Does Disability Pay More Than Social Security

Applying for Disability benefits has a reputation as a time-consuming and inefficient process. Consequently, many people entering their 60s who could potentially qualify for disability benefits may opt to just elect for Social Security a couple of years early to avoid the hassle. However, this strategy has the potential to cost you a lot of money in the long run. Whether opting for disability would be the more remunerative strategy will depend on your age. A financial advisor could help you weigh the best options for your retirement goals.

How Much Work Do You Need

In addition to meeting our definition of disability, you must have worked long enough and recently enough under Social Security to qualify for disability benefits.

Social Security work credits are based on your total yearly wages or self-employment income. You can earn up to four credits each year.

The amount needed for a work credit changes from year to year. In 2022, for example, you earn one credit for each $1,510 in wages or self-employment income. When you’ve earned $6,040 you’ve earned your four credits for the year.

The number of work credits you need to qualify for disability benefits depends on your age when your disability begins. Generally, you need 40 credits, 20 of which were earned in the last 10 years ending with the year your disability begins. However, younger workers may qualify with fewer credits.

For more information on whether you qualify, refer to How You Earn Credits.

How Do You Calculate What My Weekly Benefit Amount For Disability Insurance Will Be

We will calculate your weekly benefit amount using a base period. This base period covers 12 months and is divided into four consecutive quarters of three months each.

Your weekly benefit amount is about 60 to 70 percent of wages earned 5 to 18 months before your claim start date, up to the maximum weekly benefit amount. You must have been paying SDI taxes on these wages . Your base period does not include wages paid at the time your disability begins.

You can get a general estimate of your weekly benefit amount using our Weekly Benefit Calculator. This calculator should be used as an estimate only.

You May Like: Denied Social Security Disability Appeal

How Do Ssdi And Social Security Retirement Work Together

SSDI pays out your full retirement benefits until you qualify to draw them under the traditional Social Security retirement scheme. Once you reach full retirement age based on the year you were born, the SSA will automatically start your retirement benefits and cease your SSDI payments.

The SSA allows you to file for retirement benefits as early as age 62. You can also wait and receive your full benefit amount when you reach full retirement age. Depending on what year you were born, this may vary from 65 to 67 years old.

Applying For Disability Benefits

You can call toll free 772-1213 to make an appointment to apply at your local Social Security office. You may apply for SSDI benefits online. You can also start an SSI application online. However, you will need to go into a Social Security office to complete the application. When you apply, you will need to give SSA information about:

- Your medical conditions and treatment,

- How your medical conditions affect your ability to function,

- Information about your past work, and

- Information about your education.

Don’t Miss: Bilateral Hearing Loss Va Disability

Special Rules For People Who Are Blind Or Have Low Vision

We consider you to be legally blind under Social Security rules if your vision cannot be corrected to better than 20/200 in your better eye. We will also consider you legally blind if your visual field is 20 degrees or less, even with a corrective lens. Many people who meet the legal definition of blindness still have some sight and may be able to read large print and get around without a cane or a guide dog.

If you do not meet the legal definition of blindness, you may still qualify for disability benefits. This may be the case if your vision problems alone or combined with other health problems prevent you from working.

There are several special rules for people who are blind that recognize the severe impact of blindness on a person’s ability to work. For example, the monthly earnings limit for people who are blind is generally higher than the limit that applies to non-blind workers with disabilities.

In 2022, the monthly earnings limit is $2,260.

How Has The Covid

Working people with disabilities experience disproportionate job loss, compared to workers without disabilities, during economic downturns,39 and SSI applications generally increase when the unemployment rate increases . This trend held during the Great Recession and subsequent economic recovery.40 One exception to the general trend is the period from 2003 to 2007, when SSI applications continued to rise despite falling unemployment.41 Possible explanations for this anomaly include factors such as the lagged effect of federal welfare reform leading TANF enrollees to switch to SSI and persistently high poverty rates.42 The same study also found that the likelihood of applying for SSI significantly increases during extended periods of high unemployment.43

Figure 7: Percent change in SSI Applications Filed by Adults Ages 18-64 and U.S. Unemployment Rates, 1991-2019

Don’t Miss: Free Car Repair For Disabled

Do I Qualify For The Exception To This Rule Can I Draw Both Ssdi And Retirement

There is one exception that allows qualified individuals to draw both retirement and SSDI benefits at the same time, but this is rare and still does not allow them to collect more than their full retirement benefit.

This occurs when someone opts for early retirement between age 62 and their full retirement age but is then approved for SSDI benefits. Some people set themselves up for this by filing for early retirement after an injury or illness caused them to have to quit work. They can begin receiving early retirement to help them cover bills until their SSDI claim receives approval and the waiting period for those benefits expires.

Once this happens, they can begin receiving additional money from the SSA each month on top of their early retirement benefits. This will bring them to their full retirement benefit amount. They are also most likely qualified for retroactive benefits, which will bring them to their full retirement amount for any month they suffered a disability but were not yet approved for SSDI.

