Filing Your Tax Return And Va Disability Pay

The IRS doesnt require you to declare your VA disability as part of your gross income when filing your previous years federal tax return. You dont need to include any documentation with your taxes to prove that your disability pay is tax-free.

There are a few situations when you want to include documentation from the VA, specifically when filing a federal tax refund.

If either of these applies to you, you may be eligible for a federal tax refund:

- An increase in your rating with a retroactive determination

- If you receive Combat-Related Special Compensation after youve been awarded Concurrent Retirement and Disability

You can file an amended federal tax by filing IRS Form 1040X. However, if you receive a 1099-R from the Defense Finance and Accounting Service , you likely dont need to file any additional documents with the IRS, as adjustments have already been made.

Make sure to include any relevant documentation from the VA explaining why youre filing an amended federal return. Its best to sit down with a qualified tax professional if you have any questions about amending a tax return.

Veteran Readiness And Employment Program

The VR& E Program assists veterans with service-connected disabilities to prepare for, find and keep suitable jobs. For veterans with service-connected disabilities so severe that they cannot immediately consider work, this program offers services to improve their ability to live as independently as possible.The VR& E Program includes the following services:

Automobile Allowance And Adaptive Equipment

Link to more information and application:

The VA may provide a one-time payment of not more than $21,488.29 to help you buy a specially equipped vehicle.

In some situations, one or more adaptive-equipment grants to change a vehicle so it has features like power steering, brakes, seats, windows, or lift equipment to help you get into and out of the vehicle

You must already be service-connected for these conditions before purchasing a vehicle to receive the payment.

The VA may grant the money directly to the veteran OR they may pay the equipment seller directly.

Eligibility:

- Ankylosis in 1 or both knees or hips

Read Also: Disabled Veteran Plates Handicap Parking

Burial And Plot Allowance

A surviving dependent can qualify for allowances to help pay for burial and funeral costs for a disabled veteran. If the veteran died of a service-connected disability ON or AFTER September 11, 2001, the maximum VA burial benefit allowance is $2,000 or $1,500 for a Veteran who died BEFORE September 11, 2001.

Contact Us For Help Now

George Sink, P.A. Injury Lawyers

HEADQUARTERS

© 2022 All Rights Reserved Disabled Vets

DISCLAIMER: Information on this website is not legal advice. Reviewing the information on this website does not create an attorney-client relationship with the law firm. Nothing presented on this website reflects an endorsement by the U.S. Government or any branch of the military. The attorney, investigator, or a representative of the firm may visit you anywhere in SC or GA for initial investigations in many circumstances. George Sink, Sr licensed in SC.

*No fee if no recovery. Fees computed before deducting expenses from recovery. “We dont get paid until you get paid or similar language refers only to fees charged by the attorney. Court costs and other additional expenses of legal action usually must be paid by the client. Contingent attorneys’ fees refers only to those fees charged by attorneys for their legal services. Contingent fees are not permitted in all types of cases.

Any result the lawyer or law firm may have achieved on behalf of clients in one matter does not necessarily indicate similar results can be obtained for other clients. Verdicts, awards, and total recoveries presented reflect gross numbers, before attorneys fees, costs and expenses are deducted.

Read Also: Free Moving Services For Disabled

+ Everyday Discounts For 100 Percent Disabled Veterans

Okay, this one took us a long time, but we did it! The Insiders Guide to 300+ Revised and Expanded Everyday Discounts for 100 Percent Disabled Veterans! Weve also separated specific veteran discounts by product/service category to assist you in your search. Disabled veterans can potentially save thousands of dollars per year by taking full advantage of these great disabled veteran discounts listed HERE.

North Dakota Dependent Tuition Waiver

Eligible dependents of certain disabled veterans can obtain a bachelors degree or certificate of completion free of tuition and fee charges at any North Dakota state-supported institution of higher education or technical or vocational school.

The student must be the dependent of a resident veteran who is 100% disabled as a result of service-connected causes, who was killed in action or died from wounds or other service-connected causes, or who died from service-connected disabilities.

The diploma must be earned within a 45-month or 10-semester period or its equivalent.

Don’t Miss: What Qualifies You For Social Security Disability

How Can I Qualify For A 100 Percent Va Disability Rating

To qualify for a 100 percent VA rating, you must either have one condition rated at 100%, or have one or more individual VA ratings increased, which will then increase your total combined rating to 95.00 or higher .

