Does Social Security Send The State Ssi Checks

The SSA administers the state supplement for some states, including California, New Jersey, Pennsylvania, and Michigan, so the extra state payment is included in people’s SSI checks in those states.

Other states pay the supplement directly to you, separately from your federal SSI payment. If you live in a state that pays its own supplement, you need to apply for the state disability check directly from a state agency .

If the SSA administers the payment for your state, you apply for it automatically when you fill out an SSI application there’s no need to fill out another form.

For more information, see our article on the state supplementary payment.

How Much Will You Receive From Social Security Disability

Each and every year, millions of Americans suffer from a disabling condition. It is not uncommon for a disability to interfere with an individual’s ability to work and earn an income. As a result, these disabled individuals must rely on Social Security Disability benefits to make ends meet. Many of the people who are applying for SSDI find themselves uncertain as to how much money do they get on disability.

If you are approved for Social Security Disability benefits, how much money do you get on disability? Unfortunately, the answer to this question isn’t always cut and dry. There are, however, ways that you can estimate what you might expect from the Social Security Administration. If you are wondering how much money you are eligible to receive through Social Security Disability benefits, the following information can help you understand the ways of determining your monthly disability benefit amount may be.

Which Pays More Ssi Or Ssdi

Home » FAQs » Social Security Disability » Which Pays More SSI Or SSDI?

The Social Security Administration provides two programs for those who are disabled: Supplemental Security Income and Social Security Disability Insurance . Those who qualify for disability benefits might wonder which one pays more.

First, lets talk about what SSI and SSDI cover. SSI benefits can provide extra money to low-income, low-asset adults and disabled children. SSDI is available for those who have earned Social Security-covered income and can no longer work.

Both SSI and SSDI can provide necessary income to those who need it. The amount that each pays depends on the individual.

You May Like: How Much Is Disability In Illinois

Other Income That Could Reduce Your Ssdi Payment

Any disability benefits you receive from a private long-term disability insurance policy won’t affect your SSDI benefits. Nor will SSI or VA benefits impact your SSDI amount. But government-regulated disability benefits, such as workers’ comp or temporary state disability benefits, can affect your SSDI benefits. Here’s how that works: If the amount in SSDI plus the amount from government-regulated disability benefits is more than 80% of the amount you earned before you became disabled, the SSDI or other benefits will be reduced.

Before Inez became disabled, her average earnings were $5,000 per month. Inez, her spouse, and her two children would be eligible to receive a total of $3,000 a month in Social Security disability benefits. But Inez also receives $2,000 a month from workers’ compensation.

The total amount of benefits Inez and her family would receive$5,000is more than 80% of her average earnings. So, her family’s Social Security benefits will be reduced by $1,000, from $3,000 to $2,000. That way, the $2,000 a month from workers’ comp and the $2,000 in disability benefits means they will receive a total of $4,000 per month, which is 80% of the earnings figure of $5,000.

The following types of government benefits could lower your SSDI payment:

- workers’ comp payments

- civil service disability benefits, and

- state or local government retirement benefits based on disability.

Iii: Who Receives Ssdi

Eligibility criteria are strict, and most SSDI applicants are rejected. Applicants for SSDI benefits must be

- Insured for disability benefits .

- Suffering from a severe, medically determinable physical or mental impairment that is expected to last 12 months or result in death, based on clinical findings from acceptable medical sources.

- Unable to perform substantial gainful activity anywhere in the national economy regardless of whether such work exists in the area where the applicant lives, whether a specific job vacancy exists, or whether he or she would be hired.

Lack of education and low skills are considered for older, severely impaired applicants who cant realistically change careers but not for younger applicants.

There is a five-month waiting period for SSDI, but Supplemental Security Income may be available during that period for poor beneficiaries with little or no income and assets.

SSA denies applicants who are technically disqualified and sends the rest to state disability determination services for medical evaluation. Applicants denied at that stage may ask for a reconsideration by the same state agency, and then appeal to an administrative law judge at SSA. Roughly half of people who get an initial denial pursue an appeal.

SSA monitors disability decisions at all stages of the process. SSA conducts ongoing quality reviews at all stages of the application and appeal process. Many reviews occur before any benefits are paid, thus reducing errors.

Also Check: Free Car Repair For Disabled

With A Dependent Spouse Or Parent But No Children

Compensation rates for 30% to 60% disability rating

Find the dependent status in the left column that best describes you. Then look for your disability rating in the top row. Your basic monthly rate is where your dependent status and disability rating meet.

