Cost Of Disability Insurance By Gender

Traditionally, disability insurance costs more for women than men when all other factors are equal .

In fact, women can pay up to 40 percent higher premiums than men for disability insurance. Thatâs because historical data shows women suffer disabilities that impact their careers, such as breast cancer, autoimmune disorders, and depression, more often than men. Disability claims for women also typically last longer than those for men.

In the two charts in the occupation section above, with all other factors being equal, women were quoted rates between 25 percent and 33 percent more.

However, it’s important to note that Massachusetts has passed legislation to prevent insurance companies from using gender as a determining factor in the cost of coverage. New York has introduced legislation as well.

If you’re more of a video person, watch how personal factors and policy details will impact your disability insurance cost:

Your Policy Choices Matter Too

So far, weâve highlighted personal factors that influence the cost of long term disability insurance. However, there are also various policy choices that will influence how much you pay in monthly premiums.

The benefit period you select is a prime example. The longer your benefit period is, the more you can expect to pay in premium. More often than not, the most cost-effective benefit period length is 5 years.

Your elimination period, or waiting period, is another example of a policy choice that impacts long term disability insurance cost. The elimination period for disability insurance is similar to the deductible on property insurance. Itâs the part you pay out-of-pocket before benefits kick in. Cost runs the opposite of your benefit period: The longer your waiting period is, the less you will pay in premium.

Elimination periods for long term disability can be as little as 30 days or as long as a year. The standard length is 60 or 90 days.

Depending On Age Long Term Disability Insurance Annual Cost Ranges From $450 To Over $1500

Age plays a big factor in determining the cost of long term disability insurance. For example, the average annual premium in 2021 for the 18 to 24 age group was $451. For the 45 to 54 cohort, it was $1,800.

There’s often a financial advantage to taking out a long term disability insurance policy at a younger age. In 2021, the average monthly long term disability insurance cost was…

- $38 for ages 18-24

Recommended Reading: Fl Disabled Veteran License Plate

Ensuring Employers Have The Right Expertise

Our Workplace Possibilities consultants provide employers with access to local, onsite support.3 Consultants work with employees proactively and coach managers on how to spot employees needing support and refer them to our program.

They can help ease the burden on HR by working directly with employees, coordinating available benefits. Consultants also help employers with Americans with Disabilities Act Amendments Act accommodations.4

What Type Of Disability Insurance Should You Buy

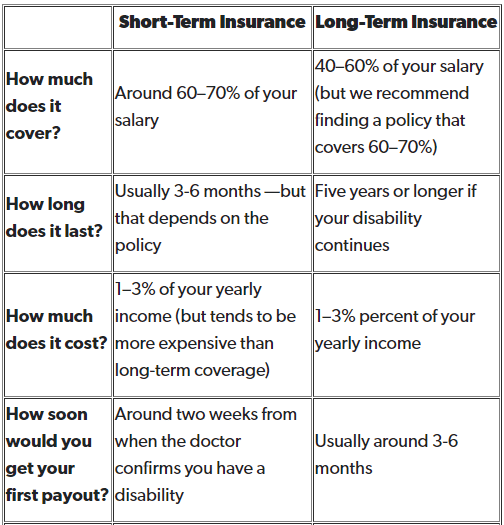

Disability insurance coverage should replace about 60% of your monthly pre-tax income if you are unable to work due to an illness or injury. When youre shopping for disability coverage, you have three primary choices: long-term, short-term, and Social Security disability insurance.

Long-term disability insurance is the best option for most people.

Long-term disability is easier to qualify for than Social Security disability insurance, and short-term disability insurance only offers coverage for up to a year. A long-term policy the most comprehensive and cost-effective form of income protection you can buy to keep your financial goals on track.

However, each type of disability insurance can complement each other for instance, a short-term policy can pay benefits during the waiting period before your long-term policy coverage kicks in.

