Will Applying For Social Security Benefits Affect Unemployment

While unemployment benefits will not affect Social Security payment amounts, unless the payments exceed the SSI maximum, the opposite is true under some circumstances. Funds received through one of Social Security benefit programs may end up reducing a persons unemployment benefits, depending on the state in which the recipient lives.

Social Security benefits only affect unemployment benefit amounts in the following states: Illinois, Louisiana, Minnesota, and South Dakota .

This wasnt always the case. In the early 2000s, 20 states and the District of Columbia had Social Security offset laws. States began repealing them in 2003 amid advocacy efforts on the issue. The most recent state to do so was Illinois, which repealed its offset law in 2015.

Minnesota still has partial offset laws regarding Social Security and unemployment compensation. For residents who receive both benefits, Minnesota reduces unemployment insurance by half of your Social Security benefits. There are determining factors, such as when you started receiving disability payments and the length of time between filing for Social Security and filing for unemployment.

Disability Benefits From State Government

From January 2021, the Department of Paid Family Medical leave offers a cash benefit to Massachusetts employees who need to take paid leave for medical or family reasons. Find out more at Paid Family and Medical Leave .

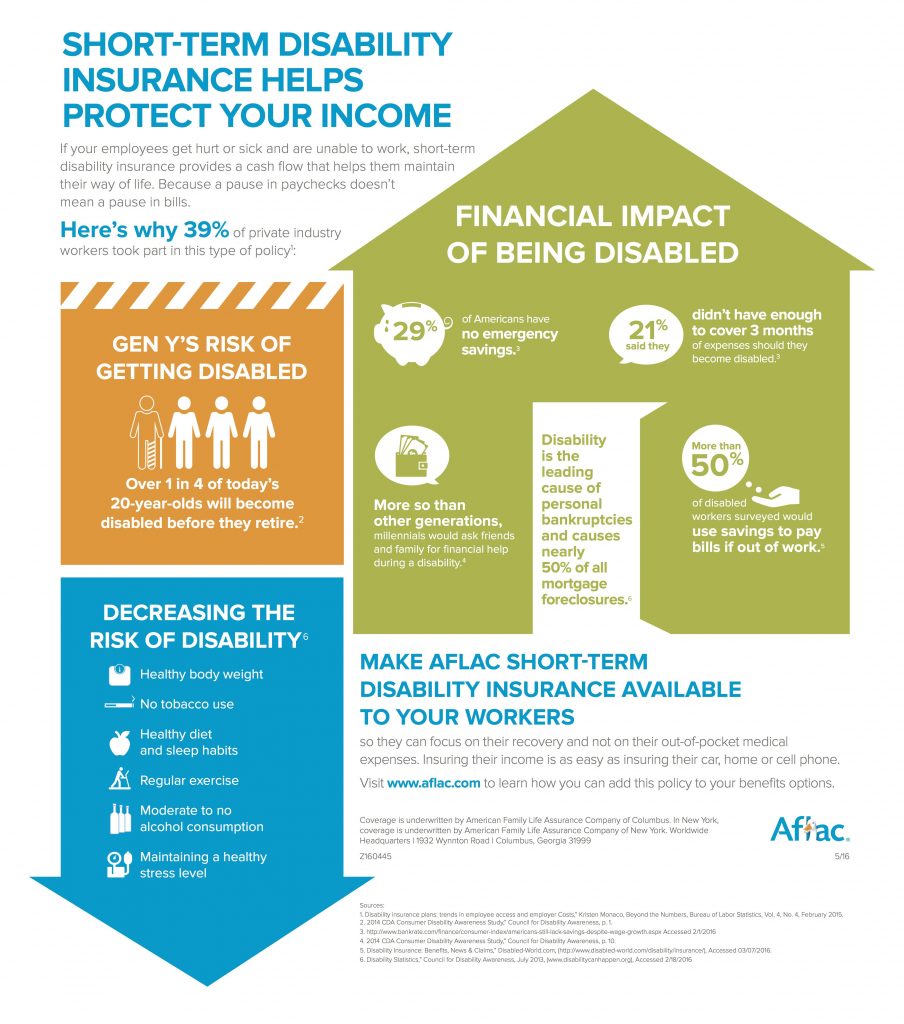

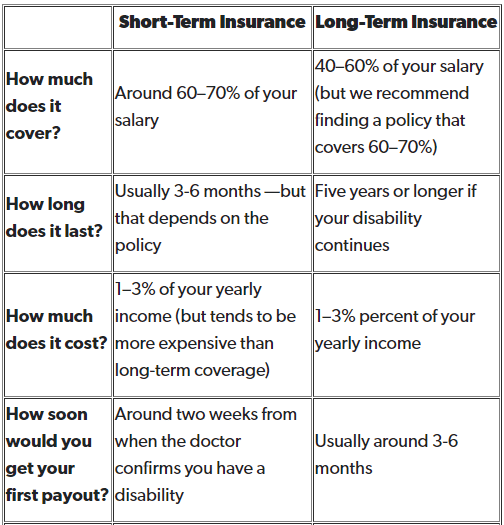

Some employers offer short- or long-term disability insurance as a benefit to their employees. You should check with your human resources department to find out whether your employer offers this benefit and if you have previously enrolled in it. If you have private disability insurance through your employer, or that youve bought individually, typically it will require you to apply for any public benefits available. In conversations about disability insurance, if people are referring to disability, they often mean PFML.

The Department of Transitional Assistance provides cash benefits to people with very low income and assets. If you are unable to work for at least 60 days due to a disabling condition, you may be eligible for one of their programs.

What If Youre Still Not Ready To Go Back To Work

If youre on short-term disability, your benefits will end when your predetermined time period is over or when you return to workwhichever comes first. But what if youve already maxed out your short-term disability benefits and you still cant head back into the office?

Lets return to our example of missing out on work for major back surgery. Your doctor determined that youd need six months to fully recover, and your short-term disability plan approved you for that amount of time.

However, you had some pretty significant complications with your surgery and your recovery. As the end of those six months draw near, its evident that you arent physically capable of sitting at a desk for eight hours each daythis is a problem that will plague you for a lot longer, perhaps even permanently. Now what? Are you just out of luck?

If you have long-term disability benefits, it should be straightforward enough to transition into those benefits if you meet the new definition of disability for your long-term plan. The definition for disability under a long-term plan is typically subtly different than the definition for short-term disability.

Some insurers require new paperwork from the claimant and new medical records before they will begin paying a long-term disability benefit, says McDonald.

You May Like: Is Social Security Disability Income Taxable By The Irs