Can You Receive Retroactive Payments

Once the SSA approves your SSDI application and calculates your monthly benefit, you may be entitled to a back pay award. How many months of payments you will receive will depend on the date you applied for benefits and your disability onset date.

If you are applying for SSDI benefits, you need the assistance of a skilled Social Security disability lawyer to get your application approved and receive the benefits you deserve. To schedule a free consultation with a member of our legal team, fill out the online form on this page or call our Roswell office today.

|

Related Links: |

You May Like: Non Attorney Representative Social Security Disability

Who Is Eligible For Di Benefits

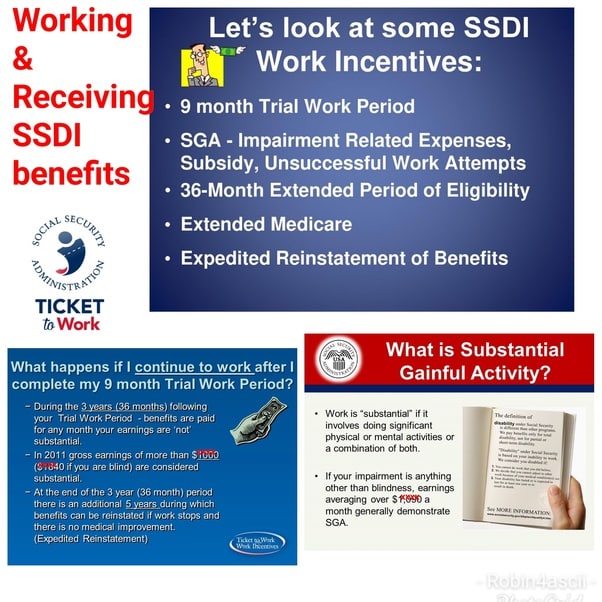

The Social Security test of disability is very strict. To be eligible for disability benefits, the Social Security law says that the applicant must be unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment which can be expected to result in death or which has lasted or is expected to last for a continuous period of at least 12 months. Furthermore, the impairment or combination of impairments must be of such severity that the applicant is not only unable to do his or her previous work but cannot, considering his or her age, education, and work experience, engage in any other kind of substantial gainful work which exists in the national economy ).

A person is considered to be involved in substantial gainful activity if he or she earns more than a certain amount. If a non-blind individual earns more than $1,170 a month in 2017, he or she would not be eligible for disabled worker benefits. The amount is adjusted each year to keep up with average wages. The substantial gainful activity level for blind individuals in 2017 is $1,950 a month.

State agencies, operating under federal guidelines, make the medical and vocational determinations for the Social Security Administration about whether applicants meet the test of disability in the law. Medical records, work history, and the applicants age and education are considered in making the determination.

Differences Between Ssi And Ssdi

There are three main differences between SSI and SSDI:

1. The Type Of Program

SSI was created to care for elderly, blind, and disabled individuals who would have a more challenging time affording food and shelter. Because SSI is restricted for this group of people, it has very limited financial requirements, making it what is commonly known as a “means-tested” benefit.

On the other hand, SSDI is an entitlement program that gives financial assistance to those who have worked and paid into the Social Security system for a minimum of ten years without considering current income or assets.

2. Medical Benefits

Applying for SSI also comes with the perk of automatic qualification for Medicaid benefits. Many people apply for SSI primarily because Medicaid provides extensive coverage, including health insurance.

Beneficiaries of SSDI are eligible for Medicare two years after they are eligible for SSDI benefits, as opposed to ten years in the case of Social Security Disability Insurance.

3. The Financial Benefits Vary Greatly

Regarding the amount of money provided, SSI and SSDI benefits vary considerably. In 2022, the federal SSI average payment standard will be $841 per month for an individual , while the average SSDI payment is expected to be $1,358 per month.

Because SSDI is based on the beneficiary’s earnings record, some people may receive much more than this.

Recommended Reading: Mental Health Short Term Disability

Benefits For Widows Or Widowers With Disabilities

If something happens to a worker, benefits may be payable to their widow, widower, or surviving divorced spouse with a disability if the following conditions are met:

- The widow, widower, or surviving divorced spouse is between ages 50 and 60.

- The widow, widower, or surviving divorced spouse has a medical condition that meets our definition of disability for adults and the disability started before or within seven years of the worker’s death.

Widows, widowers, and surviving divorced spouses cannot apply online for survivors benefits. If they want to apply for these benefits, they should contact Social Security immediately at 1-800-772-1213 to request an appointment

To speed up the application process, complete an Adult Disability Report and have it available at the time of your appointment.

We use the same definition of disability for widows and widowers as we do for workers.

Tips For Getting Retirement Ready

- A financial advisor could help you prepare for retirement. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Relying on Social Security alone may not be the best option when it comes to saving for retirement. As you approach early retirement age, its best to save as much as you can along the way. Our retirement calculator can help you determine how much money you need to retire comfortably.

