There Are Two Types Of Disability Policies: Short

Disability policies have two different protection features that are important to understand:

What Type Of Disability Insurance Do I Need

Disability insurance is one of the most important parts of financial planning. While you may have enough of an emergency fund to cover a few months of expenses if you were unable to work, most people cannot afford to not work for much longer particularly if you cannot work for years.

If you can afford to purchase both types of disability income insurance, then it often makes sense to purchase both short and long-term disability plans. In this way, you will have insurance coverage for relatively short periods of time when you cannot work and have the peace of mind to know that you will have income replacement if you are unable to work for much longer.

If two disability insurance policies are not in your budget, then your best option is to purchase an individual policy for long-term disability coverage. These types of plans are often more expensive but are a more substantial financial safety net. At the same time, focus on building up your emergency fund so that you can cover your basic expenses if you have a shorter-term illness or injury.

Whats The Difference Between Long Term And Short Term Disability Insurance

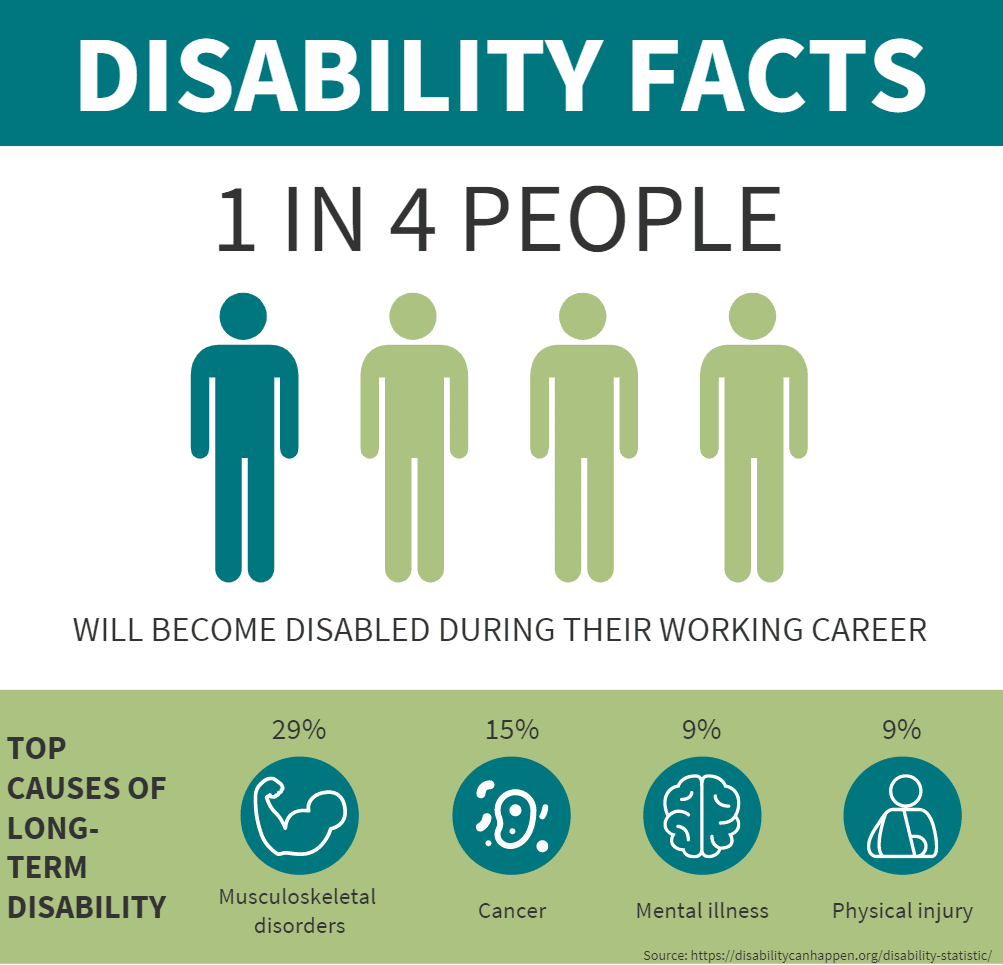

Most people think disability is something that happens to other people, but its more common than you may think. More than a quarter of todays 20-year-olds can expect to be out of work for at least a year before they reach retirement age due to a disabling condition.1 And some of the most common reasons for disability claims include pregnancy, mental health issues and cancer2 conditions that might not be top-of-mind when you think about disability. Thats why its so important to protect yourself in case an unexpected illness or injury keeps you out of work for an extended period of time. But before you can choose the right protection for a potential disability, you first need to understand the difference between the two primary types of disability insurance: short term and long term.