Streamline Your Application Process

The application process will depend on what kind of Short Term Disability coverage you have and your insurers requirements. If your benefits plan includes services from a third-party disability management service like DMI, ensure you are utilizing their expertise to help you along the way.

If you are applying for short term disability coverage, you want to focus on your treatment and recovery. To get your claims experience started right, our partners at DMI offer their advice to get things going in the right direction:

- Fill out application forms in their entirety. Your application for benefits will be based primarily on the accuracy and comprehensiveness of the information that you provide, so double checking or having a close friend or family member look over your application form for any missing information can save you valuable time and energy.

- Ensure your doctor, treatment team or specialist fills out the appropriate paperwork and provides the clinical records relating to your claims. This is the information your insurer will use to adjudicate your claim for benefits.

- You will need to provide a clear and legible copy of one of the following documents: birth certificate, drivers license, or a government-issued passport.

- Other information you may need to include is your SIN number, banking information for direct deposit, an up-to-date mailing address, as well as your employers address.

Recommended Reading: Bankofamerica/kdoldebitcard

How Long Ltd Benefits May Be Payable

These benefits will begin after you have been disabled for 180 calendar days and are reduced by any sick leave you use. LTD benefits end when you are no longer disabled or reach age 65, except benefits for disabilities caused by mental disorders, or other limited conditions, which are limited to two years. If you become disabled after reaching age 60, however, your benefits could continue for a limited period after age 65. Your plan contains incentives and extra benefits to help keep you at work. Accommodations may be available under the plan to adjust your workplace so you can stay at work, or to help you return to work. Vocational rehabilitation and return to work services may be available to help you return to work after a disability.

Don’t Miss: 50 Percent Va Disability Benefits

Is Your Condition Found In The List Of Disabling Conditions

For each of the major body systems, we maintain a list of medical conditions we consider severe enough to prevent a person from doing SGA. If your condition is not on the list, we must decide if it is as severe as a medical condition that is on the list. If it is, we will find that you have a qualifying disability. If it is not, we then go to Step 4.

We have two initiatives designed to expedite our processing of new disability claims:

- Compassionate Allowances: Certain cases that usually qualify for disability can be allowed as soon as the diagnosis is confirmed. Examples include acute leukemia, Lou Gehrigs disease , and pancreatic cancer.

- Quick Disability Determinations: We use sophisticated computer screening to identify cases with a high probability of allowance.

For more information about our disability claims process, visit our Benefits for People with Disabilities website.

You Cant Be Doing A Substantial Amount Of Work And Get Social Security Disability

By Bethany K. Laurence, Attorney

If you are earning more than $1,310 per month, then yes, youll have to quit your job, or work fewer hours, to be considered for disability benefits. Social Security considers anything above that amount to be substantial gainful activity, or SGA. The SGA amount is adjusted each year according to the current price/wage index.

