What Information Must Employees Submit To Qualify And File A Claim For Sd

Employees must submit documented proof of their medical condition and inability to work from a physician.

Plan administrators, employers, or insurers have submission forms for filing claims. They review the forms and employees medical records to decide whether to approve or deny a claim.

Submission forms may vary by plan, but typically include:

- Employees contact information, job duties and pay

- Injury, illness and other medical details

- Physicians statement

- Employers statement

Benefits For Children With Disabilities

A child under age 18 may have a disability, but we don’t need to consider the child’s disability when deciding if he or she qualifies for benefits as a dependent. The child’s benefits normally stop at age 18 unless they are a full-time student in an elementary or high school or have a qualifying disability.

Children who were receiving benefits as a minor child on a parents Social Security record may be eligible to continue receiving benefits on that parents record upon reaching age 18 if they have a qualifying disability.

Knowing The Differences Can Make A Smoother Application Process

The differences between short-term disability and FMLA aren’t always very obvious. It’s possible that if a person is ineligible for one, they may qualify for the other. Knowing the key differences between the two can help speed up the process and avoid setbacks for both parties, employer and employee alike.

The content appearing on this website is not intended as, and shall not be relied upon as, legal advice. It is general in nature and may not reflect all recent legal developments. Thomson Reuters is not a law firm and an attorney-client relationship is not formed through your use of this website. You should consult with qualified legal counsel before acting on any content found on this website.

Also Check: How Much Can I Get On Disability

Policy Terms And Responsibilities

As an employer, you can create a policy dictating that employees use sick days before going on short-term disability for an extended illness. You can also require documentation from a doctor to prove an illness or injury.

During the time that an employee misses work, the employer may also request that the employee visit an approved medical provider or an occupational medicine center for regular updates on the progress of the employee’s health.

A third-party claims administrator will be in charge of managing these aspects while the employee takes time out of work. Employees must report any changes in their status immediately. These rules are in place to help prevent insurance fraud, a problem that costs employers billions of dollars annually.

Various short-term disability plans dictate different terms for qualifications. The main terms typically include:

- Employees need to work for the employer for a certain amount of time before coverage kicks in.

- Employees need to work full-time, usually 30 hours or more a week.

The following components may be included in a short-term disability plan benefits package:

- Percentage of weekly salary paid out .

- Duration of short-term disability benefits .

- The maximum amount of time covered under the disability program

Its also important to know the rules of the states in which employees reside.

Benefits For Widows Or Widowers With Disabilities

If something happens to a worker, benefits may be payable to their widow, widower, or surviving divorced spouse with a disability if the following conditions are met:

- The widow, widower, or surviving divorced spouse is between ages 50 and 60.

- The widow, widower, or surviving divorced spouse has a medical condition that meets our definition of disability for adults and the disability started before or within seven years of the worker’s death.

Widows, widowers, and surviving divorced spouses cannot apply online for survivors benefits. If they want to apply for these benefits, they should contact Social Security immediately at 1-800-772-1213 to request an appointment

To speed up the application process, complete an Adult Disability Report and have it available at the time of your appointment.

We use the same definition of disability for widows and widowers as we do for workers.

You May Like: The Americans With Disabilities Act

How To Apply For Short

For employees, the first step in applying for short-term disability is to contact youtheir human resources department. They can also review your benefits documentation, or contact your short-term disability vendor.

Some employers require workers to use any available sick days before their short-term disability period begins. Others ask for a note from the employees physician before approving requests for short-term disability.

Once an employee has completed their claim form for short-term disability and provided the necessary documents, they should submit it to you or your insurance provider. Be clear with your employees about what documentation they need, and when they need to submit it to get full access to their benefits.

How Does Aflac Short

Aflac is a well-known insurance company that provides various insurance products, including short-term disability insurance. Short-term disability insurance is a type of insurance that provides financial protection for individuals who are unable to work due to a temporary illness or injury. It can provide a source of income when you cannot work, helping to cover expenses such as medical bills and household bills.

