurance is the smart bet to provide a safety net for your future.

Also Check: Attorneys For Social Security Disability

Do I Need Both Short Term And Long Term Disability Insurance

As you can probably tell, short term and long term disability insurance policies are designed to work together. Short term disability is intended to cover you immediately following a serious illness or injury, and long term disability insurance is intended to maintain income replacement if your condition keeps you out of work past the end of your short term disability benefit period, even to retirement, depending on your plan. If you have both short term and long term disability policies in place, short term disability will pay you benefits during the waiting period before your long term disability coverage begins, at which point youll transition from one policy to the next to receive benefits. For that reason, it makes sense to have both policies to help ensure an unexpected health problem wont derail your financial confidence for a few months or for several years.

Why Should Pediatricians File For Long

Pediatricians are physicians who specialize in the healthcare of infants, children, and young adults. As mentioned, they are a vital part of the community. Parents bring their children and trust them to take care of them. If a pediatrician were to try and work through a disability, they may make a mistake. Moreover, they could place a patient in danger by giving the wrong medical advice, prescribing the wrong medicine, or reading medical files wrong.

In addition, pediatricians spend between 9 and 11 years studying before they may begin practicing medicine. Others may study for upward of 17 years if they want to pursue a career in a subspeciality of pediatric medicine. A disability can sideline a pediatricians career they have worked so diligently to achieve.

Long-term disability benefits can protect a pediatricians income. Usually, coverage protects between 60 and 80 percent of their pre-disability income. Of course, this percentage will vary from policy to policy. Thus, it is important to thoroughly read your policy to fully understand the breadth of its coverage.

Recommended Reading: Va Disability Rates By Condition

Does Long Term Disability Provide Extended Medical Or Dental Care As Well

No, long term disability policies are designed to only provide wage replacement. However, if you have a benefit plan with your employer and are unable to return to work because of a long term disability then you may be able to get a benefit continuation paid by your employer while you are on long term disability.

How Do I Get Disability Insurance

You can purchase disability insurance either as an individual or through your employment.

Your employer may offer short term disability insurance or long term disability insurance or both as part of their employee benefits package. Self-employed individuals may be able to buy disability insurance through a professional association. If group disability insurance is available, this is an attractive option because the premiums are typically lower than individual plans. Sometimes, the coverage may even be available for free.

Keep in mind that if your employer pays the insurance premiums, the benefits will be taxable. For example, if your group policy replaces 60% of income, you may actually end up with 45% or 50% of your earnings, depending on your tax bracket. This is one of the reasons why relying solely on your group disability insurance plan may not give you adequate protection. The other reason is lack of portability. Group disability insurance is tied to your job. If you change jobs, the coverage will end.

In contrast, the payout of an individual policy is not taxable since you pay the premiums with after-tax dollars. As such, you know exactly how much money you will receive on a monthly basis. Also, unlike a group policy, you can customize an individual disability insurance plan. You can tweak the coverage to meet your specific needs by adding relevant riders.

Don’t Miss: Can You Get Disability For Ibs

What Kinds Of Conditions Can Qualify For Ltd Benefits

Some examples of conditions that can qualify for long-term disability include:

The above list is only a sampling of the wide range of conditions that can disable a person. In short, if a condition makes it impossible for you to work for an extended period, then you may qualify for benefits. However, to receive an approval for your claim, you must prove that your condition disabled you per the definition of disability within your policy.

How Much Do They Cost

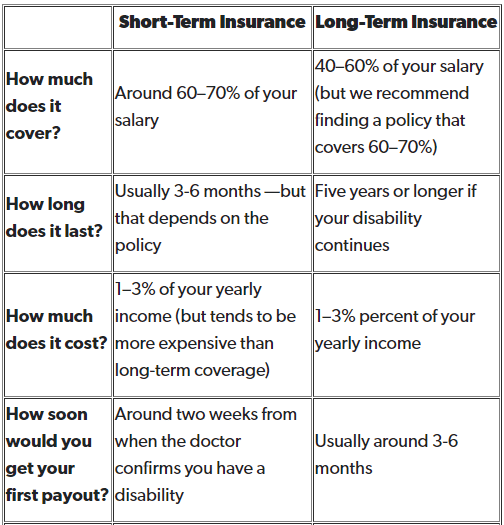

The cost can vary greatly depending on your age, your profession, and the options you choose. Generally speaking, an individual long-term policy can cost anywhere from 1% to 4% of your annual income2. Short-term disability can be even more costly for individuals to purchase, which is why its usually provided as a group employment benefit. So, is it better to have short-term or long-term disability? The answer is that its usually a good idea to consider both. To understand more about what goes into calculating your premiums, take a look at The cost of disability insurance.