If your spouse receives Aid and Attendance benefits, be sure to also look at the Added amounts table, and add it to your amount from the Basic monthly rates table.

| Dependent status | 30% disability rating | 40% disability rating | 50% disability rating | 60% disability rating | ||||

|---|---|---|---|---|---|---|---|---|

| Dependent status | 30% disability rating | 508.05 | 40% disability rating | 731.86 | 50% disability rating | 1,041.82 | 60% disability rating | 1,319.65 |

| With spouse | 30% disability rating | 568.05 | 40% disability rating | 811.86 | 50% disability rating | 1,141.82 | 60% disability rating | 1,440.65 |

| With spouse and 1 parent | 30% disability rating | 616.05 | 40% disability rating | 875.86 | 50% disability rating | 1,222.82 | 60% disability rating | 1,537.65 |

| With spouse and 2 parents | 30% disability rating | 664.05 | 40% disability rating | 939.86 | 50% disability rating | 1,303.82 | 60% disability rating | 1,634.65 |

| With 1 parent | 30% disability rating | 556.05 | 40% disability rating | 795.86 | 50% disability rating | 1,122.82 | 60% disability rating | 1,416.65 |

| With 2 parents | 30% disability rating | 604.05 | 40% disability rating | 859.86 | 50% disability rating | 1,203.82 | 60% disability rating | 1,513.65 |

Compensation rates for 70% to 100% disability rating

How Much You Can Receive In Disability Benefits

As of the 2022 totals, the most you can receive from Social Security Disability Insurance is $3,450. The average SSDI payment is about $1,200, but there are several factors that come into play when determining how much you will receive in monthly benefits.

You can visit the Social Security website’s to get an estimate of how much you will be receiving in monthly disability benefits.

You May Like: How To Get Disability In Ga

Substantial Gainful Activity & Disability Benefits

While receiving SSDI benefits, you may engage in substantial gainful activity but only up to a limit. For 2022, that SGA limit is $1350 for most people. Those who are statutorily blind may make $2260. For blind individuals, this SGA does not apply to supplemental security insurance SSI benefits, a different type of social security. However, for non-blind people, the SGA limit applies to both SSI and Social Security retirement . In neither case your spouses income will not impact your qualification for SSDI benefits.

This seems rather straightforward, but heres where this can get a little more complex.

How Much Does Ssdi Pay

The Social Security Administration uses your Average Indexed Monthly Earnings and Primary Insurance Amount to calculate your SSDI benefits. The formula Social Security uses is quite complicated, and most people won’t be interested in trying to calculate their benefits on their own, especially because Social Security can give you a good estimate.

Recommended Reading: How Va Disability Is Calculated

Factors That Determine Long

Premiums vary based on the length and type of coverage, your health, the benefit amount, and other factors. In this section, well highlight how these factors may determine costs.

- Age: The earlier you buy disability insurance, the lower your premium rates will be. Thats because as you age, your health declines and you become more likely to suffer a disability or illness. You can, however, lock in the rates for life when you purchase disability insurance when youre healthy.

- Gender: Men pay less than women for disability insurance, because more women file claims for pregnancy and mental health conditions. However, disability insurance rates increase at a faster rate for men than for women, with men paying about 50% higher rates at age 40 and 191% higher rates at age 60 than they would at age 24.1

- Occupation: Hazardous occupations, such as working with heavy equipment, might pay more than someone who sits at a desk all day.

- Health: Your health also affects cost, as people with a history of disabling conditions such as back injuries, arthritis, and asthma could potentially pay higher premiums.

The Average Monthly Benefit In 2022 Is $1358 And It Will Increase In 2023

In 2022, the estimated average Social Security disability benefit for a disabled worker receiving Social Security Disability Insurance is $1,358 per month, according to the Social Security Administration . That figure is expected to go up to $1,483 in 2023. These benefits are based on average lifetime earnings, not on household income or the severity of an individuals disability.

If youve kept your annual Social Security statement, you can find what you are likely to receive in the Estimated Benefits section. The total amount that a disabled worker and their family can receive is about 150% to 180% of the disabled workers benefit. Eligible family members can include a spouse, divorced spouse, child, disabled child, and/or an adult child disabled before age 22.

The estimated average monthly Social Security benefits payable to a disabled worker, their spouse, and one or more children in 2023 is $2,616, which is an increase from the approximate benefit of $2,383 in 2022. These, along with other amounts, are subject to change annually based on inflation.

For a more precise indication, Social Security has an online calculator that you can use to obtain an estimate of both retirement and disability benefits for you and your family members.

