The Number Of People Qualifying For Social Security Disability Benefits Has Increased

For over 60 years, Social Security disability has helped increasing numbers of workers and their families replace lost income. Several factors have contributed to this increase, which the Social Security Trustees and our actuaries have projected for decades. For example, baby boomers have reached their most disability-prone years and more women have joined the workforce in the past few decades, working consistently enough to qualify for benefits if they become disabled.

Despite the increase, the 9 million or so people getting Social Security disability benefits represent just a small subset of Americans living with disabilities.

Can I Collect Long

People with disabilities with low incomes and assets may qualify for Supplemental Security Income or SSI. To qualify for SSI, it is necessary to meet the income limitations set by the Social Security Administration.

You can receive both LTD benefits and SSI benefits. However, LTD benefits count as income for SSI purposes. In such a case, you may not be eligible for SSI – or your SSI may be lowered – if you receive LTD benefits. Find out more about applying for SSDI, SSI, and LTD benefits by contacting a disability benefits lawyer.

Can You Collect Social Security Retirement And Disability At The Same Time

Home » Frequently Asked Questions » Can You Collect Social Security Retirement and Disability at the Same Time?

In most cases, you cannot collect Social Security retirement and Social Security Disability Insurance at the same time. You may, however, qualify for Supplemental Security Income if you meet the strict financial criteria while drawing either Social Security retirement or SSDI benefits.

The Social Security Administration created the SSDI program to bridge the gap between when someone must leave the workforce due to a disability and when they can draw retirement benefits. For this reason, there is only one way to collect both retirement and SSDI at the same time.

Read Also: Crsc And 100 Va Disability

Get Ssa Benefits While Living Abroad

U.S. citizens can travel to or live in most, but not all, foreign countries and still receive their Social Security benefits. You can find out if you can receive benefits overseas by using the Social Security Administrations payment verification tool. Once you access the tool, pick the country you’re visiting or living in from the drop-down menu options.

How Much Can Disabled Vets Get Paid In Ssd Benefits

Finally, if approved, your disability payments should equal 40% of your average monthly paychecks earned during your work history. The SSA only considers your work history and lifetime earnings when deciding how much SSD money you get. Your symptoms, pain level, number of health issues or age have zero impact on your SSD benefit amount. If you have questions about applying for Social Security disability, you can get free legal advice today over the phone. This

Don’t Miss: History Of Disability In America

What If You Make More Than The 2022 Maximum Income Limit

Earning more than the monthly income limit for eligibility has the effect of disqualifying the SSD recipient from the formal definition of disabled. The fact that an SSD recipient earned more than the monthly income limit is evidence that the benefits recipient is not disabled under the governments regulations. The result is a suspension of benefits. However, SSD recipients whose income rises above the monthly eligibility income limit immediately become eligible for SSD benefits again when their income returns to a level beneath the maximum income set by the Social Security Administration.

How Much Can You Earn In 2022 And Draw Social Security Disability

Each year, the Social Security Administration adjusts the threshold monthly income eligibility amounts and the benefit payments are adjusted to reflect the rate of inflation over the previous year. At London Disability, we focus 100% of our attention and all our professional skill on keeping SSDI and SSI applicants and benefit recipients up to date on the latest developments that might affect benefits. We want everyone who already receiving benefits and all those thinking about applying for SSD or SSI benefits to be fully informed. For more answers to your questions, contact London Disability disability advocates and Attorney Scott London by clicking here or call 877-978-3405.

Read Also: Lawyer For Social Security Disability

Special Rules For People Who Are Blind Or Have Low Vision

We consider you to be legally blind under Social Security rules if your vision cannot be corrected to better than 20/200 in your better eye. We will also consider you legally blind if your visual field is 20 degrees or less, even with a corrective lens. Many people who meet the legal definition of blindness still have some sight and may be able to read large print and get around without a cane or a guide dog.

If you do not meet the legal definition of blindness, you may still qualify for disability benefits. This may be the case if your vision problems alone or combined with other health problems prevent you from working.