Recommended Reading: Universal Studios Disability Pass 2022

How Much Will It Cost To Sue My Insurance Company

Roger Foisy, as do most disability insurance lawyers, works on a contingency fee basis. This means that the lawyer only collects their legal fee if they are successful in your claim. In addition, Roger R. Foisy Professional Corporation offers an initial free consultation to potential clients. For a helpful explanation on how fees are determined please see my video blog How Ontario Injury Lawyer Fees are Determined.

Dont Miss: What Happens If You Get Ppp And Unemployment

What Qualifies For Short

To qualify for short-term disability benefits, an employee must be unable to do their job, as deemed by a medical professional. Medical conditions that prevent an employee from working for several weeks to months, such as pregnancy, surgery rehabilitation, or severe illness, can qualify to receive benefits. Since employers in most states must legally provide workers compensation insurance to all employees, any injuries incurred on the job are typically covered under a workers comp policy and are therefore not eligible for short-term disability.

While most non-work-related temporary medical conditions are covered by a short-term disability policy, there can be exclusions for preexisting conditions or intentional and foreseeable injuries . While employees can qualify for time off under the Family and Medical Leave Act to care for a sick relative, most short-term disability policies would not provide benefits if the covered employee is not the one with the illness.

Read Also: Va Disability Rates For Conditions

How Much Does Disability Pay Each Month

The payment disability claimants receive depends on which Social Security program they qualify for. The Federal Social Security Disability Insurance Program pays benefits based on your average lifetime earnings. The Federal Supplemental Security Income program pays benefits based on the SSI Federal benefit rate less any countable income you may have.

The AIME determines your monthly benefit amount. Generally speaking, the more you have in qualified earnings, the more your benefit will be. The max monthly payment for SSDI in 2021 is $3,148.

Maximum Federal Supplemental Security Income payment amounts increase with the cost-of-living increases that apply to Social Security benefits. The latest such increase, 1.3 percent, became effective January 2021. For 2021, the maximum benefit is $794 monthly for individuals, and $1,191 for eligible couples.

Recommended Reading: Teleclaim Sc

Benefits For Children With Disabilities

A child under age 18 may have a disability, but we don’t need to consider the child’s disability when deciding if he or she qualifies for benefits as a dependent. The child’s benefits normally stop at age 18 unless they are a full-time student in an elementary or high school or have a qualifying disability.

Children who were receiving benefits as a minor child on a parents Social Security record may be eligible to continue receiving benefits on that parents record upon reaching age 18 if they have a qualifying disability.

You May Like: New York Life Disability Claim Status

You Have Accumulated At Least 600 Hours Of Insurable Employment During The Qualifying Period

Hours of insurable employment are the hours you work, for one or more employers under written or verbal contracts of service, for which you receive wages.

The qualifying period is the shorter of:

- the 52-week period immediately before the start date of your EI claim or

- the period since the start of a previous EI benefit period, if that benefit period started during the last 52 weeks.

To be eligible for EI sickness benefits, you must have accumulated at least 600 hours of insurable employment in your qualifying period.

If you are a self-employed fisher, you must have earned $3,760 from fishing during the 31-week qualifying period immediately before the start of your benefit period. For more information on EI benefits for self-employed fishers, consult the guide called Employment Insurance Benefits for Fishers .

Adults With A Disability That Began Before Age 22

An adult who has a disability that began before age 22 may be eligible for benefits if their parent is deceased or starts receiving retirement or disability benefits. We consider this a “child’s” benefit because it is paid on a parent’s Social Security earnings record.

The Disabled Adult Child who may be an adopted child, or, in some cases, a stepchild, grandchild, or step grandchild must be unmarried, age 18 or older, have a qualified disability that started before age 22, and meet the definition of disability for adults.

Example

It is not necessary that the DAC ever worked. Benefits are paid based on the parent’s earnings record.

- A DAC must not have substantial earnings. The amount of earnings we consider substantial increases each year. In 2022, this means working and earning more than $1,350 a month.

Working While Disabled: How We Can Help

Read Also: How To Disable Apps On Iphone

Disability And Leaving The Public Service

You should immediately notify your manager if your physician has certified that your illness is continuing and you are unable to return to work. Your manager may grant you leave without pay for a period sufficient to enable you to make the necessary adjustments and preparation for separation from the public service.

