How Does Long Term Disability Work In California

Long-Term Disability insurance is private insurance that helps people who can’t work because of a disability. If you have LTD insurance, it will replace some of the income you lose when you can’t work because of a disability. Some people have LTD insurance from their employers. Others purchase it individually.

What Is The Average Weekly Benefit Amount Paid In California

How Much Does Disability Pay In California

The temporary disability insurance program in the state of California will reimburse you a portion of your usual salary. In 2022, the highest amount of weekly benefits that can be paid is 1,540 dollars. By Lisa Guerin, J.D.

Your weekly payments from Social Security Disability Insurance will typically be equal to 55% of those average weekly wages, with a minimum benefit of $50 and a maximum benefit of $1,540 each week.Note that the precise amount of the benefit is computed using a sliding scale that starts at 55 percent.The proportion that is given to those with extremely low income is typically larger than the percentage that is given to the majority of individuals.

Read Also: Va Disability Rating For Degenerative Disc Disease

Who Qualifies For Permanent Disability

Your doctor is the one who will be in charge of creating your disability rating, as well as providing their professional judgment about whether or not the handicap may be considered permanent.If, on the other hand, your condition is readily apparentfor example, if you have lost limbs or have restricted mobilityyou may be eligible for complete and permanent disability benefits even without a medical opinion.

What Are Permanent Disability Benefits In California

Permanent disability payments are a sort of payment that are granted to employees in the state of California who experience a permanent accident or health condition that is connected to their place of employment. 1 In most cases, the payment of permanent disability benefits begins when the payment of temporary disability benefits comes to an end. 2.

Read Also: What Is 100 Va Disability

Does Permanent Disability Mean Forever

In most cases, you wont be considered for permanent disability benefits until your treating physician has determined that you have reached a plateau in your recovery. This means that it is not anticipated that your condition will improve further with additional treatment, at least in the near future.

What Is The Highest Paying State For Disability

Read Also: Social Security Disability Overpayment Statute Of Limitations

Filing Too Early Or Too Late

The Employment Development Department requires that you file your claim for SDI benefits within a certain time frame. You must wait nine days after you become disabled to file a claim. Also, you must file your claim within 49 days of becoming disabled. If you file a claim too late, you will have to include a letter explaining why you missed the deadline.

My Employer Offers Private Short

Typically, yes. If the benefits are integrated, the EDD will pay you an amount for SDI, and your employer or its insurance carrier will pay you an additional amount to cover some or all of the difference between SDI and your full wages.

If you dont know whether your employer integrates benefits with the EDD, ask your HR department or manager for information.

Read Also: How Much Does Disability Pay In California

Having A Qualifying Disability That Prevents You From Substantial Work

The Social Security Administration has a strict disability standard, with five different areas they look at, as determined by their bluebook.

The California Department of Social Services website states that to qualify for SSDI, the disability must be a physical and/or mental condition that:

- Has lasted, or is expected to last, for a minimum of 12 months, or death is expected to result from the disability

- Prevents the person from being able to perform any substantial work, also referred to as substantial gainful activity .

Substantial work in 2021 means earnings of $1,310 per month . Any income below this cap still allows you to be eligible for SSDI.

How The States California Disability Benefits Program Works

If health problems force you to stop working for at least one week, you likely qualify for California disability benefits. The state manages these payments, and most employees in this state pay into the program through their payroll taxes. Some disabled workers that cannot claim SDI benefits include:

- Interstate Railroad employees

- Anyone claiming a religious exemption

Read Also: Short Term Disability For Pregnancy

How To Calculate Temporary Disability

If you are unable to work at all, you will receive temporary total disability. The amount of temporary total disability you receive is two-thirds of your average weekly wage .13 The average weekly wage is calculated depending on your work situation:

- work more than 30 hours and five days a week: your average weekly wage is the earnings per day times days worked per week.14

- paid by commission or earn different amounts each week: you can take the average weekly earnings over one year.15

- none of the above: you can determine another method to get a fair idea of your weekly wage.16

If you can work part-time, you will receive temporary partial disability. Temporary partial disability amounts are calculated on the wages that you are losing from the hours you are not working.17