Read Also: Disabled American Veterans Charity Rating

How Many Hours Can I Work On Disability 2020

Social Security typically allows up to 45 hours of work per month if youre self-employed and on SSDI. That comes out to around 10 hours per week. The SSA will also see whether or not youre the only person working for your business. You must not be earning SGA, along with not working too many hours.

Can a person on Social Security disability work after age 65?

Disabled folks over 65 can collect Social Security disability benefits rather than retirement. By Lorraine Netter, Contributing Author Some individuals who are over the age of 65 may not have the desire or financial ability to retire, but become disabled and are unable to continue working.

When do you qualify for Social Security disability?

The grids make it easier for those between the ages of 60 and 65 to qualify for Social Security disability. When you apply for disability after age 60 but before full retirement age, if you dont meet the requirements of a medical listing, Social Security applies special age-specific rules when it evaluates your disability.

I Received My Notice Of Computation Why Havent I Received A Benefit Payment

This notice does not confirm that you are eligible to receive benefits.

We send you the Notice of Computation to let you know your potential weekly and maximum benefit amount based on the wages you earned in your base period. We may need more information before making a decision about your eligibility.

Don’t Miss: What Disabilities Qualify For Medicaid Under 65

What Are The 3 Types Of Social Security

cardiovascular conditions, such as heart failure or coronary artery disease. senses and speech issues, such as vision and hearing loss. respiratory illnesses, such as COPD or asthma. neurological disorders, such as MS, cerebral palsy, Parkinsons disease, or epilepsy.

Even though the Social Security Administration administers the funds, the funds for SSI come from US Treasury General Funds. This is completely different from FICA taxes as a result of you do not want to pay FICA taxes or earn money to qualify for these benefits.

It is out there to adults with disabilities, youngsters with disabilities and folks 65 or older. Individuals with enough work historical past could also be eligible to obtain SSI along with incapacity or retirement advantages. The quantity individuals receive varies based on their different sources of income and the place they stay.

Can I Qualify For Ssi While Collecting Social Security Retirement Benefits

While you cannot collect Social Security retirement and SSDI at the same time to increase your benefits beyond the full retirement amount, there is a program that may allow you to collect additional income.

SSI, which stands for Supplemental Security Income, is a Social Security program that helps seniors and those with a disability who have an extremely low income or limited assets. To qualify for SSI, you need to meet strict income qualifications and have only a minimum amount of resources. Resources, as the SSA defines the term, can be anything that can be turned into cash, such as:

- Bank accounts, stocks, or U.S. savings bonds

Read Also: Disability For Arthritis In Spine

My Health Benefits Stopped While I Was On Paid Family Leave What Can I Do

The US Department of Labor provides a temporary extension of health benefits at group rates for certain former employees through the Consolidated Omnibus Budget Reconciliation Act program. For more information, contact the DOL at 1-866-275-7922. For TTY, use 1-877-889-5627.

There are two ways you can notify us of the deceased claimants date of death to stop their benefit payments:

- Phone: Call us at 1-800-480-3287.

- Mail: Use the PO Box address printed on the payment notice.

If eligible, benefits are payable through the date of death. We will need the following information to stop benefit payments and contact you with additional instructions:

- Claimants full name

What Ssi Stands For

SSI stands for Supplemental Security Income. Social Security administers this program. We pay monthly benefits to people with limited income and resources who are disabled, blind, or age 65 or older. Blind or disabled children may also get SSI.

This occurs when a incapacity applicant is approved for Social Security incapacity insurance benefits but receives only a low monthly fee. Someone often will get a low SSDI cost if they made low wages or they didnt work much in recent times. If youre applying for Social Security disability advantages, youll must fill out type SSA-827.

Read Also: Student Loan Forgiveness For 100 Disabled Veterans

Can You Get Social Security Disability Insurance And Long Term Disability At The Same Time

Yes, its possible. If you qualify for Social Security disability benefits, your benefit amount will not be reduced if you are also receiving individual LTD benefits. However, the opposite does not always hold true: some private long-term disability policies will reduce the benefit amount once a policyholder starts receiving SSDI benefits. It all depends on the specific terms and conditions of your long-term disability policy.

What We Mean By Disability

The definition of disability under Social Security is different than other programs. Social Security pays only for total disability. No benefits are payable for partial disability or for short-term disability.

We consider you to have a qualifying disability under Social Security rules if all the following are true:

- You cannot do work and engage in substantial gainful activity because of your medical condition.

- You cannot do work you did previously or adjust to other work because of your medical condition.

- Your condition has lasted or is expected to last for at least one year or to result in death.

This is a strict definition of disability. Social Security program rules assume that working families have access to other resources to provide support during periods of short-term disabilities, including workers’ compensation, insurance, savings, and investments.

You May Like: How Much Money For Disability