This type of insurance can be especially important for those who do not have a lot of savings or financial cushion to fall back on in the event of an unexpected illness or injury. It can help to ease the financial burden and allow you to focus on your recovery without worrying about how you will pay your bills.

In this blog post, we will discuss the details of Aflac short-term disability insurance, including eligibility, coverage details, the claim process, cost, and the advantages of purchasing this type of coverage. We hope that this information will help you to make an informed decision about whether Aflac short-term disability insurance is right for you.

You May Like: California Disability Insurance Phone Number

How Does Short Term Disability Work

Short term disability ensures you aren’t left in the lurch when you can’t clock in. It’s a type of insurance that covers you financially if you’re too ill or injured to work. Depending on the policy, disability will pay you a part of your income in weekly or monthly installments for a period of up to 12 months.

In this article, well review everything from what qualifies for a claim to how long short term disability lasts once youre on it.

Can You Go On Short

Short-term disability generally covers behavioral health issues, which can include anxiety, depression and stress. However, the claims process for these conditions tends to be more difficult. Claims analysts may need all of the medical records pertaining to the diagnosis so they can evaluate what is preventing the employee from working.

Recommended Reading: Dating Sites For People With Disabilities

Short Term Disability Insurance

Available through the workplace, this coverage helps protect your income if you cant work after an accident or illness.

Weekly payments: receive a portion of your salary for 3 months to 1 year, depending on your policy

Rehab incentives: coverage may include financial incentives designed to help you transition back to work

Easy claims filing: report claims online or by phone

Competitive rates: this group coverage is offered only through employers

For complete plan details, talk to your companys benefits administrator.

Types Of Disability Policies

There are two types of disability policies.

-

Short-term policies may pay for up to two years. Most last for a few months to a year.

-

Long-term policies may pay benefits for a few years or until the disability ends.

Employers who offer coverage may provide short-term coverage, long-term coverage, or both.

If you plan to buy your own policy, shop around and ask:

-

How is disability defined?

-

How long do benefits last?

-

How much money will the policy pay?

Read Also: Disability Lawyers In Birmingham Al

How Do I Ask My Doctor For Short

Employees who plan to apply for short-term disability should notify their attending physicians so they can gather the necessary forms and supporting records.

This article is intended to be used as a starting point in analyzing short-term disability and is not a comprehensive resource of requirements. It offers practical information concerning the subject matter and is provided with the understanding that ADP is not rendering legal or tax advice or other professional services.

Mental Health Tips For Avoiding Burnout

Not everyone can get approved for disability benefits due to mental health issues, so what are some ways that you can avoid burnout? Here are a few tips for avoiding burnout and keeping yourself in a good mental place. First, make sure that you take time off from work to focus on things that you enjoy. Most everyone gets some paid time off, so make sure that you use this time. Completely unplug from work and enjoy time with your friends and family or enjoy time alone if that is what you prefer.

Next, try to get at least 8 hours of sleep each night and get some exercise at least five days per week. Even if you just get out and walk for 20 minutes, exercise releases chemicals in your brain that put you in a better mood. Lastly, keep a check on your diet. Eating healthy foods can also help with mental health conditions, so try and make healthy choices when it comes to what you put on your plate.

Don’t Miss: Inclusion Of Students With Disabilities

Is Your Condition Severe

Your condition must significantly limit your ability to do basic work-related activities, such as lifting, standing, walking, sitting, or remembering for at least 12 months. If it does not, we will find that you do not have a qualifying disability.

If your condition does interfere with basic work-related activities, we go to Step 3.

How Do I Initiate My Short Term Disability Claim

Also Check: Spinal Cord Stimulator And Disability

Does Disability Continue After Termination

If youve lost your job while on disability, get in contact with the insurer. Ultimately, it comes down to whether or not the monthly premium is being paid, although there are some exceptions. Rarely, and particularly in the case of long term disability, if you are terminated for cause, you may become ineligible to receive benefits.