Don’t Miss: How To Apply For Disability In Arkansas

Do I Need Disability Insurance

TBH thats a personal question only you can answer.

But! As your honest advisor, lets help you think this through. No crazy math calculations are needed for this one. Disability insurance is a must-have for anyone depending on their regular income to pay for rent or mortgage costs, those who need a paycheque to support their family or provide for other daily living expenses, those who have limited access to savings or investments to maintain their current lifestyle for an extended period of time, or any other financial obligations. If youre one of the rare people who could live the rest of your life in comfort off of your current savings, then maybe this product isnt for you.

The Occupational Duties Of A Pediatrician

When filing a long-term disability claim with your insurer as a pediatrician, it is important to be cognizant of two points: the material duties of your job and how your insurer will determine the material duties of your job.

Pediatricians have several occupational duties. These duties can include performing routine health and wellness checkups, conducting physical exams, tracking a childs development over time, answering questions parents may have about their childrens health, prescribing medication, administering vaccines, and referring specialists as necessary. Of course, these duties are just a snapshot of the full range of a pediatricians responsibilities.

It can also be beneficial to obtain a copy of your job description. For example, showing up to work consistently on time is a duty that you may not think to mention. Yet if you suffer from a debilitating condition, it may become impossible to reliably show up to the office every day.

Moreover, you may specialize in a certain area of pediatrics, such as neonatology, pediatric cardiology, pediatric oncology, pediatric surgery, pediatric pulmonology, and others. It is important to demonstrate how your condition prevents you from performing your specialized duties as well.

The O*Net Database is a much more detailed summary of the duties and skills a pediatrician has in their job. However, you should still make note of your specific duties when you file your claim to ensure that nothing is overlooked.

Recommended Reading: Social Security Disability Earnings Limit 2022

More Opportunities For Coverage

You can provide Short Term Disability insurance for your employees. You can also offer them the option to increase their coverage at group rates. Consider adding a Short Term Disability plan for buy-up.

Even if youre not providing group insurance, your employees can still take advantage of group rates when buying their own coverage or coverage for their dependents. Consider adding Short Term Disability insurance for purchase.

How Does A Policy Work

There are two types of disability insurance:

Short-term policies step in for periods of up to six months when you cant work. They typically pay some 60% to 80% of your pre-tax salary to approximate your net take-home salary.

LTD policies often pay 60% to 70% of your income. Common policy periods are two years, five years or 10 years. Some policies may continue paying until you reach the traditional retirement age.

The average claim period for a long-term policy is around 34 months, according to CDA.

Also Check: New York State Disability Benefits

Protect Your Earnings With Disability Coverage

Its important to consider what can happen if an injury or sickness hinders your ability to work. Especially in the prime of your income-earning years when you are more likely to easily qualify for disability coverage at a lower premium.

PolicyAdvisor has years of experience helping Canadians with disability insurance and can help you understand your current disability benefits and assist you in filling any gaps in coverage.

Ok With Social Security Disability

Most disability insurance agents like to gloss over the fact that we all have a disability policy. It isn’t a particularly great one and the benefit isn’t very high, but there is a policy included in your Social Security benefits. If you are particularly frugal or have a significant nest egg already AND you’re OK that this policy is much less likely to pay than a typical individual disability policy, then it may make sense to skip a disability policy. But when I say frugal, I really mean it. I recently saw my Social Security disability benefit and it’s less than $3,000 a month. That’s not going to cut it for most attendings, including me.

My family relies on both my income and my belaying skills. I back up both whenever possible.

You May Like: Disability Pass At Disney World