Also Check: This Device Is Disabled Code 22

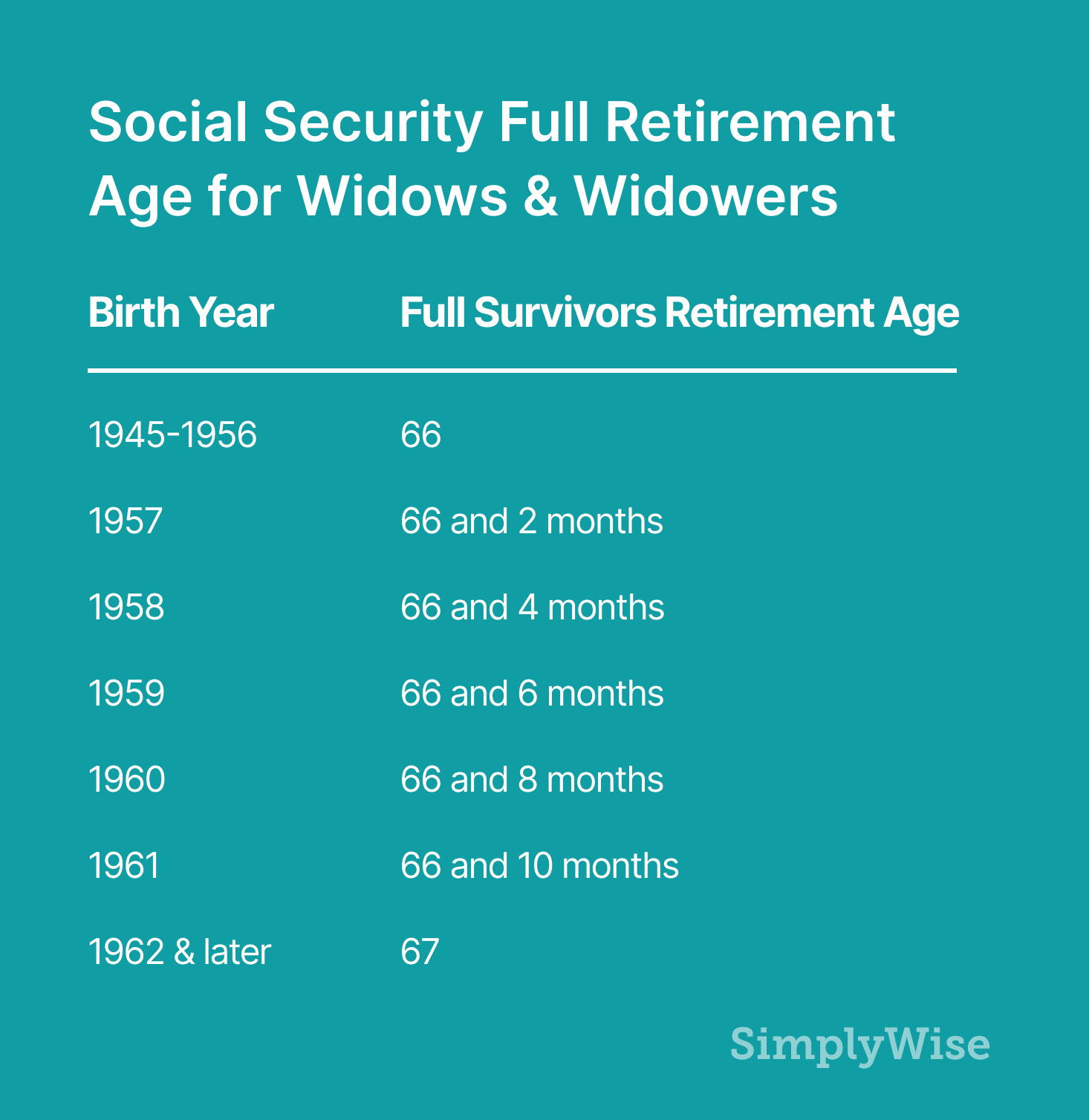

Benefits For Widows Or Widowers With Disabilities

If something happens to a worker, benefits may be payable to their widow, widower, or surviving divorced spouse with a disability if the following conditions are met:

- The widow, widower, or surviving divorced spouse is between ages 50 and 60.

- The widow, widower, or surviving divorced spouse has a medical condition that meets our definition of disability for adults and the disability started before or within seven years of the worker’s death.

Widows, widowers, and surviving divorced spouses cannot apply online for survivors benefits. If they want to apply for these benefits, they should contact Social Security immediately at 1-800-772-1213 to request an appointment

To speed up the application process, complete an Adult Disability Report and have it available at the time of your appointment.