There are several special rules for people who are blind that recognize the severe impact of blindness on a person’s ability to work. For example, the monthly earnings limit for people who are blind is generally higher than the limit that applies to non-blind workers with disabilities.

In 2022, the monthly earnings limit is $2,260.

Other Ways You Can Apply

Apply With Your Local Office

You can do most of your business with Social Security online. If you cannot use these online services, your local Social Security office can help you apply. You can find the phone number for your local office by using our Office Locator and looking under Social Security Office Information. The toll-free Office number is your local office.

Apply By Phone

If You Do Not Live in the U.S. Or One of Its Territories

Contact the if you live outside the U.S. or a U.S. territory and wish to apply for retirement benefits.

Mailing Your Documents

If you mail any documents to us, you must include the Social Security number so that we can match them with the correct application. Do not write anything on the original documents. Please write the Social Security number on a separate sheet of paper and include it in the mailing envelope along with the documents.

You May Like: Catholic Charities Housing For Disabled

How Do Benefits Work And How Can I Qualify

While you work, you pay Social Security taxes. This tax money goes into a trust fund that pays benefits to:

-

Those who are currently retired

-

People with disabilities

-

The surviving spouses and children of workers who have died

Each year you work, youll get credits to help you become eligible for benefits when its time for you to retire. Find all the benefits the Social Security Administration offers.

There are four main types of benefits that the SSA offers:

-

Learn about earning limits if you plan to work while receiving Social Security benefits

Does Getting Benefits In One Program Help Getting Benefits In The Other Program

Does having one benefit make getting the other benefit any easier? Overall, the answer is maybe it depends on your circumstances.

VA approval does not help get Social Security disability. In the past, if you were the recipient of a very high VA rating , your chances for success on your Social Security disability claim were quite good. In past decisions, federal circuit courts found that VA disability ratings were entitled to “great weight.”

In 2017, Social Security published new regulations saying that Social Security will no longer take VA approvals for disability compensation into account when deciding whether to grant disability benefits. In addition, written denials or hearing decisions from Social Security will no longer provide any information on whether the agency considered the VA’s approval in its determination.

Social Security will, however, consider any evidence that the VA took into account in making its own disability determination. The VA and the Department of Defense share medical records electronically with Social Security, which will use the evidence in evaluating its applications for Social Security disability insurance and SSI. Social Security may also use VA or DOD evidence to expedite the processing of claims for Wounded Warriors and veterans with a 100% disability compensation rating.

For more information on applying for Social Security disability, see our article on disability benefits for veterans.

You May Like: How To Apply For Disability In New Mexico

Ssd 2022 Maximum Monthly Income Limit Rises From $1310 To $1350

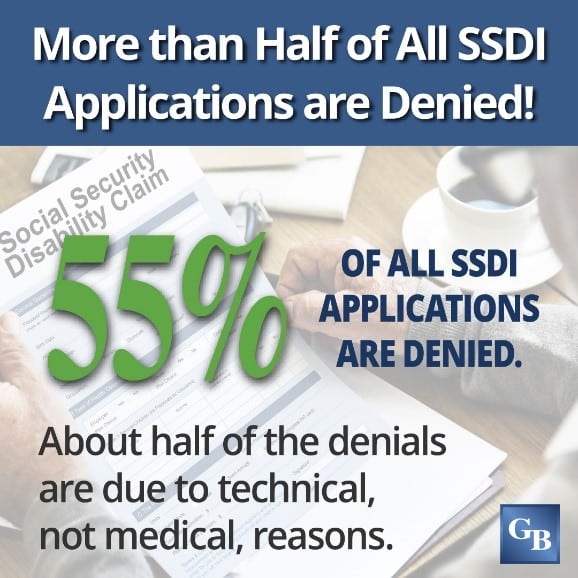

Social Security Disability benefits are reserved exclusively for workers or former workers who earned sufficient work credits and whose physical or mental impairments are serious and long-lasting enough to prevent them from performing substantial gainful activities for at least 12 months.

