What Qualifies For Short Term Disability Insurance

Short term disability insurance covers temporary injuries and illnesses that are less serious in nature. Like long term coverage, what qualifies for short term disability depends on the definition of disability, which varies from policy to policy. In general, eligibility for benefits is tied to your ability to perform the duties of your current occupation.

Your short term disability insurance policy may also require that you lose a certain percentage of earnings due to disability. During your short term disability leave, you may be required to provide the insurance company with updated medical information to verify your disability and continued eligibility for benefits beyond the initial approval of your claim.

In addition to injuries and illnesses that limit your ability to work, surgical procedures that are deemed medically necessary will qualify you for short term disability benefits. Some policies will provide benefits for bariatric weight-loss surgeries. Organ donation is usually covered as well. Purely cosmetic procedures will likely not be covered.

You may also qualify for benefits if prescription medications or medical procedures cause side effects that keep you from working.

Short Term Disability Insurance Means Planning For The Unexpected

Unexpected medical problems can interfere with your ability to work and earn an income. With short term disability coverage, life can go on as it should. Meaning you can focus on recovering, not your finances.

AdvanceCare covers your loss of income due to short term disability by paying you cash benefits until youre healthy to return working. Consider it insurance for your paycheck. This disability income provides a safety net for you and your loved ones.

Shoppers who are 65 or older are not eligible for this plan.

What to expect

Get A Helping Hand While You Recover

Even small injuries can interfere with your ability to work. For many people, unplanned time away from work can make it difficult to manage household costs.

When you’re recovering from a covered injury, illness or childbirth, the last thing you need is more stress. Short Term Disability Insurance can help you stay on top of medical costs, household bills and day-to-day expenses by replacing a portion of your normal income. The ongoing payments are made directly to you, so you can use them however you need.

Some of the top reasons our customers use this benefit:1

- Behavioral health

- Joint disorders

Short Term Disability Insurance is here to help with your income, so you can focus on getting better. See your HR representative for more information.

Read Also: How To Get Short Term Disability Approved While Pregnant

Sd Could Be A Boost For Smbs And Employees

Employees benefit faves shouldnt keep your small business from offering SD coverage. Heres why:

If youre already offering SD to your employees or arent yet convinced that you should, the question and answer segment below forms a complete guide to understanding how the benefit works.

Similarities And Differences Between Short

Short-term disability and the FMLA both offer some form of protection for employees who need to take a leave of absence from work, but each has its own considerations, terms, and requirements.

The conditions for taking short-term disability are typically quite different than FMLA qualifications. For example, the FMLA requires employment for 12 months and 1,250 work hours. If the employee is eligible for FMLA leave and works for a covered employer, they can take up to 12 weeks leave.

On the other hand, employees may only have to work for as few as 90 days to be eligible for short-term disability, although that amount of time can vary from employer to employer. Also, in some cases, short-term disability can last longer than the 12 weeks provided in the FMLA with some employers providing up to 26 weeks or more.

Another significant difference between short-term disability and FMLA leave is that short-term disability generally only applies to injuries and illnesses suffered by the employee, while the FMLA permits employees to take leave to care for family members with serious medical conditions in addition to their own medical concerns.

Also Check: Homeless Shelters For Disabled Adults

Making Sure Your Job Will Be There When You Return

State short-term disability programs offer wage replacement but they offer little to no job protection. You must apply for leave under the Family and Medical Leave Act or a state medical leave lawor rely on the Americans with Disabilities Act to ensure your employer will take you back after a period of disability. Read our article on keeping your job after disability leave for more information.

How Do You Receive Short

In order for you to receive your short-term disability insurance benefits, youllneed to submit your insurance claim to the relevant insurer. This involves the filling out a form that has to either be printed or filled online.

Youll need to describe your medical condition and any other related information. After that your physician will have to complete their section of the form. Once the claim form has been submitted, the insurance company will review your medical records and evaluate if it can be considered as a short-term disability.

Remember to keep all evidence as youll be asked for all forms of documentation.