What If Your Employer Doesnt Offer Short

You can purchase insurance for disability privately, but for a pretty high price. The cost can vary based on your age and the level of benefits, but some estimates state that you should expect to pay between one and three percent of your annual gross income. So, if youre earning a $50,000 salary, purchasing your own short-term disability policy could cost between $500 and $1,500 each year. The biggest barrier to securing private coverage is cost, McDonald says. Shop around to get the best deal.

Also Check: Iphone Disabled How To Fix

Pera Defined Benefit Vested Employee & Unum Short

Employees with at least five years of PERA Defined Benefit Retirement Plan covered employment service may be eligible for PERA STD benefits. The Unum STD insurance coverage will always coordinate with an employees PERA STD coverage. The PERA STD benefits will always be the primary STD benefits and will be an offset to Unum STD benefits.

PLEASE NOTE: Paid leave supplements will offset PERA disability payments. Employees should stop paid leave supplements prior to the commencement of PERA disability benefits.

Eligibility For Aflac Short

If you are interested in purchasing Aflac short-term disability insurance, it is important first to understand the eligibility requirements. Aflac has specific criteria that must be met to be eligible for coverage.

Generally, individuals who are employed and eligible for group benefits through their employer may be able to apply for Aflac short-term disability insurance. This may include full-time, part-time, and temporary employees. Self-employed individuals may also be eligible to apply for coverage.

Read Also: Multiple Joint Replacements And Disability

What Qualifies As Short

The exact definition of a qualifying short-term disability differs between states, but typically includes disabling injuries, prolonged sickness and pregnancy. Various exclusions apply for self-inflicted injuries or those acquired during illegal acts or acts of war.

Unlike long-term disability benefit, it is usually required only that an employee cannot carry out their job, rather than any job. However, in New York and Puerto Rico the benefit is dependent upon employees being unable to carry out any work for which their training and experience makes them reasonably qualified.

Americans With Disabilities Act

The Americans with Disabilities Act provides many protections for people with disabilities. This can include mental health conditions as well. Part of the protection means that you cannot be discriminated against at work due to your condition, and you are also entitled to certain reasonable accommodations when performing your job. These accommodations could be anything from an extra mental health day to getting reassigned to a boss who is more compassionate. You might be required to submit medical evidence of your condition to qualify for these accommodations, but using the protection of the ADA can be a great way to make your life a little easier when dealing with your mental health issues.

Read Also: How Much Disability Do You Get For Bpd

Why Offer Sd When The Fmla Also Allows Employees Time Off For Medical Reasons

The Family Medical Leave Act is a federal law that requires all public employers and private companies with 50 or more employees to allow eligible workers 12 weeks of unpaid leave in a calendar year.

While the law doesnt pay employees who are on leave, it gives them time off to:

- Care for a family member with a serious medical condition.

- Give birth or care for a newborn.

- Adopt a child or become a guardian to a foster child.

- Recuperate from a serious health condition that keeps them from working.

To qualify for FMLA, employees must have worked at least 12 months and accumulated 1,250 work hours before leave begins.

Both SD and FMLA protect workers jobs while theyre on leave you cant fire workers solely for taking time off for medical reasons. But FMLA doesnt replace lost wages.

When medical leave under FMLA expires, employees may be eligible for additional time off under an SD plan.