If your conditions have worsened since you last applied and now qualify for a higher rating, you can submit a new claim on VA.gov by checking the box for an increased evaluation.

Further, you can always add new primary or secondary disabilities, but youll need to prove service connection.

Heres the deal fellow veterans

So many veterans are Stuck, Frustrated, and Underrated by the VA.

And were on a MISSION to change it so you and your family get the VA disability benefits you deserve for serving our country.

If youre ready to increase your VA rating, maybe even to 100% if eligible by law, checkout my brand-new FREE video training for 2023:

VA CLAIM SECRETS: Top 3 Strategies to WIN Your VA Claim, PROVE Service Connection, and INCREASE Your VA Rating in Less Time!

Reveal SECRET VA Claim Tips & Strategies for Veterans

Click the red button below to watch the FREE training:

Concealed Weapon Permit Fee Exemption For Service

-

Any Veterans having a service-connected disability shall be exempted from concealed weapon permit fees and renewal fees. The Veteran must be a resident of the state for 12 months or longer immediately preceding the filing of the application. However, this residency requirement may be waived, provided the applicant possesses a valid permit from another state, is active military personnel stationed in Mississippi, or is a retired law enforcement officer establishing residency in the state. Miss. Code Ann., §45-9-101

You May Like: Definition Of Specific Learning Disability

Also Check: Non Profit Organization For Disabled

Special Monthly Compensation Benefits For 100% Disabled Veterans

VA Special Monthly Compensation, also known as VA SMC benefits, is additional tax-free compensation that can be paid to disabled veterans, their spouses, surviving spouses, and parents. For disabled veterans, VA Special Monthly Compensation is a higher rate of compensation paid due to special circumstances, such as the need of aid and attendance by another person or by specific disability. For example, the loss or use of a creative organ, which is Erectile Dysfunction for men and Female Sexual Arousal Disorder for women.

Va Aid And Attendance Program

The VA Aid and Attendance program is a VA Pension Benefit that helps cover the costs of daily living for housebound veterans and/or those in nursing homes. Aid and Attendance benefits are a form of Special Monthly Compensation added to the amount of a monthly VA Pension for qualified Veterans and survivors. If the Veteran requires help with daily activities or he/she is housebound, click HERE now to learn more.

Also Check: Legal Help For Disabled Persons

How Much Does The Widow Of A 100% Disabled Veteran Receive

The program provides lifetime benefits ranging from about $1,280 a month to $2,940 a month to eligible surviving spouses, depending on the deceased veterans pay grade. Additional payments are available for dependent children. Some parents of deceased veterans also may get benefits if their income is low.

You May Like: 100 Disabled Veteran Dental Benefits For Family

What Benefits Do 100% Disabled Vets Get

Home » FAQs » What Benefits Do 100% Disabled Vets Get?