Read Also: What Mental Disorders Qualify For Social Security Disability

What Information Must Employees Submit To Qualify And File A Claim For Sd

Employees must submit documented proof of their medical condition and inability to work from a physician.

Plan administrators, employers, or insurers have submission forms for filing claims. They review the forms and employees medical records to decide whether to approve or deny a claim.

Submission forms may vary by plan, but typically include:

- Employees contact information, job duties and pay

- Injury, illness and other medical details

- Physicians statement

- Employers statement

What Factors Affect The Cost Of Short

Several factors can influence the bottom line of your insurance bill:

- Your income: When you have a high salary, youll likely pay higher insurance premiums.

- Your add-ons: If you opt-in to additional benefits, you may have to pay extra.

- Your preexisting conditions: If you regularly smoke or drink alcohol, you might be more at risk for developing certain disabilities or illnesses. And, if you have preexisting conditions that might make you more prone to becoming injured or sick in the future, you may miss out on good health discounts or shortened elimination periods.

- Your line of work: Certain occupations are more dangerous than others. If you work at a construction site or on a fishing boat, for example, you are more likely to become injured than if you work at a quiet desk job. People with high-risk jobs like these may be charged higher premiums.

You May Like: Can You Get Disability For Congestive Heart Failure

Why Std Is Sold Separately From Ltd

If STD and LTD both do the same thing, why are they split into two types of policies which are often purchased differently? There are a few reasons.

For one, short-term disabilities are much more common than long-term disabilities, and coverage may be provided by the government. Also, people with temporary disabilities have different needs than those with more permanent disabilities. For example, in addition to pay replacement-related benefits, many group STD plans have a number of rehabilitation benefits and features.

Short-term insurance can also be sold more efficiently as group coverage. People at a given company in a specific industry are more likely to experience the same kinds of disabilities, so its easier for the insurance company to calculate the risk involved. And coverage doesnt need to be very personalized, because the desired outcome is the same every time: to get the disabled employee back to work with as little disruption as possible.

As a result, STD coverage is most often provided by employers, as an affordable or no-cost group benefit to all employees. STD and LTD benefits are taxable if the premium is paid for by your employer, and non-taxable if paid for on a post-tax basis.

Best Overall: Mutual Of Omaha

Mutual of Omaha

- No-exam policies available: Yes, for applicants ages 18-45 applying for up to $6,000 in monthly benefits

- Maximum coverage amount: $20,000 per month

-

Benefit periods range from six months to 10 years

-

Maximum monthly benefit of $20,000

-

Generous built-in policy benefits

-

No-exam underwriting available for some applicants

-

Pregnancy benefit

-

Coverage for mental or nervous disorders is limited without purchasing an additional rider

-

Partial disability benefits cost extra

-

Must contact an agent to apply

Taking the top spot for best overall short-term disability insurance coverage is Mutual of Omaha. This insurer provides up to 10 years of benefits , with some policies offering coverage as soon as 30 days after your eligible disability. Monthly benefits are available up to $20,000, and policies can be issued through age 61.

Mutual of Omaha has been around since 1909 and has an A+ financial strength rating from AM Best. It offers insurance coverage across the country, though not all policies are available in all states.

Short-term disability coverage through Mutual of Omaha is some of the most comprehensive and benefit-rich around. Policies come full of built-in benefits, such as a survivor benefit, waiver of premium benefit, guaranteed renewability, rehabilitation coverage, and up to six weeks of leave for maternity. Elimination periods are available in lengths of 30, 60, and 90 days. Longer elimination periods of 180, 365, and 730 days are also available.

You May Like: Can I Work While On Social Security Disability

Can You Collect Short

In some states, you can collect both short-term disability benefits and sick pay at the same time. But, you generally aren’t allowed to “double-dip,” although the rules vary by state. Instead, you collect a certain percentage of your salary from the state program, and you can make up the difference with your sick time or PTO , if you’ve accrued enough of it. Again, each state’s rules are different visit your state’s employment development department for more information.