The Differences Between Short

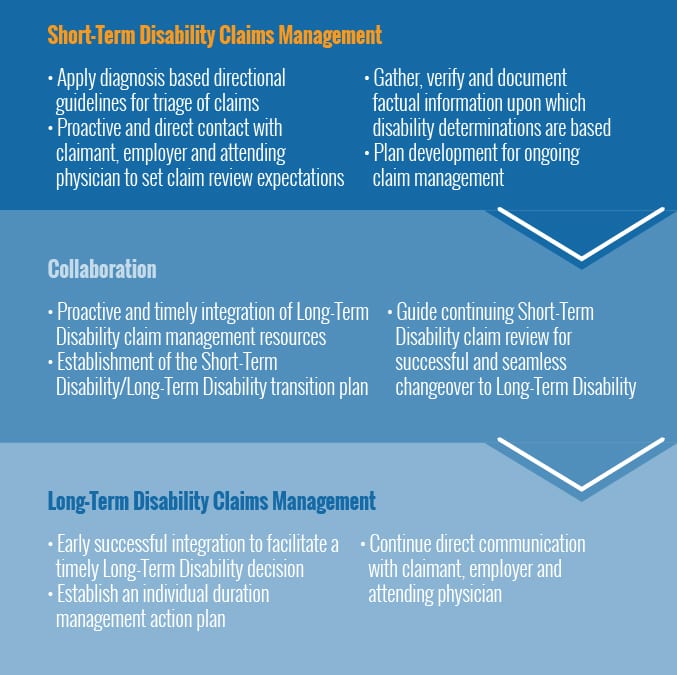

While short- and long-term disability insurance have similarities neither have a deductible or minimum spending threshold and they both cost 1% to 3% of your annual salary they also have several differences.

The two primarily differ based on the length of the coverage period. Short-term disability insurance is more suited for situations in which an employee was injured but can ultimately return to work, whereas long-term disability helps those who will be out of work for a long time, or even permanently.

In addition to the coverage length, benefits begin at different times for each insurance. For short-term disability, benefits begin after a predetermined amount of time, called an elimination period, ranging from seven to 30 days, with 14 days being the average. The elimination period for long-term disability is longer, lasting anywhere from 30 days to two years, with 90 days being the most common. This range will depend on the policy you purchase cheaper policies incur longer elimination periods.

Finally, short- and long-term disability insurance each cover a different portion of an employees income. While the exact amount is determined by their salary and plan coverage, short-term disability insurance typically covers about 80% of ones income, while long-term is closer to 60%.

for more expert tips & business owners stories.

To stay on top of all the news impacting your small business, go here for all of our latest small business news and updates.

Recommended Reading: Free Legal Aid Social Security Disability

Can You Contact Your Employees While Theyre On Short

You have the right to contact employees while theyre on short-term disability as long as you dont ask them to perform any sort of work. For example, if you have a quick question or two about their benefits, or about a work-related procedure, you can reach out.

Unlike some other programs like the Family Medical Leave Act and the Americans with Disabilities Act that provide time off for employees, short-term disability doesnt offer any sort of job protection. Employees on short-term disability also arent entitled to the same job position when they return from it. Its up to your company how youd like to set return-to-work policies.

What Qualifies For Short

The most common reasons for a short-term disability claim are:

- Pregnancy/maternity leave

To meet short-term disability qualifications, the medical condition must not be related to the work environment or job-related responsibilities, otherwise, it might be covered under the employers workers compensation insurance.

Read Also: When Did The Disability Rights Movement Start

What Is Short Term Disability Insurance

If youre not exactly sure what short term disability insurance is, how it differs from other kinds of disability plans, and what it can do for you, we can help.

The first thing to know is why you need disability insurance: 1 in 4 workers become disabled during their working years1 and when you cant work, you probably dont earn income. Disability insurance helps protect your income by paying a periodic cash benefit if you have an illness or injury and are unable to work. Thats why its also called disability income insurance.

Many people think disability insurance coverage is for on-the-job accidents at construction sites and factories. Those are actually covered by workers compensation insurance. Short Term Disability insurance is for everything else that can cause a medical condition that keeps you from working. The fact is, most disabilities arent even caused by accidents or injury theyre caused by chronic conditions or illnesses such as cancer, heart disease, or even arthritis. Many short-term policies also cover pregnancy, particularly group policies. This article will help answer three key questions: