Ssdi And Ssi Attorney Fees

As mentioned, attorney fees are limited to 25% of your back pay. But the amount must not be more than $6,000. This applies to both SSDI and SSI claims.

Note that the payment will be based on your back pay and not on your monthly benefit amount. This means that if youre not entitled to back pay, your lawyer will receive nothing. Though in cases like this, the lawyer is allowed to file a petition to the SSA requesting a higher fee. Besides, disability claims almost always include back payment.

For SSDI, your retroactive benefits are calculated from the onset of your disability to when your claim got approved. If youre applying for SSI benefits, the back pay is computed from when you applied for benefits to the date of your claims approval. Back pays are usually included in your first benefits check.

You dont have to hand your attorney the fee yourself. The SSA will deduct the social security attorney fee from your first payment. For example, your back pay totaled $10,000 and your first monthly benefit is $1,500. Your lawyer will only be entitled to $2,500 and you will receive a check worth $9,000 .

Most disability lawyers get less than the maximum amount of $6,000. Thats because most cases, especially compassionate allowance claims, usually take no more than a few months to get approved.

Are There Any Other Fees I Should Be Aware Of

The 25 percent/$6,000 limit does not include any out-of-pocket expenses a Social Security disability attorney incurs on your behalf. These expenses are typically nominal , but lawyers do have the right to recover those fees from you irrespective of the outcome of your claim .

Some of the common expenses a lawyer will have to pay upfront for a disability claimant include:

- Obtaining medical records

Read Also: Is Adhd Considered An Intellectual Disability

When Does It Make Sense To Hire An Erisa Long

When people do these appeals on their own, they get denied. Then by the time you get the Federal District Court, theres not enough information in the administrative record to support the claim. So the claim dies and goes nowhere.

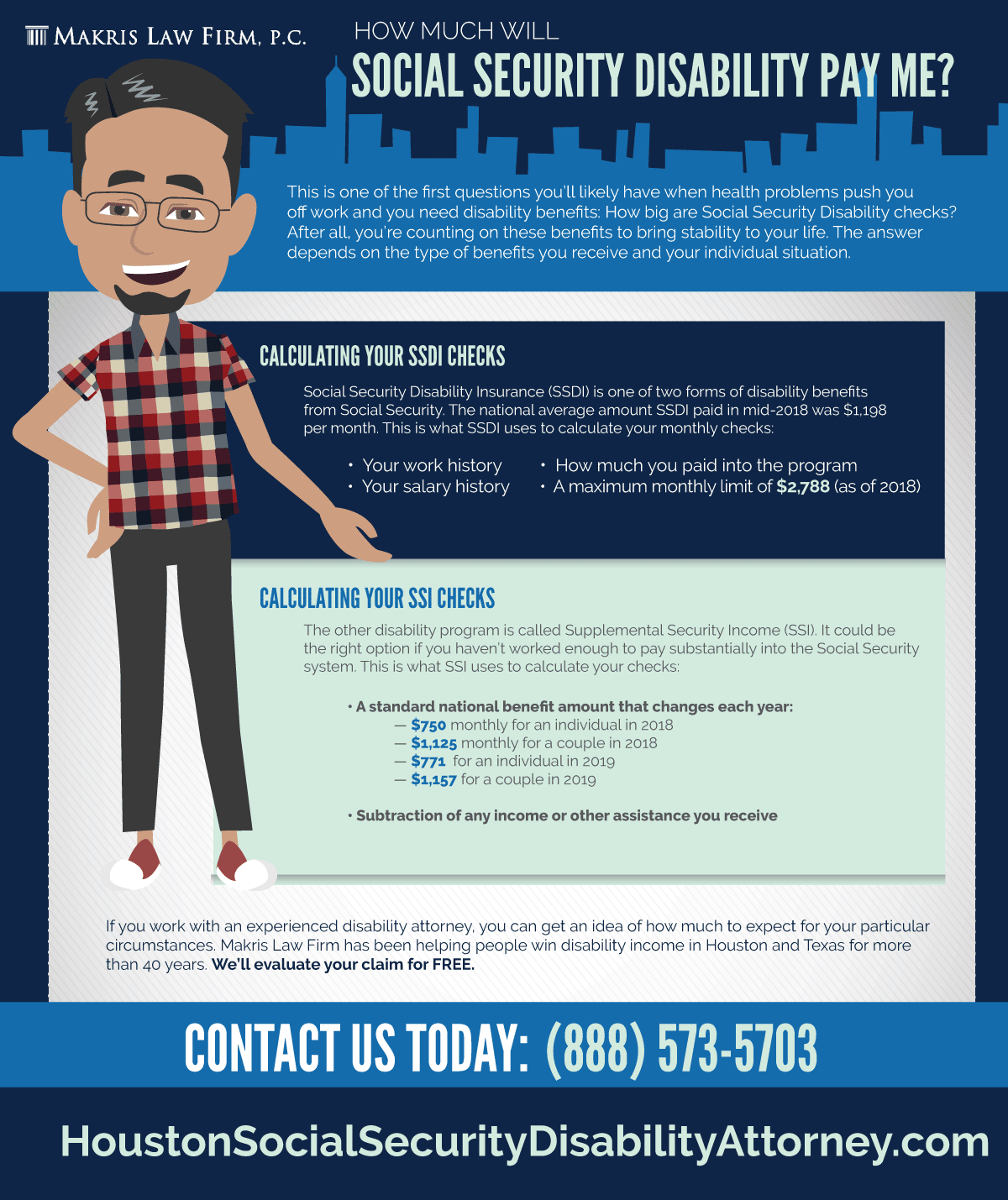

So this person is essentially just left with Social Security Disability. SSDI usually requires being out of work for about a year before you can even get it. Or doctors to say that youre lifetime-disabled because of a recognized disabling condition that they have a list of in Social Security Disability.

If you have Social Security Disability, you might get $1,100, $1,200, $1,500 a month to pay for that. But if youve got a long-term disability policy and you are a higher earner, you can make more. Lets say you make $4,500 a month, then you should be getting about $3,000 a month in long-term disability benefits from your insurance company. Thats a big difference. $3,000 a month versus $1,500 a month makes a big difference in the life of ordinary people.

Read Also: Negatives Of Getting Social Security Disability

Answer A Few Questions To Check Your Eligibility

Unlike many attorneys, Social Security disability lawyers don’t charge up-front fees or require a retainer to work on a disability case. Most disability attorneys and nonlawyer representatives will be paid a fee only if they win the case . How much does a disability lawyer cost? The answer depends on how long your case takes and how much you receive in disability benefits.

Here’s what you need to know about Social Security disability lawyers’ fees, and how much you might have to pay.

The majority of disability claimants in our survey paid their disability representatives less than $4,000.

What Is A Contingency Fee

A contingency fee can apply to any practice or any case, but most cases do not operate on a contingency fee though, or if they do, they still require an additional upfront fee. This is because a contingency fee is only paid out if the case is won, and usually, its paid from the winnings of the case.

Tabak Law handles its Social Security disability cases entirely on contingency, which means you pay us nothing up front, and we only get paid if we win. That also means that even if you win, youre not out any money since we are paid with a portion of the settlement.

Also Check: How To Apply For Disability In Arizona

All Social Security Disability Lawyers Charge Fees On A Contingency Basis Where You Only Pay If You Win

Applicants for Social Security disability are very unlikely to find an attorney to represent them for free, even at legal aid offices. This is because attorneys who help disability claimants work on a contingency basis, meaning that they only get paid for their work if they win your case. In addition, fees paid to disability lawyers are approved by Social Security and are limited to certain amounts.

Does Legal Representation At The Hearing Stage Help

If your initial application is denied, it will go through another review. Most cases are also rejected during the second review. You are then entitled to a hearing. Surveys found that having the representation of an SSD lawyer at the hearing stage more than doubled the applicants chances of having a successful outcome. Out of those who had an attorney, 50 percent had their claim approved through a hearing while only 23 percent of applicants who represented themselves had their applications approved.

Read Also: This Device Is Disabled Code 22

Are There Limitations To Ssdi Contingency Fees

We know what you might be thinking. If you win your case, you are going to start receiving monthly checks. Will the contingency fee take from those monthly checks? No, your lawyer will only be paid out of your past-due benefits also known as back pay. Additionally, the fee is legally limited to 25% up to a maximum of $6,000.

Do I Have To Make Sure My Lawyer Is Paid

No, not usually. It is usually a very hands-off process for the claimant. The SSA will take the attorneys contingency fee out of your retroactive Social Security benefits before they send the balance of the money to you.

However, SSA may make a rare mistake of paying the entire retroactive benefits amount to you, including the part that was supposed to be withheld and paid directly by them to the attorney as their fee. In that instance, you will be required to pay the attorney the portion of the retroactive benefits that were meant to be sent to the attorney but sent to you in error .

Donât Miss: What Happens After Social Security Disability Is Approved

You May Like: Benefits For 100 Disabled Veterans In Texas

Hire A Reputable Greenville Social Security Lawyer

If you are applying for SSA disability benefits for the first time, or want to file an appeal against an initial rejection, we can help you. Here at Robert Surface, we have been working with Social Security disability benefits applicants for many years. We help Greenville-based applicants file for benefits and have their claims accepted as soon as possible.

We also strive to make sure that you receive the maximum amount of money in lieu of back pay. If you want to discuss your claim or see what contingency fee arrangement we offer, wait no more. to discuss your claim with our disability lawyers for free.

Other Costs For Social Security Disability Cases

Besides the attorney fees, there are other out-of-pocket expenses, although a good attorney will make every effort to minimize these costs as long as its not detrimental to your case. And like with the attorney fee, most lawyers will not charge for these costs until the end of your case.

Here are some costs an SSD attorney may include in their incidental expenses:

- Gathering of updated medical records

- Witness or expert testimony

Any additional expenses should be included in a fee agreement youll be asked to sign when you choose a lawyer to represent you. Also, read your fee agreement thoroughly and ask your SSD attorney about any additional costs that could come up. A good lawyer will be able to outline everything clearly for you. And any large expenses, such as a medical exam, will have to get your approval beforehand.

Read Also: What Conditions Are Considered For Disability

What If There Is No Back Pay

What happens if you are approved for benefits and there is no back pay awarded? If there are no back-dated benefits awarded during your claims approval, your attorney will not be paid a fee. If there is no back pay, or if there are other extenuating circumstances, your lawyer or advocate can submit a fee petition to Social Security to request a higher fee to ensure he or she is paid for their work. Back pay is calculated by going back to the date the SSA determined your disability began, which is a maximum 12 months back preceding the date of your application for benefits.

Get A Free Consultation From A Disability Lawyer About Your Ltd Payments

If youre planning to file for LTD benefits, its always a good idea to consult an attorney. The long-term disability attorneys at Bross & Frankel, PA, understand the complex rules of long-term disability and know how to apply them to protect clients rights. When necessary, we help people fight insurance companies to obtain the benefits they deserve.

There are no attorney fees charged unless you receive your disability benefits, so you have nothing to lose by speaking with us today. To schedule a free consultation with an ERISA lawyer at our law firm, call 856-210-3345 or contact us online.

Speak with an experienced Social Security Disability lawyer about your claim today.

You May Like: Caught Working While On Disability

What Are The Maximum Attorney Fees In Ssdi And Ssi Cases

The Social Security Administration sets limitations on how much SSDI lawyers can charge. Fees are limited to 25% of your past-due benefits . For example, if you are entitled to $12,000 in back pay, your attorney will receive no more than $3,000. Additionally, fee awards cannot exceed $6,000, no matter how much your back pay is. So if you were entitled to $30,000 in back pay, your attorney would end up getting less than 25%.

When you hire an SSDI attorney, you will usually sign a fee agreement outlining the exact amount of the fee. The SSA will then review the fee agreement to make sure it follows the rules.

What Is The Most An Attorney Can Charge For Disability

First, the fundamentals: Fees charged by Social Security disability attorneys are generally limited by federal law to 25% of your back pay, or $6,000, whichever is less. Back payments are positive effects that accumulated while you waited for Social Security to approve your claim. There will not be a need to pay out-of-pocket costs.

- You owe no attorney fees if your claim is denied.

- Fees are only due if and when we win your case.

- Assume, for example, that we are successful in obtaining your disability benefits.

- Your onset date is 17 months prior to today .

- In this case, you may be entitled to 12 months of back benefits under SSA regulations .

- If your monthly benefit is $850, your back benefits would be $10,200 .

- On this amount, the attorneys fee would be $2,550 .

- If this figure were greater than $6000, then only $6000 would be used.

Don’t Miss: Short Term Disability For Mental Health

You Only Pay An Attorney Fee If We Win Your Case There Is No Attorney Fee If You Do Not Win

One of the main reasons people do not hire an attorney to help them with their disability case is they are afraid of the cost. Most people think that hiring an attorney will cost too much money. However, in Social Security Disability cases, the attorney fee is set by law and is also contingency based. Contingency based means the attorney is only paid a fee if she wins the case. If an attorney is trying to charge you an upfront fee for legal services that you must pay before she takes the case, then the attorney is breaking the law. Do not hire that attorney, because they do not understand how the fee process works in disability cases.