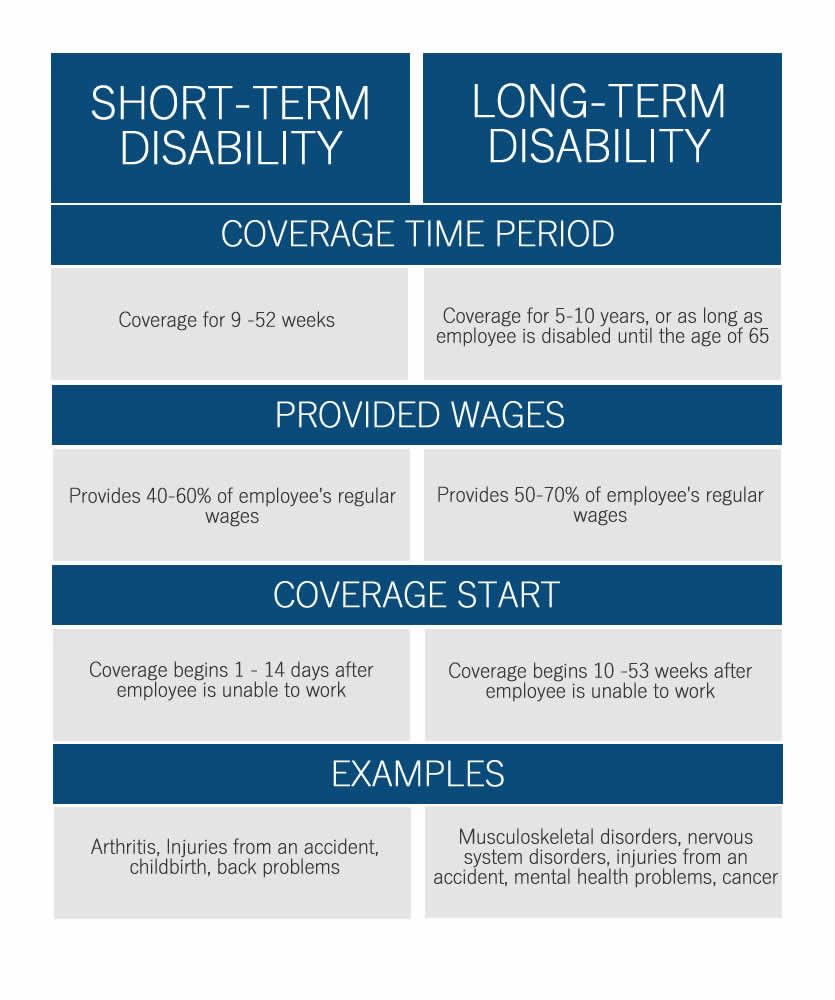

Whats The Elimination Period

While short term disability insurance begins paying benefits within a couple weeks following a qualifying illness or injury, long term disability insurance requires a longer waiting period, called an elimination period, before a policyholder begins receiving benefits. The length of the elimination period varies by policy but is often around 90 days. When considering a disability policy, take into account how you will cover your expenses during the elimination period. Do you have an emergency fund to cover your lost income and any medical bills you accrue during this time? If not, you may consider purchasing additional coverage to protect you immediately following a disabling illness or injury.

Read Also: Adults With Disabilities Day Programs

How Much Is Disability A Month In California

Your main insurance amount is calculated by the Social Security Administration based on these amounts using a formula .This is the foundational amount that will be utilized to calculate your benefit.The Social Security Disability Insurance payout range is, on average, between $800 and $1,800 each month.In the year 2020, the highest possible benefit payment for you would be $3,011 per month.

What Counts As Disability

Any time your doctor certifies that you cannot do your job, you are disabled in the eyes of EDD. You dont have to be unable to do any type of work, you just have to be unable to do the regular and customary duties of your job.

Pregnancy. You can generally receive SDI two to four weeks before you are due to give childbirth and for four weeks after your child is born .

Elective surgery. Recovery from elective and cosmetic surgeries is covered by SDI, as long as your doctor certifies that you are disabled.

Recommended Reading: How To Apply For Veterans Disability

I Am Expecting My First Benefit Payment But Have Not Received It Yet What Should I Do

We will issue payments in one of two ways:

- Electronic: If you choose this option, your benefit payments will be deposited to a debit card sent to you. Or, they will be added to an unexpired debit card from a previous Unemployment Insurance, Disability Insurance, or Paid Family Leave claim. Once your first payment is approved, expect the payment to be available within five business days.