How And How Often Will You Receive Payments

Be aware that if your employer works with an insurer to offer short-term disability benefits, then payments will often be administered by the insurance company. That means they might arrive in a different form or on a different schedule than youre used to. For example, when Tiernan used short-term disability, she was given a debit card that her short-term disability payments were added to. It was typically every 14 days that I was paid, she says. Then youd have to transfer the funds from that debit card to your bank account if that was your preference.

Don’t Miss: Can You Get Disability For Hearing Loss And Tinnitus

Best For Coverage Options: The Hartford

Hartford Life Insurance

-

Does not offer insurance for individuals you have to sign up through your employer

-

Difficult to estimate your personal premium until you contact your employer

-

Website not transparent about which preexisting conditions or exclusions would prevent you from receiving coverage

Founded in 1810 as a fire insurance company, The Hartford is one of the oldest insurance companies in the United States and has an A- AM Best rating. The company has a reputation for being an all-American insurer since it has provided coverage for national sites like the Hoover Dam, the Golden Gate Bridge, and the St. Louis Seaway. The Hartford helps cover important elements of your recovery, like supporting your return to the workplace and connecting you with mental health professionals. With these extra benefits, The Hartford provides an impressively holistic approach to short-term disability coverage.

The Ability Advantage portal lets customers manage their claims and monitor their account from their own computer. Where The Hartford really shines though is with its built-in features. While many companies provide you the option to select add-ons like premium waivers or financial advising, The Hartford offers these benefits for free.

Does Sd Cover Employees Who Become Ill With Covid

SD eligibility depends on a plans definition of disability, according to Ogletree Deakins, a global labor and employment law firm.

Employers are using a broad definition of disability, amending their SD policies or lifting the waiting or elimination periods to accommodate workers with COVID-19, the law firm reports.

If you fully fund your SD plan, Ogletree Deakins recommends vetting any changes with your insurance company beforehand, If you use a third-party administrator, the firm recommends that you make sure plan changes can cover employees with COVID-19.

All plan changes must comply with ERISA.

Also Check: How Much Is Full Disability

How Do Sick Time And Workers Compensation Coincide With Sd

SD differs from other types of medical leave because it covers only non-work-related illnesses and injuries. Workers compensation , for instance, pays the wages and medical costs of employees who become ill or injured on the job. Either states or employers provide WC coverage.

Employers may offer paid sick time and disability benefits in tandem, so that when one benefit ends, the other may kick in, if necessary.

SD plans may require employees to be off the job for a certain number of days before they can file a benefit claim. This requirement, known as an elimination period, discourages employees from filing for SD when using sick days is a more practical option.

SD differs from other types of medical leave because it covers only non-work-related illnesses and injuries. Workers compensation , for instance, pays the wages and medical costs of employees who become ill or injured on the job.