Read Also: Job Skills Training For Adults With Disabilities

What Is Disability Insurance

Disability insurance is income protection.

Its insurance that pays you, the policyholder, a regular paycheck when youre hurt or sick and cant work.

It protects your income from the very real possibility youll be disabled for a period of time during your career, whether due to injury or illness.

If you have disability insurance through your employer, you may pay for the policy, your employer may pay for the policy, you may split the costbut either way, youre the one whos paid if you cant work because of disability.

Which Is Better To Have

The Texas Medical Association has determined that an individual’s average length of a disability insurance claim lasts 31.6 months. Itâs apparent that a short-term disability policy with a benefit period of 3-6 months is not going to be sufficient to protect someone for the average length of disability. Very few people have two or more years of liquid savings to draw upon if they have short-term disability insurance but donât have long-term disability coverage.

A good question to ask yourself: âIf I was to become permanently disabled, could I cover my expenses until retirement?â Your answer to this question is the best determinant of your need for long-term disability insurance.

The information and content provided herein is for educational purposes only, and should not be considered legal, tax, investment, or financial advice, recommendation, or endorsement. Breeze does not guarantee the accuracy, completeness, reliability or usefulness of any testimonials, opinions, advice, product or service offers, or other information provided here by third parties. Individuals are encouraged to seek advice from their own tax or legal counsel.

Don’t Miss: Short Term Disability Insurance Individual

Whats The Difference Between Long

Have you just started a new job, and heard a lot of different terms in orientation about disability? Are you faced with the possibility of being on disability, and dont understand everything? At the Herren Law Firm, we understand the process of disability insurance and filings, and can help when the time comes.

Long Term Disability And Its Benefits

Long Term Disability can be used following Short Term Disability plans or alone.

Long Term Disability coverage provides wage replacement that is between 50-70% percent of your earnings before a non-work related injury impacted your ability to work.

If a LTD plan is offered through your employer, it is very important to sign up during the initial enrollment period, when you cannot be denied coverage for a pre-existing condition. Read the plan summary for definitions detailing what is covered as well as specific details required by your plan.

Most LTD plans include a waiting period that lasts from 3-26 weeks, which coincides with the length of time you can be paid for STD benefits, before you are eligible to begin receiving LTD benefits.

In order to continue to qualify for benefits detailed medical information must be provided to the LTD carrier initially and then throughout the life of the claim as requested. Failure to do so will result in termination of your benefit. If you are considered disabled longer than 90 days, most policies do not require you to continue paying premiums.

Most LTD policies have two definitions of disability: Own Occupation and Any Occupation.

- During the Own Occupation period, benefits are payable if the employee is unable to perform his or her regular job or a similar job. This period can last up to two years.

You May Like: Power Of Attorney For Disabled Adults

Should I Purchase Short

Although illnesses and injuries can’t be predicted, they’re likely to affect your workplace at some point in the future. For comprehensive protection, employers may consider offering a combination of both short-term and long-term disability insurance to employees. These policies are an important complement to any group health insurance plan or general liability insurance plan and help to minimize the impact of debilitating illnesses and injuries on both your employees and your business.

Tags

Disability Insurance And Paid Family Leave Benefits

The California State Disability Insurance program provides short-term Disability Insurance and Paid Family Leave wage replacement benefits to eligible workers who need time off work.

You may be eligible for DI if you are unable to work due to non-work-related illness or injury, pregnancy, or childbirth.

You may be eligible for PFL to:

- Care for a seriously ill family member.

- Bond with a new child.

- Participate in a qualifying event because of a family members military deployment to a foreign country.

To file for benefits, read messages from the EDD, submit online forms, or manage your profile, access your SDI Online account.