- If you choose this option, your benefit payments will be issued by EDD check. Allow 10 days from the date the check was issued for delivery.

If you have not received your payment in the timeframe listed above, contact us. If it has been more than 10 days since your check was issued, we will confirm if your check has already been cashed. If it has, we will mail you a copy of the check and the endorsing signature. If the signature is yours, no further action is needed. If the signature is not yours, contact us for further instructions.

Types Of Permanent Disability Benefits

Under Californias workers comp system, there are two types of permanent disability benefits, including:

1. Permanent Partial Disability

-

People deemed partially disabled with a rating ofbelow 100% are entitled to weekly payments at an established amount.

-

The higher a workers disability rating, the more weeks they can be paid and the more money they can collect.

-

Permanent partial disability claims are the most common type of workers comp claims and comprise over half of all workers comp claims in the United States.

2. Permanent total disability:

- If you are100% disabled and can prove your disabilities occurred from work, youre entitled to receive weekly payments for the rest of your life.

- You may also be able to receive a lifetime pension if your disability rating isbetween 70% and 90%.

Recommended Reading: American Disabilities Act Of 1990

Differences Between Ssdi And Ssi Benefits In California

Social Security Disability Insurance is the program under which those who have paid into the Social Security system can receive benefits, in a manner similar to those collecting retirement benefits. It is a form of insurance for those employed, and workers contribute to this fund through payroll deductions.

In contrast, Supplemental Security Income is a program for those with limited resources who have become disabled. It is a type of welfare program. There are work requirements for SSDI, but none for SSI. This is intended to fill the gap for disabled persons who cannot meet the work requirements. There are asset limits for SSI, but none for SSDI.

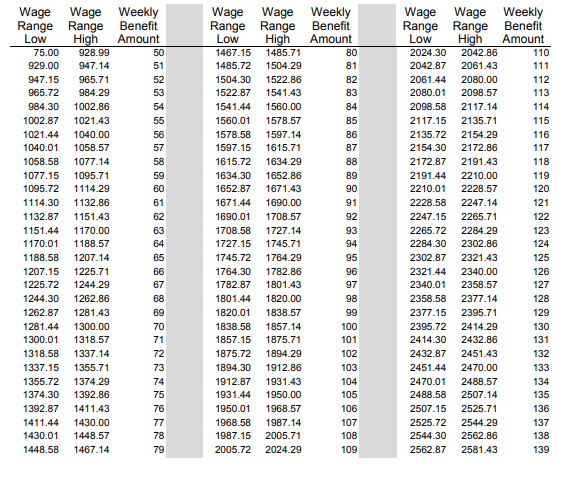

Modification To Whole Person Impairment

Whole person impairment is converted to disability using modifiers in the Permanent Disability Rating Schedule . For injuries on or after Jan. 1, 2013, the future earning capacity modifier is eliminated and replaced with a 1.4 modifier of the whole person impairment. Therefore, when rating permanent disability, replace the FEC adjustment in the 2005 PDRS, with the 1.4 whole person modifier chart below. Look up the whole person impairment on the chart and read right across for the modified whole person after the 1.4 adjustment. After the 1.4 modification of whole person impairment, use the 2005 PDRS to adjust for occupation and age to arrive at permanent disability.

| WPI |

|---|

Also Check: Indoor Activities For Disabled Adults

How Does An Injured Worker Calculate Temporary Total Disability Payments

The amount of a persons TTD check is two-thirds of the workers average weekly wage rate/weekly earnings.5

Once the state calculates the amount of an employees TTD benefits, it then adjusts it according to the minimum and maximum TTD rates for that year.

Example: Assume Jill suffers a work injury in 2022. Prior to the injury, she earned $2,100 per week. Two-thirds of her weekly earnings is $1,400. However, since the maximum temporary total disability rate for 2022 is $1,356.31, Jill will only receive that amount in benefits.

Consider, though, the scenario where Jill earned $200 per week before her injury. Two-thirds of this amount is approximately $133.33. But since this amount is below the minimum TTD rate for 2022, Jill will receive the minimum benefit rate of $203.44.