How Much Does A Disability Lawyer Cost

February 23, 2022 by Andrew Price

Claimants applying for Supplemental Security Income or Social Security Disability Insurance benefits may choose to work with a disability lawyer. But before you make the decision to hire a disability lawyer, its important to first educate yourself about fee structures.

Read Also: Va Disability Percentage By Condition

Who Pays The Legal Fees

When you hire a Social Security disability lawyer and reach a fee agreement, this agreement must be submitted to SSA in writing. SSA then reviews the agreement and approves or rejects it. If the agreement is approved and your claim finally meets success, SSA pays the agreed-upon amount directly to your attorney. These are the legal fees of the lawyer, and they are deducted from your backpay.

Talk To A Social Security Disability Attorney For Free

Social Security Disability lawyers John Foy & Associates never charge you a thing unless we win your case. And with more than 20 years of experience helping Social Security Disability applicants win the benefits they need, we know what the SSA is looking for. Let us give you a FREE consultation to discuss your case and how we can help. To get started today, call us at , or complete the form to the right for your free consultation.

Call or text or complete a Free Case Evaluation form

Recommended Reading: Working Part Time On Disability

How Much Will A Social Security Disability Lawyer Charge In Attorney Fees

Attorneys are typically paid on one of two ways: by the hour at a set hourly rate and on a contingency fee basis for a percentage of the recovery in a claim.

Disability lawyers are paid according to the second method. Social Security disability attorneys do not charge fees at the beginning of the claim or require a retainer to work on an SSDI or SSI claim. Most disability attorneys will be paid a fee only if they win the case

Fee Agreements And Fee Petitions

To get their fees paid, Social Security lawyers enter into written fee agreements with their clients and submit those fee agreements to Social Security for approval. If Social Security approves the fee agreement, it will pay your attorney for you directly out of your backpay. The attorney and the client can agree on any fee, as long as it does not exceed $6,000 or 25% of your backpay, whichever is less. That limit on fees is a part of Social Security law, and in most cases, an attorney canât charge more than that.

We recently surveyed readers about how much Social Security paid their lawyers after they were approved for benefits. For the majority, the fees were less than the $6,000 cap. For details, see our article on average fees paid to Social Security disability lawyers.

If a disability case requires multiple hearings or an appeals to the Appeals Council or federal court, a disability lawyer is permitted to file a fee petition with SSA to request to be paid more than the $6,000 limit. Social Security will review the fee petition and will approve it only if it is reasonable. To learn more, read Noloâs article on when a lawyer can file a fee petition to charge more than $6,000.

Also Check: Homes For Adults With Disabilities

How Much Are Social Security Attorneys Fees

In most cases, a Social Security disability attorneys fee is limited to 25% of the retroactive, or past-due benefits you are awarded. This fee is capped at a maximum of $6,000.00, so the fee is whichever is less: either 25% or $6,000.00. There is no minimum fee.

You usually dont have to pay anything up front to a disability lawyer. Instead any fee is paid out of the back benefits you receive. Usually, Social Security handles the payment of fees directly, withholding the money from your backpay award, and sending the remainder to you.

You May Like: How To Apply For Short Term Disability In Ma

Are Ltd Payments Taxed

Yes, LTD disability payments can be treated as taxable income. The taxation arrangement for LTD benefits depends on whether you have an employer-sponsored plan or a private one.

- LTD benefits are taxed as ordinary income if you paid the monthly premium with before-tax dollars .

- If you share the cost of the plan premiums with your employer, you are only taxed on the portion of the payments attributable to your employers contribution.

- You are not required to pay taxes on LTD benefits if you purchased the plan with your own after-tax dollars.

If you have questions regarding the tax implications of your benefits, consult an experienced New Jersey LTD benefits attorney.

You May Like: Free Moving Services For Disabled

How Much Are Social Security Disability Lawyers Paid For Their Services

Your lawyer is legally bound not to require any more than 25 percent of the past-due benefits you are owed. In fact, they cannot legally take more than $6,000, no matter how much you are owed in past-due benefits. However, if your case happens to end up in federal district court, they are allowed to charge more depending on your specific agreement. Be sure to review your contract carefully, so you know what you are signing and agreeing to.

Payment to your SSD attorney is limited to your past-due benefits, also known as back pay. If you do not end up receiving any back pay benefits, your attorney will not receive any type of fee. In these cases, however, the lawyer is allowed to petition the SSA to request being paid a fee.

Under nearly all circumstances, it does not cost anything upfront to hire a Social Security Disability attorney. Their fee will come out of your award, if and when you receive it. The SSA will pay them directly, and you will not be hassled with turning the money over to them.