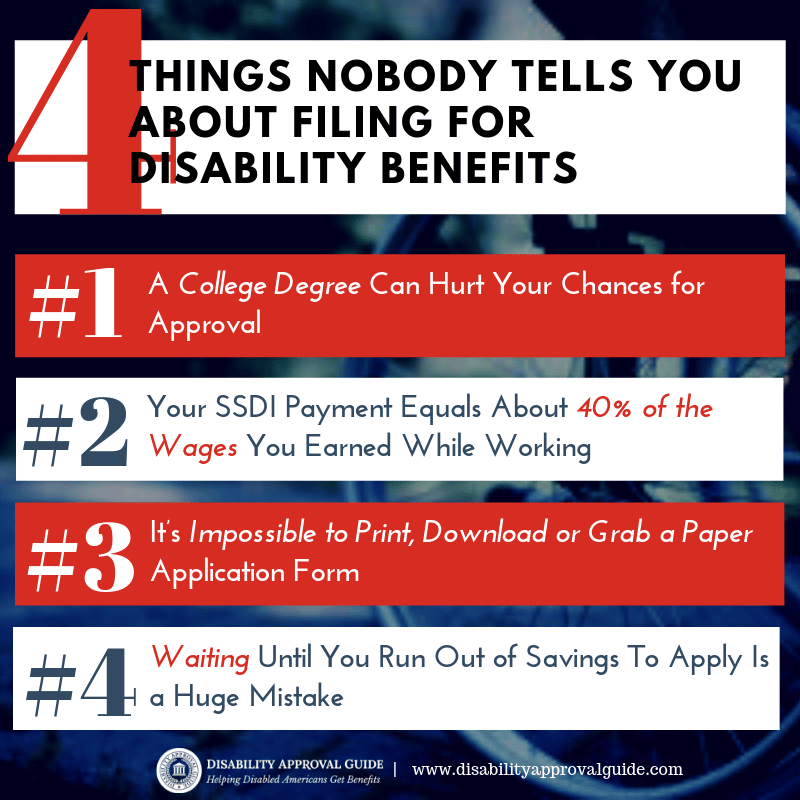

Disabled vets with a 100% rating get a wide range of benefits from The U.S. Department of Veterans Affairs to help them adjust to a better life, such as monthly payments, health care benefits, property tax waivers, housing grants, free air travel, and more.

If you are completely disabled but have not received a 100% disability rating, it is vital to file for a decision review process. This step may help you receive rightful compensation from VA.

Also Check: Can I Work While On Social Security Disability

Specific Health Care Services You May Receive

The healthcare benefit for 100% disabled vets covers a wide range of services. For example, it may help you pay for primary care and consultation fees. It also covers preventative care and the cost of buying assistive devices.

More expenses the healthcare benefit can help you with are:

- Paying a licensed caregiver

- Living in a nursing home

- Transportation to medical appointments

Chapter 31 Vocational Rehabilitation And Employment Program

The Chapter 31 Vocational Rehabilitation and Employment program, also known as Voc Rehab, is designed to assist veterans with service-connected disabilities to obtain suitable employment and/or achieve independent living goals. It consists of several application phases, involving tasks for both VR& E staff and Veterans to complete. A full list of Voc Rehab coordinators can be found HERE. Veterans can also get started with the VR& E process by contacting your local VA Regional Office.

You May Like: Can You Collect Unemployment While On Disability

Free Va Healthcare And Prescription Medications For 100 Disabled Veterans

This is one of the top 100 percent disabled veteran benefits, which includes free VA health care for disability conditions related to military service for veterans with a disability rating of at least 50%, as well as for those who cant afford to pay for care. 100% disabled veterans receive completely free VA care, with services including but not limited to, emergency care, preventative care, primary care, specialty care, mental health services, home health care, dental and vision care, geriatrics and extended care, medical equipment, prosthetics, nursing home placement, medically related travel benefits, and hearing aids. Veterans can

State Property Tax Exemptions For 100 Percent Disabled Veterans

Most states offer property tax exemptions for disabled veterans. Some states even have full waiver of property taxes for 100 percent disabled veterans on their primary residence. While not all 50 states offer the same tax breaks for disabled veterans, and the criteria to qualify for a waiver differs from state to state, its in your best interest to check with your state county tax assessors office to see if you qualify. You may be eligible to save thousands of dollars each year with this incredible state benefit due to reduced or no property taxes owed.

Read Also: Va Disability Rating For Degenerative Disc Disease

Va Ratings For Cancer: Temporary Total

If you are service-connected for an active cancer, VA should automatically assign a 100 percent disability rating. This rating continues for as long as your cancer is active, and then for another six months following the successful completion of a treatment program, such as chemotherapy, radiation, or surgery. Six months after your cancer treatment ends, VA will schedule you for a Compensation & Pension examination to evaluate the current status of your condition.

If the examination shows that your cancer is no longer active and is in remission, VA will evaluate the cancer based on its residuals. For example, erectile dysfunction and urinary incontinence are common residual symptoms of prostate cancer. If prostate cancer is no longer active, VA will likely reduce the disability rating for that condition and assign new ratings based on the severity of the veterans erectile dysfunction and urinary incontinence if present.

Free Tax Preparation For Disabled Veterans

The Volunteer Income Tax Assistance program offers FREE tax help to disabled veterans who generally make $56,000 per year or less. IRS-certified volunteers provide FREE basic income tax return preparation with electronic filing to qualified individuals. Intuit Turbo Tax offers its online IRS Free File Program if youre a disabled veteran with an Adjusted Gross Income of $36,000 or less OR you qualify for the Earned Income Tax Credit . Click HERE to learn more about this free tax filing software for disabled veterans.

Don’t Miss: New York Life Disability Claim Status

How Do I Qualify For Va Housebound Benefits

The VA Housebound program is a Pension Benefit payable to veterans who are permanently disabled and are confined to their residence.