Unemployment Benefits Vs Disability Benefits

When you apply for unemployment benefits, you are acknowledging that you are able and ready to work if a job becomes available. The unemployment office requires individuals who receive unemployment benefits to actively seek employment. Refusing reasonable offers for jobs or failing to actively search for work is a reason to terminate your unemployment benefits.

On the other hand, when you apply for long-term disability benefits, you claim the exact opposite. Whether you are applying for Social Security disability income or applying for long-term disability benefits through a private insurance carrier, you are stating in your application that you are unable to work because of a qualifying disability.

The definition of disabled may differ slightly between government and private disability insurance. However, the common factor is that you are claiming you cannot work.

Also Check: Z Uber Com Account Disabled

How Do You Apply For Short

Your first step is to make sure that your illness or injury is well-documented, as youll have to provide some medical evidence or backing. Consult with your doctor and find out what youre up against first. Make sure you speak honestly about your symptoms, McDonald says. That medical record will be reviewed by an insurance company, so start out with a strong pronouncement of, Hey, Im having this problem.

Be aware that short-term disability plans have a requirement for how many days you need to be out of work before you can claim disabilityits called an elimination period. You dont want to claim short-term disability for something that could be covered by sick days, Bartolic says.

To get the ball rolling with your employer, approach your HR department to file an initial claim . Dont have an HR department? Connect with your manager or look at your plan overview to get the necessary documents. Your physician will need to sign off on your claim form before you even submit your application, to vouch for the fact that your injury or illness prevents you from working.

After you submit your claim, your employer or the insurance company that administers your short-term disability plan will request that you submit your medical records so that they can review them and verify that theyre consistent with your disability claim. Contact your healthcare providers office to find out the best way to send those records over.

Can I Collect Disability Insurance Benefits If I Am Collecting Unemployment Benefits

It is challenging for a disabled claimant to obtain either short or long term disability benefits when they are receiving or have received unemployment benefits. It is not impossible to get STD or LTD benefits, but a claimant would be much better off not seeking unemployment. One of the criteria to be eligible for unemployment benefits is that the employee must be able to work, available to work and actively seeking work. In a situation where a person has an own occupation policy, then it could be possible to receive unemployment and disability benefits. The other important reason to not seek unemployment is that in most ERISA / GROUP disability policies, any unemployment benefits received will offset any disability benefits which are owed.

You May Like: Can You Draw Unemployment If You Quit Your Job

Read Also: Social Security Disability Spousal Benefits Calculator

Are Government Workers Eligible For Disability Benefits

Some government workers, including school employees, may be eligible for Disability Insurance benefits. To find out, review your collective bargaining contract. If you have wages from another employer in your base period, you may be eligible even though your current employer doesnt participate in State Disability Insurance. If you arent sure if youre eligible, file a claim anyway.

Social Security Disability Insurance

Social Security Disability Insurance is a federal assistance program designed to help compensate American workers who are unable to continue at their jobs because of illness or injury. In general, medical conditions that qualify for Social Security disability benefits are expected to last for at least a year and/or are considered terminal.

Keep in mind that SSDI is difficult to qualify for in fact, as many as 60% of SSDI claims are denied upon first review. While you may eventually be awarded benefits through the appeals process, that process can be lengthy.

Another key point about SSDI disability benefits is that your ability to qualify is directly related to the number of work credits youve earned throughout your working life. In other words, you must have paid a certain amount of Social Security taxes while you were an employee to be eligible for SSDI benefits.

Many SSDI payouts hover around $1200, so if you have a higher level of income, its unlikely you can cover your regular expenses with only an SSDI benefit.

Read Also: Social Security Disability Over 55 Odds. Of Winning

Changes To Support You During Covid

Temporary changes have been made to the EI program to help you access EI sickness benefits. The following changes are in effect until September 25, 2021, and could apply to you:

- the waiting period may be waived

- you dont need to get a medical certificate

- you only need 120 insured hours to qualify for benefits because youll get a one-time credit of 480 insured hours to help you meet the required 600 insured hours of work

- youll receive at least $500 per week before taxes but you could receive more

- if you received the CERB, the 52-week period to accumulate insured hours will be extended

Sections on this page impacted by these temporary changes are flagged as Temporary COVID-19 relief.

Employment Insurance sickness benefits can provide you with up to 15 weeks of financial assistance if you cannot work for medical reasons. You could receive 55% of your earnings up to a maximum of $595 a week.

You must get a medical certificate to show that youre unable to work for medical reasons. Medical reasons include illness, injury, quarantine or any medical condition that prevents you from working.

Find out if you have employer-paid sick leave

Some employers provide their own paid sick leave or short-term disability plan. Before you apply for EI sickness benefits, check with your employer to find out if they have a plan in place.

If you have a long-term or permanent disability