Eligibility for SSD benefits requires a disability as defined by the Social Security Disability Insurance program guidelines. The definition of a qualified disability includes an inability to earn a monthly income higher than the amount set by the Social Security Administration. In 2021, an SSD benefits recipient could earn no more than $1,350 in earned income per month to continue to be eligible for benefits. Beginning January 1, 2022, the monthly income limit for SSD will be $1,350.

What Income Is Not Counted? Not all income you receive is considered income for purposes of the SSDI monthly earned income limit. Any unearned income, interest, or dividends from investments are not counted toward the monthly limit. Neither is a spouses income. SSDI also has no limit on the number of assets you have available. The only income that does count is income earned from performing work or in exchange for services you provided.

Ask Larry: When Is The Best Time To Submit My Social Security Application

Ask Larry

Economic Security Planning, Inc.

Today’s Social Security column addresses questions about when applications for benefits can be submitted, who might and might not be able to receive spousal benefits and whether investment withdrawals affect Social Security disability benefits. Larry Kotlikoff is a Professor of Economics at Boston University and the founder and president of Economic Security Planning, Inc.

Have Social Security questions of your own youd like answered? Ask Larry about Social Security here.

When Is The Best Time To Submit My Social Security Application?

Hi Larry, I will be 66 and nine months later this year when I plan to retire. I’ve heard different accounts of when it’s best to submit the actual application. When would you say the best time is? Thanks, Bryan

Hi Bryan, You can submit your application for benefits up to four months prior to the month that you want your benefits to start. So if you want to claim benefits in, say, 6/2023, you can apply anytime between 2/1/2023 and 6/31/2023.

Read Also: Short Term Disability For Pregnancy

Benefits For Widows Or Widowers With Disabilities

If something happens to a worker, benefits may be payable to their widow, widower, or surviving divorced spouse with a disability if the following conditions are met:

- The widow, widower, or surviving divorced spouse is between ages 50 and 60.

- The widow, widower, or surviving divorced spouse has a medical condition that meets our definition of disability for adults and the disability started before or within seven years of the worker’s death.

Widows, widowers, and surviving divorced spouses cannot apply online for survivors benefits. If they want to apply for these benefits, they should contact Social Security immediately at 1-800-772-1213 to request an appointment

To speed up the application process, complete an Adult Disability Report and have it available at the time of your appointment.

We use the same definition of disability for widows and widowers as we do for workers.

Can You Collect Social Security And Disability

Wondering whether you can collect Social Security and Social Security Disability Insurance at the same time? The short answer is probably not. The long answer, however, is maybe. Social Security and SSDI serve similar purposes, but the requirements vary for each. Social Security is for those whove reached early or full retirement age, while disability insurance typically serves younger individuals who cannot work due to serious medical conditions. However, an exception may apply. Heres what you need to know.

A financial advisor can help you manage social security benefits and create a financial plan for your long-term retirement needs and goals.

You May Like: Va Disability Rates By Condition

What Happens When Your Nine Month Trial Work Period Ends

The Trial Work Period permits nine months of above-the-limit monthly earnings while continuing to receive the full monthly SSD benefit payment. Once the nine months are all used, the Social Security Administration encourages the working SSD recipient to continue earning a higher income. SSD created the Extended Period of Eligibility of three additional months during which the SSD recipient can continue to earn more than the SSD income limit and still receive their usual monthly SSD payment.

After the three-month Extended Period of Eligibility is used, then SSD benefit payments will stop if the SSD recipient continues to work and earn more than the monthly income limit. But, for another period of 36 months, benefits will be resumed if the workers income falls beneath the monthly income limit for SSD benefits eligibility.

How To Receive Federal Benefits

To begin receiving your federal benefits, like Social Security or veterans benefits, you must sign up for electronic payments with direct deposit.

If You Have a Bank or Credit Union Account:

- Call the Go Direct Helpline at .