Read Also: Social Security Disability Earnings Limit 2022

Is Your Condition Severe

Your condition must significantly limit your ability to do basic work-related activities, such as lifting, standing, walking, sitting, or remembering for at least 12 months. If it does not, we will find that you do not have a qualifying disability.

If your condition does interfere with basic work-related activities, we go to Step 3.

Factor In Possible Disability

Your health insurance will probably cover most of your care for an injury or illness. However, many people have to pay a high deductible before receiving care or have a health insurance policy that doesnt cover every medical expense. Since you may not be earning an income while disabled, your LTDI coverage should be high enough to get you the care you need and help you recover.

You May Like: California State Disability Phone Number

What Is Long Term Disability Insurance

Long term disability insurance is defined as a policy that pays you, the policyholder, direct monthly benefits to replace a portion of your earnings if you become disabled and cannot work in your occupation.

This form of disability insurance is designed to cover serious injuries and illnesses that keep you out of work for three months or longer, as well as permanent disabilities that leave you unable to return to work.

Long term disability coverage is a smart investment for healthy, employed individuals who want to secure their financial future. You can get covered by yourself, as a part of a group, or both.

What Is The Difference Between Private Long

If you cant afford long-term disability insurance or your company doesnt offer it, you may wish to apply for federal disability benefits.

Supplemental Security Income provides a monthly cash benefit for people who are disabled and have limited income and limited resources. Social Security Disability Insurance benefits are available to people with disabilities who have paid high enough Social Security taxes while employed. Both are programs from the federal government, and youll need to apply to either SSI or SSDI to see if you qualify.

Read Also: Benefits For 100 Disabled Veterans In Texas

Cost Of Disability Insurance By Age

When it comes to the cost of your policy, your age is one of the biggest determining factors. Because youâre more likely to become disabled as you get older, disability insurance is more costly as you age. Some estimate that comparable policies can increase in cost up to 5 percent a year as a person ages. Therefore, itâs best to purchase when youâre younger in order to obtain the lowest rates.

Here is an illustration of how much more you will pay the longer you wait to buy coverage. The following rates are for different aged men with technical jobs making $85,000 a year. Each policy is for a $4,300 monthly benefit that lasts for five years.

- A 40-year-old will pay $82 a month

- A 45-year-old will pay $104 a month

- A 50-year-old will pay $129 a month

- A 55-year-old will pay $167 a month

The older you are, the more you will pay for coverage.

Example Disability Insurance Premium Rates

The fastest way to see how much coverage will cost for you is to get a disability insurance estimate. But if youd rather see some numbers, we get it. Here are some example rates for a few different ages and occupations that should give you an idea of how much disability insurance coverage will cost.

You May Like: Can You Get Disability For Hearing Loss And Tinnitus

Metlife Defines Disability When:

- you are limited from performing the material and substantial duties of your regular occupation due to your sickness or injury and

- you have a 20% or more loss in your indexed monthly earnings due to the same sickness or injury and

- during the waiting period, you are unable to perform any of the material and substantial duties of your regular occupation.

Find What You’re Looking For At Northwestern Mutual

1 S& P Global Market Intelligence. Prepared and calculated by Northwestern Mutual. U.S. rank based on direct premiums earned. Disability income insurance rank reflects Individual Business, Long-Term category .

2 An average Northwestern Mutual individual disability income insurance policy ) with a $2,000 monthly benefit costs males $25.63/month and females $36.68/month. Typical coffee costs $72.52/month. Eligibility for individual disability income insurance, additional policy benefits and qualifications for benefits is subject to underwriting and determined on a case-by-case basis.

3 Loyalty is based on Northwestern Mutual client data.

Disability income insurance policies contain some contractual features and optional benefits that may not available in all states. The ability to perform the substantial and material duties of your occupation is only one of the factors that determine eligibility for disability benefits. These policies also contain exclusions, limitations and reduction-of-benefit provisions. Eligibility for disability income insurance, additional policy benefits and qualification for benefits is determined on a case-by-case basis. For costs and complete details of coverage, please contact a Northwestern Mutual financial representative.