Note: It may be necessary to send some documents via U.S. mail.

Note:On February 9, 2022, Governor Newsom signed Senate Bill 114 which requires employers with 26 or more employees to provide Supplemental Paid Sick Leave for specific COVID-19 related reasons. The law is retroactive to January 1, 2022, and will end September 30, 2022.

New: On September 29, 2022, Governor Newsom signed Assembly Bill 152 which extends the COVID-19 Supplemental Paid Sick Leave until December 31, 2022.

Also Check: How To Disable Voiceover On Iphone

Whats The Difference Between Short Term Vs Long Term Benefit Periods

The biggest difference between short term and long term disability insurance is the period of time youll receive benefits if youre unable to work. This period is called the benefit period. As the name indicates, short term disability insurance is intended to cover you for a short period of time following an illness or injury that keeps you out of work. While policies vary, short term disability insurance typically covers you for a term between 3-6 months. On the other hand, long term disability is intended to provide benefits for a longer period, and benefit periods for long term disability insurance are usually stated in years: 5, 10, 20 or even until you reach retirement age, depending on your plan.

Ready To Apply Were Here To Help

If you are unable to work due to a disability, you may be overwhelmed by the thought of applying for insurance benefits. The paperwork can be daunting but you dont have to do it alone. Our law firm is here to help.

Bross & Frankel is committed to helping individuals with disabilities get the benefits that they need. With decades of combined experience, we have the knowledge to help you achieve the best possible outcome for your disability application. To learn more or to schedule a free claim review with a New Jersey disability benefits lawyer, call us today at or fill out our online contact form.

You May Like: 100 Disabled Veteran Moving Assistance

How Much Does Short

Short-term disability pricing varies based on the employees age and weekly compensation. But according to the U.S. Bureau of Labor Statistics, the approximate cost for employers to provide both short- and long-term disability insurance to all private sector workers is 1% of total compensation cost, or $624 per full-time worker, per year.1

In Addition To The Traditional Disability Policies There Are Several Options You Should Consider When Purchasing A Policy:

- Additional purchase options Your insurance company gives you the right to buy additional insurance at a later time.

- Coordination of benefits The amount of benefits you receive from your insurance company is dependent on other benefits you receive because of your disability. Your policy specifies a target amount you will receive from all the policies combined, so this policy will make up the difference not paid by other policies.

- Cost of living adjustment The COLA increases your disability benefits over time based on the increased cost of living measured by the Consumer Price Index. You will pay a higher premium if you select the COLA.

- Residual or partial disability rider This provision allows you to return to work part-time, collect part of your salary and receive a partial disability payment if you are still partially disabled.

- Return of premium This provision requires the insurance company to refund part of your premium if no claims are made for a specific period of time declared in the policy.

- Waiver of premium provision This clause means that you do not have to pay premiums on the policy after youre disabled for 90 days.

Don’t Miss: Best States For Disability Benefits

Differences Between Short And Long

Waiting periods

Disability insurance policies usually have a waiting period, sometimes known as an elimination period. This means you have to wait a certain amount of time before you begin receiving payments. The waiting period starts at the onset of your disability. You must wait the specified amount of time until you are eligible to receive benefits.

Short-term benefits might be available immediately, or very soon after you become disabled. Think 1-2 weeks, maximum. Keep in mind, the length of the waiting period might be different if you are sick as opposed to injured. Any waiting periods are set out in your group insurance policy.

Long-term disability waiting periods are longer, as you might expect. They can be anywhere from 3 to 6 months. If your insurance plan includes both short- and long-term disability, they will likely be set up so that the long-term begins when the short-term ends.

Length

The most obvious difference is the one thats right there in the name. Short-term disability benefits cover a shorter period of time. Depending on the plan, the amount of time you can receive benefits is usually 3-6 months. This is the maximum amount. If you have to remain off work for longer, you will need to seek out different disability benefits. Usually, if your place of employment has short-term disability benefits, they will have long-term to follow when you run out.