If You Don’t have a Bank or Credit Union Account:

- Direct Express debit card – a pre-paid debit card. Get help by calling the Go Direct Helpline at .

Make Changes to an Existing Direct Deposit Account:

On Go Direct’s FAQ page, learn how to make changes to an existing direct deposit account. You also may contact the federal agency that pays your benefit for help with your enrollment.

Don’t Miss: New Jersey Disability Claim Status

If You Get Social Security Disability Income And Have Medicare

- Youâre considered covered under the health care law and donât have to pay the penalty that people without coverage must pay.

- You canât enroll in a Marketplace plan to replace or supplement your Medicare coverage.

- One exception: If you enrolled in a Marketplace plan before getting Medicare, you can keep your Marketplace plan as supplemental insurance when you enroll in Medicare. But if you do this, youâll lose any premium tax credits and other savings for your Marketplace plan.

Information For Military & Veterans

Social Security pays disability benefits through two programs: the Social Security Disability Insurance program and the Supplemental Security Income program. SSDI is for workers and certain family members if they worked long enough and recently enough to qualify for benefits. SSI is for people who are 65 or older, as well as people of any age, including children, who are blind or have disabilities. To be considered eligible for SSI, you must also have income and resources below specific financial limits.

Before you apply for Social Security disability benefits, please review the to make sure you understand what to expect during the application process. Also, gather the information and documents youll need to complete an application.

Read Also: Social Security Disability Impairment Listing

Social Security Entitlement Requirements

Many people who are eligible for Supplemental Security Income may also be entitled to receive Social Security benefits. In fact, the application for SSI benefits is also an application for Social Security benefits. We often need to obtain additional information from the person before we can award Social Security benefits.

The following sections provide information on who may be entitled to Social Security benefits.

TO BE ELIGIBLE FOR SOCIAL SECURITY BENEFITS AS A WORKER YOU MUST BE:

Age 62 or older, or disabled or blind and

“Insured” by having enough work credits.

For applications filed December 1, 1996, or later, you must either be a U.S. citizen or lawfully present alien in order to receive monthly Social Security benefits.

HOW MUCH WORK DO YOU NEED TO BE”INSURED”?

We measure work in “work credits”. You can earn up to four work credits per year based on your annual earnings. The amount of earnings required for a work credit increases each year as general wage levels rise.

To be eligible for most types of benefits , you must have earned an average of one work credit for each calendar year between age 21 and the year in which you reach age 62 or become disabled or blind, up to a maximum of 40 credits. A minimum of six work credits is required, regardless of age.

The rules are as follows:

| Born After 1929 |

|---|

| 40 |

WHO CAN RECEIVE BENEFITS ON YOUR EARNINGS RECORD?

If you are receiving retirement or disability benefits, your spouse may qualify if he or she is:

| Back |

Benefits For Children With Disabilities

A child under age 18 may have a disability, but we don’t need to consider the child’s disability when deciding if he or she qualifies for benefits as a dependent. The child’s benefits normally stop at age 18 unless they are a full-time student in an elementary or high school or have a qualifying disability.

Children who were receiving benefits as a minor child on a parents Social Security record may be eligible to continue receiving benefits on that parents record upon reaching age 18 if they have a qualifying disability.

You May Like: How Do I Extend My Temporary Disability In Nj

How Has The Covid

Working people with disabilities experience disproportionate job loss, compared to workers without disabilities, during economic downturns,39 and SSI applications generally increase when the unemployment rate increases . This trend held during the Great Recession and subsequent economic recovery.40 One exception to the general trend is the period from 2003 to 2007, when SSI applications continued to rise despite falling unemployment.41 Possible explanations for this anomaly include factors such as the lagged effect of federal welfare reform leading TANF enrollees to switch to SSI and persistently high poverty rates.42 The same study also found that the likelihood of applying for SSI significantly increases during extended periods of high unemployment.43

Figure 7: Percent change in SSI Applications Filed by Adults Ages 18-64 and U.S. Unemployment Rates, 1991-2019