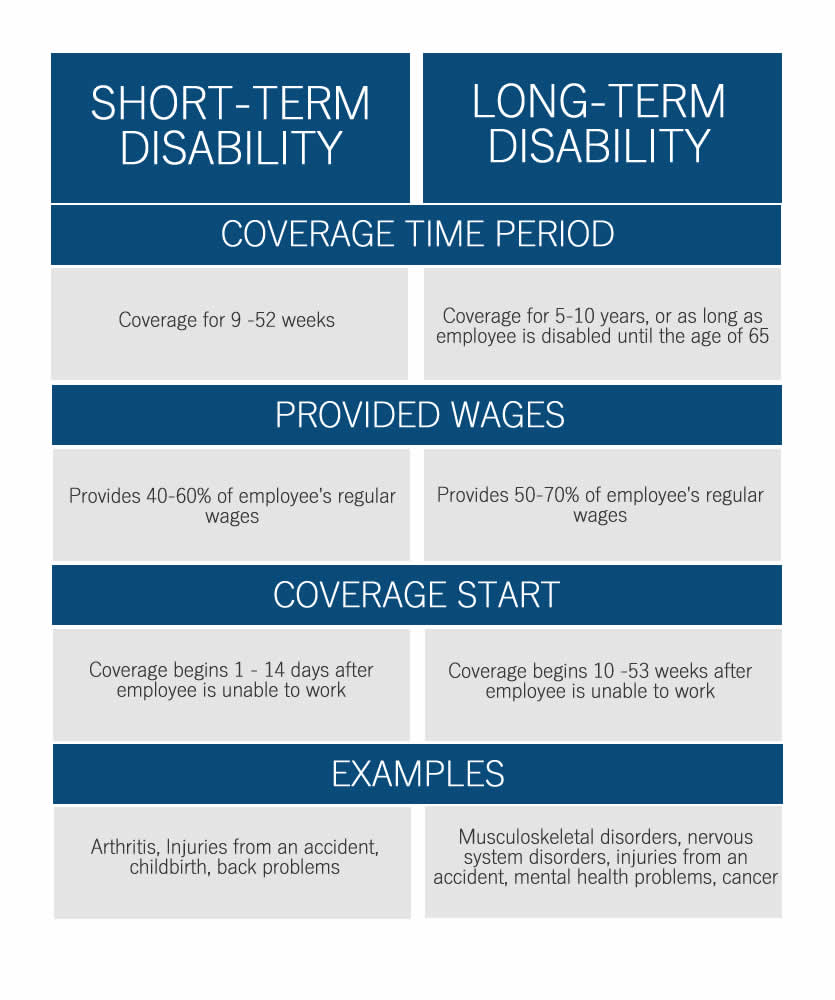

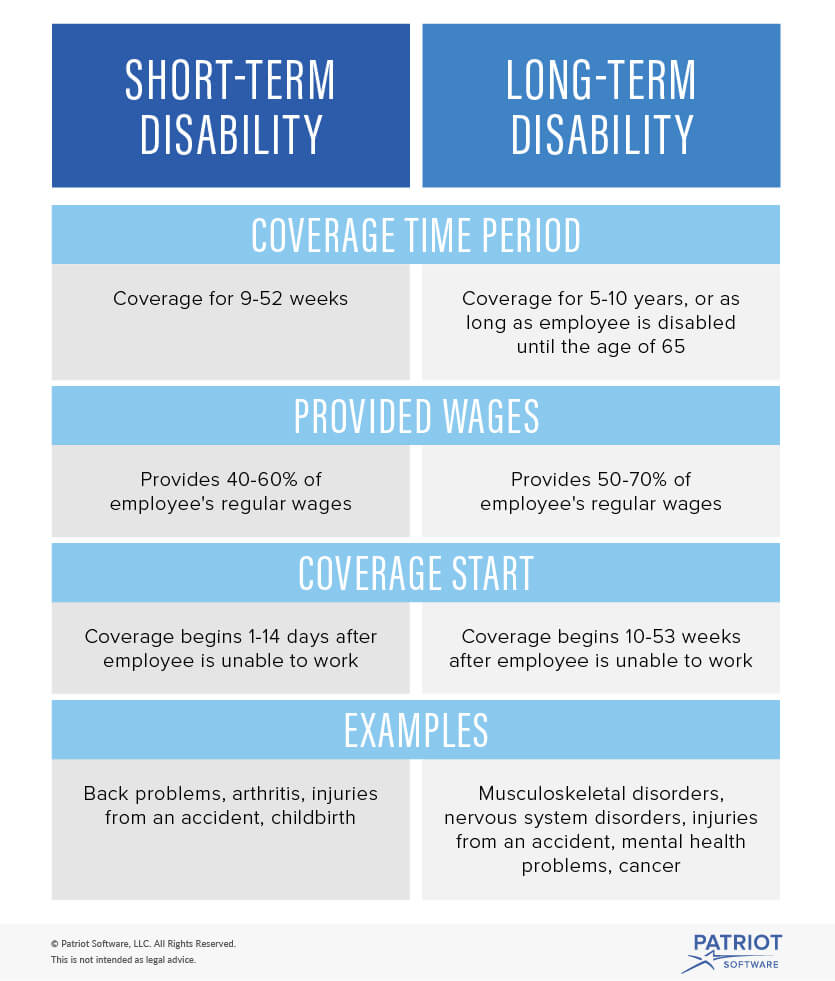

Types Of Disability Policies

There are two types of disability policies.

-

Short-term policies may pay for up to two years. Most last for a few months to a year.