90-2721-86

Northwestern Mutual General Disclaimer

Recommended Reading: Unlock Iphone That Is Disabled

How Much Does Disability Insurance Cost

The cost of disability insurance depends on the type of policy you are selectingeither short or long term. Other factors such as age, length of benefit, health, and coverage amount will affect premium cost. Employer-provided short-term coverage is usually the most cost-effective but long-term disability coverage is best to purchase individually.

Disability insurance is an important part of your insurance portfolio, along with life and critical illness insurance. If you can no longer work due to an injury or illness, disability insurance provides you a living benefitits income replacement for when youre down and out.

So, whats it going to cost you? There are different types of disability insurance, different cost influencers, and even employer benefits to consider. Were here to demystify how much disability insurance can actually cost, looking at what the insurance covers, how much you can expect to pay in premiums, and why its worth it!

How To Reduce Your Short Term Disability Insurance Premiums

Finding the right level of disability insurance protection with a price that matches your budget can be a balancing act. While your age, gender, occupation, and health history may be mostly out of your control, there are still some levers to pull if youre looking for the most affordable disability income protection that still meets your needs.

Read Also: Iphone Disabled How To Fix

National Social Insurance Programs

In most developed countries, the single most important form of disability insurance is that provided by the national government for all citizens. For example, the United Kingdom‘s version is part of National Insurance the United States‘ version is Social Security : specifically, several parts of SS including Social Security Disability Insurance and Supplemental Security Income . These programs provide a floor beneath all other disability insurance. In other words, they are the safety net that catches everyone who was otherwise uninsured or underinsured. As such, they are large programs with many beneficiaries. The general theory of the benefit formula is that the benefit is enough to prevent abject poverty.

What Is Evidence Of Insurability

If you are required to submit Evidence of Insurability, you must:

MetLife will then determine if you are insurable under the plan.

Also Check: Va Disability Percentages For Conditions

Best For Rider Options: Mutual Of Omaha

Mutual_of_Omaha

If youre looking for long-term disability insurance that lets you really customize your policy and keep coverage for as long as possible, Mutual of Omaha may have what you need. They are our top choice for best policy rider options, allowing you to choose between features like future insurability, critical illness coverage, and return of premium, to name a few.

-

Up to $12,000 per month in benefits

-

Premiums stay level through age 67

-

Many built-in policy benefits

-

Multiple additional riders to choose from

-

Shortest elimination period is 60 days

-

Coverage can be continued through age 75, but premiums will increase

-

Quotes not available online

-

Policies must be purchased through an agent

Providing insurance coverage since 1909, Mutual of Omaha has become a trusted name throughout the United States. They hold an A+ financial strength rating from AM Best and are a Fortune 500 company with more than 13 million members.

Mutual of Omahas long-term disability insurance offers full-scale and personalized income protection for individuals with any budget or preference. Applicants do have to choose between a policy that is either non-cancelable with premiums locked in for the duration of the benefit period or guaranteed renewable with premiums that could be increased if the company’s coverage offerings change.

In order to get a quote or purchase a policy, youll need to go through a Mutual of Omaha agent directly.

Benefits For Widows Or Widowers With Disabilities

If something happens to a worker, benefits may be payable to their widow, widower, or surviving divorced spouse with a disability if the following conditions are met:

- The widow, widower, or surviving divorced spouse is between ages 50 and 60.

- The widow, widower, or surviving divorced spouse has a medical condition that meets our definition of disability for adults and the disability started before or within seven years of the worker’s death.

Widows, widowers, and surviving divorced spouses cannot apply online for survivors benefits. If they want to apply for these benefits, they should contact Social Security immediately at 1-800-772-1213 to request an appointment

To speed up the application process, complete an Adult Disability Report and have it available at the time of your appointment.

We use the same definition of disability for widows and widowers as we do for workers.