The VA considers housebound status for veterans who are substantially confined to their residence but are still able to leave with help.

A residence can include:

- Assisted living facility

Veterans who meet one or both of the following criteria qualify for VA Housebound Benefits:

- The veteran has a single, permanent disability evaluated as 100 percent disabling. Because of this, you are permanently confined to your immediate location . For example, you have a permanent 100 percent PTSD rating and cant leave your home without assistance.

- The veteran has a single, permanent disability evaluated as 100 percent disabling, or another disability or disabilities that are evaluated as 60 percent disabling or higher. For example, you have a permanent 70 percent rating for heart disease and are confined to a nursing home.

If the veteran requires help with daily activities or he/she is , click HERE now to learn more.

Concurrent Receipt Of Va Disability Pay And Military Retirement Pay

The Concurrent Retirement and Disability Pay program allows military retirees to receive BOTH military retired pay and VA disability compensation. Generally, you must be a regular military retiree with a combined VA disability rating of 50% or higher to qualify for CRDP. Click HERE to learn more DFASs CRDP program for military retirees with a VA disability rating.

Read Also: Mortgage Assistance For Disabled Homeowners

What Is A Va Survivors Pension

VA survivors pensions are payments made to spouses and dependents of deceased veterans. However, if you have remarried or earn an income higher than the eligibility limits set by Congress, you may not qualify.

Like the DIC benefits, survivors pension payments are made monthly. The amounts may also change depending on the rates set by Congress.

Since the survivors pension benefit is only available to spouses of vets who served during specific wartime periods, it is vital to confirm if your partner was in this category. Contact VA for more information about their deployment history if you are unsure.

Complete a Free Case Evaluation form now

North Dakota Dmv Benefits For 100% Disabled Veterans

North Dakota veterans with a service-connected 100% disability rating are eligible for Disabled American Veteran license plates.

DAV license plates exempt veterans from paying sales tax on up to two vehicles. Additionally, there is no annual license or registration fee. An unremarried surviving spouse can retain one DAV plate for their own use.

Don’t Miss: Low Income Apartment For Disabled

How Much Does Va Healthcare Cost

If you have a disability rating of 50 percent or higher, its TOTALLY FREE.

Thus, 100 percent disabled veterans get free healthcare through the VA.

When enrolling for VA healthcare benefits, every veteran is assigned to a priority group between 1 and 8.

The VA uses priority groups to better assign resources across its healthcare system.

Generally, earlier priority group numbers mean a veteran has priority to make appointments and get care sooner.

Veterans with a 100 percent VA rating meet the eligibility requirements for Health Care Priority Group 1, which is the highest priority group available and no co-payments.

What Is The Difference Between Va Disability Compensation And Disabled Veteran Benefits For Spouses

If a Veteran becomes wounded or injured or becomes sick as a result of their military service, they may be entitled to VA disability compensation. This is a tax-free monthly payment from the Department of Veterans Affairs related to service connected disabilities. If it is determined that the Veteran has a compensable service connected condition, or multiple conditions, they will assign a disability rating between 0% and 100%.

Additionally, a 100 percent service-connected disabled Veteran may be eligible for several benefits for spouses through the Department of Veterans Affairs . These programs help ease some of the burdens placed on Veteran families.

What does this mean? If you are a spouse, you need to know what VA benefits you qualify for and how to apply for them.

Don’t Miss: Is Disability Income Taxable By Irs

Taxes And Medical Discharge Payments

If you were discharged from the military due to a medical reason and received a one-time lump-sum payment as a result, you may wonder if this is taxable. The good news is these payments are not taxable, and you can now file for a refund if you previously paid taxes. Based on the 2016 Combat-Injured Veterans Tax Fairness Act, you can now file a claim for credit or refund of taxes paid on any lump sum after January 17, 1991.

Increased Disability Payments For Veterans With Dependents

Veterans entitled to compensation who have a disability rated at 30% or more are entitled to additional compensation for dependents. Dependent children between the ages of 18 and 23 must be attending school and a dependent for tax purposes.

Parents may be considered dependents if the veteran provides more than 50% of their support. Veterans with a disabled spouse may also be eligible for increased benefits. Check with the VA for details.

There is also a Dependency & Indemnity Compensation benefit for survivors of some disabled veterans.

Also Check: Individuals With Disabilities In Education Act