-

Long-term policies may pay benefits for a few years or until the disability ends.

Employers who offer coverage may provide short-term coverage, long-term coverage, or both.

If you plan to buy your own policy, shop around and ask:

-

How is disability defined?

-

How long do benefits last?

-

How much money will the policy pay?

Recommended Reading: Iphone Disabled How To Fix

Is Individual Short

Its not uncommon for advisers to tell people to not purchase individual short-term disability insurance policies, as they might be as pricey as long-term coverage, with the only difference that its benefits are for a shorter period of time.

However, if your employer doesnt over short-term disability insurance, you should consider getting it privately, despite its costs. Of course, if you already have a financial strain, perhaps you shouldnt be considering purchasing it privately.

Moreover, if you do have pre-existing conditions, theres no point purchasing it. On the other hand, if youre a stay home mom who works remotely and your company doesnt offer any disability insurance, its better if you purchase an individual short-term disability insurance.

What If Your Short

The first thing to do is to carefully read the correspondence thats saying its not being approved, Bartolic says. That will tell the person a lot, and will tell them what to do if they disagree with the decision.

Most disability plans in America are covered under the Employee Retirement Income Security Act , which means claims are reviewed through the lens of this federal law. If your plan is covered by ERISA, the law requires that the denied individual be presented with a right to appeal that decision, McDonald says. So be sure to take advantage of the appeals process within the designated time frame.

Read Also: Lawyer For Social Security Disability

Best For Financial Stability: State Farm

State Farm

-

Quotes and policies only available through an agent

-

No normal childbirth or pregnancy coverage

-

No coverage for complications from cosmetic surgery

-

Maximum benefit up to $3,000 per month

Besides Mutual of Omaha, State Farm is the only provider to offer short-term disability benefit periods as long as three years. Short-term disability insurance through State Farm provides between $300 and $3,000 in monthly coverage, depending on your occupation and current income.

Founded in 1922, State Farm currently holds an A++ financial strength rating from AM Best, the highest rating available. Their short-term disability insurance policies are offered in 47 states . They also boast a simple application process that provides you with fast coverage.

There are some important exclusions to keep in mind with State Farm for instance, theres limited coverage for mental or nervous disorders, and no coverage for complications stemming from cosmetic procedures, unlike some other providers. State Farm doesnt offer optional riders either.

You cannot purchase a policy or get a quote for coverage online through the State Farm website. Instead, youll need to contact a local agent for a quote and policy details.

Paid Leave Supplement To Std Benefit

Employees are required to use accrued paid leave during the 30-day waiting period for short-term disability benefits, including the use of accrued annual leave and/or compensatory time once accrued sick leave has been exhausted.

Employees who elect to be made whole will use accrued sick leave first, then annual leave or compensatory time as available.

Also Check: Assisted Living For Disabled Adults

Individual Short Term Disability Insurance

Short-term disability insurance is beneficial in protecting you from a lapse of income in the event of being unable to work for an extended period of time, due to sickness or injury.

Employers sometimes offer short-term disability insurance with varied coverage, depending on the policy plans offered.

However, it is possible to acquire short-term disability insurance without going through your employer.

Best For Ease Of Qualifications: Aflac

-

Can only enroll through your employer

-

Different states have different limitations and exclusions

-

Monthly benefit is lower than what some other companies offer

Its easy to qualify for short-term disability insurance through Aflac because customers can sign up for some products without underwriting. That means Aflac guarantees coverage to clients for certain plans, even if those clients choose to opt out of answering medical questions or taking a medical exam.

When you sign up for short-term disability insurance, however, you might be asked to provide medical records or your medical history to insurance agents. Depending on this medical screening, you may be denied coverage, be forced to accept longer elimination periods, or be charged higher premiums for your insurance. These medical questions can make it difficult to qualify for a plan you want at a price you can afford.

To get a quote for your short-term disability plan, youll need to contact your employer who will let you know if they have Aflac plans and which options you can select for coverage. When you opt for this insurance through your employer, youll likely be able to have your bills automatically deducted from your paycheck.

Recommended Reading: Pa Department Of Aging And Disability Services