How Long Does It Take To Get Disability In California

Also Check: Benefits For 100 Disabled Veterans In Texas

Read Also: Reasons For Short Term Disability

Who Is Eligible For Sdi In California

You’re medically eligible for SDI if you’re unable to work due to a disability and have lost income as a result. But the first seven days of your time off work is a waiting period, and you won’t get paid for those days. The EDD uses this “SDI elimination period” to make sure that only employees who are seriously ill or injured can collect from the SDI program.

You’re technically eligible for SDI if you’ve received at least $300 in wages, from which SDI taxes were withheld, during the base period. The base period is a one-year period, usually ending just before the last complete calendar quarter before you filed a claim. For example, if you file a claim in April 2022, the base period is 2021. Read more in our article on eligibility for SDI in California.

The California State Disability Insurance Benefit Is Estimated At Between 60 And 70 Of Wages Earned Prior To A Non

California is one of five states that has a state mandated temporary disability insurance which replaces a portion of wages lost due to a disability that was incurred outside of the workplace. The disability can include an illness or injury, whether it be physical or mental, along with pregnancy and childbirth or even elective surgery, among other medical conditions.

State Disability Insurance is a short-term program that pays benefits for up to a year, unlike Social Security disabilitywhich is for conditions that last at least a year or could result in death. The exact amount that recipients could get depends on their earnings and how much theyve paid into the program.

Recommended Reading: How Much Disability Can I Draw

Statutory Disability Insurance In New York State

In New York State, there is a disability benefits insurance, that provides temporary cash benefits paid to an eligible wage earner to partially replace wages lost, whether the wage earner is disabled by an off-the-job illness or injury or for disabilities arising from pregnancy.

Who is required to provide state disability benefits insurance according to New York State disability insurance

Each employer, who hires one and more employees on each of 30 days in any calendar year, is required to provide state disability benefits insurance for their employees. These employees have to provide it unless they are considered exempt.

Among those employees, who are not considered exempt belongs

- Each employer of one or more employees on each of 30 days in any calendar year becomes a covered employer four weeks after the 30th day of such employment.

- Employees or recent employees of a covered employer, who have worked at least four consecutive weeks.

- Employees of an employer who elects to provide benefits by filing an Application for Voluntary Coverage.

- Employees who change jobs from one covered employer to another covered employer are protected from the first day on the new job. Generally, an eligible employee does not lose protection during the first 26 weeks of unemployment, provided he/she is eligible for and is claiming unemployment insurance benefits.

- Domestic or personal employees who work 40 or more hours per week for one employer.

What Is Considered To Be A Permanent Disability In California

There is a wide range of medical conditions, including injuries and illnesses, that can qualify a worker for permanent disability benefits.

A prime example is a repetitive stress injury , which is an injury that can develop over time as a result of repetitive movements such as typing or lifting heavy machinery or equipment.

Other injuries that commonly qualify workers for permanent disability benefits in California include:

- Damage to your knees and joints

- Amputations of any body parts like arms, legs, eyes, or fingers

You May Like: Social Security Disability Income Limits

Years Experience Assisting Californias Workers With Permanent Disability Benefits

While most workers fully recover from their job-related injuries and illnesses, some do not and continue to experience medical issues. In the event of lasting injuries, California workers compensation insurance provides for the payment of permanent disability benefits. Moga Law Firm has significant experience helping injured workers receive the disability benefits entitled to them under the law. Let our team of highly skilled Upland workmans comp lawyers evaluate your case and personally guide you through the benefit claims process step by step.

How Does Ca Disability Work

Payroll deductions are used to make employee contributions to the State of Californias Short-Term Disability Insurance program.This requirement applies to all state workers.When an employee has a condition that prevents them from working, they are eligible to collect weekly benefits from the program.These benefits continue until the individual is either able to return to work or the benefits run out.

Read Also: How To Change Va Disability Direct Deposit

Whats The Difference Between Short Term Vs Long Term Benefit Periods

The biggest difference between short term and long term disability insurance is the period of time youll receive benefits if youre unable to work. This period is called the benefit period. As the name indicates, short term disability insurance is intended to cover you for a short period of time following an illness or injury that keeps you out of work. While policies vary, short term disability insurance typically covers you for a term between 3-6 months. On the other hand, long term disability is intended to provide benefits for a longer period, and benefit periods for long term disability insurance are usually stated in years: 5, 10, 20 or even until you reach retirement age, depending on your plan.