We use the same definition of disability for widows and widowers as we do for workers.

Social Security Benefits For Children: Who’s Eligible How To Apply And Payment Dates

If you have kids and you receive Social Security Disability Insurance or retirement benefits, your children could also qualify for benefits. These are called Social Security Child’s Insurance Benefits, which the Social Security Administration disburses to children as long as one parent is entitled to receive benefits.

This is to “help to stabilize the family’s financial future,” the SSA says. The Social Security money for children is also designed to help provide necessities to kids while they’re still enrolled in school.

Also Check: Disabled Veteran Benefits In Texas

Information You Need To Apply

Before applying, be ready to provide information about yourself, your medical condition, and your work. We recommend you print and review the . It will help you gather the information you need to complete the application.

Information About You

- Your date and place of birth and Social Security number.

- The name, Social Security number, and date of birth or age of your current spouse and any former spouse. You should also know the dates and places of marriage and dates of divorce or death .

- Names and dates of birth of children not yet 18 years of age.

- Your bank or other and the account number.

Information About Your Medical Condition

- Name, address, and phone number of someone we can contact who knows about your medical conditions and can help with your application.

- Detailed information about your medical illnesses, injuries, or conditions:

- Names, addresses, phone numbers, patient ID numbers, and dates of treatment for all doctors, hospitals, and clinics.

- Names of medicines, the amount you are taking, and who prescribed them.

- Names and dates of medical tests you have had and who ordered them.

Information About Your Work:

- Award letters, pay stubs, settlement agreements, or other .

We accept photocopies of W-2 forms, self-employment tax returns, and medical documents, but we must see the originals of most other documents, such as your birth certificate.

Do not delay applying for benefits because you do not have all the documents. We will help you get them.

Recognizing That I Needed Disability Benefits A Few Years After Being Diagnosed With Juvenile Arthritis Was Hard The Challenge Of Applying For And Receiving Disability Was Harder Than It Should Have Been

Five years. Thats how long it took for me to start receiving disability benefits after I first applied. According to the Social Security Administration , it should take three to five months to process an application. But a decision doesnt guarantee you will receive assistance, and you have to keep reapplying until you do.

Sure, receiving any amount of income is nice, especially if you have an invisible disability and illness that makes it very challenging to work full-time. The process of applying for Social Security Disability Insurance and Supplemental Security Income shouldnt be as difficult as it was for me. There were so many roadblocks that I had to go through to get the help I needed. Whats more, receiving these benefits didnt automatically make my life easier, either. Heres a look at why.

Read Also: Can You Get Disability For Arthritis In Your Back

Please Answer A Few Questions To Help Us Determine Your Eligibility

How much your SSDI benefit will be is based on your “covered earnings”the wages that you paid Social Security taxes onprior to becoming disabled.

What is SSDI? Social Security Disability Insurance is the federal insurance program that provides benefits to qualified workers who can no longer work. To be eligible, you must be insured under the program and you must meet the Social Security Administration’s definition of disabled. SSI payments, on the other hand, aren’t based on past earnings.

Your SSDI benefits may be reduced if you get disability payments from other sources, such as workers’ comp, but regular income won’t affect your SSDI payment amount.

When Will My Ltd Benefits Begin When Will They End

If your LTD insurance company provides short-term disability insurance, you won’t begin receiving LTD benefits until after your short-term coverage has expired. Short-term coverage typically begins after you’ve exhausted all your sick leave, and it generally lasts for three to six months, depending on the policy. Short-term coverage usually pays out a higher percentage of your salary than does long-term coverage.

In addition, employees are usually required to have worked for the employer for a minimum amount of time before they’re covered, and most LTD policies have an “active work requirement” so that only full-time employees are eligible.

The length of time you’ll receive benefits can vary widely depending on the policy. Some plans pay benefits for a fixed number of years , while others will provide payments until you turn 65. Note that most LTD policies have a twenty-four month limitation on benefits based solely on mental or nervous conditions.

You could be eligible for up to $3,345 per month In SSDI Benefits

Also Check: How To Disable Pop Up Blocker On Mac

When Do You Receive Ssi Payments

The SSA pays SSI and SSDI benefits at different times. If you are eligible for both benefits, its good to know when your payments will come.

You will get your SSI benefits on the first of each month. The first payment starts the month after your application. If the first of the month is on a weekend or holiday, youll get your benefits the business day before.

You can receive your SSI payments in one of three ways:

- Through direct deposit

- Loaded onto a debit card

- Sent through a check in the mail

The SSA asks that you wait until the fourth business day to contact them about missing mail payments.