Payments

Definition of Disability

My Employer Offers Long Term Disability Insurance But Not Short Term Disability Insurance

Some employers offer their employees long term disability insurance coverage, but not short term disability insurance coverage. Again, employers are not required to offer any coverage at all. If your employer offers long term disability insurance but not short term disability insurance, you can purchase your own policy through an insurance agent. Additionally, most disability policies provide replacement of a percentage of your pre-disability earnings. It is also possible to purchase a supplemental long term disability insurance policy that will make up the difference. For example, if your employers plan pays 60% of your wages if you become disabled, you can purchase a separate plan to pay the remaining 40% of your pre-disability wages.

Don’t Miss: Hands Free Shoes For Disabled

How Long Do Benefits Last

The amount of time you can receive disability benefits is called the benefit period. Short-term disability insurance is meant to cover you for a short period of time following an illness or injury that keeps you out of work. It typically provides benefits for 3-6 months.

Long-term disability insurance is meant to provide benefits for a longer period like 5, 10, 20 years, or even until you reach retirement age, depending on your policy.

The average long-term disability claim is about 3 years, so a problem with only having short-term disability insurance is that the coverage isnt enough for a lot of people. A short-term policy can be a good supplement to a long-term policy by paying you benefits during the waiting period before your long-term coverage begins.

How Long Does Long

Once long-term disability benefits have been approved, an employee can continue to receive benefits for the length of the policy term or until they return to work. Most long-term disability plans provide coverage for 36 months, although some plans can provide coverage for up to 10 years or even for the life of the policyholder.

Don’t Miss: Social Security Disability Impairment Listing

How Much Do They Pay While Youre Disabled

One of the great things about both types of disability insurance is that they pay benefits directly to you, and you can use them to cover expenses however you like. Benefits will vary by policy, but most short-term disability insurance pays around 70% to 100% of your salary. If you rely on commissions or other non-salary bonuses for a significant part of your income, you may want to check with your employer to see if commissions and bonuses are covered. Sometimes, they are not.

Individual long-term disability insurance usually covers anywhere from 50% to 70% of your income, and it more often includes non-salary income in the calculation. In addition to providing coverage for a longer period, this difference makes it more effective for people with commission-based jobs or for those who are self-employed. Some long-term disability policies will also include partial benefits as you recover and return to work, to help ease the transition back.

Related: Can I get disability insurance if self-employed?

Whats The Difference Between Short And Long Term Disability Insurance Coverage

July 20, 2021 By Rich Frankel

Over the past year of the COVID-19 pandemic, Americans have become more aware of our own mortality than perhaps at any other point in recent history. While many of us are now more familiar with how quickly we could face serious or even life-threatening health problems, we may not realize how common disability actually is.

According to the Centers for Disease Control and Prevention , 61 million Americans or 1 in 4 adults live with a disability. These impairments include everything from physical health conditions to mental health issues that affect an individuals ability to work, take care of themselves, and perform basic life tasks.

One way to protect yourself financially is through a disability insurance policy. Disability coverage offers monthly benefits to policyholders who are unable to work due to an impairment. There are two primary types of insurance available: short-term disability insurance , and long-term disability insurance .

Read Also: Can You Get Disability For Hearing Loss And Tinnitus

Advantages And Disadvantages Of Long Term Disability Insurance

Long term disability insurance provides monthly payments in the event of a disability lasting six months or longer, and some policies provide benefits until the policy holder reaches the age of 75 or older.

The primary advantage of long term disability insurance is the peace of mind that comes with knowing that benefits of up to 70 percent of the policy holderâs salary will continue as long as a disability lasts. Additionally, long term policies usually allow for more options, such as coverage for hospital stays and adding supplemental insurance to increase monthly payments.

The main drawback of long term disability insurance is that long term policies cost substantially more than short term insurance. Furthermore, long term policies usually have a waiting period of between three and six months or longer before the insurance company begins paying benefits, leaving disabled individuals to pay their own expenses for the first few months of a disability. Finally, the payment plans of some long term disability policies may change after two years of continuous disability.

Because of these advantages and disadvantages, long term disability insurance is typically best for individuals who have savings or other insurance to cover the first few months of their disability, and workers who can afford higher premiums in exchange for long term benefits.

Donât Miss: 100 Disabled Veteran Dental Benefits For Family