Recommended Reading: How To Apply For Disability In New Mexico

Buying Disability Insurance If Youre Transgender

Every disability insurance company has its own guidelines for transgender and gender-nonconforming people. Depending on the company, your premiums may be priced based on your gender assigned at birth even if it differs from your actual gender identity. Not only is this disparaging, it also has significant consequences for the premiums you pay for disability insurance at any age.

If your company refuses to process your application under your actual gender identity, you can continue to shop around for another insurer that correctly genders you when determining your rates.

What Spending Changes Will You Make If Disabled

A lot of financial professionals believe that 60%-70% is the sweet spot for income replacement because most people simply dont spend as much when they dont work. Why?

- You dont have commuting costs

- You dont spend as much on lunch and coffee breaks

- You spend less on your wardrobe

- You will likely pay less taxes

In addition, you may be able to lower your housing costs substantially. Many professionals choose to live in affluent urban areas because that is where their jobs are. When they dont need to be close to a given workplace, they can choose to move to a less-costly area more suited to their new life.

Recommended Reading: Property Tax Relief For Disabled

Long Term Disability Insurance

Available through the workplace, this coverage helps maintain your standard of living if you’re unable to earn a paycheck due to an accident or illness

Covers essential living expenses: can help pay for food, clothing, utilities, your mortgage, car payments and more

Direct monthly payments: receive a portion of your salary paid directly to you each month if youre unable to work

Rehab incentives: coverage may include financial incentives designed to help you transition back to work

Easy claims filing: report claims online or by phone

Competitive rates: this group coverage is offered only through your employer

For complete plan details, talk to your companys benefits administrator.

Not All Jobs Occupations Are Treated Equally

Disability insurance is designed to protect your income, so it should come as no surprise that your career will have a major impact on your premium rate. Insurance companies classify jobs based on the hazards of the work, as some are more prone to injury or illness than others.

Your occupation will also be assessed based on the difficulty of returning to work following an injury or illness. The more difficult it is to perform a job with certain injuries or illnesses, the more the insurance company will likely have to pay in benefits.

Job occupations are grouped into specific risk classes, which are numbered on a scale of 1 to 5 or 6. Typically, the higher the number, the less risk an insurer considers that profession. The lower the risk, the lower the premium rate.

When you compare policies, you should note that insurers assign different risk classes to the same profession. One insurer may designate a job as a 4, while another may classify it as a 5.

Also Check: Va Disability Rating For Lower Back Pain

What Happens If The Dac Gets Married

If the child receives benefits as a DAC, the benefits generally end if they get married. However, some marriages are considered protected.

The rules vary depending on the situation. Contact a Social Security representative at 1-800-772-1213 to find out if the benefits can continue.

1-800-772-1213

To speed up the application process, complete an Adult Disability Report and have it available at the time of your appointment.

What Types Of Conditions Are Covered By Long

There are a wide range of serious injuries and illnesses covered by long-term disability insurance. Some examples from Bradshaw include:

-

Accident resulting in a traumatic brain injury that disables the individual physically or mentally

-

Many types of cancer, based on the course of treatment

-

Progressive health conditions like multiple sclerosis or Parkinsons disease

Recommended Reading: Ohio Department Of Developmental Disability

What Does Disability Insurance Cover

Disability Insurance is available for either short- or long-term policies, allowing businesses and individuals to customize it for their specific needs.

This policy is often used to cover maternity leave. Many states do not have a standard or coverage for women having a child. If they do have any coverage, it may only cover four to six weeks of leave. Short-term Disability allows a woman extra time to bond with her baby, continue to heal, and adjust to the new addition to the family.

For those in need of rehabilitation services, which aid in returning to work at a faster rate or even Employee Assistance Programs , long-term Disability coverage can offer these services and more. Rehabilitation services allow an employee to learn how to either regain the use of a damaged part of the body or compensate for a newly unusable body part by utilizing other parts of the body. Therefore, this policy will pay for this service to mitigate the loss of potentially extended payments overall. In addition, those requiring addiction or grief counseling or other EAPs will find long-term Disability plans useful in paying for these services, allowing the employee to return to work much faster: